State Street Corporation Announces Issuance of Preferred Stock

06 Fevereiro 2025 - 8:00PM

Business Wire

State Street Corporation (“State Street”) (NYSE: STT) announced

today that it has issued $750 million of depositary shares, each

representing a 1/100th ownership interest in a share of its 6.450%

Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series K

(the “Series K Preferred Stock”), with a liquidation preference of

$100,000 per share.

Consistent with recent securities issuances, State Street

accessed a broad investor base through a diverse syndicate of

underwriters with Blaylock Van, LLC, a minority-owned investment

bank, and Siebert Williams Shank & Co., LLC, a minority and

women-owned investment bank, each acting as co-managers on the

transaction. The underwriting syndicate also included BofA

Securities, Inc. and Morgan Stanley & Co. LLC, each acting as

joint book-running managers.

Dividends on the Series K Preferred Stock will be payable on the

liquidation preference amount, on a non-cumulative basis, quarterly

in arrears on the 15th day of March, June, September and December

of each year, commencing on June 15, 2025. Dividends will accrue

(i) from the date of issuance to, but excluding, September 15, 2030

at a fixed rate of 6.450% per annum and (ii) from and including

September 15, 2030, for each five-year reset period, at a rate per

annum equal to the five-year U.S. Treasury rate as of the most

recent reset dividend determination date, plus a spread of 2.135%.

Dividend payments on the Series K Preferred Stock will only be

payable when, as and if declared by State Street’s board of

directors, or any duly authorized committee of its board of

directors. State Street may redeem the Series K Preferred Stock (i)

in whole or in part on any dividend payment date on or after

September 15, 2030, subject to regulatory approval, and (ii) in

whole but not in part within 90 days following the occurrence of a

regulatory capital treatment event.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With $46.6 trillion in assets

under custody and/or administration and $4.7 trillion* in assets

under management as of December 31, 2024, State Street operates

globally in more than 100 geographic markets and employs

approximately 53,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

*Assets under management as of December 31, 2024 includes

approximately $82 billion of assets with respect to SPDR® products

for which State Street Global Advisors Funds Distributors, LLC

(SSGA FD) acts solely as the marketing agent. SSGA FD and State

Street Global Advisors are affiliated.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206745497/en/

Media: Carolyn Cichon +1 617 664 8672 Investor:

Elizabeth Lynn +1 617 664 3477

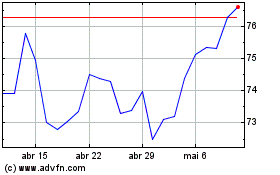

State Street (NYSE:STT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

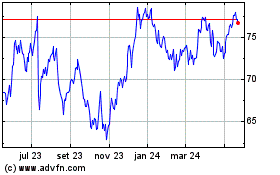

State Street (NYSE:STT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025