bluebird bio Announces 1-for-20 Reverse Stock Split

04 Dezembro 2024 - 6:05PM

Business Wire

bluebird bio, Inc. (NASDAQ: BLUE) (“bluebird bio” or the

“Company”) today announced that it will proceed with a 1-for-20

reverse stock split (“Reverse Stock Split”) of the Company’s common

stock following approval by both its Board of Directors and BLUE

stockholders at its reconvened annual meeting held on December 4,

2024. As previously announced, the primary goal of the Reverse

Stock Split is to increase the per share market price of the

Company’s common stock to regain compliance with Nasdaq’s minimum

bid price requirement for continued listing.

The Reverse Stock Split is expected to become effective at 5

p.m., Eastern Time, on December 12, 2024. The common stock is

expected to begin trading on a split-adjusted basis when the

markets open on December 13, 2024, under the existing trading

symbol “BLUE”. The new CUSIP number for the common stock following

the Reverse Stock Split will be 09609G 209.

When the Reverse Stock Split is effective, every 20 shares of

BLUE common stock issued will be combined automatically into 1

share of common stock. No fractional shares will be issued if, as a

result of the Reverse Stock Split, a stockholder would otherwise

become entitled to a fractional share because the number of shares

of common stock they hold before the Reverse Stock Split is not

evenly divisible by the split ratio. Instead, each stockholder will

be entitled to receive a cash payment in lieu of a fractional

share.

Equiniti Trust Company, LLC (“Equiniti”), formerly American

Stock Transfer & Trust Company, LLC (“AST”), is acting as the

exchange agent and transfer agent for the Reverse Stock Split.

Stockholders holding their shares electronically are not required

to take any action to receive post-split shares. Stockholders

owning shares through a bank, broker or other nominee will have

their positions adjusted to reflect the Reverse Stock Split and

will receive payment for any fractional shares in accordance with

their respective bank’s, broker’s, or nominee’s particular

processes.

Additional information about the Reverse Stock Split can be

found in bluebird’s definitive proxy filed with the U.S. Securities

and Exchange Commission (the “SEC”) on September 26, 2024 and on

the Company’s Investor Relations website at

http://investor.bluebirdbio.com.

About bluebird bio, Inc.

bluebird bio is pursuing curative gene therapies to give

patients and their families more bluebird days.

Founded in 2010, bluebird has been setting the standard for gene

therapy for more than a decade—first as a scientific pioneer and

now as a commercial leader. bluebird has an unrivaled track record

in bringing the promise of gene therapy out of clinical studies and

into the real-world setting, having secured FDA approvals for three

therapies in under two years. Today, we are proving and scaling the

commercial model for gene therapy and delivering innovative

solutions for access to patients, providers, and payers.

With a dedicated focus on severe genetic diseases, bluebird has

the largest and deepest ex-vivo gene therapy data set in the field,

with industry-leading programs for sickle cell disease,

β-thalassemia and cerebral adrenoleukodystrophy. We custom design

each of our therapies to address the underlying cause of disease

and have developed in-depth and effective analytical methods to

understand the safety of our lentiviral vector technologies and

drive the field of gene therapy forward.

bluebird continues to forge new paths as a standalone commercial

gene therapy company, combining our real-world experience with a

deep commitment to patient communities and a people-centric culture

that attracts and grows a diverse flock of dedicated birds.

bluebird bio, LYFGENIA, ZYNTEGLO and SKYSONA are registered

trademarks of bluebird bio, Inc. All rights reserved.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements that are not statements of historical facts

are, or may be deemed to be, forward-looking statements, such as

statements concerning the expected timing of the Reverse Stock

Split, the impact of stockholder approval of the Reverse Stock

Split, the goals of the Reverse Stock Split, the impact of the

Reverse Stock Split on the Company’s share price, and the Company’s

ability to meet the minimum per share bid price requirement for

continued listing on Nasdaq. Such forward-looking statements are

based on historical performance and current expectations and

projections about bluebird’s future goals, plans and objectives and

involve inherent risks, assumptions and uncertainties, including

internal or external factors that could delay, divert or change any

of them in the next several years, that are difficult to predict,

may be beyond bluebird’s control and could cause bluebird’s future

goals, plans and objectives to differ materially from those

expressed in, or implied by, the statements. No forward-looking

statement can be guaranteed. Forward-looking statements in this

press release should be evaluated together with the many risks and

uncertainties that affect bluebird bio’s business, particularly

those identified in the risk factors discussion in bluebird bio’s

Annual Report on Form 10-K for the year ended December 31, 2023, as

updated by its subsequent Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K and other filings with the Securities and

Exchange Commission. These risks and uncertainties include, but are

not limited to: delays and challenges in bluebird’s

commercialization and manufacturing of its products, including

challenges in manufacturing vector for ZYNTEGLO and SKYSONA to meet

current demand; the internal and external costs required for

bluebird’s ongoing and planned activities, and the resulting impact

on expense and use of cash, has been, and may in the future be,

higher than expected, which has caused bluebird, and may in the

future cause bluebird, to use cash more quickly than it expects or

change or curtail some of its plans or both; substantial doubt

exists regarding bluebird’s ability to continue as a going concern;

bluebird’s expectations as to expenses, cash usage and cash needs

may prove not to be correct for other reasons such as changes in

plans or actual events being different than bluebird’s assumptions;

the risk that additional funding may not be available on acceptable

terms, or at all; risks related to bluebird's loan agreement,

including the risk that operating restrictions could adversely

affect bluebird's ability to conduct its business, the risk that

bluebird will not achieve milestones required to access future

tranches under the agreement, and the risk that bluebird will fail

to comply with covenants under the agreement, including with

respect to required cash and revenue levels, which could result in

an event of default; the risk that the efficacy and safety results

from bluebird’s prior and ongoing clinical trials will not continue

or be seen in the commercial context; the risk that the QTCs

experience delays in their ability to enroll or treat patients; the

risk that bluebird experiences delays in establishing operational

readiness across its supply chain; the risk that there is not

sufficient patient demand or payer reimbursement to support

continued commercialization of the Company’s therapies; the risk of

insertional oncogenic or other safety events associated with

lentiviral vector, drug product, or myeloablation, including the

risk of hematologic malignancy; the risk that bluebird’s products,

including LYFGENIA, will not be successfully commercialized; and

risks related to compliance with Nasdaq continued listing

requirements. The forward-looking statements included in this

document are made only as of the date of this document and except

as otherwise required by applicable law, bluebird bio undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

changed circumstances or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204905459/en/

Investors & Media Investors: Courtney O’Leary,

978-621-7347 coleary@bluebirdbio.com Media: Jess Rowlands,

857-299-6103 jess.rowlands@bluebirdbio.com

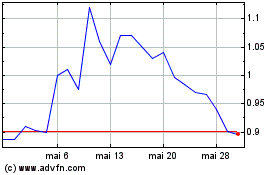

bluebird bio (NASDAQ:BLUE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

bluebird bio (NASDAQ:BLUE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024