Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated

financial and operating results for the third quarter ended

September 30, 2024, in accordance with International Financial

Reporting Standards (IFRS).

“Our third quarter operational performance was strong across all

segments, supporting our return to a tier-one cost structure,” said

Tim Gitzel, Cameco’s president and CEO. “Looking past quarterly

earnings, which can vary significantly, there is a clear underlying

trend of improving operational performance and cash flow

generation, backed by stable and rising market prices. Apart from

the impact of a stronger US dollar, our financial outlook for both

Cameco and Westinghouse remained strong and unchanged. To recognize

the return to our tier-one production rate and the continued

strengthening of the industry’s long-term prospects, our board of

directors declared an increased 2024 annual dividend of $0.16 per

common share. We are also recommending a dividend growth plan to

our board of directors, under which we expect to at least double

last year’s dividend of $0.12 per common share, to $0.24 per common

share, over the fiscal periods 2024 through 2026, subject to annual

consideration by our board.

“Our disciplined strategy aligns our marketing, operational, and

financially focused decisions. From a marketing perspective, we

have contracts in both our uranium and fuel services segments that

have deliveries spanning more than a decade. However, in a market

where we are seeing sustained, positive momentum for nuclear

energy, we are continuing to be selective in committing our

unencumbered, tier-one, in-ground uranium inventory and UF6

conversion capacity under long-term contracts, to capture greater

upside for many years to come.

“The marketing element of our strategy guides our operational

decisions to ensure our supply aligns with our commitments, so we

balance our production rates, inventory position, long-term

purchases, product loans, and near-term market purchases in order

to deliver full-cycle value. This past quarter was a good example

of that prudent management of our supply sources, with our 2024

uranium production outlook increasing from 22.4 million pounds (our

share) of uranium, to up to 23.1 million pounds (our share) of

uranium, thanks to strong production from McArthur River/Key Lake.

The higher production level for 2024 is fully committed within our

contract portfolio and allows us to rebalance our other supply

sources, including a partial offset of the increase in Saskatchewan

by lower production and purchases from JV Inkai, where we now

expect production of 7.7 million pounds (100% basis) of uranium,

down about 600,000 pounds of uranium from last year due to the

ongoing acid supply challenges in Kazakhstan.

“The marketing and operational decisions set the stage for the

financial element of our strategy, under which we expect strong

cash flow generation to underpin our conservative capital

allocation priorities. Those priorities include a focus on debt

management, as is evident with the prudent refinancing activities

we have undertaken in 2024, and the prepayment of a large portion

of the term loan we utilized to purchase Westinghouse.

“We are continuing to see a positive shift in government,

industry and public support for nuclear energy, further supported

by recent announcements between utilities, reactor developers, and

the industrial energy users, who are now extending financial

support to ensure future access to clean, reliable and scalable

nuclear power. Cameco, with our assets and investments across the

fuel and reactor life cycles, is uniquely positioned to benefit

from those tailwinds as a responsible, commercial supplier with

multiple long-lived, tier-one assets in reliable jurisdictions,

proven operating experience, and a strong balance sheet to execute

our strategy. In a market where we are seeing sustained, positive

momentum for nuclear energy, we believe our disciplined strategy

will allow us to achieve our vision of ‘energizing a clean-air

world’ in a manner that reflects our values, including a commitment

to address the risks and opportunities that we believe will make

our business sustainable over the long term.”

- Dividend: Our board of directors declared a 2024 annual

dividend of $0.16 per common share, payable on December 13, 2024,

to shareholders of record on November 27, 2024. The decision to

declare an annual dividend is reviewed regularly by our board in

context of our cash flow, financial position, strategy and other

relevant factors, including appropriate alignment with the cyclical

nature of our earnings. To recognize the return to our tier-one

production rate, and in line with the principles of our capital

allocation framework, we have recommended to our board of directors

a dividend growth plan for consideration. Based on our plan, we

expect an annual increase of at least $0.04 per common share over

the fiscal periods 2024 through 2026, to achieve a doubling of the

2023 dividend from $0.12 per common share, to $0.24 per common

share. In 2022, the board increased the dividend by 50% to reflect

the expected improvement in our financial performance as we began

the transition to our tier-one run rate.

- Financial results impacted by purchase accounting: Third

quarter results reflect normal quarterly variations in sales

volumes, as well as delayed sales for Joint Venture Inkai (JV

Inkai) due to continued transportation challenges, and the ongoing

impact of purchase accounting for Westinghouse. Net earnings were

$7 million, adjusted net losses were $3 million, and adjusted

EBITDA was $308 million. During the first nine months of the year,

net earnings of $36 million and adjusted net earnings of $115

million were lower, while adjusted EBITDA of $1.0 billion was

higher than in 2023. Adjusted net earnings and adjusted EBITDA are

non-IFRS measures, see below.

- Strong 2024 financial outlook: We continue to expect

strong cash flow generation. Due to the continued strengthening of

the US dollar, we have updated our exchange rate assumption to

reflect the average rate year-to-date in 2024 of $1.00 (US) for

$1.35 (Cdn) (previously $1.00 (US) for $1.30 (Cdn)). As a result,

our expected uranium average realized price increased to $77.80 per

pound (previously $74.70 per pound), driving up several financial

outlook metrics, including estimated consolidated revenue for the

year, which is now expected to be about $3.01 billion to $3.16

billion (previously $2.85 billion to $3.0 billion), and our outlook

for our share of Westinghouse’s 2024 adjusted EBITDA, which is now

expected to be between $460 million and $530 million (previously

$445 million to $510 million). See Outlook for 2024 in our third

quarter MD&A for more information. Adjusted EBITDA attributable

to Westinghouse is a non-IFRS measure, see below.

- Strong uranium segment performance: In our uranium

segment, production volumes for the third quarter and for the first

nine months of the year were strong. Higher revenues and gross

profit compared to last year were primarily driven by higher sales

volume and higher Canadian dollar average realized price.

Deliveries of 7.3 million pounds during the quarter were higher

than the same period in 2023, while deliveries of 20.8 million

pounds year-to-date were slightly lower than the same period last

year due to normal quarterly variations, although it remained in

line with the delivery pattern disclosed in our annual MD&A.

Our annual expectation for uranium deliveries of between 32 million

and 34 million pounds remains unchanged. See Uranium in our third

quarter MD&A for more information.

- Increased 2024 uranium production outlook: We updated

our 2024 production outlook to be up to 37.0 million pounds (up to

23.1 million pounds our share) of uranium, to advance our strategy

in step with the positive market momentum and to meet our

commitments under our long-term contracts. The higher planned

annual production level is due to the consistent run rate at the

Key Lake mill, which we now expect to produce 19 million pounds

(100% basis) of uranium in 2024 (previously 18 million pounds of

uranium), partially offset by lower expected production and

purchases from JV Inkai. Expected market and committed purchases

for 2024 have been realigned to account for the increased

uncertainty on the timing of receipt of our remaining share of 2024

production from JV Inkai. We have either taken delivery of, or have

commitments for, the majority of our expected 2024 market

purchases, but may look for additional opportunities to add to our

inventory. See Outlook for 2024 in our third quarter MD&A for

more information.

- Inkai production lower than previously expected: At JV

Inkai, production for the third quarter was similar to last year,

but lower for the first nine months of this year compared to the

same period in 2023, due to differences in the annual mine plan, a

shift in the acidification schedule for new wellfields, and

unstable acid supply throughout the year. Maximum annual expected

production is now estimated to be approximately 7.7 million pounds

(100% basis) of uranium, as the previous target of 8.3 million

pounds of uranium was contingent upon receipt of sufficient volumes

of sulfuric acid in accordance with a specific schedule and is now

deemed unachievable. The first shipment containing approximately

2.3 million pounds of our share of Inkai’s 2024 production has

arrived at the Canadian port and is expected to arrive at the Blind

River refinery before the end of 2024. The timing for the shipment

of our remaining share of 2024 production is uncertain, and our

allocation of this year’s planned production from JV Inkai remains

under discussion. The timing of deliveries from JV Inkai impacts

our share of earnings from equity-accounted investee and the timing

of receipt of our share of dividends. An updated NI 43-101

technical report for the Inkai mine is being finalized and is

expected to be filed under Cameco’s profile on SEDAR+ within 45

days of this release. Changes to the mineral reserves, production

profile, costs, sensitivities, environmental and regulatory

matters, and other scientific and technical information will be

updated in the relevant sections of the report.

- Solid adjusted EBITDA from Westinghouse: While

Westinghouse reported a net loss of $57 million (our share), for

the third quarter compared to $47 million (our share) in the second

quarter, adjusted EBITDA was $122 million, compared to $121 million

in the second quarter. Due to normal variability in the timing of

its customer requirements, and delivery and outage schedules, we

expect to see stronger performance from the Westinghouse segment in

the fourth quarter, with higher expected cash flows. Purchase

accounting, which required the revaluation of Westinghouse’s

inventory and other assets at the time of acquisition, and the

expensing of certain non-operating acquisition-related transition

costs continues to impact quarterly earnings and our 2024 earnings

outlook. See Outlook for 2024 and Our earnings from Westinghouse in

our third quarter MD&A for more information.

- Selective long-term contracting, maintaining exposure to

higher prices: As of September 30, 2024, we had commitments

requiring delivery of an average of about 29 million pounds per

year from 2024 through 2028. We also have contracts in our uranium

and fuel services segments that span more than a decade, and in our

uranium segment, many of those contracts benefit from

market-related pricing mechanisms. In addition, we have a large and

growing pipeline of business under discussion both on- and

off-market, which we expect will help further build our long-term

contract portfolio.

- Maintaining financial discipline and balanced liquidity to

execute on strategy:

- Strong balance sheet: As of September 30, 2024, we had

$197 million in cash and cash equivalents and $1.3 billion in total

debt, demonstrating our ability to maintain liquidity while

prioritizing repayment of our term loan debt. In addition, we have

a $1.0 billion undrawn credit facility, which matures October 1,

2028. We continue to expect strong cash flow generation in

2024.

- Focused debt reduction: Thanks to our risk-managed

financial discipline, and strong cash position, in the third

quarter we continued to prioritize the reduction of the

floating-rate term loan used to finance the Westinghouse

acquisition, repaying another $100 million (US) of the remaining

$300 million (US) principal outstanding. We plan to continue to

prioritize repayment of the remaining $200 million (US) outstanding

principal on the term loan while balancing our liquidity and cash

position.

- Maintaining financial flexibility: We plan to file a new

base shelf prospectus in the fourth quarter as the existing

prospectus expired in October.

- Changes to the executive team: Effective October 7,

2024, David Doerksen was appointed senior vice-president and chief

marketing officer, overseeing the international marketing team in

the development and execution of Cameco’s marketing strategy, and

Lisa Aitken was appointed vice-president, marketing.

Consolidated financial results

THREE MONTHS

NINE MONTHS

HIGHLIGHTS

ENDED SEPTEMBER 30

ENDED SEPTEMBER 30

($ MILLIONS EXCEPT WHERE INDICATED)

2024

2023

CHANGE

2024

2023

CHANGE

Revenue

721

575

25%

1,953

1,744

12%

Gross profit

171

152

13%

533

429

24%

Net earnings attributable to equity

holders

7

148

(95)%

36

281

(87)%

$ per common share (basic)

0.02

0.34

(94)%

0.08

0.65

(88)%

$ per common share (diluted)

0.02

0.34

(94)%

0.08

0.65

(88)%

Adjusted net earnings (losses) (ANE)

(non-IFRS, see below)

(3)

137

>(100)%

115

249

(54)%

$ per common share (adjusted and

diluted)

(0.01)

0.32

>(100)%

0.26

0.57

(54)%

Adjusted EBITDA (non-IFRS, see below)

308

234

32%

992

511

94%

Cash provided by operations (after working

capital changes)

52

185

(72)%

376

487

(23)%

The financial information presented for the three months and

nine months ended September 30, 2023, and September 30, 2024, is

unaudited.

Selected segment highlights

THREE MONTHS

NINE MONTHS

ENDED SEPTEMBER 30

ENDED SEPTEMBER 30

HIGHLIGHTS

2024

2023

CHANGE

2024

2023

CHANGE

Uranium

Production volume (million lbs)

4.3

3.0

43%

17.3

11.9

45%

Sales volume (million lbs)

7.3

7.0

4%

20.8

22.2

(6)%

Average realized price1

($US/lb)

60.18

52.57

14%

58.28

48.62

20%

($Cdn/lb)

82.33

70.30

17%

78.97

65.40

21%

Revenue

600

489

23%

1,642

1,452

13%

Gross profit

154

139

11%

467

349

34%

Earnings before income taxes

171

218

(22)%

615

474

30%

Adjusted EBITDA2

240

224

7%

790

601

31%

Fuel services

Production volume (million kgU)

3.2

2.0

60%

9.9

9.6

3%

Sales volume (million kgU)

3.5

2.1

67%

7.9

7.8

1%

Average realized price 3

($Cdn/kgU)

34.54

39.87

(13)%

39.17

37.44

5%

Revenue

120

86

40%

311

291

7%

Earnings before income taxes

17

28

(39)%

71

97

(27)%

Adjusted EBITDA2

28

36

(22)%

96

121

(21)%

Adjusted EBITDA margin (%)2

23

42

(45)%

31

42

(26)%

Westinghouse

Revenue

726

-

n/a

2,052

-

n/a

(our share)

Net loss

(57)

-

n/a

(227)

-

n/a

Adjusted EBITDA2

122

-

n/a

320

-

n/a

1

Uranium average realized price is

calculated as the revenue from sales of uranium concentrate,

transportation and storage fees divided by the volume of uranium

concentrates sold.

2

Non-IFRS measure, see below.

3

Fuel services average realized price is

calculated as revenue from the sale of conversion and fabrication

services, including fuel bundles and reactor components,

transportation and storage fees divided by the volumes sold.

The table below shows the costs of produced and purchased

uranium incurred in the reporting periods (see non-IFRS measures

below). These costs do not include care and maintenance costs,

selling costs such as royalties, transportation and commissions,

nor do they reflect the impact of opening inventories on our

reported cost of sales.

THREE MONTHS

NINE MONTHS

ENDED SEPTEMBER 30

ENDED SEPTEMBER 30

($CDN/LB)

2024

2023

CHANGE

2024

2023

CHANGE

Produced

Cash cost

29.21

32.37

(10)%

20.90

25.60

(18)%

Non-cash cost

10.40

12.24

(15)%

9.66

11.92

(19)%

Total production cost 1

39.61

44.61

(11)%

30.56

37.52

(19)%

Quantity produced (million lbs)1

4.3

3.0

43%

17.3

11.9

45%

Purchased

Cash cost

109.59

79.14

38%

100.13

69.88

43%

Quantity purchased (million lbs)1

1.8

0.8

>100%

6.2

5.0

24%

Totals

Produced and purchased costs

60.26

51.88

16%

48.91

47.09

4%

Quantities produced and purchased (million

lbs)

6.1

3.8

61%

23.5

16.9

39%

1

Due to equity accounting, our share of

production from JV Inkai is shown as a purchase at the time of

delivery. These purchases will fluctuate during the quarters and

timing of purchases will not match production. There were no

purchases during the quarter. In the first nine months of 2024, we

purchased 1.2 million pounds at a purchase price per pound of

$128.42 ($95.63 (US)).

Non-IFRS measures

The non-IFRS measures referenced in this document are

supplemental measures, which are used as indicators of our

financial performance. Management believes that these non-IFRS

measures provide useful supplemental information to investors,

securities analysts, lenders and other interested parties in

assessing our operational performance and our ability to generate

cash flows to meet our cash requirements. These measures are not

recognized measures under IFRS, do not have standardized meanings,

and are therefore may not be comparable to similarly titled

measures presented by other companies. Accordingly, these measures

should not be considered in isolation or as a substitute for the

financial information reported under IFRS. We are not able to

reconcile our forward-looking non-IFRS guidance because we cannot

predict the timing and amounts of discrete items, which could

significantly impact our IFRS results.

The following are the non-IFRS measures used in this

document.

ADJUSTED NET EARNINGS

Adjusted net earnings is our net earnings attributable to equity

holders, adjusted for non-operating or non-cash items such as gains

and losses on derivatives and adjustments to reclamation provisions

flowing through other operating expenses, that we believe do not

reflect the underlying financial performance for the reporting

period. Other items may also be adjusted from time to time. We

adjust this measure for certain of the items that our

equity-accounted investees make in arriving at other non-IFRS

measures. Adjusted net earnings is one of the targets that we

measure to form the basis for a portion of annual employee and

executive compensation (see Measuring our results in our 2023

annual MD&A).

In calculating ANE we adjust for derivatives. We do not use

hedge accounting under IFRS and, therefore, we are required to

report gains and losses on all hedging activity, both for contracts

that close in the period and those that remain outstanding at the

end of the period. For the contracts that remain outstanding, we

must treat them as though they were settled at the end of the

reporting period (mark-to-market). However, we do not believe the

gains and losses that we are required to report under IFRS

appropriately reflect the intent of our hedging activities, so we

make adjustments in calculating our ANE to better reflect the

impact of our hedging program in the applicable reporting period.

See Foreign exchange in our 2023 annual MD&A for more

information.

We also adjust for changes to our reclamation provisions that

flow directly through earnings. Every quarter we are required to

update the reclamation provisions for all operations based on new

cash flow estimates, discount and inflation rates. This normally

results in an adjustment to an asset retirement obligation asset in

addition to the provision balance. When the assets of an operation

have been written off due to an impairment, as is the case with our

Rabbit Lake and US ISR operations, the adjustment is recorded

directly to the statement of earnings as “other operating expense

(income)”. See note 10 of our interim financial statements for more

information. This amount has been excluded from our ANE

measure.

As a result of the change in ownership of Westinghouse when it

was acquired by Cameco and Brookfield, Westinghouse’s inventories

at the acquisition date were revalued based on the market price at

that date. As these quantities are sold, Westinghouse’s cost of

products and services sold reflect these market values, regardless

of their historic costs. Our share of these costs is included in

earnings from equity-accounted investees and recorded in cost of

products and services sold in the investee information (see note 7

to the financial statements). Since this expense is non-cash,

outside of the normal course of business and only occurred due to

the change in ownership, we have excluded our share from our ANE

measure.

Westinghouse has also expensed some non-operating

acquisition-related transition costs that the acquiring parties

agreed to pay for, which resulted in a reduction in the purchase

price paid. Our share of these costs is included in earnings from

equity-accounted investees and recorded in other expenses in the

investee information (see note 7 to the financial statements).

Since this expense is outside of the normal course of business and

only occurred due to the change in ownership, we have excluded our

share from our ANE measure.

To facilitate a better understanding of these measures, the

table below reconciles adjusted net earnings with our net earnings

for the third quarter and first nine months of 2024 and compares it

to the same periods in 2023.

THREE MONTHS

NINE MONTHS

ENDED SEPTEMBER 30

ENDED SEPTEMBER 30

($ MILLIONS)

2024

2023

2024

2023

Net earnings attributable to equity

holders

7

148

36

281

Adjustments

Adjustments on derivatives

(28

)

41

19

-

Inventory purchase accounting (net of

tax)

-

-

50

-

Acquisition-related transition costs (net

of tax)

5

-

24

-

Adjustment to other operating expense

(income)

5

(48

)

(12

)

(42

)

Income taxes on adjustments

8

(4

)

(2

)

10

Adjusted net earnings (losses)

(3

)

137

115

249

The following table shows what contributed to the change in

adjusted net earnings (non-IFRS measure, see above) for the third

quarter and first nine months of 2024 compares to the same periods

in 2023.

THREE MONTHS

NINE MONTHS

ENDED SEPTEMBER 30

ENDED SEPTEMBER 30

($ MILLIONS)

IFRS

ADJUSTED

IFRS

ADJUSTED

Net earnings - 2023

148

137

281

249

Change in gross profit by segment

(We calculate gross profit by deducting

from revenue the cost of products and services sold, and

depreciation and amortization (D&A), net of hedging

benefits)

Uranium

Impact from sales volume changes

6

6

(22

)

(22

)

Higher realized prices ($US)

74

74

270

270

Foreign exchange impact on realized

prices

14

14

12

12

Higher costs

(78

)

(78

)

(139

)

(139

)

Change – uranium

16

16

121

121

Fuel services

Impact from sales volume changes

9

9

2

2

Higher (lower) realized prices ($Cdn)

(19

)

(19

)

14

14

Lower (higher) costs

13

13

(32

)

(32

)

Change – fuel services

3

3

(16

)

(16

)

Other changes

Lower administration expenditures

15

15

11

11

Higher exploration and research and

development expenditures

(2

)

(2

)

(10

)

(10

)

Change in reclamation provisions

(66

)

(13

)

(40

)

(10

)

Lower earnings from equity-accounted

investees

(66

)

(61

)

(176

)

(102

)

Change in gains or losses on

derivatives

68

(1

)

(23

)

(4

)

Change in foreign exchange gains or

losses

(68

)

(68

)

-

-

Lower finance income

(30

)

(30

)

(75

)

(75

)

Higher finance costs

(12

)

(12

)

(48

)

(48

)

Change in income tax recovery or

expense

3

15

13

1

Other

(2

)

(2

)

(2

)

(2

)

Net earnings (losses) - 2024

7

(3

)

36

115

EBITDA

EBITDA is defined as net earnings attributable to equity

holders, adjusted for the costs related to the impact of the

company’s capital and tax structure including depreciation and

amortization, finance income, finance costs (including accretion)

and income taxes. Included in EBITDA is our share of

equity-accounted investees.

ADJUSTED EBITDA

Adjusted EBITDA is defined as EBITDA, as further adjusted for

the impact of certain costs or benefits incurred in the period

which are either not indicative of the underlying business

performance or that impact the ability to assess the operating

performance of the business. These adjustments include the amounts

noted in the ANE definition.

In calculating adjusted EBITDA, we also adjust for items

included in the results of our equity-accounted investees that are

not adjustments to arrive at our ANE measure. These items are

reported as part of other expenses within the investee financial

information and are not representative of the underlying

operations. These primarily include transaction, integration and

restructuring costs related to acquisitions.

The company may realize similar gains or incur similar

expenditures in the future.

ADJUSTED EBITDA MARGIN

Adjusted EBITDA margin is defined as adjusted EBITDA divided by

revenue for the appropriate period.

EBITDA, adjusted EBITDA and adjusted EBITDA margin are non-IFRS

measures which allow us and other users to assess results of

operations from a management perspective without regard for our

capital structure.

To facilitate a better understanding of these measures, the

tables below reconcile net earnings with EBITDA and adjusted EBITDA

for the third quarter and first nine months of 2024 and 2023.

For the quarter ended September 30, 2024:

FUEL

($ MILLIONS)

URANIUM

SERVICES

WESTINGHOUSE

OTHER

TOTAL

Net earnings (loss) attributable to

equity holders

171

17

(57

)

(124

)

7

Depreciation and amortization

59

11

-

1

71

Finance income

-

-

-

(4

)

(4

)

Finance costs

-

-

-

35

35

Income taxes

-

-

-

38

38

230

28

(57

)

(54

)

147

Adjustments on equity investees

Depreciation and amortization

2

-

93

-

Finance expense

-

-

54

-

Income taxes

3

-

(2

)

-

Net adjustments on equity investees

5

-

145

-

150

EBITDA

235

28

88

(54

)

297

Loss on derivatives

-

-

-

(28

)

(28

)

Other operating expense

5

-

-

-

5

5

-

-

(28

)

(23

)

Adjustments on equity investees

Acquisition-related transition costs

-

-

7

-

Other expenses

-

-

27

-

Net adjustments on equity investees

-

-

34

-

34

Adjusted EBITDA

240

28

122

(82

)

308

For the quarter ended September 30, 2023:

FUEL

($ MILLIONS)

URANIUM

SERVICES

OTHER

TOTAL

Net earnings (loss) attributable to

equity holders

218

28

(98

)

148

Depreciation and amortization

47

8

1

56

Finance income

-

-

(34

)

(34

)

Finance costs

-

-

23

23

Income taxes

-

-

41

41

265

36

(67

)

234

Adjustments on equity investees

Depreciation and amortization

2

-

-

Income taxes

5

-

-

Net adjustments on equity investees

7

-

-

7

EBITDA

272

36

(67

)

241

Gain on derivatives

-

-

41

41

Other operating income

(48

)

-

-

(48

)

Adjusted EBITDA

224

36

(26

)

234

For the nine months ended September 30, 2024:

FUEL

($ MILLIONS)

URANIUM1

SERVICES

WESTINGHOUSE

OTHER

TOTAL

Net earnings (loss) attributable to

equity holders

615

71

(227

)

(423

)

36

Depreciation and amortization

148

25

-

4

177

Finance income

-

-

-

(18

)

(18

)

Finance costs

-

-

-

117

117

Income taxes

-

-

-

87

87

763

96

(227

)

(233

)

399

Adjustments on equity investees

Depreciation and amortization

12

-

267

-

Finance income

-

-

(3

)

-

Finance expense

-

-

172

-

Income taxes

27

-

(50

)

-

Net adjustments on equity investees

39

-

386

-

425

EBITDA

802

96

159

(233

)

824

Gain on derivatives

-

-

-

19

19

Other operating income

(12

)

-

-

-

(12

)

(12

)

-

-

19

7

Adjustments on equity investees

Inventory purchase accounting

-

-

66

-

Acquisition-related transition costs

-

-

32

-

Other expenses

-

-

63

-

Net adjustments on equity investees

-

-

161

-

161

Adjusted EBITDA

790

96

320

(214

)

992

For the nine months ended September 30, 2023:

FUEL

($ MILLIONS)

URANIUM1

SERVICES

OTHER

TOTAL

Net earnings (loss) attributable to

equity holders

474

97

(290

)

281

Depreciation and amortization

147

24

3

174

Finance income

-

-

(93

)

(93

)

Finance costs

-

-

69

69

Income taxes

-

-

100

100

621

121

(211

)

531

Adjustments on equity investees

Depreciation and amortization

6

-

-

Income taxes

16

-

-

Net adjustments on equity investees

22

-

-

22

EBITDA

643

121

(211

)

553

Other operating income

(42

)

-

-

(42

)

Adjusted EBITDA

601

121

(211

)

511

CASH COST PER POUND, NON-CASH COST PER POUND AND TOTAL COST

PER POUND FOR PRODUCED AND PURCHASED URANIUM

Cash cost per pound, non-cash cost per pound and total cost per

pound for produced and purchased uranium are non-IFRS measures. We

use these measures in our assessment of the performance of our

uranium business. These measures are not necessarily indicative of

operating profit or cash flow from operations as determined under

IFRS.

To facilitate a better understanding of these measures, the

table below reconciles these measures to cost of product sold and

depreciation and amortization for the third quarter and first nine

months of 2024 and 2023.

THREE MONTHS

NINE MONTHS

ENDED SEPTEMBER 30

ENDED SEPTEMBER 30

($ MILLIONS)

2024

2023

2024

2023

Cost of product sold

386.5

304.6

1,027.0

959.1

Add / (subtract)

Royalties

(38.4

)

(22.3

)

(88.5

)

(61.0

)

Care and maintenance costs

(13.4

)

(12.1

)

(37.3

)

(35.2

)

Other selling costs

(2.9

)

(3.0

)

(12.2

)

(7.1

)

Change in inventories

(8.9

)

(106.8

)

93.4

(201.8

)

Cash costs of production (a)

322.9

160.4

982.4

654.0

Add / (subtract)

Depreciation and amortization

59.3

47.1

147.5

147.2

Care and maintenance costs

(0.2

)

(0.8

)

(0.6

)

(3.4

)

Change in inventories

(14.4

)

(9.6

)

20.2

(2.0

)

Total production costs (b)

367.6

197.1

1,149.5

795.8

Uranium produced & purchased (million

lbs) (c)

6.1

3.8

23.5

16.9

Cash costs per pound (a ÷ c)

52.93

42.21

41.80

38.70

Total costs per pound (b ÷ c)

60.26

51.88

48.91

47.09

Management's discussion and analysis (MD&A) and financial

statements

The third quarter MD&A and unaudited condensed consolidated

interim financial statements provide a detailed explanation of our

operating results for the three and nine months ended September 30,

2024, as compared to the same periods last year. This news release

should be read in conjunction with these documents, as well as our

audited consolidated financial statements and notes for the year

ended December 31, 2023, first quarter, second quarter and annual

MD&A, and our most recent annual information form, all of which

are available on our website at cameco.com, on SEDAR+ at

sedarplus.ca, and on EDGAR at sec.gov/edgar.shtml.

Qualified persons

The technical and scientific information discussed in this

document for our material properties McArthur River/Key Lake, Cigar

Lake and Inkai was approved by the following individuals who are

qualified persons for the purposes of NI 43-101:

MCARTHUR RIVER/KEY LAKE

- Greg Murdock, general manager, McArthur River, Cameco

- Daley McIntyre, general manager, Key Lake, Cameco

CIGAR LAKE

- Kirk Lamont, general manager, Cigar Lake, Cameco

INKAI

- Sergey Ivanov, deputy director general, technical services,

Cameco Kazakhstan LLP

Caution about forward-looking information

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect. Examples of forward-looking information in this news

release include: our view that our third quarter operational

performance supports our return to a tier-one cost structure, and

that there is a trend of improving operational performance and cash

flow generation, backed by stable and rising market prices; our

financial outlook for both Cameco and Westinghouse; our expectation

of continued strengthening of the industry’s long term prospects;

our recommended dividend growth plan and expectations regarding

dividend payments, and increases through 2026; our perception of

sustained, positive momentum for nuclear energy, and our ability to

capture greater upside in future years; our view that our strategy

will align with our commitments, permitting us to deliver

fully-cycle value; our 2024 uranium production outlook; our ability

to rebalance our supply sources; our production expectations for JV

Inkai; our expectation of strong cash flow generation, and

intention to prioritize debt management and reduction while

maintaining liquidity and strong cash flow generation; our

perception of a positive shift in government, industry and public

support for nuclear energy, and continuing financial support for

access to nuclear power; our belief that Cameco is uniquely

positioned to benefit from those developments; our expected ability

to achieve our vision, including a commitment to make our business

sustainable over the long term; our expected uranium average

realized prices, production and deliveries and outlook for our

share of Westinghouse’s 2024 adjusted EBITDA, as well as its

performance and cash flows; expected Key Lake Mill and JV Inkai

production levels, and timing of shipments and deliveries; the

expected timing of the finalization and filing of a new technical

report for the Inkai mine; our expectations regarding the building

of our long-term contract portfolio and pipeline of business under

discussion; our intention to file a new base shelf prospectus in

the fourth quarter; and the timing of our third quarter conference

call and announcement of our 2024 fourth quarter and annual

results.

Material risks that could lead to different results include:

unexpected changes in uranium supply, demand, long-term

contracting, and prices; changes in consumer demand for nuclear

power and uranium as a result of changing societal views and

objectives regarding nuclear power, electrification and

decarbonization; the risk that our views regarding nuclear power,

its growth profile, and benefits, may prove to be incorrect; the

risk that we may not be able to achieve planned production levels

within the expected timeframes, or that the costs involved in doing

so exceed our expectations; the risk that the production levels at

Inkai may not be at expected levels due to the unavailability of

sufficient volumes of sulfuric acid or for any other reason, or

that it may not be able to deliver its production when expected,

risks to Westinghouse’s business associated with potential

production disruptions, the implementation of its business

objectives, compliance with licensing or quality assurance

requirements, or that it may otherwise be unable to achieve

expected growth; the risk that we may not be able to meet sales

commitments for any reason; the risks to our business associated

with potential production disruptions, including those related to

global supply chain disruptions, global economic uncertainty,

political volatility, labour relations issues, and operating risks;

the risk that we may not be able to implement our business

objectives in a manner consistent with our environmental, social,

governance and other values; the risk that the strategy we are

pursuing may prove unsuccessful, or that we may not be able to

execute it successfully; the risk that Westinghouse may not be able

to implement its business objectives in a manner consistent with

its or our environmental, social, governance and other values; the

filing of our new base shelf prospectus or the new technical report

for the Inkai mine may be delayed for unanticipated reasons; we may

be unable to pay dividends on our common shares through 2026 in the

amounts we currently expect; and the risk that we may be delayed in

announcing our future financial results.

In presenting the forward-looking information, we have made

material assumptions which may prove incorrect about: uranium

demand, supply, consumption, long-term contracting, growth in the

demand for and global public acceptance of nuclear energy, and

prices; our production, purchases, sales, deliveries and costs; the

market conditions and other factors upon which we have based our

future plans and forecasts; our contract pipeline discussions;

Inkai production, its receipt of sufficient volumes of sulfuric

acid, and our allocation of planned production and timing of

deliveries; assumptions about Westinghouse’s production, purchases,

sales, deliveries and costs, the absence of business disruptions,

and the success of its plans and strategies; the success of our

plans and strategies, including planned production; the absence of

new and adverse government regulations, policies or decisions; that

there will not be any significant adverse consequences to our

business resulting from production disruptions, including those

relating to supply disruptions, economic or political uncertainty

and volatility, labour relation issues, aging infrastructure, and

operating risks; the assumptions relating to Westinghouse’s

adjusted EBITDA; the filing of our new base shelf prospectus and

the new technical report for the Inkai mine will not be delayed for

unanticipated reasons; annual dividends on our common shares will

be declared and paid in the amounts we expected through 2026 and

our ability to announce future financial results when expected.

Please also review the discussion in our 2023 annual MD&A,

our 2024 first and second quarter MD&A and our most recent

annual information form for other material risks that could cause

actual results to differ significantly from our current

expectations, and other material assumptions we have made.

Forward-looking information is designed to help you understand

management’s current views of our near-term and longer-term

prospects, and it may not be appropriate for other purposes. We

will not necessarily update this information unless we are required

to by securities laws.

Conference call

We invite you to join our third quarter conference call on

Thursday, November 7, 2024, at 8:00 a.m. Eastern.

The call will be open to all investors and the media. To join

the call, please dial (844) 763-8274 (Canada and US) or (647)

484-8814. An operator will put your call through. The slides and a

live webcast of the conference call will be available from a link

at cameco.com. See the link on our home page on the day of the

call.

A recorded version of the proceedings will be available:

- on our website, cameco.com, shortly after the call

- on post view until midnight, Eastern, December 7, 2024, by

calling (855) 669-9658 (Canada/ USA toll-free) or (412) 317-0088

(International toll) (Passcode 7713061)

2024 fourth quarter and annual report release date

We plan to announce our 2024 fourth quarter and annual

consolidated financial and operating results before markets open on

February 20, 2025. Announcement dates are subject to change.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations, as well as significant

investments across the nuclear fuel cycle, including ownership

interests in Westinghouse Electric Company and Global Laser

Enrichment. Utilities around the world rely on Cameco to provide

global nuclear fuel solutions for the generation of safe, reliable,

carbon-free nuclear power. Our shares trade on the Toronto and New

York stock exchanges. Our head office is in Saskatoon,

Saskatchewan, Canada.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries unless

otherwise indicated.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106081013/en/

Investor inquiries:

Cory Kos 306-716-6782 cory_kos@cameco.com

Media inquiries:

Veronica Baker 306-385-5541 veronica_baker@cameco.com

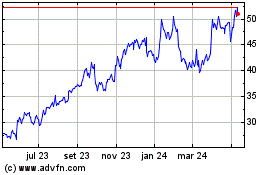

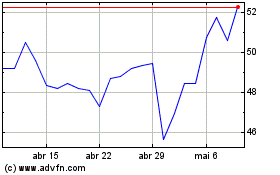

Cameco (NYSE:CCJ)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Cameco (NYSE:CCJ)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024