Ranpak Holdings Corp. Announces Completion of Refinancing Transaction

19 Dezembro 2024 - 6:30PM

Business Wire

Ranpak Holdings Corp. (NYSE: PACK) (“Ranpak” or “the Company”),

a leading provider of environmentally sustainable, systems-based,

product protection and end-of-line automation solutions for

e-Commerce and industrial supply chains, today reported that it has

completed the previously announced refinancing of the existing

senior secured credit facilities of Ranger Pledgor LLC,

(“Holdings”), Ranpak Corp., (the “U.S. Borrower”) and Ranpak B.V.

(the “Dutch Borrower” and together with the U.S. Borrower, the

“Borrowers”). In connection with the closing, the Borrowers entered

into a new First Lien Credit Agreement (the “Credit Agreement”) by

and among Holdings, the Borrowers, the lending institutions party

thereto and UBS AG, Stamford Branch, as Administrative Agent. UBS

Securities LLC, Goldman Sachs Bank USA, Morgan Stanley Senior

Funding, Inc. and Wells Fargo Securities, LLC acted as joint lead

arrangers and joint bookrunners for the New Credit Facilities

described below.

The Credit Agreement provides for a $410 million U.S.

dollar-denominated first lien term facility maturing in December

2031 (the “Term Facility”) and a $50 million revolving facility

available in U.S. dollars and Euros maturing in December 2029 (the

“Revolving Facility”, and together with the Term Facility, the “New

Credit Facilities”). The amortization rate for the Term Facility is

1.00% per annum. The Term Facility accrues interest, at the

Borrowers’ option, at either (i) the secured overnight financing

rate (“SOFR”) plus 4.50% or (ii) the base rate plus 3.50%, in

either case subject to a step-down to 4.25% for SOFR borrowings and

3.25% for base rate borrowings, respectively, based on the first

lien net leverage ratio level. The Revolving Facility accrues

interest, at the Borrower’s option, at either (i) SOFR or the

applicable eurocurrency rate plus 4.00% or (ii) the base rate plus

3.00%, in either case subject to step-downs to 3.25% for SOFR or

eurocurrency borrowings and 2.25% for base rate borrowings,

respectively, based on first lien net leverage ratio levels. As of

December 19, 2024, no amounts under the Revolving Facility have

been drawn.

Proceeds of the New Credit Facilities were used in part to

consummate the refinancing of the existing credit facilities and

pay all fees, premiums, expenses and other transaction costs

incurred in connection therewith at the closing of the New Credit

Facilities.

About Ranpak: Founded in 1972, Ranpak's goal was to

create the first environmentally responsible system to protect

products during shipment. The development and improvement of

materials, systems and total solution concepts have earned Ranpak a

reputation as an innovative leader in e-commerce and industrial

supply chain solutions. Ranpak is headquartered in Concord

Township, Ohio and has approximately 850 employees. Additional

information about Ranpak can be found on its website:

https://www.ranpak.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219233321/en/

Contact for Investors: ir@ranpak.com

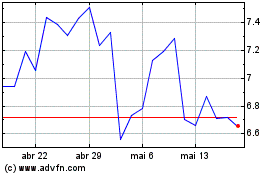

Ranpak (NYSE:PACK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

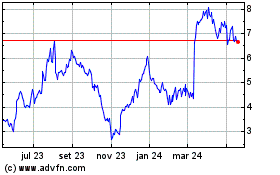

Ranpak (NYSE:PACK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025