TPG RE Finance Trust, Inc. Announces Tax Treatment of 2024 Dividends

28 Janeiro 2025 - 6:15PM

Business Wire

TPG RE Finance Trust, Inc. (NYSE: TRTX) (“TRTX” or the

“Company”) today announced the income tax treatment of its 2024

common stock and its 6.25% Series C Cumulative Redeemable Preferred

Stock (the “Series C Preferred”) dividends.

The following table summarizes, for income tax purposes, the

nature of cash dividends paid to the Company’s common stockholders

for the tax year ended December 31, 2024:

Common Stock (CUSIP # 87266M107)

Record

Date

Payment Date

Total Distribution per

Share

Ordinary Income per Share

(1)

Capital Gain per Share

Non-Dividend

Distribution

12/29/2023(2)

1/25/2024

$0.2400

$0.1990

$0.0000

$0.0410

3/28/2024

4/25/2024

0.2400

0.1990

0.0000

0.0410

6/27/2024

7/25/2024

0.2400

0.1990

0.0000

0.0410

9/27/2024

10/25/2024

0.2400

0.1990

0.0000

0.0410

12/27/2024(3)

1/24/2025

0.2400

0.0000

0.0000

0.0000

Totals

$1.2000

$0.7960

$0.0000

$0.1640

The following table summarizes, for income tax purposes, the

nature of cash dividends paid to the holders of the Company’s

Series C Preferred Stock for the tax year ended December 31,

2024:

Series C Preferred Stock (CUSIP#

87266M206)

Record

Date

Payment Date

Total Distribution per

Share

Ordinary Income per Share

(1)

Capital Gain per Share

Non-Dividend

Distribution

3/18/2024

3/28/2024

$0.3906

$0.3906

$0.0000

$0.0000

6/18/2024

6/28/2024

0.3906

0.3906

0.0000

0.0000

9/20/2024

9/30/2024

0.3906

0.3906

0.0000

0.0000

12/20/2024

12/30/2024

0.3906

0.3906

0.0000

0.0000

Totals

$1.5624

$1.5624

$0.0000

$0.0000

1. Ordinary Income dividends are

eligible for the 20% deduction applicable to “qualified REIT

dividends” pursuant to IRC Section 199A.

2. Pursuant to IRC Section

857(b)(9), cash distributions made on January 25, 2024 with a

record date of December 29, 2023 are treated for federal income tax

purposes as received by shareholders on December 31, 2023 to the

extent of the Company’s 2023 earnings and profits. As the Company’s

aggregate 2023 dividends paid in 2023 exceeded its 2023 earnings

and profits, the January 2024 cash distribution declared in the

fourth quarter of 2023 is treated as a 2024 distribution for

federal income tax purposes and is being included on the 2024 Form

1099-DIV.

3. Pursuant to IRC Section

857(b)(9), cash distributions made on January 24, 2025 with a

record date of December 27, 2024 are treated for federal income tax

purposes as received by shareholders on December 31, 2024 to the

extent of the Company’s 2024 earnings and profits. As the Company’s

aggregate 2024 dividends paid in 2024 exceeded its 2024 earnings

and profits, the January 2025 cash distribution declared in the

fourth quarter of 2024 will be treated as a 2025 distribution for

federal income tax purposes and will be included on the 2025 Form

1099-DIV.

Shareholders are encouraged to consult with their personal tax

advisors as to their specific tax treatment of the Company’s

dividends. For additional information, refer to the Investor

Relations section of the Company’s website.

ABOUT TRTX

TPG RE Finance Trust, Inc. is a commercial real estate finance

company that originates, acquires, and manages primarily first

mortgage loans secured by institutional properties located in

primary and select secondary markets in the United States. The

Company is externally managed by TPG RE Finance Trust Management,

L.P., a part of TPG Real Estate, which is the real estate

investment platform of global alternative asset management firm TPG

Inc. (NASDAQ: TPG). For more information regarding TRTX, visit

https://www.tpgrefinance.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128982863/en/

INVESTOR RELATIONS CONTACT +1 (212) 405-8500

IR@tpgrefinance.com MEDIA CONTACT TPG RE Finance Trust, Inc.

Courtney Power +1 (415) 743-1550 media@tpg.com

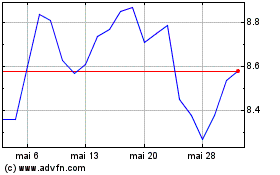

TPG Real Estate Finance (NYSE:TRTX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

TPG Real Estate Finance (NYSE:TRTX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025