Li-Cycle and Glencore resume their

collaboration to assess the technical and economic viability of a

new Hub facility in Portovesme, Italy, including a concept and

pre-feasibility study

Study expected to be led and funded by

Glencore, with Li-Cycle providing technical support

Project expected to leverage Li-Cycle’s

patented Spoke & Hub Technologies™ and utilize parts of

Glencore’s existing Portovesme facility

With closing of the $475 million loan facility

with U.S. Department of Energy (“DOE”), the first tranche of

Glencore’s unsecured convertible notes will be automatically

modified on December 9, 2024, in accordance with its terms

Li-Cycle continues to prioritize securing a

complete funding package to restart construction of the Rochester

Hub project and enable first advance of the DOE loan facility

Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the

“Company”), a leading global lithium-ion battery resource recovery

company, is pleased to announce that the Company and Glencore

International AG, a wholly-owned subsidiary of Glencore plc (LON:

GLEN) (together with its subsidiaries, “Glencore”), a leading

producer, recycler and marketer of nickel and cobalt for the

production of lithium-ion batteries, are resuming their

collaboration to assess the technical and economic viability of

developing a new Hub facility in Portovesme, Italy, including a

concept and pre-feasibility study.

The study is expected to be led and funded by Glencore, with

Li-Cycle providing technical expertise and support. The project

would utilize infrastructure and equipment at Glencore’s existing

Portovesme metallurgical complex in Sardinia, Italy and leverage

Li-Cycle’s patented Spoke & Hub Technologies™ to produce

critical battery materials such as lithium, nickel and cobalt from

recycled battery content. The black mass processed at the

Portovesme Hub would be supplied from Glencore’s commercial network

and Li-Cycle’s Spoke recycling facility located near Magdeburg,

Germany.

Once operational, the Portovesme Hub would be expected to

support the European battery supply chain by providing sustainable

post-processing recycling capacity. The Company believes that the

project would also support meeting EU minimum recycled content

requirements for new batteries and the EU recycling target of at

least 15% of strategic raw materials by 20301.

“We are pleased to continue our assessment and study of the

Portovesme Hub project with Glencore,” said Ajay Kochhar,

Li-Cycle’s President and CEO. “We believe the project has

significant potential and can address the lack of post-processing

recycling capacity in Europe needed for a localized closed-loop

battery supply chain and provide a sustainable secondary source of

critical battery materials. Separately, we remain focused on

securing a full funding package needed to restart construction at

our flagship Rochester Hub project and enable the first advance

under the finalized DOE loan facility.”

Following the recently announced $475-million loan facility with

the U.S. Department of Energy (“DOE Loan Facility”),2 a major

milestone in the Company’s funding efforts for the Rochester Hub

project, Li-Cycle remains focused on securing the complete funding

package required to restart the Rochester Hub project's

construction and satisfy funding conditions for the first advance

under the DOE Loan Facility. Li-Cycle is also continuing efforts to

strengthen its Spoke business through optimization initiatives and

improvements at its core Generation 3 Spoke recycling

facilities.

The closing of the DOE Loan Facility triggers an automatic

modification of the first tranche of the unsecured convertible

notes issued by the Company to Glencore on May 31, 2022, as amended

and restated on March 25, 2024 (the “First A&R Glencore

Convertible Note”). The modification, effective December 9, 2024,

will result in adjustments to the maturity date, interest rate, and

conversion price of the First A&R Glencore Convertible Note, as

well as introduce mandatory redemption provisions and security

interests, as described in the Company’s most recent Quarterly

Report on Form 10-Q. The adjustment to the conversion price of the

First A&R Glencore Convertible Note is expected to increase

Glencore’s beneficial ownership in the Company on a pro forma,

fully-diluted basis to approximately 66% as of December 9, 2024.

Definitive information regarding the modification will be included

in a Current Report on Form 8-K to be filed after the completion of

the modification.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery

resource recovery company. Established in 2016, and with major

customers and partners around the world, Li-Cycle’s mission is to

recover critical battery-grade materials to create a domestic

closed-loop battery supply chain for a clean energy future. The

Company leverages its innovative, sustainable and patent-protected

Spoke & Hub Technologies™ to recycle all different types of

lithium-ion batteries. At our Spokes, or pre-processing facilities,

we recycle battery manufacturing scrap and end-of-life batteries to

produce black mass, a powder-like substance which contains a number

of valuable metals, including lithium, nickel and cobalt. At our

future Hubs, or post-processing facilities, we plan to process

black mass to produce critical battery-grade materials, including

lithium carbonate, for the lithium-ion battery supply chain. For

more information, visit https://li-cycle.com/.

Forward-Looking Statements

Certain statements contained in this press release may be

considered “forward-looking statements” within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995, Section 27A

of the U.S. Securities Act of 1933, as amended, Section 21 of the

U.S. Securities Exchange Act of 1934, as amended, and applicable

Canadian securities laws. Forward-looking statements may generally

be identified by the use of words such as “believe”, “may”, “will”,

“continue”, “anticipate”, “intend”, “expect”, “should”, “would”,

“could”, “plan”, “potential”, “future”, “target” or other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters, although not all

forward-looking statements contain such identifying words.

Forward-looking statements in this press release include but are

not limited to statements about: the expectation that the concept

and pre-feasibility study for a Hub facility in Portovesme, Italy

will be led and funded by Glencore, with Li-Cycle providing

technical expertise and support; the expectation that the project

would utilize infrastructure and equipment at Glencore’s existing

Portovesme metallurgical complex in Sardinia, Italy and leverage

Li-Cycle’s patented Spoke & Hub Technologies™ to produce

critical battery materials such as lithium, nickel and cobalt from

recycled battery content; the expectation that the black mass

processed at the Portovesme Hub would be supplied from Glencore’s

commercial network and Li-Cycle’s Spoke recycling facility located

near Magdeburg, Germany; the expectation that the Portovesme Hub

would support the European battery supply chain by providing

sustainable post-processing recycling capacity; the expectation

that the project will support meeting EU minimum recycled content

requirements for new batteries and the EU recycling target of at

least 15% of strategic raw materials by 2030; the expectation that

the project has significant potential and can address the lack of

post-processing recycling capacity in Europe needed for a localized

closed-loop battery supply chain and provide a sustainable

secondary source of critical battery materials; the expectation

that Li-Cycle will continue efforts to strengthen its Spoke

business through optimization initiatives and improvements at is

core Generation 3 Spoke recycling facilities; and the expectation

that the automatic adjustment to the conversion price of the First

A&R Glencore Convertible Note will increase Glencore’s

beneficial ownership in the Company on a pro forma, fully-diluted

basis to approximately 66% as of December 9, 2024.

These statements are based on various assumptions, whether or

not identified in this press release, including but not limited to

assumptions regarding the timing, scope and cost of Li-Cycle’s

projects, including paused and curtailed projects; the processing

capacity and production of Li-Cycle’s facilities; Li-Cycle’s

ability to source feedstock and manage supply chain risk;

Li-Cycle’s ability to increase recycling capacity and efficiency;

Li-Cycle’s ability to obtain financing on acceptable terms or at

all; the success of Li-Cycle’s cash preservation plan; the outcome

of the go-forward strategy of the Rochester Hub; Li-Cycle’s ability

to retain and hire key personnel and maintain relationships with

customers, suppliers and other business partners; expectations

related to the outcome of future litigation; general economic

conditions; currency exchange and interest rates; compensation

costs; and inflation. There can be no assurance that such estimates

or assumptions will prove to be correct and, as a result, actual

results or events may differ materially from expectations expressed

in or implied by the forward-looking statements.

These forward-looking statements are provided for the purpose of

assisting readers in understanding certain key elements of

Li-Cycle’s current objectives, goals, targets, strategic

priorities, expectations and plans, and in obtaining a better

understanding of Li-Cycle’s business and anticipated operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes and is not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability.

Forward-looking statements involve inherent risks and

uncertainties, most of which are difficult to predict and many of

which are beyond the control of Li-Cycle and are not guarantees of

future performance. Li-Cycle believes that these risks and

uncertainties include, but are not limited to, the following:

Li-Cycle’s inability to fund the anticipated costs of, and realize

the anticipated benefits from, its Spoke optimization plan;

Li-Cycle’s inability to satisfy the drawdown conditions and access

funding under the DOE Loan Facility; Li-Cycle’s inability to

develop the Rochester Hub as anticipated or at all, and other

future projects including its Spoke network expansion projects in a

timely manner or on budget or that those projects will not meet

expectations with respect to their productivity or the

specifications of their end products; risk and uncertainties

related to Li-Cycle’s ability to continue as a going concern;

Li-Cycle’s insurance may not cover all liabilities and damages;

Li-Cycle’s reliance on a limited number of commercial partners to

generate revenue; Li-Cycle’s failure to effectively remediate the

material weaknesses in its internal control over financial

reporting that it has identified or its failure to develop and

maintain a proper and effective internal control over financial

reporting; and risks of litigation or regulatory proceedings that

could materially and adversely impact Li-Cycle’s financial results.

These and other risks and uncertainties related to Li-Cycle’s

business are described in greater detail in the sections titled

“Item 1A. Risk Factors” and “Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operation—Key

Factors Affecting Li-Cycle’s Performance” in its Annual Report on

Form 10-K and the sections titled “Part II. Other Information—Item

1A. Risk Factors” and “Part I. Financial Information—Item 2.

Management’s Discussion and Analysis of Financial Condition and

Results of Operation—Key Factors Affecting Li-Cycle’s Performance”

in its Quarterly Reports on Form 10-Q, in each case filed with the

U.S. Securities and Exchange Commission and the Ontario Securities

Commission in Canada. Because of these risks, uncertainties and

assumptions, readers should not place undue reliance on these

forward-looking statements. Actual results could differ materially

from those contained in any forward-looking statement.

Li-Cycle assumes no obligation to update or revise any

forward-looking statements, except as required by applicable laws.

These forward-looking statements should not be relied upon as

representing Li-Cycle’s assessments as of any date subsequent to

the date of this press release.

_______________________ 1 As defined by the EU’s Battery

Regulation and Critical Raw Materials Act. 2 Including up to $445

million of principal and up to $30 million in capitalized

interest.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204543579/en/

Investor Relations & Media

Louie Diaz Sheldon D'souza

Investor Relations: investors@li-cycle.com Media:

media@li-cycle.com

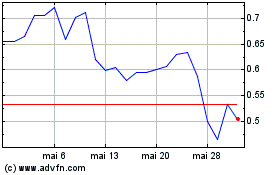

Li Cycle (NYSE:LICY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Li Cycle (NYSE:LICY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024