CUTERA, INC. (Nasdaq: CUTR), a leading provider of aesthetic and

dermatology solutions, today reported financial results for the

third quarter ended September 30, 2024.

- Consolidated revenue for the third quarter of 2024 of $32.5

million

- Cash, cash equivalents, and restricted cash of $59.0

million

- AviClear growth of 16% vs prior year period driven by

international capital system sales

- Global core capital growth of 7% on a sequential quarterly

basis

- Full-year guidance maintained for both revenue and year-end

cash balance

“Our third quarter reflects consistent execution against our

strategic priorities, with core capital sales improving on a

sequential basis, AviClear continuing to grow year-over-year driven

by strong sales and utilization in international markets, and

favorable underlying trends in our gross margin and operating

expense profile,” commented Taylor Harris, Chief Executive Officer

of Cutera, Inc. “We remain focused on expanding access to AviClear,

our breakthrough technology for the treatment of acne, through

training and education, practice development, and clinical

indication expansion.”

Third Quarter 2024 Financial Highlights

Consolidated revenue for the third quarter of 2024 was $32.5

million, a decrease of 30% compared to the third quarter 2023.

Revenue in the third quarter of 2023 included skincare revenue of

$7.1 million; following the termination of our skincare

distribution agreement in February 2024, the third quarter of 2024

did not include skincare revenue. Revenue related to capital

systems sales declined 17%, while recurring sources of revenue,

excluding skincare, declined 19%.

Gross profit was $1.8 million, or 6% of revenue for the third

quarter of 2024, compared to a gross profit of $6.5 million, or 14%

of revenue, for the third quarter of 2023. On a non-GAAP basis,

gross profit was $3.7 million, or 12% of revenue, for the third

quarter of 2024, compared to $9.0 million, or 19%, for the third

quarter of 2023. Gross profit in the third quarter, on a GAAP and a

non-GAAP basis, was negatively affected by $10.1 million, or 31% of

revenue, of non-cash expense related to excess and obsolete

inventory.

Operating expenses were $38.0 million for the third quarter of

2024, compared to $47.4 million in the prior year period. On a

non-GAAP basis, operating expenses were $34.7 million for the third

quarter of 2024, compared to $39.8 million for the prior year

period. Operating expenses for the third quarter of 2024, on a GAAP

and non-GAAP basis, include a $5.4 million charge related to

doubtful accounts receivable. The Company no longer adjusts for

costs related to a retention plan implemented in April 2023, in its

Reconciliation of Non-GAAP Financial Measures. Accordingly, the

Company has not adjusted for $0.4 million of retention plan costs

incurred in the third quarter of 2024. Further, the Company has

revised the presentation of current and prior year periods to

remove adjustments related to retention plan costs of $4.0 million

for the nine months ending September 30, 2024, and $1.4 million and

$4.3 million, in the three and nine months ended September 30,

2023, respectively.

GAAP operating loss was $36.2 million and $40.9 million for the

third quarters of 2024 and 2023, respectively. Non-GAAP operating

loss was $31.0 million for the third quarter of 2024, compared to a

Non-GAAP operating loss of $30.9 million for the third quarter of

2023.

Cash, cash equivalents, and restricted cash, were $59.0 million

as of September 30, 2024, compared to $84.3 million as of June 30,

2024.

2024 Outlook

Management is reaffirming full-year revenue guidance of $140

million to $145 million, as well as guidance for year-end 2024

cash, cash equivalents and restricted cash of approximately $40

million.

Conference Call

The Company’s management will host a conference call to discuss

these results and related matters today at 1:30 p.m. PT (4:30 p.m.

ET). Participating in the call will be Taylor Harris, Chief

Executive Officer, Stuart Drummond, Interim Chief Financial

Officer, and Shelby Eckerman, Vice President, Finance.

Participants can register for the conference call at this

registration link. Upon registering, a calendar booking will be

provided by email including the dial-in details and a unique PIN to

access the call. Using this process will by-pass the operator and

avoid the call queue. Registration will remain open until the end

of the live conference call.

If participants prefer to dial in and speak with an operator,

dial Canada/USA Toll Free: 1-844-763-8274 or +1-647-484-8814. It is

recommended that you call in 10 minutes prior to the scheduled

start time if you are using one of these operator-assisted phone

numbers.

The call will also be webcast and can be accessed from the

Investor Relations section of Cutera’s website at

http://www.cutera.com/. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

About Cutera, Inc.

Cutera is a leading provider of aesthetic and dermatology

solutions for practitioners worldwide. For over 25 years, Cutera

has strived to improve lives through medical aesthetic technologies

that are driven by science and powered through partnerships. For

more information, call 1-888-4-CUTERA or visit Cutera.com.

*Use of Non-GAAP Financial

Measures

In this press release, to supplement the Company’s condensed

consolidated financial statements presented in accordance with

Generally Accepted Accounting Principles (“GAAP”), management has

disclosed certain non-GAAP financial measures for gross profit,

gross margin rate, and income or loss from operations. Non-GAAP

adjustments include depreciation and amortization including

contract acquisition costs, stock-based compensation, enterprise

resource planning (“ERP”) implementation costs, certain legal and

litigation costs, costs associated with restructuring activities

and the separation of its officers and other executives, gain on

termination of a distribution agreement, and certain other

adjustments. From time to time in the future, there may be other

items that the Company may exclude if the Company believes that

doing so is consistent with the goal of providing useful

information to investors and management. The Company has provided a

reconciliation of each non-GAAP financial measure used in this

earnings release to the most directly comparable GAAP financial

measure.

The Company defines non-GAAP operating income (loss), also

commonly known as adjusted EBITDA, as operating income (loss)

before depreciation and amortization, stock-based compensation, ERP

implementation costs, certain legal and litigation costs,

severance, gain on early termination of distribution agreement, and

other adjustments.

Company management uses non-GAAP financial measures as aids in

monitoring the Company’s ongoing financial performance from quarter

to quarter, and year to year, and for benchmarking against other

similar companies. Non-GAAP financial measures used by the Company

may be calculated differently from, and therefore may not be

comparable to, similarly titled measures used by other companies.

These non-GAAP financial measures should be considered along with,

but not as alternatives to, the operating performance measure as

prescribed by GAAP. Non-GAAP financial measures for the statement

of operations and net income per share exclude the following:

Depreciation and amortization, including contract acquisition

costs. The Company has excluded depreciation and amortization

expense in calculating its non-GAAP operating expenses and net

income measures. Depreciation and amortization are non-cash charges

to current operations;

Stock-based compensation. The Company has excluded the

effect of stock-based compensation expenses in calculating its

non-GAAP operating expenses and net income measures. Although

stock-based compensation is a key incentive offered to the

Company's employees, the Company continues to evaluate its business

performance excluding stock-based compensation expenses. The

Company records stock-based compensation expenses related to grants

of options, employee stock purchase plans, and performance and

restricted stock. Depending upon the size, timing, and terms of the

grants, this expense may vary significantly but will recur in

future periods. The Company believes that excluding stock-based

compensation better allows for comparisons to its peer

companies;

ERP implementation costs. The Company has excluded ERP

system costs related to direct and incremental costs incurred in

connection with its multi-phase implementation of a new ERP

solution and the related technology infrastructure costs. The

Company excludes these costs because it believes that these items

do not reflect future operating expenses and will be inconsistent

in amounts and frequency, making it difficult to contribute to a

meaningful evaluation of the Company’s operating performance;

Certain legal and litigation costs. The Company has

excluded costs incurred related to its litigation against Lutronic

Aesthetics as well as the settlement of $5.8 million, which is not

part of the Company’s ordinary course of business. The Company’s

complaint against Lutronic alleged misappropriation of trade

secrets, violation of the Racketeer Influenced and Corrupt

Organizations Act (“RICO”), interference with contractual relations

and other claims. The Company excludes these costs as well as the

settlement because this litigation is a result of a discrete event

that was not part of the Company’s business strategy, but has a

significant effect on the results of operations. The costs are

incidental to and do not reflect the efficiencies and effectiveness

of the Company’s core operations;

Severance. The Company has excluded costs associated with

restructuring activities and the separation of its officers and

other executives in calculating its non-GAAP operating expenses and

non-GAAP Operating Income. The Company has excluded restructuring

costs because a restructuring represents a discrete event that

signifies a change in the Company’s strategy, but these costs are

not indicative of the ongoing financial performance of the

business. The Company excludes executive separation costs because

executive separations are unpredictable and not part of the

Company’s business strategy but could have a significant impact on

the results of operations;

Gain on early termination of distribution agreement. The

Company has excluded a gain recorded in connection with the early

termination of a distribution agreement with ZO USA in calculating

its non-GAAP operating expenses and non-GAAP operating income

(loss). The Company recorded the net gain of $9.7 million in the

Company's condensed consolidated statement of operations for the

three months ended March 31, 2024. The Company has excluded this

gain as it is not indicative of the ongoing financial performance

of the business, and not part of the Company’s business

strategy.

The Company believes that excluding all of the items above

allows users of its financial statements to better review and

assess both current and historical results of operations. The

Company no longer adjusts for costs related to a retention plan

implemented in April 2023, as such costs represent a normal,

recurring, operating cost, and accordingly, has not adjusted for

$0.4 million of retention plan costs incurred in the third quarter

of 2024. Further, the Company has revised the presentation of the

prior year periods to remove adjustments for retention plan costs

of $1.4 million and $4.3 million, in the three and nine months

ended September 30, 2023, respectively.

Safe Harbor Statement

Certain statements in this press release, other than purely

historical information, are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act, and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These statements include but are not limited to express or implied

statements regarding expanding access to AviClear, and full year

revenues and cash, cash equivalents and restricted cash, along with

other express or implied statements regarding Cutera’s plans,

objectives, strategies, financial performance, guidance and

outlook, product launches and performance, trends, prospects, or

future events. In some cases, you can identify forward-looking

statements by the use of words such as, but not limited to, “may,”

“could,” “seek,” “guidance,” “predict,” “potential,” “likely,”

“believe,” “will,” “should,” “expect,” “anticipate,” “estimate,”

“plan,” “intend,” “forecast,” “foresee” or variations of these

terms and similar expressions or the negative of these terms or

similar expressions. Forward-looking statements are based on

management's current expectations and beliefs and are subject to

risks and uncertainties, which are difficult to predict and may

cause Cutera's actual results to differ materially from the express

or implied forward-looking statements herein. These forward-looking

statements are not guarantees of future performance, and

stockholders should not place undue reliance on forward-looking

statements. There are several risks, uncertainties, and other

important factors, many of which are beyond Cutera’s control, that

could cause its actual results to differ materially from the

forward-looking statements, including risks involved with continued

expansion of AviClear, Cutera’s financial position and debt service

requirements, and making financial projections, as well as the

other risks described in the “Risk Factors” section of Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K, and other documents filed from time to time

with the United States Securities and Exchange Commission by

Cutera.

All statements made in this release are made only as of the date

set forth at the beginning of this release. Accordingly, undue

reliance should not be placed on forward-looking statements. Cutera

undertakes no obligation to update publicly any forward-looking

statements to reflect new information, events, or circumstances

after the date they were made, or to reflect the occurrence of

unanticipated events. If Cutera updates one or more forward-looking

statements, no inference should be drawn that it will make

additional updates concerning those or other forward-looking

statements. Cutera's financial performance for the third quarter

ended September 30, 2024, as discussed in this release, is

preliminary and unaudited, and subject to adjustment.

CUTERA, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands) (unaudited)

September 30, December 31,

2024

2023

Assets Current assets: Cash and cash equivalents

$

57,614

$

143,612

Accounts receivable, net

33,150

43,121

Inventories

56,908

62,600

Other current assets and prepaid expenses

12,842

19,852

Total current assets

160,514

269,185

Long-term inventories

28,664

16,283

Property and equipment, net

23,521

37,275

Deferred tax asset

590

579

Restricted cash

1,363

-

Goodwill

1,339

1,339

Operating lease right-of-use assets

10,593

10,055

Other long-term assets

7,834

11,575

Total assets

$

234,418

$

346,291

Liabilities and Stockholders' Deficit Current

liabilities: Accounts payable

$

7,949

$

19,829

Accrued liabilities

35,972

55,055

Operating leases liabilities

3,386

2,441

Deferred revenue

8,382

10,422

Total current liabilities

55,689

87,747

Deferred revenue, net of current portion

1,689

1,494

Operating lease liabilities, net of current portion

8,397

8,887

Convertible notes, net of unamortized debt issuance costs

420,422

418,695

Other long-term liabilities

1,095

1,298

Total liabilities

487,292

518,121

Stockholders’ deficit: Common stock

20

20

Additional paid-in capital

136,929

131,496

Accumulated deficit

(389,823

)

(303,346

)

Total stockholders' deficit

(252,874

)

(171,830

)

Total liabilities and stockholders' deficit

$

234,418

$

346,291

CUTERA, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

(unaudited) Three Months Ended Nine Months

Ended September 30, September 30, September

30, September 30,

2024

2023

2024

2023

Products $

27,242

$

40,989

$

88,714

$

146,285

Service

5,258

5,489

16,956

16,544

Total net revenue

32,500

46,478

105,670

162,829

Products

27,991

36,586

75,045

98,696

Service

2,696

3,435

8,749

9,961

Total cost of revenue

30,687

40,021

83,794

108,657

Gross profit

1,813

6,457

21,876

54,172

Gross margin %

5.6

%

13.9

%

20.7

%

33.3

%

Operating expenses: Sales and marketing

18,928

25,808

63,269

88,591

Research and development

4,353

4,592

13,817

16,844

General and administrative

14,749

17,004

31,951

47,448

Gain on early termination of distribution agreement

-

-

(9,708

)

-

Total operating expenses

38,030

47,404

99,329

152,883

Loss from operations

(36,217

)

(40,947

)

(77,453

)

(98,711

)

Amortization of debt issuance costs

(580

)

(561

)

(1,726

)

(1,670

)

Interest expense on convertible notes

(3,071

)

(2,939

)

(8,969

)

(8,836

)

Interest income

768

2,288

3,248

6,946

Other expense (income), net

575

(1,948

)

(1,128

)

(2,564

)

Loss before income taxes

(38,525

)

(44,107

)

(86,028

)

(104,835

)

Income tax expense

493

167

449

765

Net loss $

(39,018

)

$

(44,274

)

$

(86,477

)

$

(105,600

)

Net loss per share: Basic $

(1.94

)

$

(2.22

)

$

(4.31

)

$

(5.32

)

Diluted $

(1.94

)

$

(2.22

)

$

(4.31

)

$

(5.32

)

Weighted-average number of shares used in per share

calculations: Basic

20,154

19,932

20,079

19,858

Diluted

20,154

19,932

20,079

19,858

CUTERA, INC. CONSOLIDATED FINANCIAL HIGHLIGHTS

(in thousands, except percentage data) (unaudited)

Three Months Ended % Change Nine Months

Ended % Change September 30, September 30,

2024 Vs September 30, September 30, 2024

Vs

2024

2023

2023

2024

2023

2023

Revenue By Geography: North America $

14,651

$

24,855

-41.1

%

$

49,150

$

84,494

-41.8

%

Japan

3,420

11,529

-70.3

%

14,847

37,247

-60.1

%

Rest of World

14,429

10,094

+42.9

%

41,673

41,088

+1.4

%

Total Net Revenue $

32,500

$

46,478

-30.1

%

$

105,670

$

162,829

-35.1

%

International as a percentage of total revenue

54.9

%

46.5

%

53.5

%

48.1

%

Revenue By Product Category: Systems - North America $

9,253

$

16,982

-45.5

%

$

30,926

$

59,750

-48.2

%

- Rest of World (including Japan)

13,771

10,618

+29.7

%

40,258

41,654

-3.4

%

Total Systems

23,024

27,600

-16.6

%

71,184

101,404

-29.8

%

Consumables

4,218

6,248

-32.5

%

13,330

20,186

-34.0

%

Skincare

-

7,141

-100.0

%

4,200

24,695

-83.0

%

Total Products

27,242

40,989

-33.5

%

88,714

146,285

-39.4

%

Service

5,258

5,489

-4.2

%

16,956

16,544

+2.5

%

Total Net Revenue $

32,500

$

46,478

-30.1

%

$

105,670

$

162,829

-35.1

%

CUTERA, INC. CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (in thousands) (unaudited)

Three Months Ended Nine Months Ended September

30, September 30, September 30, September

30,

2024

2023

2024

2023

Cash flows from operating activities: Net loss

$

(39,018

)

$

(44,274

)

$

(86,477

)

$

(105,600

)

Adjustments to reconcile net loss to net cash used in operating

activities: Stock-based compensation

1,841

1,616

5,543

6,552

Depreciation and amortization

1,669

1,987

5,464

5,225

Amortization of contract acquisition costs

1,113

3,016

3,882

7,085

Amortization of debt issuance costs

581

561

1,727

1,670

Deferred tax assets

(82

)

19

(11

)

62

Provision for credit losses

4,931

3,574

9,739

5,488

Accretion of discount on investment securities and investment

income, net

-

902

-

1,048

Changes in assets and liabilities: Accounts receivable

(3,402

)

276

232

(9,755

)

Inventories

11,841

2,317

3,259

1,781

Other current assets and prepaid expenses

118

5,128

7,010

4,352

Other long-term assets

(142

)

(860

)

(472

)

(5,642

)

Accounts payable

(9,668

)

(3,069

)

(11,880

)

(4,735

)

Accrued liabilities

5,737

(7,157

)

(18,704

)

(10,963

)

Operating leases ,net

(27

)

(14

)

(83

)

(44

)

Deferred revenue

(234

)

(899

)

(1,845

)

(390

)

Net cash used in operating activities

(24,742

)

(36,877

)

(82,616

)

(103,866

)

Cash flows from investing activities: Acquisition of

property and equipment

(173

)

(5,534

)

(1,390

)

(30,642

)

Proceeds from disposal of property and equipment

-

-

63

-

Proceeds from maturities of marketable investments

-

41,044

193,903

Purchases of marketable investments

-

-

-

(23,467

)

Net provided by (used in) cash used in investing activities

(173

)

35,510

(1,327

)

139,794

Cash flows from financing activities: Proceeds from exercise

of stock options and employee stock purchase plan

-

465

-

1,323

Taxes paid related to net share settlement of equity awards

(26

)

(87

)

(110

)

(3,273

)

Payments on finance lease obligation

(393

)

(149

)

(582

)

(386

)

Net cash provided by (used in) financing activities

(419

)

229

(692

)

(2,336

)

Net increase (decrease) in cash, cash equivalents and restricted

cash

(25,334

)

(1,138

)

(84,635

)

33,592

Cash, cash equivalents, and restricted cash at beginning of period

84,311

181,354

143,612

146,624

Cash, cash equivalents, and restricted cash at end of period

$

58,977

$

180,216

$

58,977

$

180,216

CUTERA, INC.

Reconciliation of Non-GAAP

Financial Measures to the Most Directly Comparable GAAP Financial

Measure

(in thousands)

Three Months Ended September 30, 2024 Gross

Profit Gross Margin OperatingExpenses

OperatingIncome Reported

$

1,813

5.6

%

$

38,030

$

(36,217

)

Adjustments: Depreciation and amortization including contract

acquisition costs

1,643

5.1

%

1,138

2,781

Stock-based compensation

102

0.3

%

1,739

1,841

Legal - Lutronic settlement

-

0.0

%

-

-

Severance

189

0.6

%

454

643

Gain on early termination of distribution agreement

-

0.0

%

-

-

Other adjustments

-

0.0

%

-

-

Total adjustments

1,934

6.0

%

3,331

5,265

Non-GAAP

$

3,747

11.5

%

$

34,699

$

(30,952

)

Three Months Ended September 30, 2023 Gross

Profit Gross Margin OperatingExpenses

OperatingIncome Reported

$

6,457

13.9

%

$

47,404

$

(40,947

)

Adjustments: Depreciation and amortization including contract

acquisition costs

2,371

5.1

%

2,361

4,732

Stock-based compensation

(19

)

0.0

%

1,636

1,617

ERP implementation cost

-

0.0

%

1,456

1,456

Legal - Lutronic expense

-

0.0

%

561

561

Severance

151

0.3

%

191

342

Board of Directors legal and advisory fees

-

0.0

%

1,280

1,280

Other adjustments

-

0.0

%

97

97

Total adjustments

2,503

5.4

%

7,582

10,085

Non-GAAP

$

8,960

19.3

%

$

39,822

$

(30,862

)

Nine Months Ended September 30, 2024 Gross Profit

Gross Margin OperatingExpenses OperatingIncome

Reported

$

21,876

20.7

%

$

99,329

$

(77,453

)

Adjustments: Depreciation and amortization including contract

acquisition costs

5,564

5.3

%

3,782

9,346

Stock-based compensation

395

0.4

%

5,148

5,543

Legal - Lutronic settlement

-

0.0

%

(5,750

)

(5,750

)

Severance

285

0.3

%

1,257

1,542

Gain on early termination of distribution agreement

-

0.0

%

(9,708

)

(9,708

)

Other adjustments

-

0.0

%

263

263

Total adjustments

6,244

5.9

%

(5,008

)

1,236

Non-GAAP

$

28,120

26.6

%

$

104,337

$

(76,217

)

Nine Months Ended September 30, 2023 Gross

Profit Gross Margin OperatingExpenses

OperatingIncome Reported

$

54,172

33.3

%

$

152,883

$

(98,711

)

Adjustments: Depreciation and amortization including contract

acquisition costs

5,968

3.7

%

6,342

12,310

Stock-based compensation

706

0.4

%

5,847

6,553

ERP implementation cost

-

0.0

%

2,744

2,744

Legal - Lutronic expense

-

0.0

%

1,607

1,607

Severance

270

0.2

%

621

891

Board of Directors legal and advisory fees

-

0.0

%

8,989

8,989

Other adjustments

307

0.2

%

682

989

Total adjustments

7,251

4.5

%

26,832

34,083

Non-GAAP

$

61,423

37.7

%

$

126,051

$

(64,628

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107740612/en/

Cutera Investor Relations Contact: Shelby Eckerman, VP,

Finance IR@Cutera.com

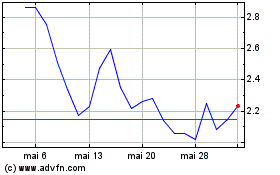

Cutera (NASDAQ:CUTR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Cutera (NASDAQ:CUTR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024