MicroStrategy Announces Proposed Private Offering of $1.75 Billion of Convertible Senior Notes

18 Novembro 2024 - 6:01PM

Business Wire

MicroStrategy® Incorporated (Nasdaq: MSTR) (“MicroStrategy”)

today announced that it intends to offer, subject to market

conditions and other factors, $1.75 billion aggregate principal

amount of its 0% convertible senior notes due 2029 (the “notes”) in

a private offering to persons reasonably believed to be qualified

institutional buyers in reliance on Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”) and to certain

non-U.S. persons in transactions outside the United States in

compliance with Regulation S under the Securities Act.

MicroStrategy also expects to grant to the initial purchasers of

the notes an option to purchase, within a 3-day period beginning

on, and including, the date on which the notes are first issued, up

to an additional $250 million aggregate principal amount of the

notes. The offering is subject to market and other conditions, and

there can be no assurance as to whether, when or on what terms the

offering may be completed.

The notes will be unsecured, senior obligations of

MicroStrategy. The notes will not bear regular interest, and the

principal amount of the notes will not accrete. The notes will

mature on December 1, 2029, unless earlier repurchased, redeemed or

converted in accordance with their terms. Subject to certain

conditions, on or after December 4, 2026, MicroStrategy may redeem

for cash all or any portion of the notes. If MicroStrategy redeems

fewer than all the outstanding notes, at least $75 million

aggregate principal amount of notes must be outstanding and not

subject to redemption as of the relevant redemption notice date.

Holders of the notes will have the right to require MicroStrategy

to repurchase for cash all or any portion of their notes on June 1,

2028. The notes will be convertible into cash, shares of

MicroStrategy’s class A common stock, or a combination of cash and

shares of MicroStrategy’s class A common stock, at MicroStrategy’s

election. Prior to June 1, 2029, the notes will be convertible only

upon the occurrence of certain events and during certain periods,

and thereafter, at any time until the second scheduled trading day

immediately preceding the maturity date. The initial conversion

rate and other terms of the notes will be determined at the time of

pricing of the offering. MicroStrategy expects that the reference

price used to calculate the initial conversion price for the notes

will be the U.S. composite volume weighted average price of

MicroStrategy’s class A common stock from 1:30 p.m. through 4:00

p.m. Eastern Standard Time on the date of pricing.

MicroStrategy intends to use the net proceeds from this offering

to acquire additional bitcoin and for general corporate

purposes.

The notes will be offered and sold to persons reasonably

believed to be qualified institutional buyers in accordance with

Rule 144A under the Securities Act and to certain non-U.S. persons

in transactions outside the United States in compliance with

Regulation S under the Securities Act. The offer and sale of the

notes and the shares of MicroStrategy’s class A common stock

issuable upon conversion of the notes, if any, have not been and

will not be registered under the Securities Act or the securities

laws of any other jurisdiction, and the notes and any such shares

may not be offered or sold in the United States absent registration

or an applicable exemption from such registration requirements. Any

offer of the notes will be made only by means of a private offering

memorandum.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy the notes, nor shall there be any

sale of, the notes in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful under the securities

laws of any such state or jurisdiction. There can be no assurances

that the offering of the notes will be completed as described

herein or at all.

Video Webinar

MicroStrategy will be discussing the proposed convertible notes

offering on a live Video Webinar beginning at approximately 9:00

a.m. Eastern Standard Time on Tuesday, November 19, 2024. If you

are a qualified institutional buyer as defined in Rule 144A under

the Securities Act, and you would like to participate in this

proposed convertible notes offering and/or attend the Video

Webinar, please complete the investor survey, which can be accessed

at https://www.microstrategy.com/investor-relations/register. We or

parties on our behalf may request additional information to verify

your status as a qualified institutional buyer. Failure to provide

requested information may prevent you from participating in our

private offering of securities pursuant to Rule 144A under the

Securities Act. Access to the Video Webinar and completion of the

investor survey does not mean you will receive an allocation in

this proposed convertible notes offering.

About MicroStrategy Incorporated

MicroStrategy (Nasdaq: MSTR) is the world's first and largest

Bitcoin Treasury Company. We are a publicly traded company that has

adopted Bitcoin as our primary treasury reserve asset. By using

proceeds from equity and debt financings, as well as cash flows

from our operations, we strategically accumulate Bitcoin and

advocate for its role as digital capital. Our treasury strategy is

designed to provide investors varying degrees of economic exposure

to Bitcoin by offering a range of securities, including equity and

fixed-income instruments. In addition, we provide industry-leading

AI-powered enterprise analytics software, advancing our vision of

Intelligence Everywhere. We leverage our development capabilities

to explore innovation in Bitcoin applications, integrating

analytics expertise with our commitment to digital asset growth. We

believe our combination of operational excellence, strategic

Bitcoin reserve, and focus on technological innovation positions us

as a leader in both the digital asset and enterprise analytics

sectors, offering a unique opportunity for long-term value

creation.

MicroStrategy, MicroStrategy AI, Intelligence Everywhere,

Intelligent Enterprise, and MicroStrategy Library are either

trademarks or registered trademarks of MicroStrategy Incorporated

in the United States and certain other countries. Other product and

company names mentioned herein may be the trademarks of their

respective owners.

Forward-Looking Statements

Statements in this press release about future expectations,

plans, and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements relating to the size and timing

of the offering, the anticipated use of any proceeds from the

offering, and the terms of the notes. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “potential,” “predict,” “project,” “should,”

“target,” “will,” “would,” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Actual

results may differ materially from those indicated by such

forward-looking statements as a result of various important

factors, including the uncertainties related to market conditions

and the completion of the offering on the anticipated terms or at

all, the other factors discussed in the “Risk Factors” section of

MicroStrategy’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on October 31, 2024, and the

risks described in other filings that MicroStrategy may make with

the Securities and Exchange Commission. Any forward-looking

statements contained in this press release speak only as of the

date hereof, and MicroStrategy specifically disclaims any

obligation to update any forward-looking statement, whether as a

result of new information, future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241118315372/en/

MicroStrategy Incorporated Shirish Jajodia Corporate Treasurer

ir@microstrategy.com

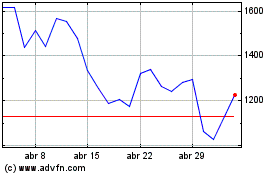

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025