ICE Midland WTI (HOU) Reaches Record Open Interest and Delivers a Record 20 million Barrels of Midland WTI Crude During November

11 Dezembro 2024 - 10:00AM

Business Wire

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today announced that its ICE

Midland WTI (ICE:HOU) crude futures reached record open interest of

160,600 contracts on November 20, 2024, up over 130% year-over-year

(y/y).

Since launch, HOU has grown into a widely accepted benchmark

price for Midland-origin and Midland-quality crude. A record 20

million barrels of Midland WTI crude were delivered through the

exchange settlement for HOU and via EFPs (Exchange for Physicals)

in November, the highest delivery month to date. EFPs provide

customers with the flexibility to deliver barrels to different

locations, as well as flexible delivery dates.

In a significant endorsement of HOU as the price of Midland

crude, Continental Resources recently announced that it has

switched a portion of its Permian production to price off of HOU,

replacing a differential to WTI Cushing. In recognition of HOU's

establishment within Midland WTI pricing, Platts, part of S&P

Global Commodity Insights, has proposed to launch a daily price

assessment of Midland WTI crude as a differential to HOU, effective

January 22, 2025. This follows General Index’s launch of a full

suite of all North American Crude grades priced as differentials to

HOU, also replacing WTI Cushing as a benchmark.

“Each of these milestones are critical elements of establishing

a new crude benchmark,” said Jeff Barbuto, Global Head of Oil

Markets at ICE. “We appreciate all of the work and support of our

partners and customers in developing this physically deliverable

benchmark for crude oil in the U.S. Gulf Coast.”

ICE HOU pricing reflects current fundamentals in Houston,

delivering physical crude into two of the biggest crude oil systems

on the U.S. Gulf Coast, the ONEOK Magellan East Houston (MEH) and

Enterprise Crude Houston (ECHO) terminals. Both are connected to

Platts-approved water terminals to deliver Midland WTI into Brent.

HOU is the only exchange-guaranteed source of ratably deliverable

Midland WTI, with the quality spec of HOU matching the Platts spec

for Midland WTI.

ICE offers HOU time spreads, as well as inter-commodity spreads

with Brent and WTI Cushing (Domestic Light Sweet) to help customers

mitigate price risk between locations and grades. Meanwhile,

customers can benefit from margin offsets as high as 98% when

clearing HOU alongside other oil positions cleared at ICE. Offsets

are available across a range of over 800 oil contracts, including

ICE Brent, ICE Gasoil, ICE WTI (Cushing), ICE Dubai (Platts), and

ICE Murban, as well as NY Harbor RBOB Gasoline and Heating Oil.

Across ICE’s global oil complex, open interest stands at 14.3

million contracts, up approximately 20% y/y. Alongside record highs

in HOU, ICE’s broader oil futures markets hit record open interest

of 9.5 million contracts on November 28, 2024. Oil is one part of

ICE’s extensive global commodity markets where open interest stands

at 63.8 million contracts, up over 10% y/y.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges –

including the New York Stock Exchange – and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology, we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines and automates industries to

connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: EXCHANGES

ICE-CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211620104/en/

ICE Media: Jess Tatham jess.tatham@ice.com +44 7377

947136

ICE Investor: Katia Gonzalez katia.gonzalez@ice.com (678)

981-3882

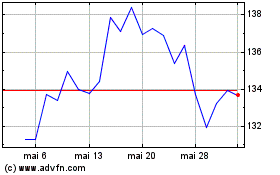

Intercontinental Exchange (NYSE:ICE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Intercontinental Exchange (NYSE:ICE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024