Emera Announces Commencement of Exchange Offer

13 Dezembro 2024 - 11:38AM

Business Wire

Emera Incorporated (“Emera”) today announced the commencement of

an exchange offer (the “Exchange Offer”) for USD $500 million

aggregate principal amount of outstanding 7.625% Fixed-to-Fixed

Reset Rate Junior Subordinated Notes due 2054 (the “Old Notes”) by

its wholly owned indirect subsidiary, EUSHI Finance, Inc. (the

“Issuer”).

On June 18, 2024, the Issuer completed the issuance of the Old

Notes to “qualified institutional buyers” under Rule 144A of the

United States Securities Act of 1933, as amended (the “Securities

Act”), to non-U.S. persons under Regulation S of the Securities Act

and on a private placement basis in Canada. The Old Notes are

guaranteed by Emera and Emera US Holdings Inc., a wholly owned

direct and indirect subsidiary of Emera.

The Old U.S. Notes are as follows:

- USD $500 million 7.625% Fixed-to-Fixed Reset Rate Junior

Subordinated Notes due 2054

In connection with the initial issuance of the Old Notes, the

Issuer entered into a registration rights agreement with the

initial purchasers of the Old Notes in which it undertook to offer

to exchange the Old Notes for new notes registered under the

Securities Act (the “New Notes”).

Pursuant to an effective registration statement on Form

F-10/Form S-4 filed with the United States Securities and Exchange

Commission (the “SEC”), holders of the Old Notes will be able to

exchange the Old Notes for New Notes in an equal principal amount.

The terms of the New Notes to be issued in the Exchange Offer are

identical in all material respects to the terms of the Old Notes

except that the New Notes have been registered under the Securities

Act and will not bear any legend restricting transfer. The

registration rights and additional interest provisions relating to

the Old Notes do not apply to the New Notes.

On December 13, 2024, the Issuer commenced the Exchange Offer

pursuant to a registration statement that has been declared

effective by the SEC. Expiration of the Exchange Offer is expected

to occur at 11:59 p.m., New York City time on January 13, 2025

(unless otherwise terminated or extended), with settlement of the

Exchange Offer occurring shortly thereafter.

The terms of the Exchange Offer are set forth in a prospectus

dated December 13, 2024. Tenders of Old Notes must be made before

the Exchange Offer expires and may be withdrawn any time prior to

expiration of the Exchange Offer. Documents related to the Exchange

Offer, including the prospectus and the associated letter of

transmittal, have been filed with the SEC and may be obtained from

the exchange agent, D.F. King & Co., Inc., 48 Wall Street -

22nd Floor, New York, New York 10005, attention: Kristian Klein;

banks and brokers call collect: (212) 269-5550, all others call

toll-free (877) 732-3617, email: EMA@dfking.com.

This announcement is neither an offer to buy nor a solicitation

of an offer to sell any of the Issuer or Emera’s securities. The

Exchange Offer is being made only pursuant to the Exchange Offer

documents which have been filed with the SEC including the

prospectus and letter of transmittal that are being distributed to

holders of the Old Notes.

Forward Looking Information

This news release contains forward-looking information within

the meaning of applicable securities laws, including without

limitation, the expected timing of the expiration and settlement of

the Exchange Offer. By its nature, forward-looking information

requires Emera to make assumptions and is subject to inherent risks

and uncertainties. These statements reflect Emera management’s

current beliefs and are based on information currently available to

Emera management. There is a risk that predictions, forecasts,

conclusions and projections that constitute forward-looking

information will not prove to be accurate, that Emera’s assumptions

may not be correct and that actual results may differ materially

from such forward-looking information. Additional detailed

information about these assumptions, risks and uncertainties is

included in Emera’s securities regulatory filings, including under

the heading “Enterprise Risk and Risk Management” in Emera’s annual

Management’s Discussion and Analysis, and under the heading

“Principal Financial Risks and Uncertainties” in the notes to

Emera’s annual and interim financial statements, which can be found

on SEDAR+ at www.sedarplus.ca.

About Emera

Emera (TSX: EMA) is a leading North American provider of energy

services headquartered in Halifax, Nova Scotia, with investments in

regulated electric and natural gas utilities, and related

businesses and assets. The Emera family of companies delivers safe,

reliable energy to approximately 2.5 million customers in Canada,

the United States and the Caribbean. Our team of 7,300 employees is

committed to our purpose of energizing modern life and delivering a

cleaner energy future for all. Emera’s common and preferred shares

are listed and trade on the Toronto Stock Exchange. Additional

information can be accessed at www.emera.com or

www.sedarplus.ca.

Source: Emera Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241213123583/en/

Emera Inc. Investor Relations Dave Bezanson VP,

Investor Relations & Pensions 902-474-2126

dave.bezanson@emera.com

Media Dina Bartolacci Seely 902-222-2683

media@emera.com

Emera (TSX:EMA.PR.C)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

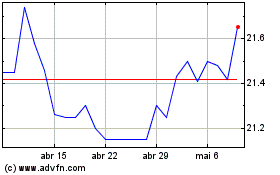

Emera (TSX:EMA.PR.C)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024