Q3 comparable brand revenue -2.9% Q3

operating margin of 17.8%; diluted EPS growth of 7.1% to $1.96

New stock repurchase authorization of $1 billion Raises

full-year 2024 outlook

Williams-Sonoma, Inc. (NYSE: WSM) today announced operating

results for the third quarter ended October 27, 2024 versus the

third quarter ended October 29, 2023.

“We are pleased with the results of our third quarter, beating

both top and bottom-line expectations. The quarter was driven by

continued improvement in our sales trend, market-share gains, and

strong profit. In Q3, our comp came in at -2.9%, with an operating

margin of 17.8%, delivering a 7.1% increase in earnings per share

to $1.96. Our operating results reflect the operational

improvements that we have been focused on all year, and demonstrate

the strength of our margin profile in a difficult environment,”

said Laura Alber, President and Chief Executive Officer.

Alber concluded, “Our strategy of focusing on returning to

growth, enhancing our world-class customer service, and driving

margin is working. And, as we head into the last quarter of the

year, we are optimistic and confident about our business. The

fourth quarter is the time of year when we shine. And, therefore,

we are raising our full-year guidance. We now expect full-year

revenues to come in at a range of down 3% to down 1.5%, and we are

raising our guidance on operating margin 40 bps to be in the range

of 17.8% to 18.2%.”

THIRD QUARTER 2024 HIGHLIGHTS

- Comparable brand revenue -2.9%.

- Gross margin of 46.7% +230bps to LY driven by (i) higher

merchandise margins of +130bps and (ii) supply chain efficiencies

of +100bps. Occupancy rate flat to LY, with occupancy costs of $195

million, -2.7% to LY.

- SG&A rate of 28.9% +150bps to LY driven by higher

employment and advertising expense, partially offset by lower

general expenses. SG&A of $521 million, +2.7% to LY.

- Operating income of $321 million with an operating margin of

+17.8%. +80bps to LY.

- Diluted EPS of $1.96. +7.1% to LY.

- Merchandise inventories +3.8% to the third quarter LY to $1.45

billion.

- Maintained strong liquidity position of $827 million in cash

and operating cash flow of $254 million, enabling the company to

deliver returns to stockholders of $606 million through $533

million in stock repurchases and $73 million in dividends.

STOCK REPURCHASE AUTHORIZATION

In September 2024, the Board of Directors approved a new $1

billion stock repurchase authorization, which will become effective

once the Company’s current stock repurchase authorization,

announced in March 2024, is fully utilized. Including the balance

of $293 million remaining under our March 2024 program, the total

stock repurchase authorization is currently $1.3 billion. The

Company’s stock repurchase programs authorize the purchase of the

Company’s common stock through open market and privately negotiated

transactions, including through Rule 10b5-1 plans, at such times

and in such amounts as management deems appropriate. The timing and

actual number of shares repurchased will depend on a variety of

factors, including price, corporate and regulatory requirements,

capital availability and other market conditions. The stock

repurchase programs do not have an expiration date and may be

limited or terminated at any time without prior notice.

FIRST QUARTER 2024 OUT-OF-PERIOD ADJUSTMENT

Subsequent to the filing of our Form 10-K, in April 2024, the

Company determined that it over-recognized freight expense in

fiscal years 2021, 2022 and 2023 for a cumulative amount of $49

million. The Company evaluated the error, both qualitatively and

quantitatively, and determined that no prior interim or annual

periods were materially misstated. The Company then evaluated

whether the cumulative amount of the over-accrual was material to

its projected fiscal 2024 results, and determined the cumulative

amount was not material. Therefore, the Condensed Consolidated

Financial Statements for the thirty-nine weeks ended October 27,

2024 include an out-of-period adjustment of $49 million, recorded

in the first quarter of fiscal 2024, to reduce cost of goods sold

and accounts payable, which corrected the cumulative error on the

balance sheet as of January 28, 2024.

SECOND QUARTER 2024 COMMON STOCK SPLIT

On July 9, 2024, the Company effected a 2-for-1 stock split of

its common stock through a stock dividend. All historical share and

per share amounts in this release have been retroactively adjusted

to reflect the stock split.

OUTLOOK

- We are raising our fiscal 2024 guidance to reflect higher net

revenue trends and higher operating margin expectations.

- In fiscal 2024, we now expect annual net revenue decline in the

range of -3.0% to -1.5% with comps in the range of -4.5% to -3.0%

in fiscal 2024.

- We are raising our guidance on our operating margin for fiscal

2024. We now expect an operating margin between 18.4% to 18.8%,

including the impact of the first quarter out-of-period adjustment

of 60bps. Without this adjustment, we expect an operating margin

between 17.8% to 18.2% in fiscal 2024.

- For fiscal 2024, we expect annual interest income to be

approximately $50 million and our annual effective tax rate to be

approximately 25.0%.

- Fiscal 2024 is a 53-week year. Our financial statements will be

prepared on a 53-week basis in fiscal 2024 and a 52-week basis in

fiscal 2023. However, we will report comps on a 53-week versus

53-week comparable basis. All other year-over-year comparisons will

be 53-weeks in fiscal 2024 versus 52-weeks in fiscal 2023. We

expect the additional week in fiscal 2024 to contribute 150bps to

net revenue and 10bps to operating margin, both of which are

reflected in our guidance.

- Over the long term, we continue to expect mid-to-high

single-digit annual net revenue growth with an operating margin in

the mid-to-high teens.

CONFERENCE CALL AND WEBCAST INFORMATION

Williams-Sonoma, Inc. will host a live conference call today,

November 20, 2024, at 7:00 A.M. (PT). The call will be open to the

general public via live webcast and can be accessed at

http://ir.williams-sonomainc.com/events. A replay of the webcast

will be available at http://ir.williams-sonomainc.com/events.

SEC REGULATION G — NON-GAAP INFORMATION

This press release includes non-GAAP financial measures. Exhibit

1 provides reconciliations of these non-GAAP financial measures to

the most comparable financial measures calculated and presented in

accordance with accounting principles generally accepted in the

U.S. (“GAAP”). We have not provided a reconciliation of non-GAAP

guidance measures to the corresponding GAAP measures on a

forward-looking basis as we cannot do so without unreasonable

efforts due to the potential variability and limited visibility of

excluded items, and for the same reasons, we are unable to address

the probable significance of the unavailable information. These

excluded items include exit costs associated with the closure of

our West Coast manufacturing facility and the exiting of Aperture,

a division of our Outward, Inc. subsidiary, as well as costs

related to reduction-in-force initiatives. We believe that these

non-GAAP financial measures, when reviewed in conjunction with GAAP

financial measures, can provide meaningful supplemental information

for investors regarding the performance of our business and

facilitate a meaningful evaluation of current period performance on

a comparable basis with prior periods. Our management uses these

non-GAAP financial measures in order to have comparable financial

results to analyze changes in our underlying business from quarter

to quarter. In addition, certain other items may be excluded from

non-GAAP financial measures when the company believes this provides

greater clarity to management and investors. These non-GAAP

financial measures should be considered as a supplement to, and not

as a substitute for or superior to the GAAP financial measures

presented in this press release and our financial statements and

other publicly filed reports. Non-GAAP measures as presented herein

may not be comparable to similarly titled measures used by other

companies.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements that

involve risks and uncertainties, as well as assumptions that, if

they do not fully materialize or are proven incorrect, could cause

our results to differ materially from those expressed or implied by

such forward-looking statements. Such forward-looking statements

include, among other things, statements in the quotes of our

President and Chief Executive Officer, our updated fiscal year 2024

outlook and long-term financial targets, and statements regarding

our industry trends and business strategies.

The risks and uncertainties that could cause our results to

differ materially from those expressed or implied by such

forward-looking statements include: continuing changes in general

economic, political, competitive and other conditions beyond our

control, and the impact on consumer confidence and consumer

spending; the continuing impact of inflation and measures to

control inflation, including changing interest rates, on consumer

spending; the impact of current and potential future tariffs and

our ability to mitigate impacts; the outcome of our growth

initiatives; our ability to anticipate consumer preferences and

buying trends; dependence on timely introduction and customer

acceptance of our merchandise; our ability to introduce and grow

new brands and brand extensions; delays in store openings;

competition from companies with concepts or products similar to

ours; labor and material shortages; timely and effective sourcing

of merchandise from our foreign and domestic vendors and delivery

of merchandise through our supply chain to our stores and

customers; effective inventory management; our ability to manage

customer returns; uncertainties in e-marketing, infrastructure and

regulation; multi-channel and multi-brand complexities; challenges

associated with our increasing global presence; the continuing

impact of global conflicts, such as the conflicts in Ukraine and

the Middle East, and shortages of various raw materials on our

global supply chain, retail store operations and customer demand;

dependence on external funding sources for operating capital;

disruptions in the financial markets; our ability to control

employment, occupancy, supply chain, product, transportation and

other operating costs; our ability to improve our systems and

processes; changes to our information technology infrastructure;

new interpretations of or changes to current accounting rules;

impact of actual and potential wars, conflicts or acts of

terrorism; the potential for increased corporate income taxes; and

other risks and uncertainties described more fully in our public

announcements, reports to stockholders and other documents filed

with or furnished to the SEC, including our Annual Report on Form

10-K for the fiscal year ended January 28, 2024 and all subsequent

quarterly reports on Form 10-Q and current reports on Form 8-K. We

have not filed our Form 10-Q for the quarter ended October 27,

2024. As a result, all financial results described here should be

considered preliminary, and are subject to change to reflect any

necessary adjustments or changes in accounting estimates that are

identified prior to the time we file the Form 10-Q. All

forward-looking statements in this press release are based on

information available to us as of the date hereof, and we assume no

obligation to update these forward-looking statements.

ABOUT WILLIAMS-SONOMA, INC.

Williams-Sonoma, Inc. is the world’s largest digital-first,

design-led and sustainable home retailer. The company’s products,

representing distinct merchandise strategies — Williams Sonoma,

Pottery Barn, Pottery Barn Kids, Pottery Barn Teen, West Elm,

Williams Sonoma Home, Rejuvenation, Mark and Graham, and GreenRow —

are marketed through e-commerce websites, direct-mail catalogs and

retail stores. These brands are also part of The Key Rewards, our

loyalty and credit card program that offers members exclusive

benefits across the Williams-Sonoma family of brands. We operate in

the U.S., Puerto Rico, Canada, Australia and the United Kingdom,

offer international shipping to customers worldwide, and have

unaffiliated franchisees that operate stores in the Middle East,

the Philippines, Mexico, South Korea and India, as well as

e-commerce websites in certain locations. We are also proud to be a

leader in our industry with our values-based culture and commitment

to achieving our sustainability goals. Our company is Good By

Design — we’ve deeply ingrained sustainability into our business.

From our factories to your home, we’re united in a shared purpose

to care for our people and our planet.

For more information on our sustainability efforts, please

visit: https://sustainability.williams-sonomainc.com/

WSM-IR

Condensed Consolidated

Statements of Earnings (unaudited)

For the Thirteen Weeks

Ended

For the Thirty-nine Weeks

Ended

October 27, 2024

October 29, 2023

October 27, 2024

October 29, 2023

(In thousands, except per share

amounts)

$

% of Revenues

$

% of Revenues

$

% of Revenues

$

% of Revenues

Net revenues

$

1,800,668

100.0

%

$

1,853,650

100.0

%

$

5,249,323

100.0

%

$

5,471,715

100.0

%

Cost of goods sold

958,953

53.3

1,031,290

55.6

2,778,767

52.9

3,216,729

58.8

Gross profit

841,715

46.7

822,360

44.4

2,470,556

47.1

2,254,986

41.2

Selling, general and administrative

expenses

521,072

28.9

507,283

27.4

1,536,169

29.3

1,468,884

26.8

Operating income

320,643

17.8

315,077

17.0

934,387

17.8

786,102

14.4

Interest income, net

11,802

0.7

7,182

0.4

43,063

0.8

16,015

0.3

Earnings before income taxes

332,445

18.5

322,259

17.4

977,450

18.6

802,117

14.7

Income taxes

83,492

4.6

84,974

4.6

237,086

4.5

206,794

3.8

Net earnings

$

248,953

13.8

%

$

237,285

12.8

%

$

740,364

14.1

%

$

595,323

10.9

%

Earnings per share (EPS):

Basic

$

1.99

$

1.85

$

5.81

$

4.60

Diluted

$

1.96

$

1.83

$

5.74

$

4.56

Shares used in calculation of

EPS:

Basic

125,333

128,285

127,334

129,436

Diluted

126,892

129,549

129,019

130,596

3rd Quarter Net Revenues and

Comparable Brand Revenue Growth (Decline)1

Net Revenues

Comparable Brand Revenue

Growth (Decline)

(In millions, except percentages)

Q3 24

Q3 23

Q3 24

Q3 23

Pottery Barn

$

718

$

778

(7.5

)%

(16.6

)%

West Elm

451

466

(3.5

)

(22.4

)

Williams Sonoma

252

252

(0.1

)

(1.9

)

Pottery Barn Kids and Teen

287

277

3.8

(6.9

)

Other2

93

81

N/A

N/A

Total

$

1,801

$

1,854

(2.9

)%

(14.6

)%

1 See the Company’s 10-K and 10-Q for the

definition of comparable brand revenue, which is calculated on a

13-week basis, and includes business-to-business revenues.

2 Primarily consists of net revenues from

Rejuvenation, our international franchise operations, Mark and

Graham, and GreenRow.

Condensed Consolidated Balance

Sheets (unaudited)

As of

(In thousands, except per share

amounts)

October 27, 2024

January 28, 2024

October 29, 2023

Assets

Current assets

Cash and cash equivalents

$

826,784

$

1,262,007

$

698,807

Accounts receivable, net

105,620

122,914

124,238

Merchandise inventories, net

1,450,135

1,246,369

1,396,864

Prepaid expenses

84,810

59,466

100,045

Other current assets

19,432

29,041

27,381

Total current assets

2,486,781

2,719,797

2,347,335

Property and equipment, net

1,019,874

1,013,189

1,026,819

Operating lease right-of-use assets

1,147,673

1,229,650

1,235,425

Deferred income taxes, net

109,444

110,656

76,272

Goodwill

77,301

77,306

77,279

Other long-term assets, net

127,267

122,950

120,639

Total assets

$

4,968,340

$

5,273,548

$

4,883,769

Liabilities and stockholders'

equity

Current liabilities

Accounts payable

$

665,803

$

607,877

$

675,505

Accrued expenses

235,146

264,306

203,958

Gift card and other deferred revenue

583,022

573,904

528,403

Income taxes payable

28,400

96,554

53,139

Operating lease liabilities

231,667

234,517

231,236

Other current liabilities

101,272

103,157

96,745

Total current liabilities

1,845,310

1,880,315

1,788,986

Long-term operating lease liabilities

1,083,809

1,156,104

1,163,631

Other long-term liabilities

132,612

109,268

117,918

Total liabilities

3,061,731

3,145,687

3,070,535

Stockholders' equity

Preferred stock: $0.01 par value; 7,500

shares authorized, none issued

—

—

—

Common stock: $0.01 par value; 253,125

shares authorized; 123,876, 128,301, and 128,270 shares issued and

outstanding at October 27, 2024, January 28, 2024 and October 29,

2023, respectively

1,239

1,284

1,283

Additional paid-in capital

545,205

587,960

571,765

Retained earnings

1,377,461

1,555,595

1,260,216

Accumulated other comprehensive loss

(16,861

)

(15,552

)

(18,604

)

Treasury stock, at cost

(435

)

(1,426

)

(1,426

)

Total stockholders' equity

1,906,609

2,127,861

1,813,234

Total liabilities and stockholders'

equity

$

4,968,340

$

5,273,548

$

4,883,769

Retail Store Data

(unaudited)

Beginning of quarter

End of quarter

As of

July 28, 2024

Openings

Closings

October 27, 2024

October 29, 2023

Pottery Barn

185

2

(1

)

186

191

Williams Sonoma

158

2

—

160

163

West Elm

122

—

—

122

123

Pottery Barn Kids

45

1

—

46

46

Rejuvenation

11

—

—

11

10

Total

521

5

(1

)

525

533

Condensed Consolidated

Statements of Cash Flows (unaudited)

For the Thirty-nine Weeks

Ended

(In thousands)

October 27, 2024

October 29, 2023

Cash flows from operating

activities:

Net earnings

$

740,364

$

595,323

Adjustments to reconcile net earnings

to net cash provided by (used in) operating activities:

Depreciation and amortization

171,657

166,027

Loss on disposal/impairment of assets

4,494

19,143

Non-cash lease expense

192,501

186,764

Deferred income taxes

(9,003

)

(7,993

)

Tax benefit related to stock-based

awards

10,472

12,455

Stock-based compensation expense

66,061

66,435

Other

(2,205

)

(2,411

)

Changes in:

Accounts receivable

17,287

(8,928

)

Merchandise inventories

(203,937

)

56,770

Prepaid expenses and other assets

(21,393

)

(35,857

)

Accounts payable

37,239

164,958

Accrued expenses and other liabilities

(17,060

)

(48,978

)

Gift card and other deferred revenue

9,367

49,878

Operating lease liabilities

(200,947

)

(200,168

)

Income taxes payable

(68,154

)

(8,005

)

Net cash provided by operating

activities

726,743

1,005,413

Cash flows from investing

activities:

Purchases of property and equipment

(154,354

)

(134,830

)

Other

360

402

Net cash used in investing

activities

(153,994

)

(134,428

)

Cash flows from financing

activities:

Repurchases of common stock

(707,477

)

(313,001

)

Payment of dividends

(208,861

)

(174,571

)

Tax withholdings related to stock-based

awards

(90,733

)

(51,108

)

Net cash used in financing

activities

(1,007,071

)

(538,680

)

Effect of exchange rates on cash and cash

equivalents

(901

)

(842

)

Net (decrease) increase in cash and cash

equivalents

(435,223

)

331,463

Cash and cash equivalents at beginning of

period

1,262,007

367,344

Cash and cash equivalents at end of

period

$

826,784

$

698,807

Exhibit 1

3rd Quarter GAAP to Non-GAAP

Reconciliation (unaudited)

For the Thirteen Weeks

Ended

For the Thirty-nine Weeks

Ended

October 27, 2024

October 29, 2023

October 27, 2024

October 29, 2023

(In thousands, except per share data)

$

% of revenues

$

% of revenues

$

% of revenues

$

% of revenues

Occupancy costs

$

194,950

10.8

%

$

200,399

10.8

%

$

588,348

11.2

%

$

606,270

11.1

%

Exit Costs1

—

—

—

(239

)

Non-GAAP occupancy costs

$

194,950

10.8

%

$

200,399

10.8

%

$

588,348

11.2

%

$

606,031

11.1

%

Gross profit

$

841,715

46.7

%

$

822,360

44.4

%

$

2,470,556

47.1

%

$

2,254,986

41.2

%

Exit Costs1

—

—

—

2,141

Non-GAAP gross profit

$

841,715

46.7

%

$

822,360

44.4

%

$

2,470,556

47.1

%

$

2,257,127

41.3

%

Selling, general and administrative

expenses

$

521,072

28.9

%

$

507,283

27.4

%

$

1,536,169

29.3

%

$

1,468,884

26.8

%

Exit Costs1

—

—

—

(15,790

)

Reduction-in-force Initiatives2

—

—

—

(8,316

)

Non-GAAP selling, general and

administrative expenses

$

521,072

28.9

%

$

507,283

27.4

%

$

1,536,169

29.3

%

$

1,444,778

26.4

%

Operating income

$

320,643

17.8

%

$

315,077

17.0

%

$

934,387

17.8

%

$

786,102

14.4

%

Exit Costs1

—

—

—

17,931

Reduction-in-force Initiatives2

—

—

—

8,316

Non-GAAP operating income

$

320,643

17.8

%

$

315,077

17.0

%

$

934,387

17.8

%

$

812,349

14.8

%

$

Tax rate

$

Tax rate

$

Tax rate

$

Tax rate

Income taxes

$

83,492

25.1

%

$

84,974

26.4

%

$

237,086

24.3

%

$

206,794

25.8

%

Exit Costs1

—

—

—

4,690

Reduction-in-force Initiatives2

—

—

—

2,174

Non-GAAP income taxes

$

83,492

25.1

%

$

84,974

26.4

%

$

237,086

24.3

%

$

213,658

25.8

%

Diluted EPS

$

1.96

$

1.83

$

5.74

$

4.56

Exit Costs1

—

—

—

0.10

Reduction-in-force Initiatives2

—

—

—

0.05

Non-GAAP diluted EPS3

$

1.96

$

1.83

$

5.74

$

4.71

1 During Q1 2023, we incurred exit costs

of $17.9 million, including $9.3 million associated with the

closure of our West Coast manufacturing facility and $8.6 million

associated with the exiting of Aperture, a division of our Outward,

Inc. subsidiary.

2 During Q1 2023, we incurred costs

related to reduction-in-force initiatives of $8.3 million primarily

in our corporate functions.

3 Per share amounts may not sum due to

rounding to the nearest cent per diluted share.

SEC Regulation G – Non-GAAP Information

These tables include non-GAAP occupancy costs, gross profit,

gross margin, selling, general and administrative expense,

operating income, operating margin, income taxes, effective tax

rate and diluted EPS. We believe that these non-GAAP financial

measures provide meaningful supplemental information for investors

regarding the performance of our business and facilitate a

meaningful evaluation of our quarterly actual results on a

comparable basis with prior periods. Our management uses these

non-GAAP financial measures in order to have comparable financial

results to analyze changes in our underlying business from quarter

to quarter. These non-GAAP financial measures should be considered

as a supplement to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120363922/en/

Jeff Howie EVP, Chief Financial Officer – (415) 402 4324 Jeremy

Brooks SVP, Chief Accounting Officer & Head of Investor

Relations – (415) 733 2371

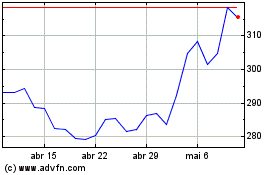

Williams Sonoma (NYSE:WSM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Williams Sonoma (NYSE:WSM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024