Atlas Energy Solutions Inc. (NYSE: AESI) (“Atlas” or the

“Company”) today announced the commencement of an underwritten

public offering (the “Offering”) of an aggregate of 10,000,000

shares of its common stock, par value $0.01 per share (“common

stock”).

The Company intends to use the net proceeds it receives from the

Offering (i) to repay indebtedness, which may include a portion of

its secured PIK toggle seller note and outstanding borrowings under

its credit facility and term loan credit facility, (ii) to fund a

portion of the cash consideration for the Company’s previously

announced acquisition of Moser Engine Service, Inc. (d/b/a Moser

Energy Systems) (the “Moser Acquisition”), including the election

to pay the aggregate transaction consideration in cash in lieu of

the issuance of stock consideration (the “Cash Option”) or, if the

Cash Option has not been exercised, redemption of the stock

consideration, if exercised by the Company, subject to market

conditions, and (iii) the remainder, if any, for general corporate

purposes, including power-related growth capital expenditures

following completion of the Moser Acquisition. The Company expects

to close the Moser Acquisition in the first quarter of 2025,

subject to customary closing conditions and regulatory approvals.

The Moser Acquisition is not contingent upon the completion of this

Offering and this Offering is not contingent upon the completion of

the Moser Acquisition.

The Company expects to grant the underwriters a 30-day option to

purchase up to an additional 1,500,000 shares of common stock at

the public offering price, less the underwriting discounts and

commissions.

Goldman Sachs & Co. LLC and Piper Sandler & Co. are

acting as lead-book running managers for the Offering. The Offering

is subject to market and other conditions, and there can be no

assurance as to whether or when the Offering may be completed, or

as to the actual size or terms of the Offering.

The Offering will be made only by means of a prospectus

supplement and the accompanying base prospectus. The Offering is

being conducted pursuant to an effective shelf registration

statement on Form S-3 (the “Registration Statement”), which was

filed with the U.S. Securities and Exchange Commission (the “SEC”)

on May 15, 2024, that became effective upon filing and the

corresponding prospectus. A preliminary prospectus supplement

thereto has been filed with the SEC. Before investing, prospective

investors should read the prospectus supplement, the accompanying

base prospectus and the documents incorporated by reference therein

for more complete information about the Company and the Offering.

You may obtain these documents for free by visiting EDGAR on the

SEC website at www.sec.gov. Alternatively, copies of the

preliminary prospectus supplement and the accompanying base

prospectus related to this Offering, and the final prospectus

supplement, when available, may be obtained by contacting:

Goldman Sachs & Co. LLC Attn: Prospectus Department 200 West

Street New York, NY 10282 Telephone: 1-866-471-2526

Prospectus-ny@ny.email.gs.com

Piper Sandler & Co. Attn: Prospectus Department 800 Nicollet

Mall J12S03 Minneapolis, Minnesota 55402 Telephone: (800) 747-3924

prospectus@psc.com

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful without registration or

qualification under the securities laws of any such state or

jurisdiction.

About Atlas Energy Solutions Atlas Energy Solutions Inc.

is a leading proppant producer and proppant logistics provider,

serving primarily the Permian Basin of West Texas and New Mexico.

We operate 14 proppant production facilities across the Permian

Basin with a combined annual production capacity of 29 million

tons, including both large-scale in-basin facilities and smaller

distributed mining units. We manage a portfolio of leading-edge

logistics assets, which includes our 42-mile Dune Express conveyor

system. In addition to our conveyor infrastructure, we manage a

fleet of over 120 trucks, which are capable of delivering expanded

payloads due to our custom-manufactured trailers and patented

drop-depot process. Our approach to managing both our proppant

production and proppant logistics operations is intently focused on

leveraging technology, automation and remote operations to drive

efficiencies.

We are a low-cost producer of various high-quality, locally

sourced proppants used during the well completion process. We offer

both dry and damp sand, and carry various mesh sizes including 100

mesh and 40/70 mesh. Proppant is a key component necessary to

facilitate the recovery of hydrocarbons from oil and natural gas

wells.

Our logistics platform is designed to increase the efficiency,

safety and sustainability of the oil and natural gas industry

within the Permian Basin. Proppant logistics is increasingly a

differentiating factor affecting customer choice among proppant

producers. The cost of delivering sand, even short distances, can

be a significant component of customer spending on their well

completions given the substantial volumes that are utilized in

modern well designs.

We continue to invest in and pursue leading-edge technologies,

including autonomous trucking, digital infrastructure, and

artificial intelligence, to support opportunities to gain

efficiencies in our operations. These technology-focused

investments aim to improve our cost structure and also combine to

produce beneficial environmental and community impacts.

While our core business is fundamentally aligned with a lower

emissions economy, our core obligation has been, and will always

be, to our stockholders. We recognize that maximizing value for our

stockholders requires that we optimize the outcomes for our broader

stakeholders, including our employees and the communities in which

we operate. We are proud of the fact that our approach to

innovation in the hydrocarbon industry while operating in an

environmentally responsible manner creates immense value. Since our

founding in 2017, our core mission has been to improve human

beings’ access to the hydrocarbons that power our lives while also

delivering differentiated social and environmental progress. Our

Atlas team has driven innovation and has produced industry-leading

environmental benefits by reducing energy consumption, emissions,

and our aerial footprint. We call this Sustainable Environmental

and Social Progress.

We were founded in 2017 by Ben M. “Bud” Brigham, our Executive

Chairman, and are led by an entrepreneurial team with a history of

constructive disruption bringing significant and complementary

experience to this enterprise, including the perspective of

longtime E&P operators, which provides for an elevated

understanding of the end users of our products and services. Our

executive management team has a proven track record with a history

of generating positive returns and value creation. Our experience

as E&P operators was instrumental to our understanding of the

opportunity created by in-basin sand production and supply in the

Permian Basin, which we view as North America’s premier shale

resource and which we believe will remain its most active through

economic cycles.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Statements that are

predictive or prospective in nature, that depend upon or refer to

future events or conditions or that include the words “may,”

“assume,” “forecast,” “position,” “strategy,” “potential,”

“continue,” “could,” “will,” “plan,” “project,” “budget,”

“predict,” “pursue,” “target,” “seek,” “objective,” “believe,”

“expect,” “anticipate,” “intend,” “estimate” and other expressions

that are predictions of or indicate future events and trends and

that do not relate to historical matters identify forward-looking

statements. Examples of forward-looking statements include, but are

not limited to, statements regarding the size and terms of the

Offering and our use of proceeds from the Offering; Atlas’s plans

to finance the Moser Acquisition; and the receipt of all necessary

approvals to close the Moser Acquisition and the timing associated

therewith.

Actual results could differ materially from those anticipated in

these forward-looking statements as a result of certain factors,

including, but not limited to, those discussed or referenced in our

filings made from time to time with the SEC, including those

discussed in the Registration Statement and the prospectus

supplement relating to this Offering, under the heading “Risk

Factors” in our Annual Report on Form 10-K, filed with the SEC on

February 27, 2024, and any subsequently filed Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K, including those

discussed in Exhibit 99.3 to our Current Report on Form 8-K filed

on January 27, 2025. Readers are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the

date hereof. Factors or events that could cause our actual results

to differ may emerge from time to time, and it is not possible for

us to predict all of them. We undertake no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future developments or otherwise, except as may

be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130365347/en/

Investor Contact Kyle Turlington 5918 W Courtyard Drive,

Suite #500 Austin, Texas 78730 United States T: 512-220-1200

IR@atlas.energy

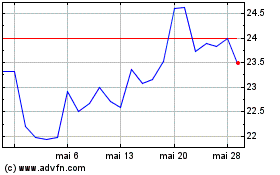

New Atlas Holdco (NYSE:AESI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

New Atlas Holdco (NYSE:AESI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025