Airgain, Inc. (NASDAQ: AIRG), a leading provider of

wireless connectivity solutions that creates and delivers embedded

components, external antennas, and integrated systems across the

globe, today reported select preliminary unaudited results for its

fourth quarter ended December 31, 2024.

Preliminary Fourth Quarter 2024 Financial Results

Based on preliminary unaudited results, the company expects

sales for the fourth quarter of 2024 to range between $14.6 million

and $15.6 million, or $15.1 million at the midpoint. The company’s

sales in the fourth quarter of 2024 were impacted by

higher-than-expected channel excess inventories and two Internet of

Things (IoT) project delays.

The company expects to report positive adjusted EBITDA (a

non-GAAP metric) for the fourth quarter of 2024, driven by gross

margin improvement and lower operating expenses.

As of December 31, 2024, the company estimates its cash and cash

equivalents at $8.5 million, an increase from $7.3 million in the

previous quarter and $7.9 million at the same time last year.

Complete financial results for the fourth quarter and full year

2024 are expected to be released after the market closes on

Thursday, February 27, 2025. The conference call details will be

issued closer to the event.

The preliminary fourth quarter 2024 financial results and cash

position announced today are based on the company’s current

expectations and may be adjusted as a result of, among other

things, completion of financial closing procedures and an audit for

the 2024 fiscal year.

Management Commentary

“Inventory challenges were more significant than anticipated,

substantially impacting our fourth quarter sales,” said Airgain

President and CEO Jacob Suen. “While we navigate these headwinds,

we continue to execute our strategic initiatives and position

Airgain for sustained long-term growth. We have successfully

completed another carrier certification for our AirgainConnect

Fleet platform. We also established a strategic partnership with

Omantel, a leading telecommunications provider in Oman, to

revolutionize the 5G landscape across the Middle East and North

Africa with our Lighthouse solution. This marks our first

multi-year, multi-million-dollar contract for Lighthouse. Looking

ahead, we are excited about the potential of our product launches,

which are expected to make a meaningful impact in the second half

of 2025.”

About Airgain, Inc.

Airgain is a premier provider of wireless connectivity

solutions, offering a range of embedded components, external

antennas, and integrated systems worldwide. We streamline wireless

connectivity across devices and markets, with a focus on solving

complex connectivity challenges, expediting time to market, and

optimizing wireless signals. Our mission is to connect the world

through optimized, integrated wireless solutions. Our product

portfolio focuses on three key markets: enterprise, consumer, and

automotive. Airgain is headquartered in San Diego, California. For

more information, visit airgain.com or follow Airgain on LinkedIn

and X.

Airgain and the Airgain logo are trademarks or registered

trademarks of Airgain, Inc. All other trademarks are the property

of their respective owner.

Forward-Looking Statements

Airgain cautions you that statements in this press release that

are not a description of historical facts are forward-looking

statements. These statements are based on the company’s current

beliefs and expectations. These forward-looking statements include

statements regarding expected fourth quarter 2024 financial results

and cash position, timing of the announcement of complete financial

results for the fourth quarter and full year 2024, the potential

amount of revenue from the Omantel contract and the expected impact

of product launches. The inclusion of forward-looking statements

should not be regarded as a representation by Airgain that any of

our plans will be achieved. Actual results may differ from those

set forth in this press release due to the risks and uncertainties

inherent in our business, including, without limitation:

adjustments to the preliminary financial results and cash position

in connection with completion of financial closing procedures and

an audit for the 2024 fiscal year, and the timing thereof; the

potential for the strategic partnership with Omantel to not meet

expectations; the market for our products is developing and may not

develop as we expect; our operating results may fluctuate

significantly, including based on seasonal factors, which makes

future operating results difficult to predict and could cause our

operating results to fall below expectations or guidance; supply

constraints on our and our customers’ ability to obtain necessary

components in our respective supply chains may negatively affect

our sales and operating results; risks associated with the

performance of our products, including bundled solutions with

third-party products; our products are subject to intense

competition, and competitive pressures from existing and new

companies may harm our business, sales, growth rates, and market

share; risks associated with quality and timing in manufacturing

our products and our reliance on third-party manufacturers; we may

not be able to maintain strategic collaborations under which our

bundled solutions are offered; overall global supply shortages and

logistics delays within the supply chain that our products are used

in, as well as adversely affecting the general U.S. and global

economic conditions and financial markets, and, ultimately, our

sales and operating results; any rise in interest rates and

inflation may adversely impact our margins, the supply chain and

our customers’ sales, which may negatively affect our sales and

operating results; our future success depends on our ability to

develop and successfully introduce new and enhanced products for

the wireless market that meet the needs of our customers, including

our ability to transition to provide a more diverse solutions

capability; we sell to customers who are price conscious, and a few

customers represent a significant portion of our sales, and if we

lose any of these customers, our sales could decrease

significantly; we rely on a limited number of contract

manufacturers to produce and ship all of our products, and our

contract manufacturers rely on a single or limited number of

suppliers for some components of our products and channel partners

to sell and support our products, and the failure to manage our

relationships with these parties successfully or a failure of these

parties to perform could adversely affect our ability to market and

sell our products; if we cannot protect our intellectual property

rights, our competitive position could be harmed or we could incur

significant expenses to enforce our rights; and other risks

described in our prior press releases and in our filings with the

Securities and Exchange Commission (SEC), including under the

heading “Risk Factors” in our Annual Report on Form 10-K and any

subsequent filings with the SEC. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof, and we undertake no obligation to

revise or update this press release to reflect events or

circumstances after the date hereof. All forward-looking statements

are qualified in their entirety by this cautionary statement, which

is made under the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995.

Note Regarding Use of Non-GAAP Financial Measures

This earnings release contains the non-GAAP financial measure

adjusted earnings before interest, taxes, depreciation,

amortization (Adjusted EBITDA). We believe this financial measure

provides useful information to investors with which to analyze our

operating trends and performance. In computing Adjusted EBITDA, we

exclude stock-based compensation expense, which represents non-cash

charges for the fair value of stock awards, interest income, net of

interest expense offset by other expense, depreciation and

amortization, workforce reduction severance and exit costs, and

provision (benefit) for income taxes. Because of varying available

valuation methodologies, subjective assumptions, and the variety of

equity instruments that can impact a company’s non-cash operating

expenses, we believe that providing non-GAAP financial measures

that exclude non-cash expense allows for meaningful comparisons

between our core business operating results and those of other

companies, as well as providing us with an important tool for

financial and operational decision-making and for evaluating our

own core business operating results over different periods of time.

Management considers these types of expenses and adjustments, to a

great extent, to be unpredictable and dependent on a considerable

number of factors that are outside of our control and are not

necessarily reflective of operational performance during a

period.

Our non-GAAP measures may not provide information that is

directly comparable to that provided by other companies in our

industry, as other companies in our industry may calculate non-GAAP

financial results differently, particularly related to

non-recurring, unusual items. Our Adjusted EBITDA is not a

measurement of financial performance under GAAP and should not be

considered as an alternative to operating or net income or as an

indication of operating performance or any other measure of

performance derived in accordance with GAAP. We do not consider

this non-GAAP measure to be a substitute for, or superior to, the

information provided by GAAP financial results.

We have not included a statement regarding our expected net

income or loss for the fourth quarter of 2024 because it is not

known and we are unable to project certain items related to its

calculation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127379859/en/

Airgain Investor Contact Matt Glover Gateway Group, Inc.

+1 (949) 574 3860 AIRG@gateway-grp.com

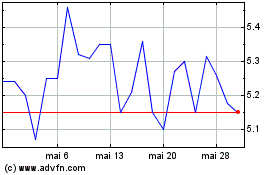

Airgain (NASDAQ:AIRG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Airgain (NASDAQ:AIRG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025