- More than 300K mortgage refinances closed in September and

October – the most in 2.5 years – as borrowers took advantage of

interest rates in the low 6% range

- Nearly 150K of those were rate/term refinances, with October

marking the first time in 3 years that rate/term volumes outpaced

those of cash-out refis

- The average rate/term borrower in September and October cut

their first lien rate by more than a point and their payment by

$320/month, for an aggregate $47M monthly savings in just those two

months alone

- Mortgage holders refinancing out of and back into Veterans

Administration (VA) loans accounted for more than 30% of rate/term

activity, more than 4x the VA market share among all active

mortgages

- More than 35% of VA and more than 10% of all rate/term

refinances this year have been originated with loan-to-value ratios

of over 100%, increasing potential performance risk down the

road

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today released its December 2024

ICE Mortgage Monitor Report, based on the company’s robust

mortgage, real estate and public records data sets.

When 30-year conforming mortgage interest rates fell into the

low 6% range in August/September of this year, the mortgage

industry experienced a welcome burst of refinance activity. This

month’s Mortgage Monitor dives deep into ICE Mortgage Trends closed

loan data to learn what that brief “boomlet” in borrowing activity

reveals about U.S. mortgage holders and their motivations in

today’s market. As Andy Walden, ICE Vice President of Research and

Analysis explains, homeowners with loans originated in the last few

years were quick to act when the rate calculus turned in their

favor.

“Homeowners pounced on their incentive to refinance as rates

fell through August and September,” said Walden. “More than 300K

mortgage holders closed on refinance transactions in September and

October, the most we’ve seen in two-and-a-half years. What’s more,

almost half of that activity involved the homeowner refinancing

into a better rate, with October marking the first time in three

years that there were more rate/term than cash-out refinances in a

given month.”

ICE Market Trends data also showed that technologically-adept

lenders were ready to meet that demand, with average closing times

among all loan types – purchase as well as cash-out and rate/term

refinances – all hitting their lowest October levels in the five

years ICE has been tracking the metric. According to ICE McDash

+NextLoan data, which tracks loans before and after a refinance or

other prepayment, this is translating into higher retention rates

as well, with servicers retaining more than a third of customers

refinancing to improve their rate or term, the best in two and a

half years. As has been the case in recent years, retention was

strongest – nearing 40% – among those who’d recently taken out

their mortgages.

“This brief, but welcome, spike in refinancing was dominated by

homeowners quickly ditching their recently acquired mortgages,”

Walden continued. “Refinances out of 2023 and 2024 vintages drove

an impressive 78% of recent rate/term lending and nearly half of

refi activity overall. The average rate/term refinancer had been in

their prior mortgage for just 15 months, the shortest average

length of time in the nearly 20 years we’ve been tracking that

metric. For most, this was a no brainer; on average, these folks

cut their first lien rates by more than a point and their monthly

mortgage payment by $320 per month. That works out to roughly $47M

in monthly payment savings locked in by homeowners in just

September and October alone.”

More than two thirds of all rate/term refinances dropped their

rate by more than a full percentage point (pp), while nearly a

third were able to improve their rate by 1.5 pp or more. Borrowers

with mortgages backed by the VA saw the largest monthly

improvements, dropping their rates by 1.28 pp on average in

October, as compared to the 1.08 to 1.18 pp declines seen among

other loan products and investor classes

"As you'd expect," Walden continued, "the interest rate

threshold at which a given homeowner would be enticed to pull the

trigger on a refi varied by loan size. Nearly half of refinancing

borrowers with balances between $250K and $375K needed a 125 basis

point (bps) reduction before deciding to refi. The distribution of

rate savings for those with balances between $375K and $624K were

largely similar. Once a borrower's balance got above $750K,

however, it was clear that less rate incentive was required for a

refinance to be of value. Nearly 40% of those borrowers cut their

first lien 75 bps or less by refinancing, and about 12% saw benefit

in doing so even with less than a 50 bps reduction."

Refinances from and back into VA mortgages accounted for

approximately 30% of September and October rate/term lending, some

four times their representation among active mortgages. In addition

to the increased prepayment risk this represents, performance risk

must be taken into consideration as well. More than 35% of 2024 VA

rate/term refinances have had loan-to-value ratios over 100%. This

stems from a combination of the refinancing of more recent

vintages, which haven't had time to improve their equity positions,

and loan programs that allow borrowers to finance closing costs and

even interest rate buydowns up to certain thresholds.

Much more information on these and other topics can be found in

this month’s Mortgage Monitor.

About Mortgage Monitor

ICE manages the nation’s leading repository of loan-level

residential mortgage data and performance information covering the

majority of the overall market, including tens of millions of loans

across the spectrum of credit products and more than 160 million

historical records. The combined insight of the ICE Home Price

Index and Collateral Analytics’ home price and real estate data

provides one of the most complete, accurate and timely measures of

home prices available, covering 95% of U.S. residential properties

down to the ZIP-code level. In addition, the company maintains one

of the most robust public property records databases available,

covering 99.9% of the U.S. population and households from more than

3,100 counties.

ICE’s research experts carefully analyze this data to produce a

summary supplemented by dozens of charts and graphs that reflect

trend and point-in-time observations for the monthly Mortgage

Monitor Report. To review the full report, visit:

https://mortgagetech.ice.com/resources/data-reports

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds, and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges --

including the New York Stock Exchange -- and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology, we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines, and automates industries to

connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Source: Intercontinental Exchange

Category: Mortgage Technology

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209445113/en/

ICE Media Contact Mitch Cohen mitch.cohen@ice.com +1

(704) 890-8158

ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com +1 (678) 981-3882

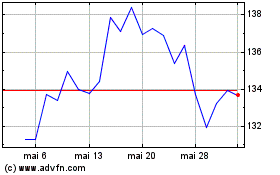

Intercontinental Exchange (NYSE:ICE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Intercontinental Exchange (NYSE:ICE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024