The BlackRock International Dividend ETF (BIDD)

is BlackRock’s first active mutual fund converted ETF

Consistent historical outperformance led by

all-female portfolio management team1

Today, BlackRock announced the successful conversion of the

BlackRock International Dividend Fund into an active ETF, creating

the BlackRock International Dividend ETF (NYSE:BIDD). This marks a

significant milestone as the firm’s first active mutual fund to

active ETF conversion, catering to the growing preference among

U.S. investors for the ETF structure. It is also BlackRock’s first

U.S.-listed active ETF that provides access to high-quality

dividend-paying companies across international developed and

emerging markets.

International equities, especially among the dividend-paying

large caps, could offer investors an alternative source of alpha

over the long term.2 The rise of mega caps in the U.S. market

underscores the need for portfolio diversification to drive

potential future returns, especially during market rotations.

Led by Olivia Treharne and Molly Greenen, the all-female

portfolio management team has a proven track record of managing one

of the largest high-conviction international equity strategies.3

BIDD extends iShares’ active ETF offering with the convenience,

liquidity and potential tax-efficiency of the ETF wrapper.

“By investing exclusively in high-quality international

businesses and concentrating on valuation, we have delivered

resilient, recurring returns over time,” said Olivia Treharne,

Portfolio Manager & Co-Head of BlackRock’s Global Equity

Team.1 “The new active ETF helps empower a broader range of

investors with easy access to pursue opportunities in the

international markets.”

Fund

Name

Ticker

Underlying

Index

Expense

Ratio

BlackRock International Dividend ETF

NYSE:BIDD

MSCI ACWI ex US Index

0.61%

As BlackRock’s first mutual fund converted ETF, BIDD represents

a new chapter in the firm’s commitment to product innovation and

simplifying access to diverse and quality investment solutions.

“Our product development strategy begins with our clients. As

fee-based advisors increasingly gravitate towards active ETFs for

their tax and cost efficiency, liquidity and transparency, this

conversion is a testament to the strength of our product platform

to deliver access to our active investment strategies in a range of

formats,” says Rachel Aguirre, Head of U.S. iShares Product at

BlackRock.

BlackRock manages $33 billion in assets under management across

over 40 active ETFs in the U.S.4

BlackRock International Dividend Active ETF (BIDD)

BIDD has substantially similar investment strategies, processes,

and portfolio management team as the converted mutual fund. It aims

to deliver strong returns by investing at least 80% of its net

assets in dividend-paying international companies.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1,400+ exchange traded funds (ETFs) and $4.2

trillion in assets under management as of September 30, 2024,

iShares continues to drive progress for the financial industry.

iShares funds are powered by the expert portfolio and risk

management of BlackRock.

Carefully consider the Funds' investment objectives, risk

factors, and charges and expenses before investing. This and other

information can be found in the Funds' prospectuses or, if

available, the summary prospectuses which may be obtained by

visiting www.iShares.com or www.blackrock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of

principal.

There is no guarantee that any fund will pay dividends.

International investing involves risks, including risks related to

foreign currency, limited liquidity, less government regulation and

the possibility of substantial volatility due to adverse political,

economic or other developments. These risks often are heightened

for investments in emerging/developing markets and in

concentrations of single countries. Funds that concentrate

investments in specific industries, sectors, markets or asset

classes may underperform or be more volatile than other industries,

sectors, markets or asset classes and the general securities

market.

Actively managed funds do not seek to replicate the performance

of a specified index, may have higher portfolio turnover, and may

charge higher fees than index funds due to increased trading and

research expenses.

Diversification and asset allocation may not protect against

market risk or loss of principal. Transactions in shares of ETFs

may result in brokerage commissions and may generate tax

consequences. All regulated investment companies are obliged to

distribute portfolio gains to shareholders.

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products,

strategies, or any security in particular. This material is

strictly for illustrative, educational, or informational purposes

and is subject to change.

The Funds are distributed by BlackRock Investments, LLC

(together with its affiliates, “BlackRock”).

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved.

BLACKROCK is a trademark of BlackRock, Inc. or its

affiliates. All other trademarks are those of their respective

owners.

____________________________ 1 BlackRock, Morningstar as of

09/30/2024. Past performance is no guarantee of future results.

2Morningstar, 11/08/2024. The average Foreign Large Blend fund has

beaten the MSCI ACWI ex USA index over the last 3/5/10Y net of

fees. Alpha is the excess return of a fund relative to the return

of a benchmark. Past performance is no guarantee of future results.

3 Morningstar, as of 11/12/2024. BIDD’s $895m AUM stands to be one

of the largest concentrated fundamental stock picking strategies in

the Morningstar Foreign Blend category. 4 BlackRock, as of

11/15/2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118430815/en/

Joanna Yau Joanna.yau@blackrock.com 646.856.7274

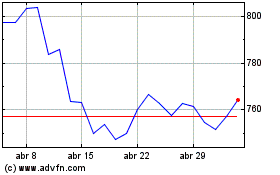

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024