Continued Demand Across the Portfolio as Flux

Diligently Follows Growth and Profitability Roadmap

Restatement of Previously Filed Financial

Statements Complete. No Impact to Cashflow

Management to Host Conference Call in

Conjunction with Q1 & Q2 FY2025 Financial Results Upon Filing

Related Forms 10-Q with the Securities and Exchange Commission

Flux Power Holdings, Inc. (NASDAQ: FLUX), a developer of

advanced lithium-ion energy storage solutions for electrification

of commercial and industrial equipment, has reported its financial

and operational results for the fiscal fourth quarter and year

ended June 30, 2024.

Key Financial and Operational Highlights and Business

Updates

($ millions)

Full Year Comparison

Q4 Comparison

FY 2024

FY 2023

(Restated)

$ Change YoY

% Change YoY

Q4-2024

Q4-2023

(Restated)

$ Change QoQ

% Change QoQ

Revenue

$60.8

$66.5

-$5.7

-8.5%

$13.4

$16.4

-$3.0

-18.4%

Gross Profit

$17.2

$15.9

$1.3

8.5%

$3.6

$3.6

$0.0

0%

Gross Margin

28%

24%

$ -

443BPS

27%

22%

$ -

490BPS

Adjusted EBITDA

-$4.0

-$4.7

$0.7

15.0%

-$1.2

-$1.3

$0.1

-7.6%

- Restatement of Financials, as shown in the table below,

includes cumulative adjustments of:

- $3.4M of non-cash excess and obsolete inventory

- $0.4M of non-cash charges for warranty obligations

- $1.4M of non-cash income statement

reclassifications

- Market environment impacted shipment timing in FY 2024:

- Higher interest rates and geopolitical uncertainties led

some customers to defer orders and shipments to FY 2025 and FY

2026

- Delayed orders may add to future quarterly revenue

growth

- Gross Margins and Adjusted EBITDA

- Continued improvement and progress toward

profitability

Restatement Impacts: Summary of Changes

($000)

First Three Quarters FY

2024

FY 2023

FY 2022

Pre FY 2022

Total

Entries to Increase (decrease) cost of

sales:

Excess and obsolete inventory

$(26)

$1,153

$864

$1,408

$3,399

Warranty expense

$398

$398

Reclassification entries:

Increase to cost of sales

$205

$208

$828

$205

$1,446

Decrease to research and development

$(205)

$(208)

$(828)

$(205)

$(1,446)

Summary:

Total impact to cost of sales

$577

$1,361

$1,692

$1,613

$5,243

Net impact to income from operations

$372

$1,153

$864

$1,408

$3,797

CEO Commentary

“Over the past six months, we focused on strengthening our

internal processes, restating certain previously-filed financials,

and completing the FY 2024 audit,” said Flux Power CEO Ron Dutt.

“In terms of the restatement, over a period of four years, we

identified approximately $5.2 million in cumulative adjustments,

mostly excess and obsolete inventory that primarily related to

product innovation and design changes of our products during a

period of rapid growth. The inventory write-down and other

necessary adjustments did not impact cashflow and the restatement

has not adversely impacted our line of credit with Gibraltar

Capital.

“We have included the corrected financials for 2022 and 2023

fiscal years and related quarters in our 2024 10-K. Our finance

team, led by CFO Kevin Royal, has taken numerous measures to

rectify the previous inventory and other accounting errors to

mitigate the possibility of a recurrence and to ensure we have the

people and systems in place to support our future growth.

“Our overall business and long-term outlook remain strong as we

move into FY 2025. Supporting our outlook, as of December 31, 2024,

our open order backlog was $17.5 million, reflecting lower order

activity in 2024 primarily due to market economics. Although we

experienced lumpiness in fiscal 2024 stemming from delays in

deliveries of new forklifts, we expect that our enhanced sales

strategies, coupled with better market conditions, will position us

for growth and move us closer to profitability in 2025.

“Gross margin initiatives have led to higher margins over each

of the last three years, increasing from 13% in 2022, to 24% in FY

2023, and to 28% in FY 2024. With strategic supply chain and

profitability improvement initiatives, lower costs and higher

volume purchasing, gross margin improvement remains a top

priority.”

Key FY 2024 Takeaways:

- Certain delays of customer orders stretched beyond

current fiscal year ending June 30, 2024

- Delays linked to forklift deferrals as a result of higher

interest rates

- No known lost customers nor lost orders to competition

- Underlying demand appears strong due to continued Lithium

adoption by customers

- Actions supporting targeted sales trajectory

- Launched new Private Label program for another top 10 Forklift

original equipment manufacturer (OEM), as highlighted below

- New product launches of heavy-duty models addressing customer

demand

- Adding salespeople to support customer demand

- Increasing marketing resources and initiatives

- Actions supporting increased gross margins

- Selected company-wide cost reductions, leveraging engineering

and purchasing initiatives

- Selected pricing increases reflecting our “total value add” to

products/customers

- Continued progress to expand technology, innovation, and

partnerships

- Telemetry features for customer asset management including

nationwide installation

- New partnership aimed at enhancing the recycling process for

end-of-life lithium-ion batteries with the largest critical battery

components recycling company in the U.S.

- Pursuit of backup battery cells sourcing and fast charging

technology product applications

- Development of machine learning and AI features for product

support of large fleets

- Automation of modularizing battery cells to launch this

summer

- Key Management Changes:

- As part of our longtime succession plan, our Chairman and Chief

Executive Officer, Ron Dutt, announced his retirement from the

Company. The Company’s Board of Directors is conducting a

comprehensive search to identify the next CEO with the assistance

of a nationally recognized search firm. Mr. Dutt will remain in his

roles until the search for his successor is complete.

- Three executive appointments have been made to accelerate our

strategy of scaling our business and expanding our Fortune 500

customer base, building on our industry reputation and operational

capabilities:

- Kevin Royal appointed CFO, has more than 20 years of successful

experience as a CFO for four publicly traded companies, with

oversight of Finance, Accounting, IT, HR, Legal, Investor

Relations, and M&A.

- Kelly Frey appointed Chief Revenue Officer, bringing over 20

years of notable experience as a sales and marketing leader,

including roles ranging from startups to Fortune 100

companies.

- Mark Barmettler appointed Senior Director Engineering with 20

years successful engineering leadership experience in manufacturing

businesses spanning electrical, software, and mechanical

designs.

- Appointed Mark Leposky, a senior-level executive with deep

operational and rapid growth experience, to our Board of Directors

as an independent director to support the next phase of our

strategy and growth.

- Miscellaneous Developments:

- Announced a strategic partnership with one of the top forklift

OEMs to launch a new private label battery program. This

collaboration marks a significant milestone for Flux Power’s

S-Series line, which now includes products with the coveted UL Type

EE certification, which provides added safety and durability

capability.

- Entered into a new partnership aimed at enhancing the recycling

process for end-of-life lithium-ion batteries with the largest

critical battery components recycling company in the U.S.,

representing a significant step forward in Flux Power’s ongoing

commitment to environmental responsibility.

- Hosted an investor day on August 7, 2024, at our headquarters

and manufacturing facility in Vista, California to showcase new

products and lean manufacturing.

- Presented at the iAccess Alpha Best Ideas Summer Conference on

June 25, 2024.

CEO Commentary Continued:

“Looking ahead, we are highly focused on expanding our sales and

marketing initiatives to secure new customer relationships at a

time when the material handling industry is increasingly seeking

sustainable and efficient energy solutions. We anticipate improving

revenue throughout fiscal year 2025 and beyond due to greater

clarity regarding interest rates and government policies, along

with furthering our product and selling initiatives.

“We are working to expand product lines for multiple customer

segments and adjacent markets with new products and filling gaps in

energy storage offerings. A new integrated onboard charger option

for M24 lithium-ion battery pack plugs into any outlet, anywhere,

for more efficient warehouse operations. We also plan to add heavy

duty models to most of our product lines in the coming months. Our

telemetry, which includes asset management features, is in the

pilot stage for a Fortune 50 company implementation nationwide. To

meet the demanding needs of our customers with cutting-edge

solutions, we continue to innovate our products and capabilities

and expand our reach into new applications.

“We are working with our distribution network to expand new

customer acquisition initiatives. We are also leveraging our

position with growth-oriented projects and developing partnerships

with vendors, technology partners, and opportunities to further

drive growth. Recently, we announced a new partnership aimed at

enhancing the recycling process for end-of-life lithium-ion

batteries with the largest critical battery components recycling

company in the U.S. Through this collaboration, our recycling

partner has commenced the reception and recycling of these cells

and modules, marking a major milestone in our sustainability

efforts.

“Finally, after 12 years as CEO, I have decided to step down in

the coming year. It has been an honor to serve as Flux Power’s

Chairman and CEO, and I will remain in these roles until the search

for a successor is complete. Looking forward, we believe our

innovative product set and focused strategy are leading us toward

near-term profitability and positioning us to be the leading

provider to large Fortune 500 material handling fleets.”

Quarterly Orders and Shipments:

The backlog status is a point in time measure but in total

reflects the underlying pacing of orders:

Fiscal Quarter Ended

Beginning Backlog

New Orders

Shipments

Ending Backlog

Restated

Restated

Restated

March 31, 2023

$

30,352,000

$

9,751,000

$

15,087,000

$

25,016,000

June 30, 2023

$

25,016,000

$

19,780,000

$

16,403,000

$

28,393,000

September 30, 2023

$

28,393,000

$

8,102,000

$

14,787,000

$

21,708,000

December 31, 2023

$

21,708,000

$

26,552,000

$

18,203,000

$

30,057,000

March 31, 2024

$

30,057,000

$

4,030,000

$

14,457,000

$

19,630,000

June 30, 2024

$

19,630,000

$

11,614,000

$

13,377,000

$

17,867,000

As of December 31, 2024, order backlog was approximately

$17.5 million.

Q4’24 Financial Results

Revenue for the fiscal fourth quarter of 2024 decreased

18% to $13.4 million compared to $16.4 million in the fiscal fourth

quarter of 2023, primarily in material handling class 1 vehicles

driven by double-digit sales declines with our OEM partners. GSE

revenue also declined year-over-year, reflecting a delay in

shipments to a large customer. In both cases the decrease in sales

volume was partially offset by shifts to higher-priced products as

well as certain pricing increases.

Gross profit for the fiscal fourth quarter of 2024 was

flat at $3.6 million compared to a gross profit of $3.6 million in

the fiscal fourth quarter of 2023. Gross margin increased to 27% in

the fiscal fourth quarter of 2024 as compared to 22% in the fiscal

fourth quarter of 2023. Gross profit margin increased nominally by

490 basis points as a result of moderate pricing increases and

improvement in materials costs.

Adjusted EBITDA loss was $1.2 million in the fiscal

fourth quarter of 2024 as compared to a loss of $1.3 million in the

fiscal fourth quarter of 2023.

Selling & Administrative expenses increased to $4.3

million in the fiscal fourth quarter of 2024 as compared to $4.1

million in fiscal fourth quarter of 2023, primarily attributable to

slightly higher marketing expenses.

Research & Development expenses decreased to $1.1

million in the fiscal fourth quarter of 2024 compared to $1.3

million in the fiscal fourth quarter of 2023, primarily due to

lower project related materials costs.

Net loss for the fiscal fourth quarter of 2024 was $2.2

million, compared to a loss of $2.2 million in the fiscal fourth

quarter of 2023. While revenue was lower in Q4 2024 gross margin

was higher, resulting in similar net loss performance.

FY’24 Financial Results

Revenue for the fiscal year 2024 decreased by 9% to $60.8

million compared to $66.5 million in the fiscal year 2023,

primarily in GSE reflecting a delay in shipments to a large

customer. Material Handling revenue also declined year-over-year as

OEM customers experienced double-digit declines in sales. In both

cases the decrease in sales volume was partially offset by shifts

to higher priced products as well as certain pricing increases.

Gross Profit for the fiscal year 2024 increased to $17.2

million compared to a gross profit of $15.9 million in the fiscal

year 2023. Gross margin was 28% in the fiscal year 2024 as compared

to 24% in the fiscal year 2023, reflecting the shift to higher

margin products and the effect of cost control and reduction

initiatives.

Adjusted EBITDA improved to a loss of $4.0 million in the

fiscal year 2024 as compared to a loss of $4.7 million in the

fiscal year 2023, driven by improved gross margins.

Selling & Administrative expenses increased to $18.9

million in the fiscal year 2024 from $17.6 million in the fiscal

year 2023, primarily attributable to stock-based compensation, new

hires in sales, sales force commissions, professional service fees

and depreciation, which were partially offset by reductions in

bonus expenses and insurance premiums.

Research & Development expenses increased to $4.9

million in the fiscal year 2024 compared to $4.7 million in the

fiscal year 2023, primarily due to increased payroll and related

benefits and stock-based compensation, which were partially offset

by reductions in materials and testing related to development of

new products, equipment rentals and bonuses.

Net loss for the fiscal year 2024 was $8.3 million as

compared with a net loss of $7.7 million in the fiscal year 2023,

primarily attributable to the increase in gross profit being more

than offset by higher sales and marketing personnel expenses and

commissions as well as the increase in interest expense due to

higher levels of borrowing at higher interest rates during the

year.

Cash was $0.6 million on June 30, 2024, as compared to

$2.4 million at June 30, 2023, reflecting changes in working

capital management. Available working capital includes: our line of

credit as of December 31, 2024, under our $16.0 million credit

facility from Gibraltar Business Capital (“Gibraltar”), with a

remaining available balance of $6.3 million subject to borrowing

base limitations and satisfaction of certain financial covenants;

and $1.0 million available under the subordinated line of credit

with Cleveland Capital. Our credit line with Gibraltar, subject to

eligible accounts receivables and inventory borrowing base,

provides for expansion up to $20 million.

Events of default occurred under the loan agreement associated

with certain EBITDA requirements that were not achieved for the

three month period ending April 30, 2024, May 31, 2024 and July 31,

2024, and non-compliance with certain other covenants under the

loan agreement. A waiver of such defaults was obtained. On January

22, 2025, we entered into Amendment No. 4 to Loan and Security

Agreement (the “Fourth Amendment”) with GBC which amended certain

terms of the Loan and Security Agreement dated July 28, 2023,

including but not limited to amending the EBITDA Minimum financial

covenant. In consideration for the Fourth Amendment, the Company

agreed to pay GBC a non-refundable amendment fee of $50,000 in

cash.

Our failure to timely file certain reports under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) means that we

are currently ineligible to use a Form S-3 Registration Statement.

In order to be eligible to file a Form S-3 with the SEC again, we

will need to timely file all reports required to be filed under the

Exchange Act for a period of at least twelve (12) calendar months

immediately preceding the filing of a new Form S-3 Registration

Statement. As such, we are evaluating alternative sources of

funding to support our growth initiatives. Our ability to continue

as a going concern is dependent upon the availability of the credit

facility from Gibraltar and our ability to meet order projections,

ship open sales orders, further improve our margins, reduce

operating costs and raise additional capital, if needed, on a

timely basis until such time as revenues and related cash flows are

sufficient to fund our operations.

Conference Call

Flux Power will not host a quarterly conference call to discuss

its financial results for the fourth quarter and full fiscal year

ended June 30, 2024. For further detail and discussion of the

Company’s financial performance, please refer to the Company’s

Annual Report on Form 10-K for the fiscal year ended June 30, 2024.

We look forward to providing future updates on our business and

expect to return to our normal cadence of quarterly conferences

calls subsequent to the filing of our Q1 & Q2 FY2025 Financial

Results Upon Filing Related Forms 10-Q with the Securities and

Exchange Commission.

Note about Non-GAAP Financial Measures

A non-GAAP financial measure is a numerical measure of a

company’s performance, financial position, or cash flows that

either excludes or includes amounts that are not normally excluded

or included in the most directly comparable measure calculated and

presented in accordance with accounting principles generally

accepted in the United States of America, or GAAP. Non-GAAP

measures are not in accordance with, nor are they a substitute for,

GAAP measures. Other companies may use different non-GAAP measures

and presentation of results.

In addition to financial results presented in accordance with

GAAP, this press release presents adjusted EBITDA, which is a

non-GAAP measure. Adjusted EBITDA is determined by taking net loss

and adding interest, taxes, depreciation, amortization, and

stock-based compensation expenses. The company believes that this

non-GAAP measure, viewed in addition to and not in lieu of net

loss, provides additional information to investors by providing a

more focused measure of operating results. This metric is an

integral part of the Company’s internal reporting to evaluate its

operations and the performance of senior management. A

reconciliation of adjusted EBITDA to net loss, the most comparable

GAAP measure, is available in the accompanying financial tables

below. The non-GAAP measure presented herein may not be comparable

to similarly titled measures presented by other companies.

US-GAAP NET INCOME (LOSS) TO

ADJUSTED EBITDA RECONCILIATION (Unaudited)

Year ended June 30,

2024

2023

Restated

Net loss

$

(8,333,000

)

$

(7,743,000

)

Add/Subtract:

Interest, net

1,718,000

1,339,000

Income tax provision

-

-

Depreciation and amortization

1,045,000

899,000

EBITDA

(5,570,000

)

(5,505,000

)

Add/Subtract:

Stock-based compensation

1,571,000

798,000

Adjusted EBITDA

$

(3,999,000

)

$

(4,707,000

)

About Flux Power Holdings, Inc.

Flux Power (NASDAQ: FLUX) designs, manufactures, and sells

advanced lithium-ion energy storage solutions for electrification

of a range of industrial and commercial sectors including material

handling, airport ground support equipment (GSE), and stationary

energy storage. Flux Power’s lithium-ion battery packs, including

the proprietary battery management system (BMS) and telemetry,

provide customers with a better performing, lower cost of

ownership, and more environmentally friendly alternative, in many

instances, to traditional lead acid and propane-based solutions.

Lithium-ion battery packs reduce CO2 emissions and help improve

sustainability and ESG metrics for fleets. For more information,

please visit www.fluxpower.com.

Forward-Looking Statements

This release contains projections and other "forward-looking

statements" relating to Flux Power’s business, that are often

identified using "believes," "expects" or similar expressions.

Forward-looking statements involve several estimates, assumptions,

risks, and other uncertainties that may cause actual results to be

materially different from those anticipated, believed, estimated,

expected, etc. Accordingly, statements are not guarantees of future

results. Some of the important factors that could cause Flux

Power’s actual results to differ materially from those projected in

any such forward-looking statements include, but are not limited

to: risks and uncertainties, related to Flux Power’s business,

results and financial condition; plans and expectations with

respect to access to capital and outstanding indebtedness; Flux

Power’s ability to comply with the terms of the existing credit

facilities to obtain the necessary capital from such credit

facilities; Flux Power’s ability to raise capital; Flux Power’s

ability to continue as a going concern. Flux Power’s ability to

obtain raw materials and other supplies for its products at

competitive prices and on a timely basis, particularly in light of

the potential impact of the COVID-19 pandemic on its suppliers and

supply chain; the development and success of new products,

projected sales, cancellation of purchase orders, deferral of

shipments, Flux Power’s ability to improve its gross margins, or

achieve breakeven cash flow or profitability, Flux Power’s ability

to fulfill backlog orders or realize profit from the contracts

reflected in backlog sale; Flux Power’s ability to fulfill backlog

orders due to changes in orders reflected in backlog sales, Flux

Power’s ability to obtain the necessary funds under the credit

facilities, Flux Power’s ability to timely obtain UL Listing for

its products, Flux Power’s ability to fund its operations,

distribution partnerships and business opportunities and the

uncertainties of customer acceptance and purchase of current and

new products, and changes in pricing. Actual results could differ

from those projected due to numerous factors and uncertainties.

Although Flux Power believes that the expectations, opinions,

projections, and comments reflected in these forward-looking

statements are reasonable, they can give no assurance that such

statements will prove to be correct, and that the Flux Power’s

actual results of operations, financial condition and performance

will not differ materially from the results of operations,

financial condition and performance reflected or implied by these

forward-looking statements. Undue reliance should not be placed on

the forward-looking statements and Investors should refer to the

risk factors outlined in our Form 10-K, 10-Q and other reports

filed with the SEC and available at www.sec.gov/edgar. These

forward-looking statements are made as of the date of this news

release, and Flux Power assumes no obligation to update these

statements or the reasons why actual results could differ from

those projected.

Flux, Flux Power, and associated logos are trademarks of Flux

Power Holdings, Inc. All other third-party brands, products,

trademarks, or registered marks are the property of and used to

identify the products or services of their respective owners.

Follow us at:

Blog: Flux Power Blog News Flux Power News Twitter: @FLUXpwr

LinkedIn: Flux Power

FLUX POWER HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

June 30,

June 30,

June 30,

2024

2023

2022

Restated

Restated

ASSETS

Current assets:

Cash

$

643,000

$

2,379,000

$

485,000

Accounts receivable, net of allowance for

credit losses of $55,000, $0 and $0 at June 30, 2024, 2023 and

2022, respectively

9,773,000

8,800,000

8,609,000

Inventories, net

16,977,000

16,158,000

14,440,000

Other current assets

945,000

918,000

1,261,000

Total current assets

28,338,000

28,255,000

24,795,000

Right of use asset

2,096,000

2,854,000

2,597,000

Property, plant and equipment, net

1,749,000

1,789,000

1,578,000

Other assets

118,000

120,000

89,000

Total assets

$

32,301,000

$

33,018,000

$

29,059,000

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

11,395,000

$

9,872,000

$

6,645,000

Accrued expenses

3,926,000

3,181,000

2,209,000

Line of credit

13,834,000

9,912,000

4,889,000

Deferred revenue

485,000

131,000

163,000

Customer deposits

18,000

82,000

175,000

Finance leases payable, current

portion

156,000

143,000

-

Office leases payable, current portion

734,000

644,000

504,000

Accrued interest

126,000

2,000

1,000

Total current liabilities

30,674,000

23,967,000

14,586,000

Long term liabilities:

Finance leases payable, less current

portion

112,000

273,000

-

Office leases payable, less current

portion

1,321,000

2,055,000

2,361,000

Total liabilities

32,107,000

26,295,000

16,947,000

Stockholders’ equity:

Preferred stock, $0.001 par value; 500,000

shares authorized; none issued and outstanding

-

-

-

Common stock, $0.001 par value; 30,000,000

shares authorized; 16,682,465, 16,462,215 and 15,996,658 shares

issued and outstanding at June 30, 2024, 2023 and 2022,

respectively

17,000

16,000

16,000

Additional paid-in capital

99,889,000

98,086,000

95,732,000

Accumulated deficit

(99,712,000

)

(91,379,000

)

(83,636,000

)

Total stockholders’ equity

194,000

6,723,000

12,112,000

Total liabilities and stockholders’

equity

$

32,301,000

$

33,018,000

$

29,059,000

FLUX POWER HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

Year ended June 30,

2024

2023

2022

Restated

Restated

Revenues

$

60,824,000

$

66,488,000

$

42,333,000

Cost of sales

43,591,000

50,598,000

36,726,000

Gross profit

17,233,000

15,890,000

5,607,000

Operating expenses:

Selling and administrative

18,932,000

17,620,000

15,515,000

Research and development

4,916,000

4,682,000

6,313,000

Total operating expenses

23,848,000

22,302,000

21,828,000

Operating loss

(6,615,000

)

(6,412,000

)

(16,221,000

)

Other income (expense):

Other income

-

8,000

-

Interest income (expense), net

(1,718,000

)

(1,339,000

)

(252,000

)

Net loss

$

(8,333,000

)

$

(7,743,000

)

$

(16,473,000

)

Net loss per share - basic and diluted

$

(0.50

)

$

(0.48

)

$

(1.07

)

Weighted average number of common shares

outstanding - basic and diluted

16,548,533

16,055,256

15,439,530

FLUX POWER HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

Year ended June 30,

2024

2023

2022

Restated

Restated

Cash flows from operating activities:

Net loss

$

(8,333,000

)

$

(7,743,000

)

$

(16,473,000

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation

1,045,000

899,000

575,000

Stock-based compensation

1,571,000

798,000

711,000

Amortization of debt issuance costs

230,000

482,000

–

Non-cash lease expense

606,000

512,000

438,000

Inventory write downs

490,000

690,000

665,000

Changes in operating assets and

liabilities:

Accounts receivable

(973,000

)

(191,000

)

(2,512,000

)

Inventories

(1,309,000

)

(2,408,000

)

(5,550,000

)

Other assets

(163,000

)

(170,000

)

(549,000

)

Accounts payable

1,523,000

3,227,000

(530,000

)

Accrued expenses

745,000

972,000

(374,000

)

Accrued interest

124,000

(32,000

)

139,000

Office leases payable

(644,000

)

1,000

(1,000

)

Deferred revenue

354,000

(518,000

)

(436,000

)

Customer deposits

(64,000

)

(93,000

)

4,000

Net cash used in operating activities

(4,798,000

)

(3,574,000

)

(23,893,000

)

Cash flows from investing activities:

Purchases of equipment

(853,000

)

(1,032,000

)

(797,000

)

Proceeds from sale of fixed assets

-

8,000

–

Net cash used in investing activities

(853,000

)

(1,024,000

)

(797,000

)

Cash flows from financing activities:

Proceeds from the issuance of common stock

in registered direct offering, net of offering costs

–

–

13,971,000

Proceeds from the issuance of common stock

in public offering, net of offering costs

-

1,556,000

1,602,000

Proceeds from stock option exercises and

employee stock purchase plan exercises

141,000

–

–

Proceeds from revolving line of credit

67,209,000

63,400,000

8,450,000

Payment of revolving line of credit

(63,287,000

)

(58,377,000

)

(3,561,000

)

Payment of finance leases

(148,000

)

(87,000

)

–

Net cash provided by financing

activities

3,915,000

6,492,000

20,462,000

Net change in cash

(1,736,000

)

1,894,000

(4,228,000

)

Cash, beginning of period

2,379,000

485,000

4,713,000

Cash, end of period

$

643,000

$

2,379,000

$

485,000

Supplemental Disclosures of Non-Cash

Investing and Financing Activities:

Initial right of use asset recognition

$

-

$

855,000

$

-

Common stock issued for vested RSUs

$

538,000

$

417,000

$

21,000

Warrants issued in connection with

borrowing agreements, recorded as debt issuance cost

$

92,000

$

-

$

253,000

Supplemental cash flow

information:

Interest paid

$

1,409,000

$

1,127,000

$

151,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129636178/en/

Media & Investor Relations: media@fluxpower.com

info@fluxpower.com

External Investor Relations: Chris Tyson,

Executive Vice President MZ Group - MZ North America 949-491-8235

FLUX@mzgroup.us www.mzgroup.us

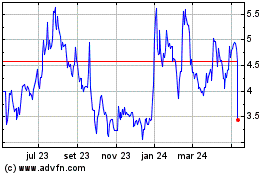

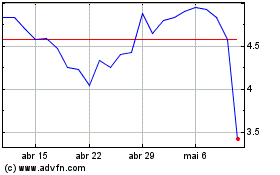

Flux Power (NASDAQ:FLUX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Flux Power (NASDAQ:FLUX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025