Morgan Stanley Capital Partners Agrees to Acquire Prescott’s

10 Dezembro 2024 - 11:00AM

Business Wire

Investment funds managed by Morgan Stanley Capital Partners

(“MSCP”), the middle-market focused private equity team at Morgan

Stanley Investment Management, have agreed to acquire Prescott’s, a

leading healthcare focused specialty outsourced clinical

engineering services provider, from Atlantic Street Capital. MSCP

is partnering with the current management team led by CEO Brian

Straeb, who will continue to lead the business.

Prescott’s provides medical equipment repair and maintenance

service solutions, alongside refurbished equipment and parts sales

and rentals for critical surgical suite modalities including

microscopes, infusion pumps, patient monitors, anesthesia machines

and sterilizers. Headquartered in Monument, Colorado, Prescott’s

serves health systems, outpatient facilities and other care

settings across the United States and the UK.

Steve Rodgers, Managing Director and Head of Healthcare

Investing at MSCP, said: “We are excited to partner with the

Prescott’s team as they continue building a best-in-class platform

in outsourced clinical engineering services for critical surgical

suite equipment. Prescott’s timely repair and maintenance services

enable continuity of care and avoid costly equipment downtime. This

investment represents our continued effort to invest in

high-quality healthcare focused outsourced services

businesses.”

Straeb said: “We are excited to partner with the MSCP team for

the next chapter of our growth. MSCP has been actively tracking the

outsourced clinical engineering space for several years and has a

deep understanding of the industry and various business models.

MSCP engaged their operations team early in the process as they

recognized the importance of looking at value creation from

multiple angles. This made them an ideal partner to contribute

meaningfully to our strategic efforts both organically and

inorganically so that we can hit the ground running immediately

post close.”

MSCP’s acquisition of Prescott’s will be its fourth investment

in the Healthcare Outsourced Services sector. Since 2019, MSCP has

invested in health plan communications solutions provider, Clarity

Software Solutions, pharma education and marketing solutions

provider, US HealthConnect and health system cost cycle management

provider, SpendMend.

Closing is subject to customary closing conditions.

Dechert acted as legal counsel, Alvarez and Marsal acted as QoE,

Tax and Operations advisor, and Cascadia Capital acted as financial

advisor to MSCP. Kramer Levin acted as legal counsel and Harris

Williams (lead advisor) and Houlihan Lokey acted as financial

advisors to Prescott’s and Atlantic Street Capital.

About Prescott’s Founded in 1984, Prescott’s is a leading

provider of healthcare medical equipment repair and maintenance

service solutions, alongside refurbished equipment & parts

sales, and rentals. Prescott’s helps healthcare providers reduce

equipment downtime, simplify equipment management, and reduce

repair and maintenance costs. The Company covers critical surgical

suite equipment modalities including surgical microscopes, infusion

pumps, patient monitors, anesthesia machines and sterilizers.

Prescott’s services health systems, outpatient facilities, clinics,

and other care settings nationwide and in the UK through a

differentiated workforce of repair technicians. For more

information, please visit the Company’s website

https://prescottsmed.com/.

About Morgan Stanley Capital Partners Morgan Stanley

Capital Partners, part of Morgan Stanley Investment Management, is

a leading middle-market private equity platform established in 1986

that focuses on privately negotiated equity and equity-related

investments primarily in North America. Morgan Stanley Capital

Partners seeks to create value in portfolio companies primarily in

a series of subsectors in the business and consumer, healthcare,

and industrial services markets with an emphasis on driving

significant organic and acquisition growth through an operationally

focused approach. For further information about Morgan Stanley

Capital Partners, please visit

www.morganstanley.com/im/capitalpartners.

About Morgan Stanley Investment Management Morgan Stanley

Investment Management, together with its investment advisory

affiliates, has more than 1,400 investment professionals around the

world and $1.6 trillion in assets under management or supervision

as of September 30, 2024. Morgan Stanley Investment Management

strives to provide outstanding long-term investment performance,

service, and a comprehensive suite of investment management

solutions to a diverse client base, which includes governments,

institutions, corporations and individuals worldwide. For further

information about Morgan Stanley Investment Management, please

visit www.morganstanley.com/im.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209554471/en/

Press Contacts Morgan Stanley: Alyson Barnes

alyson.barnes@morganstanley.com

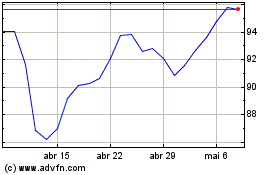

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

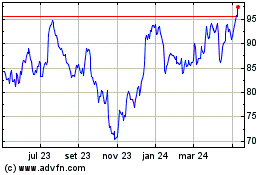

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025