Kodiak Gas Services Announces Pricing of Upsized Offering of Common Stock by Selling Stockholder

15 Novembro 2024 - 3:24AM

Business Wire

Kodiak Gas Services, Inc. (NYSE: KGS) (“Kodiak” or the

“Company”) today announced the pricing of an upsized underwritten

public offering (the “Offering”) of 5,708,885 shares of its common

stock by an affiliate of the funds known as EQT Infrastructure III

and EQT Infrastructure IV (the “selling stockholder”) at a price to

the public of $34.50 per share. The selling stockholder granted the

underwriters a 30-day option to purchase up to an additional

856,332 shares of the Company’s common stock. Kodiak will not sell

any shares of its common stock in the Offering and will not receive

any proceeds from the sale of the shares of its common stock being

offered by the selling stockholder. The Offering is expected to

close on November 18, 2024, subject to customary closing

conditions.

Concurrent with the closing of the Offering, the Company intends

to purchase from the selling stockholder in a private transaction

$15 million of common stock, or 434,783 shares, at a price per

share equal to the public offering price (the “Share Repurchase”).

The Offering is not conditioned upon the closing of the Share

Repurchase, but the Share Repurchase is conditioned upon the

closing of the Offering. The Share Repurchase is being made

pursuant to the Company’s existing $50.0 million share repurchase

program. On November 14, 2024, the Company announced that its Board

of Directors authorized a share repurchase program, beginning on

the date thereof and continuing through and including December 31,

2025. After the completion of the Share Repurchase described above,

there will be $35.0 million remaining under the Company’s share

repurchase program.

Barclays, Goldman Sachs & Co. LLC and J.P. Morgan are acting

as joint book-running managers for the Offering. The Offering is

being made only by means of a prospectus supplement and the

accompanying base prospectus, which was filed as part of an

automatic shelf registration statement on Form S-3 (File No.

333-280737), which was filed with the Securities and Exchange

Commission (the “SEC”) and became effective on July 10, 2024.

Before you invest, you should read the prospectus in that

registration statement and other documents the Company has filed

with the SEC for more complete information about the Company and

the Offering. Copies of the preliminary prospectus supplement and

accompanying base prospectus relating to the Offering, as well as

copies of the final prospectus supplement once available, may be

obtained for free on the SEC’s website at www.sec.gov or by

contacting: Barclays Capital Inc., c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by phone at

1-888-603-5847 or by email at barclaysprospectus@broadridge.com;

Goldman Sachs & Co. LLC, Prospectus Department, 200 West

Street, New York, NY 10282, telephone: 1-866-471-2526, facsimile:

212-902-9316 or by emailing Prospectus-ny@ny.email.gs.com; and J.P.

Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717, by email at

prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com

There shall not be any sale of these securities in any state or

jurisdiction in which an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Kodiak

Kodiak is the largest contract compression services provider in

the United States, serving as a critical link in the infrastructure

that enables the safe and reliable production and transportation of

natural gas and oil. Headquartered in The Woodlands, Texas, Kodiak

provides contract compression and related services to oil and gas

producers and midstream customers in high–volume gas gathering

systems, processing facilities, multi-well gas lift applications

and natural gas transmission systems.

Forward-Looking Statements

This press release includes “forward-looking statements” for

purposes of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. Forward-looking statements are statements other

than statements of historical fact. Forward-looking statements can

be identified by words such as: “anticipate,” “intend,” “plan,”

“goal,” “seek,” “believe,” “project,” “estimate,” “expect,”

“strategy,” “future,” “likely,” “may,” “should,” “will” and similar

references to future periods. They include statements regarding the

Offering, including the expected closing thereof. Although Kodiak

believes the expectations and forecasts reflected in the

forward-looking statements are reasonable, Kodiak can give no

assurance they will prove to have been correct. They can be

affected by inaccurate or changed assumptions or by known or

unknown risks and uncertainties. Important risks, assumptions and

other important factors that could cause future results to differ

materially from those expressed in the forward-looking statements

are described under “Risk Factors” in Item 1A of Kodiak’s annual

report on Form 10-K for the year ended December 31, 2023 and any

updates to those factors set forth in Kodiak’s subsequent quarterly

reports on Form 10-Q or current reports on Form 8-K. Kodiak

undertakes no obligation to release publicly any revisions to any

forward-looking statements, to report events or to report the

occurrence of unanticipated events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114119959/en/

Investor Contact: Graham Sones, VP – Investor Relations

ir@kodiakgas.com (936) 755-3529

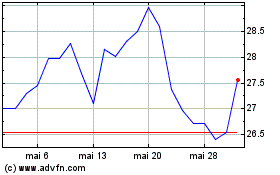

Kodiak Gas Services (NYSE:KGS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

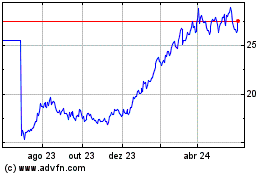

Kodiak Gas Services (NYSE:KGS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024