BlackRock’s LifePath Paycheck™ Closes 2024 with $16B in AUM

13 Janeiro 2025 - 4:21PM

Business Wire

Retirement solution is now the fastest-growing

lifetime income target-date strategy in the defined contribution

market1

BlackRock’s LifePath Paycheck™, a target-date solution which

provides the option for guaranteed lifetime income, is the fastest

growing lifetime income target-date strategy in the defined

contribution market.1 LifePath Paycheck launched in April 2024, and

six employer retirement plans – including those of Avangrid,

Adventist HealthCare Retirement Plans, Tennessee Valley Retirement

System (TVARS) and most recently, BlackRock - are currently

invested, totaling $16B in assets under management.

The LifePath Paycheck solution provides plan participants with

the option for a guaranteed stream of income for life, payable by

insurers, and is now available as an investment selection for more

than 200,000 eligible U.S. workers across the six plans. Fidelity

Investments and Bank of America have enabled access to the solution

on their recordkeeper platforms, and other recordkeepers, including

Voya Financial, are also planning to support their clients’

implementation of the LifePath Paycheck solution.

As more Americans live longer, nearly two-thirds (60%) of

workers saving for retirement worry they’ll outlive their

retirement savings, according to BlackRock’s annual Read on

Retirement® survey – and 99% of those workers say having guaranteed

retirement income would help. LifePath Paycheck provides plan

participants with the option to access guaranteed income as early

as age 59 ½ by purchasing annuity contracts issued by Equitable and

Brighthouse Financial.

“As a pioneer in retirement innovation, BlackRock is creating

new solutions for current and future generations of employees, many

of whom are expected to live into the next century. LifePath

Paycheck addresses the need for strategies that provide access to

predictable, guaranteed income throughout retirement,” said Mark

McCombe, Vice Chairman, BlackRock.

BlackRock’s survey found that nearly all (99%) of employers

surveyed are interested in providing lifetime income strategies in

their retirement plans. However, employers have been slow to

implement solutions, facing barriers to adoption including

complexity, cost, and ease of access for employees. BlackRock has

sought to address these challenges by embedding the option for

lifetime income in a target date solution, with no additional fees

associated with the purchase of the annuity contracts.

“We want to take care of our team members at every stage of

their career, including retirement. Implementing LifePath Paycheck

helped us easily integrate retirement planning into our existing

benefit offerings,” said Rob Roy, Member of the

Investment Committee for Adventist HealthCare Retirement

Plans.

“The retirement savings and spending challenges of today’s

workers will be different from those of previous decades. Forward

thinking employers know that retirement income is a game changer in

the war for talent,” said Rob Crothers, Head of U.S. Retirement,

BlackRock. “We are proud to serve as a trusted partner to our

clients in providing affordable, simple solutions that help their

employees prepare for all stages of their financial life.”

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to our asset management

clients and a leading provider of financial technology, we help

millions of people build savings that serve them throughout their

lives by making investing easier and more affordable. For

additional information on BlackRock, please visit

www.blackrock.com/corporate | Twitter: @blackrock | LinkedIn:

www.linkedin.com/company/blackrock

Disclosures

Statement from Adventist HealthCare Retirement Plans is based on

unique experience from current client and may not be representative

of all client experiences. No cash or non-cash compensation was

provided in exchange for this statement.

This material is intended for information purposes only, and

does not constitute investment advice, a recommendation or an offer

or solicitation to purchase or sell any securities, funds or

strategies to any person in any jurisdiction in which an offer,

solicitation, purchase or sale would be unlawful under the

securities laws of such jurisdiction. The opinions expressed are

subject to change without notice. Reliance upon information in this

material is at the sole discretion of the reader. Investing

involves risks.

©2025 BlackRock, Inc. or its affiliates. All Rights Reserved.

BLACKROCK and LIFEPATH PAYCHECK are trademarks of BlackRock, Inc.,

or its affiliates. All other trademarks are those of their

respective owners.

_____________________________ 1 Sourced from publicly available

data, media statements and announcements from providers of lifetime

income investment solutions currently available in market through

employer plan sponsor defined contribution plans.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113416444/en/

Media Contacts

Thomasin Bentley thomasin.bentley@blackrock.com +1 (646)

231-1769

Andreia Cheong-A-Shack Andreia.cheongashack@blackrock.com

+1 (646)-634-5568

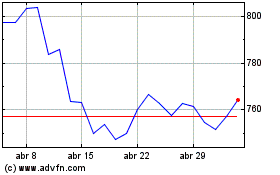

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025