Cardinal Financial Completes Issue of First Ever Mortgage-Backed Security Containing Loans Decisioned with the help of FICO Score 10 T

03 Dezembro 2024 - 10:00AM

Business Wire

Mortgage securitization proves FICO Score 10

T’s ability to improve loan options for borrowers and provide

better predictive power for lenders

HIGHLIGHTS:

- Cardinal Financial (Cardinal) originated its first VA loans

decisioned with the help of FICO® Score 10 T following early

adoption of FICO’s newest and most predictive credit score.

- Cardinal formed and traded the first government-issued

mortgage-backed security (MBS) pool featuring loans powered by

FICO® Score 10 T on November 25.

- The first MBS pool featuring FICO® Score 10 T loans was traded

to a primary dealer.

- FICO® Score 10 T helped enable Cardinal to extend more

favorable loan terms for military and active-duty borrowers whose

loans are held in this pool.

Global analytics software leader FICO (NYSE: FICO) today

announced a significant milestone in housing finance: the launch of

the first ever government-issued mortgage-backed security (MBS)

with loans decisioned using FICO® Score 10 T. This historic MBS

pool, issued by Cardinal Financial (Cardinal), included VA loans

assessed through FICO’s most innovative scoring model, setting a

new precedent for smarter lending decisions and increased borrower

inclusion.

FICO® Score 10 T incorporates trended data to provide lenders

with a more comprehensive understanding of credit behavior over

time, enabling more accurate risk assessments while expanding

opportunities for borrowers, including veterans and active-duty

military personnel. FICO collaborated with the U.S. Veterans

Administration (VA) to confirm acceptance of FICO Score 10 T ahead

of the widespread transition as required by the Federal Housing

Finance Agency.

Cardinal was one of the first lenders to adopt FICO Score 10 T

for its non-G3SE loans and began utilizing this more predictive

credit scoring model to originate VA loans in October 2024. With

the use of FICO Score 10 T, Cardinal reports that the majority of

borrowers received higher credit scores, allowing more favorable

loan terms to be offered with no observable increase in credit risk

to the lender.

Cardinal’s pool was traded to a primary dealer on November 25.

The issuance is not only expected to enhance liquidity for future

loans decisioned with the help of FICO® Score 10 T, but also

further expand the use of FICO’s newest credit score within the

secondary market.

“Today’s announcement underscores Cardinal’s role as a leader in

rethinking how we measure and manage credit risk,” said Michael

Gaines, senior vice president of Capital Markets at Cardinal

Financial. “By leveraging FICO Score 10 T, we’re not only improving

credit risk transparency for investors but also expanding

homeownership opportunities for veteran and military

borrowers.”

More than 21 mortgage lenders nationwide have proactively

adopted FICO® Score 10 T for non-GSE loans. FICO is committed to

assisting mortgage industry participants looking to transition to

its most predictive scoring model. The FICO Score Migration

Resource Center provides a detailed guide to support

organizations through their score transition with key planning

steps, activities, and implementation best practices.

“We are thrilled to see FICO Score 10 T at the heart of this

milestone security,” said Joe Zeibert, vice president of Mortgage

and Capital Markets at FICO. “By helping to enable smarter, more

precise lending decisions, FICO is driving innovation that supports

both financial institutions and the communities they serve. We

encourage mortgage investors to consider the advantages of

incorporating FICO Score 10 T into their models.”

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 U.S. and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 80 countries do everything from protecting four billion

payment cards from fraud, to improving financial inclusion, to

increasing supply chain resiliency. The FICO® Score, used by 90% of

top U.S. lenders, is the standard measure of consumer credit risk

in the U.S. and has been made available in over 40 other countries,

improving risk management, credit access and transparency.

Learn more at https://www.fico.com/en. Join the conversation at

https://x.com/FICO_corp & https://www.fico.com/blogs/. For FICO

news and media resources, visit https://www.fico.com/en/newsroom.

FICO and Score A Better Future are trademarks or registered

trademarks of Fair Isaac Corporation in the U.S. and other

countries.

About Cardinal Financial

Cardinal Financial is a dynamic, forward-thinking mortgage

organization committed to designing an exceptional experience and

tailored home financing solutions for borrowers. Licensed to sell

directly through Fannie Mae, Freddie Mac, and Ginnie Mae, the firm

operates in all 50 states, offering a wide range of lending options

to help more people achieve homeownership. Cardinal Financial's

innovative approach is powered by Octane®, their custom-built loan

origination platform, designed to streamline the lending process

from start to finish. Visit CardinalFinancial.com for more

information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203319479/en/

Julie Huang press@fico.com

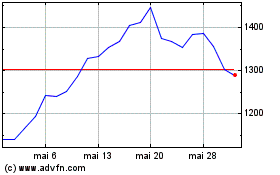

Fair Isaac (NYSE:FICO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Fair Isaac (NYSE:FICO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024