Canada Goose Announces Renewal of Regulatory Relief Regarding Share Repurchase Program

27 Janeiro 2025 - 6:15PM

Business Wire

Canada Goose Holdings Inc. (NYSE, TSX:GOOS) (“Canada Goose” or

the “Company”) today announced that it obtained exemptive relief

from the Ontario Securities Commission (“OSC”) which permits the

Company to purchase up to 10% of the “public float” (within the

meaning of the rules of the Toronto Stock Exchange (the “TSX”)) of

its subordinate voting shares (the “Shares”) through the New York

Stock Exchange and other U.S.-based trading systems (collectively,

the “U.S. Markets”) as part of the Company’s normal course issuer

bid announced on November 19, 2024 (the “Current Bid”). Absent the

exemptive relief, purchases under the Current Bid on the U.S.

Markets would be limited to a maximum of 5% of its outstanding

Shares at the beginning of any 12-month period.

The Current Bid provides for the purchase for cancellation of up

to 4,556,841 Shares over the twelve-month period commencing on

November 22, 2024 and ending no later than November 21, 2025. This

represents approximately 10% of the 45,568,419 Shares comprising

the public float of the Company determined in accordance with TSX

requirements as at November 8, 2024. As at November 8, 2024, there

were 45,800,210 subordinate voting shares issued and outstanding.

Purchases made in reliance on the exemptive relief as part of

normal course issuer bids, including the Current Bid, will be made

at market price in accordance with applicable securities laws and

the terms of the exemptive relief.

The exemptive relief is valid for a period of 36 months from the

date of issuance and applies to the Current Bid and any subsequent

normal course issuer bid in effect until such time, subject to the

terms of the exemptive relief. It is conditional upon, among other

things, purchases being made in compliance with applicable U.S.

rules governing share repurchases and Part 6 (Order Protection) of

National Instrument 23-101 Trading Rules and at a price not higher

than market price at the time of purchase. The aggregate number of

Shares purchased on any exchange or market may not exceed 10% of

the public float, as specified in Canada Goose’s notice accepted by

the TSX in respect of the relevant normal course issuer bid,

including the Current Bid. A similar exemptive relief had

previously been granted to the Company by the OSC on January 25,

2022, for a period of 36 months from its issuance.

A copy of the decision from the OSC has been filed under Canada

Goose’s SEDAR+ profile at www.sedarplus.ca.

About Canada Goose

Canada Goose is a performance luxury outerwear, apparel,

footwear and accessories brand that inspires all people to thrive

in the world outside. We are globally recognized for our commitment

to Canadian manufacturing and our high standards of quality,

craftsmanship and functionality. We believe in the power of

performance, the importance of experience, and that our purpose is

to keep the planet cold and the people on it warm. For more

information, visit www.canadagoose.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements,

including statements relating to normal course issuer bids,

including the Current Bid, and the intended purchase for

cancellation of Shares thereunder. These forward-looking statements

generally can be identified by the use of words such as “believe,”

“could,” “continue,” “expect,” “estimate,” “may,” “potential,”

“would,” “will,” and other words of similar meaning. Each

forward-looking statement contained in this press release is

subject to substantial risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by such statement. Applicable risks and uncertainties include,

among others, the impact on our operations of the current global

economic conditions and their evolution and are discussed under

“Cautionary Note regarding Forward-Looking Statements” and “Factors

Affecting our Performance” in our interim and annual Management's

Discussion and Analysis (“MD&A”) as well as under “Risk

Factors” in our Annual Report on Form 20-F for the year ended March

31, 2024. You are also encouraged to read our filings with the SEC,

available at www.sec.gov, and our filings with Canadian securities

regulatory authorities available on SEDAR+ at www.sedarplus.ca for

a discussion of these and other risks and uncertainties. Investors,

potential investors, and others should give careful consideration

to these risks and uncertainties. We caution investors not to rely

on the forward-looking statements contained in this press release

when making an investment decision in our securities. The

forward-looking statements in this press release speak only as of

the date of this release, and we undertake no obligation to update

or revise any of these statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127425910/en/

Investors: ir@canadagoose.com

Media: media@canadagoose.com

Canada Goose (NYSE:GOOS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

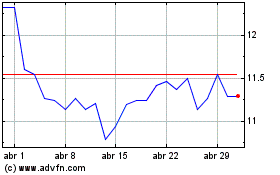

Canada Goose (NYSE:GOOS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025