Exclusive Networks: Date of Payment of the Exceptional Distribution Approved by Shareholders on October 31, 2024

10 Dezembro 2024 - 4:00AM

Business Wire

Regulatory News:

Exclusive Networks (Euronext Paris: EXN), a global leader in

cybersecurity, announces its decision to proceed to the payment, on

December 16, 2024, of the exceptional distribution of a final

amount of €484,935,812.941, approved by the shareholders at the

Ordinary General Meeting held on October 31, 2024, corresponding to

a distribution of €5.29 per share, following the ex-coupon date set

for December 12, 2024.

As announced at the Ordinary General Meeting, the exceptional

distribution will be allocated: (i) in priority to the “Other

Reserves” account, until consumption, i.e. €53,676,521.01,

corresponding to €0.59 per share on the basis of 91,670,286 shares

constituting the share capital as at October 31, 2024 and (ii) the

residual amount will be allocated to the “Share Premium” account,

i.e. €431,259,291.931, corresponding to €4.70 per share on the

basis of 91,670,286 shares constituting the share capital as at

October 31, 2024.

It should be noted that, pursuant to the interim financial

statements over the period from January 1, 2024, until October 31,

2024, the interim accounting net result of Exclusive Networks SA

realized does not exceed the amount of accumulated retained losses

as of the end of the fiscal year 2023 (i.e. € -9,887,602.48).

Under the current French tax legislation and subject to any

subsequent legislative changes, the portion of the exceptional

distribution allocated to the “Other reserves” account, i.e. €0.59

per share, will be treated for French tax purposes as an ordinary

dividend and will be subject to the tax regime applicable to

investment income (“revenus de capitaux mobiliers”):

- as regards the individual shareholders who are French tax

residents and who do not hold their shares in a stock savings plan

(“plan d’épargne en actions”), this fraction of the gross

distribution amount will be subject to a 30% flat tax levied on the

gross amount of the distribution, which breaks down into a levy at

the rate of 12.8% for income tax purposes and social levies at an

overall rate of 17.2%. By way of express and irrevocable election

exercised when filing their tax return, individual French taxpayers

may opt to globally subject their investment income, including this

exceptional distribution, to the progressive scale of the personal

income tax instead of the 30% flat tax, in this case, the taxable

portion of the exceptional distribution will benefit from a 40%

allowance;

- as regards legal entities that are French tax residents and

subject to corporate income tax, the taxable portion of the

exceptional distribution is in principle subject to corporate

income tax under standard conditions. Subject to compliance with

certain conditions, shareholders holding at least 5% of the

Company’s share capital may be, under the so-called

“parent-subsidiary” regime (régime mère-fille), exempt from

corporate income tax on this revenue, subject to the add-back of a

lump-sum corresponding to 5% of the amount of the income

distributed;

- as regards non-French tax resident shareholders, and subject to

the exemptions provided for, in particular, in articles 119 bis 2°

and 119 ter of the French Tax Code, the taxable portion of the

exceptional distribution will be subject to the withholding tax

referred to in article 119 bis of the French Tax Code, levied, on a

case by case basis, at the rates set out in article 187 of the

French Tax Code, which may also be reduced or removed in

application of the double tax treaty concluded between France and

the State of residence in which the relevant beneficiary is

resident for tax purposes.

The residual portion of the exceptional distribution allocated

to “Share premium” account, i.e. €4.70 per share, will be treated

in France, as a tax exempt return of capital, pursuant to the

provisions of Article 112, 1° of the French tax code, in the

absence of undistributed profits and reserves on balance sheet,

other than the legal reserve:

- as regards French tax resident shareholders, individuals and

legal entities subject to corporate income tax, this tax-exempt

amount should reduce the acquisition / subscription price or the

fiscal value in case of subsequent sale of Exclusive Networks

shares;

- as regards non-French tax resident shareholders, this return of

capital will not be subject to any withholding tax in France.

The summary of the French tax regime applicable to the

exceptional distribution is provided for information purposes only.

The shareholders should consult with their own tax advisor to

determine the tax regime applicable in their particular case.

This decision follows the announcement, on November 20, 2024, by

Clayton Dubilier & Rice LLP (CD&R) and Everest UK Holdco

(an entity controlled by the Permira funds) that the consortium

they are forming with the company's founder, Olivier Breittmayer

has obtained all the regulatory approvals necessary to complete the

acquisition, through a dedicated company controlled by CD&R and

Permira, of a majority stake in Exclusive Networks SA.

Information on the exceptional distribution voted on October 31,

2024 at the Annual General Meeting is available on the “Annual

General Meeting” page of the Exclusive Networks Group website

https://ir.exclusive-networks.com/agm/ordinary-general-meeting/.

About Exclusive Networks

Exclusive Networks (EXN) is a global cybersecurity specialist

that provides partners and end-customers with a wide range of

services and product portfolios via proven routes to market. With

offices in over 45 countries and the ability to serve customers in

over 170 countries, we combine a local perspective with the scale

and delivery of a single global organisation.

Our best-in-class vendor portfolio is carefully curated with all

leading industry players. Our services range from managed security

to specialist technical accreditation and training and capitalize

on rapidly evolving technologies and changing business models. For

more information visit www.exclusive-networks.com.

1 Maximum theoretical amount calculated based on a total number

of 91,670,286 shares as at October 31, 2024. In practice, the

treasury shares held by Exclusive Networks SA (i.e., at October 31,

2024, 1,013,232 shares in the aggregate) will not give right to the

exceptional distribution, the underlying non-distributed amount

remaining allocated at the “Share premium” account.

©Copyright Exclusive Networks SA | 20, Quai du Point du Jour,

Arcs de Seine, 92100 - BOULOGNE, BILLANCOURT, France

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209039403/en/

EXCLUSIVE NETWORKS CONTACTS Investors

& Analysts Nicolas Leroy Global Communications

Director ir@exclusive-networks.com Media FTI Consulting Emily Oliver /

Jamie Ricketts +33 (0)6 28 73 45 15

exclusivenetworks@fticonsulting.com

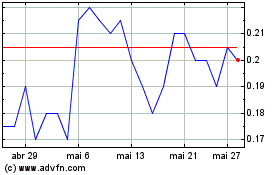

Excellon Resources (TSX:EXN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Excellon Resources (TSX:EXN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024