Key highlights:

- Softchoice Corporation, a Canadian software and cloud-focused

IT solutions provider, and World Wide Technology Holding Co., LLC,

a global technology solutions provider, combine via an all-cash

transaction

- Consideration of C$24.50 per share in cash, valuing Softchoice

at an enterprise value (“EV”) of approximately C$1.8 billion1

- Results in a total shareholder return of approximately 62%2 on

the Company’s initial public offering share price

- Provides immediate liquidity and certainty of value to the

Company’s shareholders and is not subject to any financing

condition

- Culmination of robust review process, with the oversight and

participation of a committee of independent directors and highly

qualified legal and financial advisors

- Shareholders representing 51.3% of Softchoice’s outstanding

shares have entered into voting support agreements in favour of the

Transaction

- Acquisition will add new capabilities to WWT’s software, cloud,

cybersecurity, and AI offerings to provide a comprehensive

solutions portfolio across the full spectrum of the digital

transformation journey

- Strengthens access to Commercial, Small and Medium business

customers while expanding WWT’s position in the U.S., Canada, and

around the world

- Highly complementary cultures of innovation and inclusion to

create impact for clients, colleagues and communities

Softchoice Corporation (“Softchoice” or the “Company”)

(TSX:SFTC) and World Wide Technology Holding Co., LLC (“World Wide

Technology” or “WWT”), a global technology solutions and services

provider, are pleased to announce that they have entered into an

arrangement agreement (the “Arrangement Agreement”) for Softchoice

to be acquired by WWT, via an all-cash transaction (the

“Transaction”), which values Softchoice at an enterprise value of

approximately C$1.8 billion. Shareholders, including each of the

directors and senior officers of Softchoice, which collectively

represent approximately 51.3% of Softchoice’s issued and

outstanding common shares, have entered into voting support

agreements pursuant to which such shareholders have agreed, among

other things, to support and to vote all shares held by them in

favour of the Transaction.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241231210718/en/

Andrew Caprara, Softchoice President and Chief Executive Officer

commented on the announcement: “We are excited to join WWT. Its

scale and global reach, customer base of large organizations, and

industry leading infrastructure solutions are a perfect complement

to our software and cloud focused solutions, our Canadian presence,

and our strength in the North American mid-market. We also share

similar Great Place to Work® certified organizational cultures,

demonstrating an aligned passion for our people. I believe WWT is

the ideal partner for our customers and employees and I’m excited

about our future as a combined firm.”

Jim Kavanaugh, WWT Co-Founder and Chief Executive Officer noted:

“As the AI revolution reshapes industries and transforms businesses

worldwide, we are at the forefront of this change – leading by

empowering enterprises of all sizes to achieve better business

outcomes. Softchoice has been a transformative player in the IT

industry for over 35 years, and adding its complementary software,

cloud, cybersecurity and AI capabilities to WWT’s portfolio will

enable us to create even greater value for our clients striving to

achieve their digital transformation goals.”

David Steward, WWT Founder and Chairman added: “This acquisition

strengthens our access to Commercial, Small and Medium business

customers while expanding WWT’s position in the U.S., Canada, and

around the world. Given our shared mission and Great Place to Work®

designations, we will continue our commitment to building a culture

of innovation and inclusion to be a great place to work for

all.”

Transaction Highlights

Under the terms of the Arrangement Agreement, WWT, through an

affiliate, will acquire all the issued and outstanding common

shares of Softchoice for a price of C$24.50 per share, in cash,

valuing the Company at an EV of approximately C$1.8 billion. This

price represents premiums of approximately 14%, 32% and 19%, to the

closing price of the shares on the Toronto Stock Exchange (the

“TSX”) on December 30, 2024, the closing price of the shares on the

TSX on September 23, 2024, the day prior to commencement of the

review process, and the 90-day volume weighted average price3,

respectively. The purchase price is also above the 52-week high

closing price of the common shares as of December 30, 2024, and

represents a total shareholder return of approximately 62% to the

Company’s initial public offering price of C$20.00, as adjusted for

Softchoice’s historical dividend payments. Based on the Company’s

reported financial results for the trailing twelve months to

September 30, 2024, the Consideration values the Company at an EV

to Adjusted EBITDA multiple of ~13.2x.4

Transaction Details

The Company entered into the Arrangement Agreement based on the

unanimous approval of the Company’s board of directors (the

“Board”), following receipt of the unanimous recommendation of a

committee of independent directors (the “Special Committee”), and

having determined that the Transaction is in the best interests of

the Company and is fair to the shareholders of the Company. The

Arrangement Agreement was the result of a comprehensive

solicitation and negotiation process that was undertaken at arm’s

length with the oversight and participation of the Special

Committee advised by highly qualified legal and financial advisors.

See “Unanimous Board Approval” below.

The Transaction will be implemented by way of a statutory plan

of arrangement under the Canada Business Corporations Act.

Implementation of the Transaction will be subject to, among other

things, the approval at the special meeting of shareholders (the

“Shareholders’ Meeting”) of (i) at least 66 2/3% of the votes cast

by shareholders and (ii) a simple majority of the votes cast by

shareholders (excluding common shares held by certain senior

officers of the Company, whose shares are required to be excluded

pursuant to Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions). The Company intends to

hold the Shareholders’ Meeting in March 2025, where the Transaction

will be considered and voted upon by shareholders of record. The

Transaction is also subject to court approval and customary closing

conditions, including receipt of key regulatory approvals, is not

subject to any financing condition and, assuming the timely receipt

of all required key regulatory approvals, is expected to close in

late Q1 or early Q2 2025.

A termination fee of C$49 million would be payable by Softchoice

in certain circumstances, including in the context of Softchoice

entering into a definitive agreement with respect to a superior

proposal.

Birch Hill Equity Partners (“Birch Hill”) and each of the

directors and senior officers of the Company, representing

approximately 51.3% of the outstanding shares of Softchoice, have

entered into voting support agreements under which they have

agreed, among other things, to support and to vote all shares held

by them in favour of the Transaction. The voting support agreements

terminate automatically upon termination of the Arrangement

Agreement.

Following completion of the Transaction, it is expected that the

outstanding shares will be delisted from the TSX and that

Softchoice will cease to be a reporting issuer in all applicable

Canadian jurisdictions.

Unanimous Board Approval

In making its determination to unanimously recommend approval of

the Transaction to the Board, the Special Committee, and in the

Board’s determination to approve the Transaction, the Board,

considered, among other things, the following reasons for the

Transaction:

- All-cash consideration providing certainty of value and

liquidity – the all-cash consideration is not subject to any

financing condition and provides Softchoice's shareholders with

certain and immediate value and liquidity;

- Compelling value – the implied valuation multiple on the

Transaction of 13.2x, compares favourably to transactions in the

software and technology sector, as well as the current trading

value of Softchoice’s Canadian and other globally publicly listed

peers and their corresponding implied multiples based on prevailing

equity research analyst consensus estimates for both the Company

and its peers;

- Fairness Opinions – receipt by the Board of fairness opinions

from each of TD Securities Inc. (“TD Securities”) and RBC Dominion

Securities Inc. (“RBC Capital Markets”), and receipt by the Special

Committee of an independent fairness opinion from Origin Merchant

Partners (“Origin”), which each concluded that, based upon and

subject to the assumptions, limitations and qualifications set out

in their respective opinions, that the consideration to be received

by shareholders of Softchoice pursuant to the Transaction is fair,

from a financial point of view, to such shareholders;

- Arrangement Agreement Terms – the Arrangement Agreement is the

result of a comprehensive negotiation process that was undertaken

at arm’s length with the oversight and participation of the Special

Committee advised by highly qualified legal and financial advisors

and resulted in terms and conditions that are reasonable in the

judgment of the Special Committee and the Board, including

customary “fiduciary out” rights that would enable the Company to

enter into a definitive agreement with respect to an unsolicited

proposal that constitutes a superior proposal (as defined in the

Arrangement Agreement) in certain circumstances;

- Robust Review Process – following the receipt of unsolicited

inquiries from third parties, the Company was marketed widely to

potential strategic and financial counterparties in connection with

a review process conducted by the Board and the Special Committee,

which did not surface any proposal superior to the

Transaction;

- Ability to Respond to Superior Proposal – subject to compliance

with the Arrangement Agreement, the Board, in certain circumstances

until shareholder approval is obtained, is able to consider, accept

and enter into a definitive agreement with respect to an

unsolicited proposal that constitutes a superior proposal. The

voting support agreements automatically terminate upon, among other

circumstances, the Company entering into a definitive agreement

with respect to a superior proposal. The termination fee payable by

the Company of C$49 million is reasonable in the circumstances and

only payable in customary and limited circumstances; and

- Support for the Transaction – Birch Hill, the Company’s largest

shareholder, as well as each director and senior officer of the

Company have entered into voting support agreements pursuant to

which such shareholders have agreed, among other things, to support

and to vote all shares held by them in favour of the Transaction.

Collectively, such shareholders represent approximately 51.3% of

the outstanding common shares of Softchoice.

Fairness Opinions

TD Securities and RBC Capital Markets and Origin orally

delivered fairness opinions to the Board and the Special Committee,

respectively, to the effect that, as of December 30, 2024, subject

to the assumptions, limitations and qualifications communicated to

the Company, and to be contained in the TD Securities, RBC Capital

Markets and Origin written fairness opinions (the “Fairness

Opinions”), the consideration to be received by shareholders

pursuant to the Arrangement Agreement is fair, from a financial

point of view, to such shareholders.

Copies of the Fairness Opinions, as well as additional details

regarding the terms and conditions of the Transaction and the

rationale for the recommendation made by the Board of Directors

will be set out in the management proxy circular to be mailed to

shareholders in connection with the Shareholders’ Meeting and filed

by the Company on its profile on SEDAR+ at www.sedarplus.ca.

Important Additional Information and Where to Find It

In connection with the Transaction, Softchoice intends to file

relevant materials on its profile on SEDAR+. Shareholders will be

able to obtain these documents, as well as other filings containing

information about Softchoice, the Transaction and related matters,

without charge from the SEDAR+ website at www.sedarplus.ca.

Advisors

TD Securities is acting as lead financial advisor to the

Company, and RBC is acting as co-lead financial advisor to the

Company. Origin is acting as an independent financial advisor to

the Board of Directors. Stikeman Elliott LLP is acting as legal

advisor to the Company.

BDT & MSD and BofA Securities are acting as financial

advisors to WWT, while Blake, Cassels & Graydon LLP and Bryan

Cave Leighton Paisner LLP are acting as legal advisors to WWT.

About Softchoice Corporation

Softchoice Corporation (TSX:SFTC) is a Software and

Cloud-Focused IT solutions provider that equips organizations to be

agile, innovative, and secure, and people to be engaged, connected

and creative at work. We do this by delivering secure, AI-powered

cloud and digital workplace solutions supported by our advanced

software asset management methodology and capabilities. Through our

customer success framework, we create value for our customers by

reducing their IT spending, optimizing their technology, and

supporting business-driven innovation. We are a highly engaged,

high-performing team that is welcoming, inclusive, and diverse in

thought and experience, and are certified as a Great Place to Work®

in Canada and the United States. For more information, visit:

Website: www.softchoice.com

About World Wide Technology Holding Co., LLC

Founded in 1990, World Wide Technology Holding Co., LLC, a

global technology solutions provider leading the AI and Digital

Revolution, with $20 billion in annual revenue, combines the power

of strategy, execution and partnership to accelerate digital

transformational outcomes for large public and private

organizations around the world. Through its Advanced Technology

Center, a collaborative ecosystem of the world’s most advanced

hardware and software solutions, WWT helps customers and partners

conceptualize, test and validate innovative technology solutions

for the best business outcomes and then deploys them at scale

through its global warehousing, distribution and integration

capabilities.

With nearly 10,000 employees and more than 55 locations around

the world, WWT’s culture, built on a set of core values and

established leadership philosophies, has been recognized 13 years

in a row by Fortune and Great Place to Work® for its unique blend

of determination, innovation and leadership focus on diversity and

inclusion. With this culture at its foundation, WWT bridges the gap

between business and technology to make a new world happen for its

customers, partners and communities. For more information,

visit:

Website: www.wwt.com

Forward-Looking Information

This press release contains “forward-looking information” and

“forward-looking statements” (collectively, “Forward-looking

information”) within the meaning of applicable securities laws.

This forward-looking information is identified by the use of terms

and phrases such as “may”, “would”, “should”, “could”, “expect”,

“intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe”,

or “continue”, the negative of these terms and similar terminology,

including references to assumptions, although not all

forward-looking information contains these terms and phrases.

Particularly, statements regarding the proposed Transaction,

including the reasons of the Board for entering into the

Arrangement Agreement, the terms and conditions of the Arrangement

Agreement, the attractiveness of the Transaction from a financial

point of view, the expected benefits of the Transaction, the

anticipated timing and the various steps to be completed in

connection with the Transaction, including (among other things) the

holding of the Shareholders’ Meeting (including the timing thereof)

as well as the satisfaction or waiver of the conditions to

completing the Transaction (such as receipt of required shareholder

approvals, court approvals and regulatory approvals), the

anticipated closing of the Transaction (including the timing

thereof), the anticipated delisting of the Company’s common shares

from the TSX and the Company ceasing to be a reporting issuer is

forward-looking information.

In addition, any statements that refer to expectations,

intentions, projections or other characterizations of future events

or circumstances contain forward-looking information. Statements

containing forward-looking information are not historical facts but

instead represent management’s expectations, estimates and

projections regarding future events or circumstances.

Forward-looking information is based on management’s beliefs and

assumptions and on information currently available to management,

and although the forward-looking information contained herein is

based upon what we believe are reasonable assumptions, investors

are cautioned against placing undue reliance on this information

since actual results may vary from the forward-looking

information.

Forward-looking information involves known and unknown risks and

uncertainties, many of which are beyond our control, that could

cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

risks and uncertainties include, but are not limited to, the risk

factors described in greater detail under “Risk Factors” of the

Company’s annual information form filed on SEDAR+. These risks and

uncertainties further include (but are not limited to) as concerns

the Transaction, the failure of the parties to obtain the necessary

shareholder, regulatory and court approvals or to otherwise satisfy

the conditions to the completion of the Transaction, failure of the

parties to obtain such approvals or satisfy such conditions in a

timely manner, significant Transaction costs or unknown

liabilities, failure to realize the expected benefits of the

Transaction, and general economic conditions. Failure to obtain the

necessary shareholder, regulatory and court approvals, or the

failure of the parties to otherwise satisfy the conditions to the

completion of the Transaction or to complete the Transaction, may

result in the Transaction not being completed on the proposed

terms, or at all. In addition, if the Transaction is not completed,

and the Company continues as a publicly-traded entity, there are

risks that the announcement of the proposed Transaction and the

dedication of substantial resources of the Company to the

completion of the Transaction could have an impact on its business

and strategic relationships (including with future and prospective

employees, customers, suppliers and partners), operating results

and activities in general, and could have a material adverse effect

on its current and future operations, financial condition and

prospects. Furthermore, in certain circumstances, the Company may

be required to pay a termination fee pursuant to the terms of the

Arrangement Agreement which could have a material adverse effect on

its financial position and results of operations and its ability to

fund growth prospects and current operations.

Consequently, all of the forward-looking information contained

herein is qualified by the foregoing cautionary statements, and

there can be no guarantee that the results or developments that we

anticipate will be realized or, even if substantially realized,

that they will have the expected consequences or effects on our

business, financial condition or results of operation. Unless

otherwise noted or the context otherwise indicates, the

forward-looking information contained herein represents our

expectations as of the date hereof or as of the date it is

otherwise stated to be made, as applicable, and is subject to

change after such date. However, we disclaim any intention or

obligation or undertaking to update or amend such forward-looking

information whether as a result of new information, future events

or otherwise, except as may be required by applicable law.

_____________________________________________

1 Based on September 30, 2024 net debt outstanding and using

Bank of Canada USD to CAD exchange rate as of December 30, 2024. 2

Calculated as consideration price per share plus all dividends paid

since IPO plus C$0.13 per share dividend declared on November 7,

2024, assuming reinvestment of dividends into the Company. 3 Based

on weighted average trading price on the TSX for the 90 trading

days prior to announcement. 4 “Adjusted EBITDA” is not a recognized

measure under International Financial Reporting Standards (“IFRS”),

as issued by the International Accounting Standards Board, and does

not have a standardized meaning prescribed by IFRS. For more

information on non-IFRS measures and a reconciliation to the most

comparable IFRS measures, see the Company’s management’s discussion

and analysis of financial condition and results of operations for

the three and nine months ended September 30, 2024 and September

30, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241231210718/en/

Softchoice Corporation Public Relations Cheryl

Salman Director, Communications and Brand

cheryl.salman@softchoice.com

Investor Relations Tim Foran Investor Relations

investors@softchoice.com

World Wide Technology Holding Co., LLC Public

Relations Rebecca Morrison Manager, Corporate Communications

rebecca.morrison@wwt.com

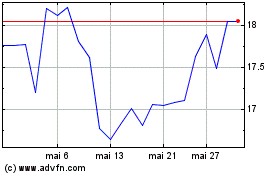

Softchoice (TSX:SFTC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Softchoice (TSX:SFTC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025