Company to host earnings conference call at

9:00 a.m. ET today

AstroNova, Inc. (Nasdaq: ALOT), a global leader in data

visualization technologies, today announced financial results for

its fiscal 2025 third quarter ended November 2, 2024.

Third Quarter FY 2025 Summary

- Net revenue of $40.4 million

- GAAP gross margin of 33.9%; non-GAAP gross margin of 34.0%

- GAAP operating margin of 3.1%; non-GAAP operating margin of

4.0%

- GAAP net income of $0.03 per diluted share; non-GAAP net income

of $0.06 per diluted share

- GAAP net income of $0.2 million; Adjusted EBITDA of $3.2

million

CEO Commentary

“Overall, our third-quarter performance was disappointing,

reflecting a significant decrease in consolidated margins and

increased operating expenses year-over-year,” said Greg Woods,

AstroNova’s President and Chief Executive Officer. “Our results

were primarily impacted by the ongoing integration of MTEX NS

(MTEX) in our Product Identification segment, as well as a key

customer’s delayed launch from the third quarter to the fourth

quarter of a large order we received for hundreds of inkjet

printers that just began shipping this month. The MTEX integration

is proving far more time-consuming and resource-intensive than we

anticipated when we completed the acquisition in May. MTEX had an

operating loss of $1.1 million in the third quarter with revenue of

$1.7 million. While its revenue is substantially higher on a

sequential basis, MTEX’s initial sales volume, revenue and margin

contributions are well short of our targets, and we are working

diligently to get the acquisition on track to deliver improved

results as rapidly as possible.

“As part of this process, we recently completed a total

realignment of MTEX’s organizational reporting structure. All of

MTEX’s key functions, including Sales and Marketing, Manufacturing,

Technology, Finance, and Human Resources, now report directly to

the AstroNova leadership team,” Woods said. “Among its goals, this

effort aims to accelerate the implementation of consistent best

practices within the MTEX sales process, ensuring alignment with

the established standards and practices of our Product

Identification segment and our organization as a whole. In

conjunction with the integration, we have also launched an

AstroNova-wide cost reduction and product line rationalization

initiative. These measures have already delivered initial

successes, including the closure of some large new orders. However,

the full integration process is anticipated to continue through

mid-calendar year 2025, with additional work required to complete

the transition.

“While the integration has been challenging, we remain confident

in MTEX’s game-changing inkjet printing technology, as well as

their manufacturing capabilities and unique, real-time, printer

monitoring and management software,” Woods said. “In the quarters

ahead, in conjunction with our product rationalization program, we

plan to incorporate the MTEX technology and software into most of

our products and even retrofit it into several models of our large

global installed base, which we expect will provide our customers

with improved performance and lower total cost of ownership.

“Despite the challenges in the PI segment in the third quarter,

our consolidated net revenue increased nearly 8% year-over-year,

driven by the continued momentum of the Aerospace product line

within our Test & Measurement (T&M) segment,” Woods said.

“The performance of the T&M segment would have been even

stronger had it not been for the nearly two-month Boeing strike,

which delayed shipments. With the strike now resolved, shipments to

Boeing are ramping back up, and we expect sales volume in that

product line to improve as we close out fiscal 2025. In our PI

segment, revenue from the previously delayed inkjet printer order

is expected to contribute several million dollars to the top line

over the next several quarters.”

Business Outlook

Given the extended integration timeline for MTEX, AstroNova is

no longer providing financial guidance for fiscal 2025 and 2026. As

part of the integration process, the Company is conducting a

comprehensive cost-reduction and product-line rationalization

initiative. This effort is aimed at reducing expenses and further

enhancing AstroNova’s product portfolio. AstroNova plans to discuss

the results of this initiative, and provide long-term financial

targets, on its full-year fiscal 2025 earnings call in March.

“Although it will take time to realize the full benefits of the

MTEX acquisition, we are encouraged about the strategic

opportunities created by the acquisition, which we expect to

improve our competitiveness and expand our offerings to meet a

broader range of customer needs,” Woods said. “We are confident

that the steps we are taking now will yield meaningful competitive

advantages, ultimately driving shareholder value.”

Q3 FY 2025 Financial

Summary

GAAP

Non-GAAP

($ in thousands, except per share

data)

Q3 FY25

Q3 FY24

YoY

Q3 FY25

Q3 FY24

YoY

Net Revenue

$40,422

$37,549

7.7%

--

--

--

Gross Profit

$13,714

$14,779

(7.2%)

$13,748

$14,779

(7.0%)

Gross Margin

33.9%

39.4%

(550 bps)

34.0%

39.4%

(540 bps)

Operating Margin

3.1%

12.3%

(920 bps)

4.0%

12.3%

(830 bps)

Net Income

$240

$2,752

(91.3%)

$513

$2,752

(81.4%)

Net Income per Common Share – Diluted

$0.03

$0.37

(91.9%)

$0.06

$0.37

(83.8%)

See reconciliation tables for

GAAP to non-GAAP reconciliations

Adjusted EBITDA was $3.2 million for the third quarter of fiscal

2025, compared with $5.7 million in the comparable period of fiscal

2024. Adjusted EBITDA for the fiscal 2025 period excludes the

impact of $0.4 million in MTEX-related acquisition expenses and

inventory-step-up costs.

Bookings for the third quarter of fiscal 2025 were $37.6

million, compared with $35.5 million in the third quarter of fiscal

2024.

Backlog as of November 2, 2024, was $27.1 million, compared with

$31.2 million at the end of the third quarter of fiscal 2024.

Q3 FY 2025 Operating Segment

Results

Product Identification

Product Identification (PI) segment revenue was $26.3 million in

the third quarter of fiscal 2025, compared with $26.5 million in

the third quarter of fiscal 2024. The decrease was primarily

related to the delayed release of a new inkjet printer, to

accommodate a key customer’s request to add additional

functionality, as well as lower PI sales volume in Europe, partly

offset by revenue from the acquisition of MTEX NS. PI segment

operating income was $1.9 million, or 7.1% of revenue, in the third

quarter of fiscal 2025, compared with segment operating income of

$4.8 million, or 18.1% of revenue, in the third quarter of fiscal

2024. The decrease was driven by higher costs during the 2025

period, partially linked to the MTEX NS acquisition, an unfavorable

product mix, reduced sales volume in Europe, and the delayed launch

of a new product originally scheduled for the third quarter of

fiscal 2025 but deferred to the fourth quarter of fiscal 2025 and

early fiscal 2026.

Test & Measurement

Test & Measurement (T&M) segment revenue was $14.1

million in the third quarter of fiscal 2025, compared with $11.0

million in the third quarter of fiscal 2024. The increase was

driven by higher sales volume in the Company’s Aerospace product

line, partly offset by lower sales volume in the Test &

Measurement product line. T&M segment operating income was $3.3

million, or 23.0% of revenue, in the third quarter of fiscal 2025,

compared with segment operating income of $2.6 million, or 23.2% of

revenue, in the same period of fiscal 2024.

Earnings Conference Call

Information

AstroNova will discuss its third quarter fiscal 2025 financial

results in an investor conference call at 9:00 a.m. ET today. To

access the conference call, please dial (833) 470-1428 (U.S. and

Canada) or (404) 975-4839 (International) approximately 10 minutes

prior to the start time and enter access code 891769. A real-time

and archived audio webcast of the call will be available through

the “Investors” section of the AstroNova website,

https://investors.astronovainc.com.

Use of Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with

generally accepted accounting principles (GAAP), this news release

contains the non-GAAP financial measures non-GAAP gross profit,

non-GAAP gross margin, non-GAAP operating expenses, non-GAAP

operating income, non-GAAP operating margin, non-GAAP net income,

non-GAAP net income per diluted share, non-GAAP segment operating

profit, and Adjusted EBITDA. AstroNova believes that the inclusion

of these non-GAAP financial measures helps investors gain a

meaningful understanding of changes in the Company’s core operating

results and can help investors who wish to make comparisons between

AstroNova and other companies on both a GAAP and a non-GAAP basis.

AstroNova’s management uses these non-GAAP financial measures, in

addition to GAAP financial measures, as the basis for measuring its

core operating performance and comparing such performance to that

of prior periods and to the performance of its competitors. These

measures are also used by the Company’s management to assist with

their financial and operating decision-making. Please refer to the

financial reconciliation table included in this news release for a

reconciliation of the non-GAAP measures to the most directly

comparable GAAP measures for the three and nine months ended

November 2, 2024, and October 28, 2023.

About AstroNova

AstroNova (Nasdaq: ALOT), a global leader in data visualization

technologies since 1969, designs, manufactures, distributes, and

services a broad range of products that acquire, store, analyze,

and present data in multiple formats. The Product Identification

segment provides a wide array of digital, end-to-end product

marking and identification solutions, including hardware, software,

and supplies for OEMs, commercial printers, and brand owners. The

Test and Measurement segment provides products designed for

airborne printing solutions, avionics, and data acquisition. Our

aerospace products include flight deck printing solutions,

networking hardware, and specialized aerospace-grade supplies. Our

data acquisition systems are used in research and development,

flight testing, missile and rocket telemetry production monitoring,

power, and maintenance applications.

AstroNova is a member of the Russell Microcap® Index and the LD

Micro Index (INDEXNYSEGIS: LDMICRO). Additional information is

available by visiting https://astronovainc.com/.

Forward-Looking Statements

Information included in this news release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are not statements of historical fact, but rather

reflect our current expectations concerning future events and

results. These statements may include the use of the words

“believes,” “expects,” “intends,” “plans,” “anticipates,” “likely,”

“continues,” “may,” “will,” and similar expressions to identify

forward-looking statements. Such forward-looking statements,

including those concerning the Company’s anticipated performance,

involve risks, uncertainties and other factors, some of which are

beyond our control, which may cause our actual results, performance

or achievements to be materially different from those expressed or

implied by such forward-looking statements. These risks,

uncertainties and factors include, but are not limited to, (i) the

risk that we may not be able to realize the expected benefits from

our acquisition of MTEX; (ii) the risk that our cost-reduction and

product line rationalization initiative may not provide the

expected benefits; (iii) that the volume of orders in our Aerospace

product line may not improve on the schedule we anticipate or at

all; (iv) the risk that we may be unable to recognize revenue from

previously delayed orders in future periods in the amounts or the

timeline that we expect; and (v) those factors set forth in the

Company’s Annual Report on Form 10-K for the fiscal year ended

January 31, 2024 and subsequent filings AstroNova makes with the

Securities and Exchange Commission. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. The reader is cautioned not to unduly rely on such

forward-looking statements when evaluating the information

presented in this news release.

ASTRONOVA, INC.

Condensed Consolidated

Statements of Income

In Thousands Except for Per

Share Data

(Unaudited)

Three Months Ended

November 2, 2024

October 28, 2023

Net Revenue

$

40,422

$

37,549

Cost of Revenue

26,708

22,770

Gross Profit

13,714

14,779

Total Gross Profit Margin

33.9

%

39.4

%

Operating Expenses: Selling & Marketing

6,752

5,744

Research & Development

1,843

1,683

General & Administrative

3,855

2,734

Total Operating Expenses

12,450

10,161

Operating Income

1,264

4,618

Total Operating Margin

3.1

%

12.3

%

Interest Expense

944

630

Other (Income)/Expense, net

46

287

Income Before Taxes

274

3,701

Income Tax Provision

34

949

Net Income

$

240

$

2,752

Net Income per Common Share - Basic

$

0.03

$

0.37

Net Income per Common Share - Diluted

$

0.03

$

0.37

Weighted Average Number of Common Shares - Basic

7,524

7,428

Weighted Average Number of Common Shares - Diluted

7,580

7,485

Nine Months Ended

November 2, 2024

October 28, 2023

Net Revenue

$

113,922

$

108,493

Cost of Revenue

73,909

71,618

Gross Profit

40,013

36,875

Total Gross Profit Margin

35.1

%

34.0

%

Operating Expenses: Selling & Marketing

19,140

18,451

Research & Development

4,859

5,028

General & Administrative

12,343

8,514

Total Operating Expenses

36,342

31,993

Operating Income

3,671

4,882

Total Operating Margin

3.2

%

4.5

%

Interest Expense

2,363

1,919

Other (Income)/Expense, net

337

242

Income Before Taxes

971

2,721

Income Tax Provision (Benefit)

(139

)

738

Net Income

$

1,110

$

1,983

Net Income per Common Share - Basic

$

0.15

$

0.27

Net Income per Common Share - Diluted

$

0.15

$

0.27

Weighted Average Number of Common Shares - Basic

7,501

7,407

Weighted Average Number of Common Shares - Diluted

7,605

7,477

ASTRONOVA, INC.

Consolidated Balance

Sheets

In Thousands

(Unaudited)

November 2, 2024

January 31, 2024

ASSETS CURRENT ASSETS Cash and Cash Equivalents

$

4,432

$

4,527

Accounts Receivable, net

25,156

23,056

Inventories, net

48,560

46,371

Prepaid Expenses and Other Current Assets

5,239

2,720

Total Current Assets

83,387

76,674

PROPERTY, PLANT AND EQUIPMENT

69,300

57,046

Less Accumulated Depreciation

(50,934

)

(42,861

)

Property, Plant and Equipment, net

18,366

14,185

OTHER ASSETS Intangible Assets, net

24,514

18,836

Goodwill

25,337

14,633

Deferred Tax Assets

11,187

6,882

Right of Use Asset

1,946

603

Other Assets

1,725

1,438

TOTAL ASSETS

$

166,462

$

133,251

LIABILITIES AND SHAREHOLDERS’ EQUITY CURRENT LIABILITIES Accounts

Payable

$

7,933

$

8,068

Accrued Compensation

3,304

2,923

Other Liabilities and Accrued Expenses

3,676

2,706

Revolving Line of Credit

20,215

8,900

Current Portion of Long-Term Debt

6,328

2,842

Short-Term Debt

1,334

-

Current Portion of Royalty Obligation

1,450

1,700

Current Liability – Excess Royalty Payment Due

864

935

Income Taxes Payable

-

349

Deferred Revenue

378

1,338

Total Current Liabilities

45,482

29,761

NON-CURRENT LIABILITIES Long-Term Debt, net of current portion

21,072

10,050

Royalty Obligation, net of current portion

1,511

2,093

Lease Liability, net of current portion

1,681

415

Grant Deferred Revenue

1,412

-

Income Tax Payables

551

551

Deferred Tax Liabilities

2,580

99

TOTAL LIABILITIES

74,289

42,969

SHAREHOLDERS’ EQUITY Common Stock

546

541

Additional Paid-in Capital

63,949

62,684

Retained Earnings

64,979

63,869

Treasury Stock

(35,025

)

(34,593

)

Accumulated Other Comprehensive Loss, net of tax

(2,276

)

(2,219

)

TOTAL SHAREHOLDERS’ EQUITY

92,173

90,282

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

166,462

$

133,251

ASTRONOVA, INC.

Condensed Consolidated

Statements of Cash Flows

(In Thousands)

(Unaudited)

Nine Months Ended

November 2, 2024

October 28, 2023

Cash Flows from Operating Activities:

Net Income

1,110

1,983

Adjustments to Reconcile Net Income to Net Cash Provided by

Operating Activities: Depreciation and Amortization

3,514

3,158

Amortization of Debt Issuance Costs

22

17

Share-Based Compensation

1,159

1,065

Restructuring - non-cash

-

2,040

Changes in Assets and Liabilities, net of impact of acquisition:

Accounts Receivable

1,619

(563

)

Inventories

1,380

2,111

Income Taxes

(1,534

)

(531

)

Accounts Payable and Accrued Expenses

(2,371

)

(2,036

)

Deferred Revenue

(1,080

)

(1,121

)

Other

(1,495

)

(221

)

Net Cash Provided by Operating Activities

2,324

5,902

Cash Flows from Investing

Activities: Purchases of Property, Plant and Equipment

(1,086

)

(1,279

)

Cash Paid for MTEX Acquisition, net of cash acquired

(19,109

)

-

Net Cash Provided (Used) for Investing Activities

(20,195

)

(1,279

)

Cash Flows from Financing

Activities: Net Cash Proceeds from Employee Stock Option

Plans

13

71

Net Cash Proceeds from Share Purchases under Employee Stock

Purchase Plan

98

79

Net Cash Used for Payment of Taxes Related to Vested Restricted

Stock

(432

)

(353

)

Borrowings under Revolving Credit Facility, net

10,774

-

Repayment under Revolving Credit Facility

-

(1,000

)

Proceeds from Long-Term Debt Borrowings

15,078

-

Payment of Minimum Guarantee Royalty Obligation

(1,247

)

(1,350

)

Principal Payments of Long-Term Debt

(6,706

)

(1,425

)

Payments of Debt Issuance Costs

(37

)

-

Net Cash Provided (Used) for Financing Activities

17,541

(3,978

)

Effect of Exchange Rate Changes on Cash and Cash Equivalents

235

236

Net Increase in Cash and Cash Equivalents

(95

)

881

Cash and Cash Equivalents, Beginning of Period

4,527

3,946

Cash and Cash Equivalents, End of Period

4,432

4,827

Supplemental Disclosures of Cash Flow

Information: Cash Paid During the Period for: Cash Paid

During the Period for Interest

1,891

1,695

Cash Paid During the Period for Income Taxes, net of refunds

1,503

1,285

Non-Cash Transactions: Capital Lease Obtained in Exchange for

Capital Lease Liabilities

1,581

—

ASTRONOVA, INC.

Revenue and Segment Operating

Profit

In Thousands

(Unaudited)

Revenue

Segment Operating

Profit

Three Months Ended

Three Months Ended

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Product Identification

$

26,317

$

26,543

$

1,868

$

4,794

Test & Measurement

14,105

11,006

3,251

2,558

Total

$

40,422

$

37,549

5,119

7,352

General & Administrative Expenses

3,855

2,734

Operating Income

1,264

4,618

Interest Expense

944

630

Other (Income)/Expense, net

46

287

Income Before Income Taxes

274

3,701

Income Tax Provision

34

949

Net Income

$

240

$

2,752

Revenue

Segment Operating

Profit

Nine Months Ended

Nine Months Ended

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Product Identification

$

76,667

$

77,416

$

7,208

$

6,848

Test & Measurement

37,255

31,077

8,806

6,548

Total

$

113,922

$

108,493

16,014

13,396

General & Administrative Expenses

12,343

8,514

Operating Income

3,671

4,882

Interest Expense

2,363

1,919

Other (Income)/Expense, net

337

242

Income Before Income Taxes

971

2,721

Income Tax Provision (Benefit)

(139

)

738

Net Income

$

1,110

$

1,983

Note: Segment Operating Profit

excludes General & Administrative Expenses

ASTRONOVA, INC.

Reconciliation of GAAP to

Non-GAAP Items

In Thousands Except for Per Share

Data

(Unaudited)

Three Months Ended

November 2, 2024

October 28, 2023

Gross Profit

$

13,714

$

14,779

Inventory Step-Up

34

-

Non-GAAP Gross Profit

$

13,748

$

14,779

Operating Expenses

$

12,450

$

10,161

MTEX-related Acquisition Expenses

(325

)

-

Non-GAAP Operating Expenses

$

12,125

$

10,161

Operating Income

$

1,264

$

4,618

MTEX-related Acquisition Expenses

325

-

Inventory Step-Up

34

-

Non-GAAP Operating Income

$

1,623

$

4,618

Net Income

$

240

$

2,752

MTEX-related Acquisition Expenses, net

247

-

Inventory Step-Up, net

26

-

Non-GAAP Net Income

$

513

$

2,752

Diluted Earnings Per Share

$

0.03

$

0.37

MTEX-related Acquisition Expenses

0.03

-

Inventory Step-Up

-

-

Non-GAAP Diluted Earnings Per Share

$

0.06

$

0.37

Nine Months Ended

November 2, 2024

October 28, 2023

Gross Profit

$

40,013

$

36,875

Inventory Step-Up

154

-

Restructuring Charges

-

2,096

Product Retrofit Costs

-

852

Non-GAAP Gross Profit

$

40,167

$

39,823

Operating Expense

$

36,342

$

31,993

MTEX-related Acquisition Expenses

(950

)

-

CFO Transition Costs

(432

)

-

Restructuring Charges

-

(555

)

Non-GAAP Operating Expense

$

34,960

$

31,438

Operating Income

$

3,671

$

4,882

MTEX-related Acquisition Expenses

950

-

CFO Transition Costs

432

-

Inventory Step-Up

154

-

Restructuring Charges

-

2,651

Product Retrofit Costs

-

852

Non-GAAP Operating Income

$

5,207

$

8,385

Net Income

$

1,110

$

1,983

MTEX-related Acquisition Expenses, net

716

-

CFO Transition Costs, net

328

-

Inventory Step-Up, net

111

-

Restructuring Charges, net

-

2,048

Product Retrofit Costs, net

-

658

Non-GAAP Net Income

$

2,265

$

4,689

Diluted Earnings Per Share

$

0.15

$

0.27

MTEX-related Acquisition Expenses

0.09

-

CFO Transition Costs

0.05

-

Inventory Step-Up

0.01

-

Restructuring Charges

-

0.28

Product Retrofit Costs

-

0.09

Non-GAAP Diluted Earnings Per Share

$

0.30

$

0.63

ASTRONOVA, INC.

Reconciliation of Net Income

to Adjusted EBITDA

Amounts In Thousands

(Unaudited)

Three

Months Ended

November 2, 2024

October 28, 2023

Net Income

$

240

$

2,752

Interest Expense

944

630

Income Tax Expense

34

949

Depreciation & Amortization

1,298

1,014

EBITDA

$

2,516

$

5,345

Share-Based Compensation

353

311

MTEX-related Acquisition Expenses

325

-

Inventory Step-Up

34

-

Adjusted EBITDA

$

3,228

$

5,656

Nine Months

Ended

November 2, 2024

October 28, 2023

Net Income

$

1,110

$

1,983

Interest Expense

2,363

1,919

Income Tax Expense (Benefit)

(139

)

738

Depreciation & Amortization

3,514

3,158

EBITDA

$

6,848

$

7,798

Share-Based Compensation

1,159

1,065

MTEX-related Acquisition Expenses

950

-

CFO Transition Costs

432

-

Inventory Step-Up

154

-

Restructuring Charges

-

2,651

Product Retrofit Costs

-

852

Adjusted EBITDA

$

9,543

$

12,366

ASTRONOVA, INC.

Reconciliation of Segment

Operating Income to Non-GAAP Operating Income

Amounts In Thousands

(Unaudited)

Three Months Ended

November 2, 2024

October 28, 2023

Product Identification

Test & Measurement

Total

Product Identification

Test & Measurement

Total

Segment Operating Profit

$

1,868

$

3,251

$

5,119

$

4,794

$

2,558

$

7,352

Inventory Step-Up

34

-

34

-

-

-

Non-GAAP - Segment Operating Profit

$

1,902

$

3,251

$

5,153

$

4,794

$

2,558

$

7,352

Nine Months Ended

November 2, 2024

October 28, 2023

Product Identification

Test & Measurement

Total

Product Identification

Test & Measurement

Total

Segment Operating Profit

$

7,208

$

8,806

$

16,014

$

6,848

$

6,548

$

13,396

Inventory Step-Up

154

-

154

-

-

-

Restructuring Charges

-

-

-

2,568

-

2,568

Product Retrofit Costs

-

-

-

852

-

852

Non-GAAP - Segment Operating Profit

$

7,362

$

8,806

$

16,168

$

10,268

$

6,548

$

16,816

Note: Segment Operating Profit excludes General &

Administrative Expenses

ASTRONOVA, INC.

Reconciliation of GAAP to

Non-GAAP Items for PI Segment

Amounts In Thousands

(Unaudited)

Three Months Ended November 2,

2024

Three Months Ended October 28,

2023

Total PI Segment as Reported

MTEX as Reported

Inventory Step-Up

Adj MTEX (Non- GAAP)

PI Excluding MTEX (Non-GAAP)

Total PI Segment as Reported

Restructuring Charges

Product Retrofit Costs

PI (Non- GAAP)

Net Revenue

$

26,317

$

1,738

$

1,738

$

24,579

$

26,543

$

26,543

Cost of Revenue

17,910

1,504

(34

)

1,470

16,440

16,024

16,024

Gross Profit

8,407

234

34

268

8,139

10,519

-

-

10,519

Selling & Marketing

5,644

839

839

4,805

4,711

4,711

Research & Development

895

209

209

686

1,014

1,014

Operating Expenses

6,539

1,048

-

1,048

5,491

5,725

-

-

5,725

Segment Operating Profit

(Loss)

$

1,868

$

(814

)

$

34

$

(780

)

$

2,648

$

4,794

$

-

$

-

$

4,794

Nine Months Ended November 2,

2024

Nine Months Ended October 28,

2023

Total PI Segment as Reported

MTEX as Reported

Inventory Step-Up

Adj MTEX (Non- GAAP)

PI Excluding MTEX (Non-GAAP)

Total PI Segment as Reported

Restructuring Charges

Product Retrofit Costs

PI (Non- GAAP)

Net Revenue

$

76,667

$

2,506

$

2,506

$

74,161

$

77,416

$

77,416

Cost of Revenue

51,313

2,340

(154

)

2,186

49,127

51,851

(2,096

)

(852

)

48,903

Gross Profit

25,354

166

154

320

25,034

25,565

2,096

852

28,513

Selling & Marketing

15,946

1,755

1,755

14,191

15,480

(443

)

15,037

Research & Development

2,200

111

111

2,089

3,237

(29

)

3,208

Operating Expenses

18,146

1,866

-

1,866

16,280

18,717

(472

)

-

18,245

Segment Operating Profit

(Loss)

$

7,208

$

(1,700

)

$

154

$

(1,546

)

$

8,754

$

6,848

$

2,568

$

852

$

10,268

Note: Segment Operating Profit

excludes General & Administrative Expenses. MTEX General &

Administrative Expenses of $273,000 for the three months ended

November 2, 2024 and $783,000 for the nine months ended November 2,

2024 results in an MTEX Operating Loss of $(1,087,000) for the

three months ended November 2, 2024 and $(2,483,000) for the nine

months ended November 2, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211854230/en/

Scott Solomon Senior Vice President Sharon Merrill Advisors

(857) 383-2409 ALOT@investorrelations.com

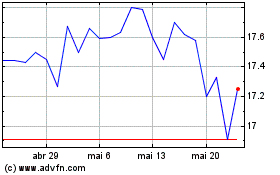

AstroNova (NASDAQ:ALOT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

AstroNova (NASDAQ:ALOT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025