Immunome Announces Proposed Public Offering of Common Stock

29 Janeiro 2025 - 6:27PM

Business Wire

Immunome, Inc. (“Immunome”) (Nasdaq: IMNM), a biotechnology

company focused on developing first-in-class and best-in-class

targeted cancer therapies, today announced its plans to commence an

underwritten public offering, subject to market and other

conditions, to issue and sell $125.0 million of shares of its

common stock. All of the shares are being offered by Immunome. In

connection with the proposed offering, Immunome expects to grant

the underwriters a 30-day option to purchase up to an additional

15% of the shares of its common stock sold in the public offering.

There can be no assurance as to whether or when the proposed

offering may be completed or as to the actual size or terms of the

proposed offering.

J.P. Morgan, TD Cowen, Leerink Partners and Guggenheim

Securities are acting as joint book-running managers for the

proposed offering. Wedbush PacGrow is acting as lead manager for

the proposed offering.

The proposed offering is being made pursuant to a shelf

registration statement on Form S-3 that was filed with the U.S.

Securities and Exchange Commission (the “SEC”) on February 13, 2024

and automatically became effective upon filing. A preliminary

prospectus supplement and accompanying prospectus relating to the

proposed offering will be filed with the SEC and will be available

for free on the SEC’s website located at http://www.sec.gov. Copies

of the preliminary prospectus supplement and the accompanying

prospectus relating to the proposed offering may be obtained, when

available, from: J.P. Morgan Securities LLC, Attention: Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

or by telephone at (866) 803-9204, or by email at

prospectus-eq_fi@jpmchase.com; TD Securities (USA) LLC, 1

Vanderbilt Avenue, New York, NY 10017, by telephone at (855)

495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com; Leerink

Partners LLC, Syndicate Department, 53 State Street, 40th Floor,

Boston, MA 02109, or by telephone at (800) 808-7525 ext. 6105, or

by email at syndicate@leerink.com; or Guggenheim Securities, LLC

Attention: Equity Syndicate Department, 330 Madison Avenue, New

York, NY 10017 or by telephone at (212) 518-9544, or by email at

GSEquityProspectusDelivery@guggenheimpartners.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Immunome, Inc.

Immunome is a clinical-stage targeted oncology company committed

to developing first-in-class and best-in-class targeted therapies

designed to improve outcomes for cancer patients. We are advancing

an innovative portfolio of therapeutics, drawing on leadership that

previously played key roles in the design, development, and

commercialization of cutting-edge targeted cancer therapies,

including antibody-drug conjugate therapies (ADCs). Our most

advanced pipeline programs are varegacestat (formerly AL102), a

gamma secretase inhibitor which is currently in a Phase 3 trial for

treatment of desmoid tumors, IM-1021, a ROR1 ADC with an active

IND, and IM-3050, a FAP-targeted radioligand, which is the subject

of an IND expected to be submitted in the first quarter of 2025.

Our pipeline also includes IM-1617, IM-1335, and IM-1340, all of

which are preclinical ADCs pursuing undisclosed targets with

expression in multiple solid tumors.

Forward-Looking Statements

Statements contained in this press release regarding Immunome’s

expectations regarding the offering are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements include

statements regarding, among other things, Immunome’s expectations

regarding the completion, timing and size of the proposed offering

and with respect to granting the underwriters a 30-day option to

purchase additional shares, are based upon Immunome’s current

expectations and involve assumptions that may never materialize or

may prove to be incorrect. Actual results could differ materially

from those anticipated in such forward-looking statements as a

result of various risks and uncertainties, which include, without

limitation, market conditions, size and expected gross proceeds of

the offering, the satisfaction of customary closing conditions

related to the proposed offering, Immunome’s ability to complete

the proposed offering, and the risks and uncertainties inherent in

Immunome’s business. These and other risks and uncertainties are

described in greater detail in the section entitled “Risk Factors”

in Immunome’s most recent annual report on Form 10-K and quarterly

report on Form 10-Q filed with the SEC, as well as discussions of

potential risks, uncertainties, and other important factors in

Immunome’s other filings with the SEC, including those contained or

incorporated by reference in the preliminary prospectus supplement

and accompanying prospectus related to the offering to be filed

with the SEC. All forward-looking statements contained in this

press release speak only as of the date on which they were made and

are based on management’s assumptions and estimates as of such

date. Immunome undertakes no obligation to update such statements

to reflect events that occur or circumstances that exist after the

date on which they were made, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129118169/en/

Investor Contact: Max Rosett Chief Financial Officer

mrosett@immunome.com

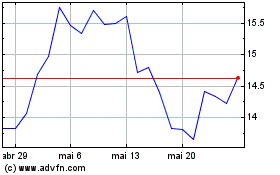

Immunome (NASDAQ:IMNM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Immunome (NASDAQ:IMNM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025