Globalstar, Inc. (NYSE American: GSAT) (“Globalstar” or the

“Company”) today announced its financial results for the third

quarter ended September 30, 2024.

"Globalstar reported strong third quarter results highlighted by

a 25% increase in total revenue. Net income and Adjusted EBITDA

both benefited significantly from the increase in high-margin

revenue with a favorable fluctuation in net income of $16 million

and an increase in Adjusted EBITDA of 34%, reaching a record high

during the quarter. Growth in wholesale capacity revenue continues

to be the primary driver of our improved financial results with

other recent business initiatives also contributing overall. As a

result, we are increasing the low end of our revenue guidance to

$245 million from $235 million and Adjusted EBITDA margin to 54%

from 53%,” commented Rebecca Clary, Chief Financial Officer.

Dr. Paul E. Jacobs, Chief Executive Officer, said, “I am pleased

with our third quarter results and progress on our long-term growth

strategy. I am also extremely proud of the Globalstar team's

efforts in response to the tragic events of Hurricanes Helene and

Milton, during which we maintained excellent service quality

throughout the impacted regions. Globalstar's system was

commercially available and able to serve a dramatic increase in

usage as numerous users affected by such events were able to access

our satellites to request emergency assistance as well as

communicate with friends and family."

Dr. Jacobs added, "In support of our mission to provide

mainstream satellite connectivity, during the third quarter, the

FCC approved our application to extend the term of our senior

HIBLEO-4 constellation by an additional 15 years and operate up to

26 replacement satellites. This modification will enable us to

continue to provide a variety of essential communications services

to our customers.”

Dr. Jacobs concluded, “Building on the foundation of successful

execution in our wholesale consumer segment, we recently announced

a significant extension of the services agreements with our largest

customer. The updated services agreements enable further growth of

our mobile satellite services, and include a new satellite

constellation, expanded ground infrastructure and increased global

mobile satellite services licensing. We are pleased to enter this

next phase of growth, and look forward to providing updates on a

wide range of activities and initiatives at our upcoming investor

day on December 12.”

THIRD QUARTER FINANCIAL REVIEW

Revenue

Total revenue for the third quarter of 2024 was $72.3 million,

which was comprised of $68.9 million of service revenue and $3.4

million of revenue generated from subscriber equipment sales. Total

revenue increased 25% from the prior year's third quarter due to an

increase in service revenue.

Higher service revenue of $15.3 million, or 28%, was due

predominantly to revenue generated from wholesale capacity

services. Wholesale capacity revenue increased during the third

quarter of 2024 due, in part, to the Company's achievement of

performance-based bonuses under the services agreements, including

an out-of-period amount of $7.5 million associated with 2023 and

first half 2024 performance and first half 2024 performance.

We also continue to make progress on other strategic

initiatives, including XCOM RAN equipment shipments, recognition of

fees associated with a proof of concept with a government services

company and other engineering contract work.

For our subscriber driven service revenue, Commercial IoT

service revenue increased 5% from the prior year's third quarter

due primarily to a 7% increase in average number of subscribers.

Service revenue associated with legacy Duplex and SPOT services was

lower due to fewer subscribers.

Income from operations

Income from operations was $9.4 million during the third quarter

of 2024, compared to $2.0 million during the prior year's quarter.

This variance was due primarily to higher revenue (as discussed

above) partially offset by higher operating expenses.

Higher cost of services resulted from network operating costs,

primarily personnel costs and maintenance. These costs are

necessary to support our new and upgraded global ground

infrastructure. A significant portion of these costs are reimbursed

to us, and this consideration is recognized as revenue when earned

in the subsequent year. We currently do not expect the operating

costs that support existing Phase 1 services to increase

meaningfully beyond current levels. Cost of services also increased

due to product development efforts as well as non-cash costs

associated with the Support Services Agreement (the “SSA”) we

entered into in August 2023 in connection with the XCOM License

Agreement.

Stock-based compensation increased from the prior year's third

quarter due primarily to restricted stock units ("RSUs") granted in

connection with the XCOM License Agreement in September 2023. The

total fair value of the RSUs was $39.5 million and is being

recognized over the derived service period of 2.6 years. We expect

that nearly 60% of the compensation cost for these RSUs will be

recognized during 2024.

Net income (loss)

Net income was $9.9 million for the third quarter of 2024,

compared to net loss of $6.2 million for the prior year's quarter.

This variance was due primarily to higher operating income, lower

interest expense and a favorable fluctuation in foreign currency

gains and losses due to the remeasurement of intercompany

balances.

Adjusted EBITDA

Adjusted EBITDA increased 34% to $42.8 million during the third

quarter of 2024 compared to $32.0 million during the prior year's

third quarter, due primarily to an increase in high-margin service

revenue. Adjusted EBITDA is a non-GAAP financial measure. For more

information on its usage and presentation, as well as a

reconciliation to GAAP net income (loss), refer to “Reconciliation

of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA”.

YEAR TO DATE FINANCIAL REVIEW

Revenue

Total revenue was $189.2 million during the nine months ended

September 30, 2024, which was comprised of $180.0 million of

service revenue and $9.2 million of revenue generated from

subscriber equipment sales. Total revenue increased 10% from the

same period in 2023 due to an increase in service revenue, offset

partially by a decrease in revenue generated from subscriber

equipment sales.

Service revenue increased $24.8 million, or 16%, for the nine

months ended September 30, 2024 compared to the same period in

2023. Consistent with the quarterly results discussed above, higher

wholesale capacity revenue was the primary driver of the increase.

Higher Commercial IoT subscribers and average revenue per user

("ARPU") also positively impacted this variance, offset partially

by fewer Duplex and SPOT subscribers. ARPU is a non-GAAP financial

measure. For more information, refer to “Schedule of Selected

Operating Measures”.

Revenue generated from subscriber equipment sales decreased $7.0

million due primarily to the timing of Commercial IoT sales. Our

pipeline for Commercial IoT opportunities remains strong, evidenced

by a 14% increase in equipment sales volume on a consecutive

quarter basis.

Income from operations

Income from operations was $3.3 million for the nine months

ended September 30, 2024 compared to $11.8 million during the same

period in 2023. This variance was primarily due to increases in

revenue being offset by higher operating expenses. Higher

stock-based compensation and cost of services were the primary

expense increases during the first nine months of 2024, offset

partially by lower cost of subscriber equipment.

Net income (loss)

Net loss was $12.9 million for the nine months ended September

30, 2024 compared to $9.6 million during the same period in 2023.

This variance was due primarily to lower operating income and

unfavorable fluctuations in foreign currency gains and losses due

to the remeasurement of intercompany balances. These items were

offset partially by a non-recurring, non-cash loss on

extinguishment of debt incurred in 2023.

Adjusted EBITDA

Adjusted EBITDA increased 15% to $105.0 million for the nine

months ended September 30, 2024 compared to $91.6 million during

the same period in 2023. Generally consistent with the quarterly

variance discussed above, an increase in high-margin service

revenue was partially offset by higher operating expenses (both

excluding adjustments for non-cash or non-recurring items).

Liquidity

As of September 30, 2024, we held cash and cash equivalents of

$51.9 million, compared to $56.7 million as of December 31, 2023.

During the first nine months of 2024, net cash flows generated from

operations of $98.5 million and net cash flows from financing

activities of $4.9 million were used to fund capital expenditures

of $107.7 million (excluding the effect of exchange rate changes on

cash).

Operating cash flows include cash receipts from our customers,

primarily from the performance of wholesale capacity services, as

well as from subscribers for the purchase of equipment and

satellite voice and data services. We use cash in operating

activities primarily for network costs, personnel costs, inventory

purchases and other general corporate expenditures. Investing

outflows largely relate to network upgrades for certain vendors,

including milestone work under the satellite procurement agreement

and the launch services agreement. Financing activities relate

primarily to the 2021 and 2023 funding agreements with our largest

customer.

FINANCIAL OUTLOOK

We are updating our previously issued financial outlook for full

year 2024 with anticipated results below.

- Total revenue between $245 million and $250 million (prior

anticipated range was $235 million to $250 million)

- Adjusted EBITDA margin of approximately 54% (prior anticipated

margin was 53%)

CONFERENCE CALL INFORMATION

As previously announced, the Company will host a conference call

to discuss its results at 5:00 p.m. Eastern Time (ET) on Thursday,

November 7, 2024. Details are as follows:

Earnings Call:

The earnings call will be available via

webcast from the following link.

Webcast Link:

https://edge.media-server.com/mmc/p/ssnimn99

To participate in the earnings call via

teleconference or to participate in the live Q&A session,

participants should register at the following link to receive an

email containing the dial-in number and unique passcode.

Participant Teleconference Registration

Link:

https://register.vevent.com/register/BIfbf09ce58a9544b79a79cf28dde1ae2a

Audio Replay:

For those unable to participate in the

live call, a replay of the webcast will be available in the

Investor Relations section of the Company's website.

About Globalstar, Inc.

Globalstar empowers its customers to connect, transmit, and

communicate in smarter ways – easily, quickly, securely, and

affordably – offering reliable satellite and terrestrial

connectivity services as an international telecom infrastructure

provider. The Company’s low Earth orbit ("LEO") satellite

constellation ensures secure data transmission for connecting and

protecting assets, transmitting critical operational data, and

saving lives for consumers, businesses, and government agencies

across the globe. Globalstar’s terrestrial spectrum, Band 53, and

its 5G variant, n53, offer carriers, cable companies, and system

integrators a versatile, fully licensed channel for private

networks with a growing ecosystem to improve customer wireless

connectivity, while Globalstar’s XCOM Radio Access Network ("RAN")

product offers significant capacity gains in dense wireless

deployments. In addition to SPOT GPS messengers, Globalstar offers

next-generation internet of things ("IoT") hardware and software

products for efficiently tracking and monitoring assets, processing

smart data at the edge, and managing analytics with cloud-based

telematics solutions to drive safety, productivity, and

profitability.

Note that all SPOT products described in this press release are

the products of SPOT LLC, which is not affiliated in any manner

with Spot Image of Toulouse, France or Spot Image Corporation of

Chantilly, Virginia.

For more information, visit www.globalstar.com.

Safe Harbor Language for Globalstar Releases

Certain statements contained in this press release other than

purely historical information, including, but not limited to,

expectations regarding future revenue, financial performance,

financial condition, liquidity, projections, estimates and

guidance, statements relating to our business plans, objectives and

expected operating results, our anticipated financial resources,

our ability to integrate the licensed technology into our current

line of business, our expectations with respect to the pursuit of

terrestrial spectrum authorities globally, the success of current

and potential future applications for our terrestrial spectrum, our

ability to meet our obligations and attain the attempted benefits

under the updated services agreements, and the assumptions upon

which those statements are based, are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “plan,” “may,” “could,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions, although not all forward-looking

statements contain these identifying words. These forward-looking

statements are based on current expectations and assumptions that

are subject to risks and uncertainties which may cause actual

results to differ materially from the forward-looking statements.

Risks and uncertainties that could cause or contribute to such

differences include, without limitation, those described under Item

1A. Risk Factors of the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 and in the Company’s other

filings with the SEC. The Company undertakes no obligation to

update any of the forward-looking statements after the date of this

press release to reflect actual results, future events or

circumstances or changes in our assumptions, business plans or

other changes.

GLOBALSTAR, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenue:

Service revenue

$

68,908

$

53,643

$

180,008

$

155,245

Subscriber equipment sales

3,399

4,040

9,164

16,154

Total revenue

72,307

57,683

189,172

171,399

Operating expenses:

Cost of services (exclusive of

depreciation, amortization, and accretion shown separately

below)

19,185

13,872

54,058

37,938

Cost of subscriber equipment sales

2,515

3,458

6,739

13,429

Marketing, general and administrative

10,439

12,090

31,438

31,843

Stock-based compensation

8,254

4,346

26,645

10,638

Reduction in the value of long-lived

assets

231

35

536

35

Depreciation, amortization, and

accretion

22,249

21,865

66,456

65,688

Total operating expenses

62,873

55,666

185,872

159,571

Income from operations

9,434

2,017

3,300

11,828

Other income (expense):

Loss on extinguishment of debt

—

—

—

(10,403

)

Interest income and expense, net of

amounts capitalized

(2,872

)

(3,945

)

(10,301

)

(11,047

)

Foreign currency gain (loss)

4,918

(4,151

)

(3,417

)

(206

)

Other

186

25

(605

)

373

Total other income (expense)

2,232

(8,071

)

(14,323

)

(21,283

)

Income (loss) before income taxes

11,666

(6,054

)

(11,023

)

(9,455

)

Income tax expense

1,732

115

1,922

185

Net income (loss)

$

9,934

$

(6,169

)

$

(12,945

)

$

(9,640

)

Net income (loss) attributable to common

shareholders

7,261

(8,842

)

(20,906

)

(17,572

)

Net income (loss) per common share:

Basic

$

0.00

$

(0.00

)

$

(0.01

)

$

(0.01

)

Diluted

0.00

$

(0.00

)

(0.01

)

(0.01

)

Weighted-average shares outstanding:

Basic

1,892,253

1,836,251

1,886,377

1,820,582

Diluted

1,910,061

1,836,251

1,886,377

1,820,582

GLOBALSTAR, INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except par value

and share data)

(Unaudited)

September 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

51,916

$

56,744

Accounts receivable, net of allowance for

credit losses of $1,446 and $2,312, respectively

43,021

48,743

Inventory

11,877

14,582

Prepaid expenses and other current

assets

20,638

22,584

Total current assets

127,452

142,653

Property and equipment, net

617,064

624,002

Operating lease right of use assets,

net

34,364

34,164

Intangible and other assets, net of

accumulated amortization of $14,742 and $12,385, respectively

138,681

123,490

Total assets

$

917,561

$

924,309

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term debt

$

34,600

$

34,600

Accounts payable and accrued expenses

34,417

28,985

Accrued satellite construction costs

1,015

58,187

Payables to affiliates

274

459

Deferred revenue, net

46,548

53,677

Total current liabilities

116,854

175,908

Long-term debt

359,759

325,700

Operating lease liabilities

28,554

29,244

Other non-current liabilities

18,301

14,478

Total non-current liabilities

406,614

369,422

Stockholders’ equity:

Series A Preferred Convertible Stock of

$0.0001 par value; 300,000 shares authorized and 149,425 issued and

outstanding at September 30, 2024 and December 31, 2023,

respectively

—

—

Voting Common Stock of $0.0001 par value;

2,150,000,000 shares authorized; 1,892,348,276 and 1,881,194,682

shares issued and outstanding at September 30, 2024 and December

31, 2023, respectively

189

188

Additional paid-in capital

2,466,279

2,438,703

Accumulated other comprehensive income

5,552

5,070

Retained deficit

(2,077,927

)

(2,064,982

)

Total stockholders’ equity

394,093

378,979

Total liabilities and stockholders’

equity

$

917,561

$

924,309

GLOBALSTAR, INC.

RECONCILIATION OF GAAP NET

INCOME (LOSS) TO NON-GAAP ADJUSTED EBITDA

(In thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Net income (loss)

$

9,934

$

(6,169

)

$

(12,945

)

$

(9,640

)

Interest income and expense, net

2,872

3,945

10,301

11,047

Derivative (gain) loss

(130

)

56

849

(243

)

Income tax expense

1,732

115

1,922

185

Depreciation, amortization, and

accretion

22,249

21,865

66,456

65,688

EBITDA (1)

36,657

19,812

66,583

67,037

Non-cash compensation

8,254

4,346

26,645

10,638

Foreign exchange (gain) loss and other

(4,973

)

4,070

3,175

(234

)

Reduction in value of inventory and

long-lived assets

266

35

571

35

Non-cash expenses and transaction costs

associated with the License Agreement (2)

1,844

3,743

5,455

3,743

Transaction costs

757

—

2,571

—

Loss on extinguishment of debt

—

—

—

10,403

Adjusted EBITDA (1)

$

42,805

$

32,006

$

105,000

$

91,622

(1)

EBITDA represents earnings before

interest, income taxes, depreciation, amortization, accretion and

derivative (gains)/losses. Adjusted EBITDA excludes non-cash

compensation expense, reduction in the value of assets, foreign

exchange (gains)/losses, and certain other non-cash or

non-recurring charges as applicable. Management uses Adjusted

EBITDA to manage the Company's business and to compare its results

more closely to the results of its peers. EBITDA and Adjusted

EBITDA do not represent and should not be considered as

alternatives to GAAP measurements, such as net income/(loss). These

terms, as defined by us, may not be comparable to similarly titled

measures used by other companies.

The Company uses Adjusted EBITDA as a

supplemental measurement of its operating performance. The Company

believes it best reflects changes across time in the Company's

performance, including the effects of pricing, cost control and

other operational decisions. The Company's management uses Adjusted

EBITDA for planning purposes, including the preparation of its

annual operating budget. The Company believes that Adjusted EBITDA

also is useful to investors because it is frequently used by

securities analysts, investors and other interested parties in

their evaluation of companies in similar industries. As indicated,

Adjusted EBITDA does not include interest expense on borrowed money

or depreciation expense on our capital assets or the payment of

income taxes, which are necessary elements of the Company's

operations. Because Adjusted EBITDA does not account for these

expenses, its utility as a measure of the Company's operating

performance has material limitations. Because of these limitations,

the Company's management does not view Adjusted EBITDA in isolation

and also uses other measurements, such as revenues and operating

profit, to measure operating performance.

(2)

In connection with the License Agreement

with XCOM, the Company entered into a Support Services Agreement

(the “SSA”) with XCOM. Fees payable by Globalstar pursuant to the

SSA were or may be paid in shares of its common stock. Costs also

include the initial nonrecurring costs associated with the

transaction as well as non-cash intangible asset technology

amortization associated with the initial purchase of certain

intangible assets made in the form of Globalstar common stock.

GLOBALSTAR, INC.

SCHEDULE OF SELECTED OPERATING

METRICS

(In thousands, except subscriber

and ARPU data)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30,

2023

Service revenue:

Subscriber services

Duplex

$

5,955

$

7,978

$

15,675

$

20,088

SPOT

10,444

11,350

31,066

33,703

Commercial IoT

6,650

6,347

19,803

16,881

Wholesale capacity services

43,861

27,517

109,149

83,406

Government and other services

1,998

451

4,315

1,167

Total service revenue

68,908

53,643

180,008

155,245

Subscriber equipment sales

3,399

4,040

9,164

16,154

Total revenue

$

72,307

$

57,683

$

189,172

$

171,399

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Average subscribers

Duplex

26,535

33,501

27,899

35,143

SPOT

242,134

258,485

245,592

262,818

Commercial IoT

512,260

477,344

506,657

472,812

Other

286

376

298

391

Total

781,215

769,706

780,446

771,164

ARPU (1)

Duplex

$

74.81

$

79.38

$

62.43

$

63.51

SPOT

14.38

14.64

14.05

14.25

Commercial IoT

4.33

4.43

4.34

3.97

(1)

Average monthly revenue per user ("ARPU")

measures service revenues per month divided by the average number

of subscribers during that month. Average monthly revenue per user

as so defined may not be similar to average monthly revenue per

unit as defined by other companies in the Company's industry, is

not a measurement under GAAP and should be considered in addition

to, but not as a substitute for, the information contained in the

Company's statement of operations. The Company believes that

average monthly revenue per user provides useful information

concerning the appeal of its rate plans and service offerings and

its performance in attracting and retaining high value

customers.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107317312/en/

Investor Contact Information:

investorrelations@globalstar.com

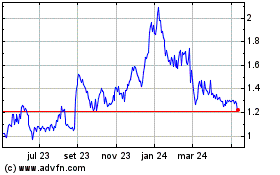

Globalstar (AMEX:GSAT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

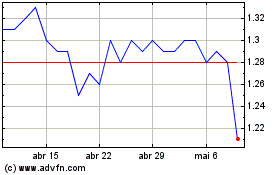

Globalstar (AMEX:GSAT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025