U.S. Stocks Close Mixed After Early Move To The Downside

13 Janeiro 2025 - 6:46PM

IH Market News

Stocks showed a notable move to the downside early in the

session on Monday but regained ground over the course of the

trading day. The S&P 500 climbed well off its worst levels of

the day and into positive territory, although the Nasdaq remained

in the red.

The S&P 500 rose 9.18 points or 0.2 percent to 5,836.22,

while the Nasdaq fell 73.53 points or 0.4 percent to a one-month

closing low of 19,088.10.

The narrower Dow, on the other hand, spent most of the day in

positive territory before closing up 358.67 points or 0.9 percent

at 42,297.12.

Weakness in the tech sector weighed on Wall Street early in the

session, as AI darling and market leader Nvidia (NASDAQ:NVDA)

plunged by as much as 4.7 percent.

Quantum computing stocks also saw continued weakness after Meta

(NASDAQ:META) CEO Mark Zuckerberg echoed Nvidia CEO Jensen Huang’s

remarks that quantum is at least a decade away from being a “useful

paradigm.”

Ongoing concerns about the outlook for interest rates also

generated negative sentiment following last Friday’s

stronger-than-expected monthly jobs report.

Selling pressure waned over the course of the trading session,

however, leading some traders to pick up stocks at reduced levels

as the S&P 500 rebounded from its lowest intraday level in over

two months.

In the coming days, reports on consumer and producer price

inflation may provide further insight into the outlook for rates.

Reports on weekly jobless claims, retail sales and industrial

production are also likely to attract attention later in the

week.

Earnings season also starts to pick up steam this week, as

financial giants Citigroup (NYSE:C), Goldman Sachs (NYSE:GS),

JPMorgan (NYSE:JPM) and Wells Fargo (NYSE:WFC) are due to report

their quarterly results.

Meanwhile, the advance by the Dow partly reflected a strong gain

by UnitedHealth (NYSE:UNH) after the U.S. government proposed a 4.3

percent average total increase to its 2026 reimbursement rates for

Medicare Advantage plans.

Sector News

Steel stocks showed a substantial move to the upside on the day,

driving the NYSE Arca Steel Index up by 2.6 percent.

U.S. Steel (X) helped lead the sector higher, surging by 6.1

percent after a report from the Wall Street Journal said

Cleveland-Cliffs (CLF) is discussing joining with Nucor (NUE) on a

possible bid for the company.

Significant strength also emerged among biotechnology stocks, as

reflected by the 2.2 percent jump by the NYSE Arca Biotechnology

Index.

Oil producer, housing, and natural gas stocks also saw notable

strength, while considerable weakness remained visible among gold,

airline and computer hardware stocks.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower on Monday, with the Japanese markets

closed for a holiday. China’s Shanghai Composite Index dipped by

0.3 percent, while Hong Kong’s Hang Seng Index slumped by 1.0

percent.

The major European markets also moved to the downside on the

day. While the German DAX Index slid by 0.4 percent, the U.K.’s

FTSE 100 Index and the French CAC 40 Index both fell by 0.3

percent.

In the bond market, treasuries showed a lack of direction over

the course of the session before closing modestly lower. As a

result, the yield on the benchmark ten-year note, which moves

opposite of its price, rose 2.7 basis points to a one-year closing

high of 4.803 percent.

Looking Ahead

Following a quiet day on the U.S. economic front, trading on

Tuesday may be impacted by reaction to a report on producer price

inflation in the month of December.

SOURCE: RTTNEWS

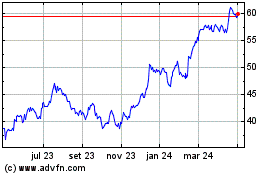

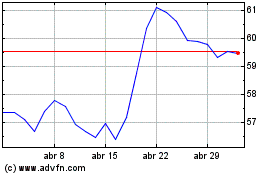

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025