The Charles Schwab Corporation Announces Secondary Offering of Its Common Stock Held by an Affiliate of The Toronto-Dominion Bank; Plans $1.5 Billion Stock Repurchase

10 Fevereiro 2025 - 9:00AM

Business Wire

The Charles Schwab Corporation (NYSE: SCHW) (the “Company” or

“Charles Schwab”) today announced the commencement of a secondary

offering of its common stock through which TD Group US Holdings

LLC, an affiliate of The Toronto-Dominion Bank (“TD”), intends to

exit its full investment in the Company. The shares being offered

by TD will be sold in an underwritten public offering.

TD currently holds 184.7 million shares of the Company’s common

stock, representing a 10.1% economic ownership.

Charles Schwab also announced today that it entered into a share

repurchase agreement with TD, conditioned on the secondary

offering, pursuant to which the Company agreed to repurchase $1.5

billion of its nonvoting common stock directly from TD, in a

private transaction, at the price per share at which the shares of

common stock are sold to the public in the secondary offering less

the underwriting discount (the “Repurchase”). Closing of the

Repurchase is expected to occur immediately following the

completion of the public offering. The Repurchase will be made

under the Company’s existing share repurchase program and will be

funded by cash on hand. Following the completion of the Repurchase,

the Company expects to have $7.2 billion remaining under its

authorized program. Over the course of 2025, the Company expects to

continue to pursue opportunistic repurchases where consistent with

its expected progress on its key financial objectives.

Following the secondary offering and the Repurchase, TD will

have disposed of all of its shares. Charles Schwab will not receive

any of the proceeds from the sale of shares of its common

stock.

The secondary offering will be led by TD Securities and Goldman

Sachs & Co. LLC.

Charles Schwab has filed a registration statement (including a

prospectus) and a preliminary prospectus supplement with the

Securities and Exchange Commission (the “SEC”) for the secondary

offering to which this communication relates. Before you invest,

you should read the prospectus in that registration statement and

other documents Charles Schwab has filed with the SEC, including

the preliminary prospectus supplement dated February 10, 2025, for

more complete information about Charles Schwab and this secondary

offering. You may get these documents for free by visiting EDGAR on

the SEC website at www.sec.gov. Alternatively, any underwriter or

any dealer participating in the offering will arrange to send you

the prospectus and the preliminary prospectus supplement if you

request them by contacting: (i) TD Securities (USA) LLC, 1

Vanderbilt Avenue, New York, NY 10017, telephone: 1 (855) 495-9846

or by email at TD.ECM_Prospectus@tdsecurities.com; or (ii) Goldman

Sachs & Co. LLC, Attn: Prospectus Department, 200 West Street,

New York, NY 10282, telephone: 1 (866) 471-2526, facsimile: (212)

902-9316 or by email at Prospectus-ny@ny.email.gs.com.

This announcement shall not constitute an offer to sell or the

solicitation of any offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements that

involve substantial risks, uncertainties and assumptions that could

cause actual results to differ materially from those expressed or

implied by such statements. These forward-looking statements

include statements regarding the offering and the Repurchase, the

Company’s plans, objectives, expectations and intentions and the

financial condition, results of operations and business of the

Company. These forward-looking statements are subject to risks and

uncertainties, including, among other things, risks related to the

ability of the Company to consummate the offering and the

Repurchase and the risks described in the Company’s most recent

reports on Form 10-K and Form 10-Q, which have been filed with the

SEC and are available on the Company’s website

(www.aboutschwab.com/financial-reports) and on the SEC’s website

(www.sec.gov). The Company makes no commitment to update any

forward-looking statements.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 36.5 million active brokerage

accounts, 5.4 million workplace plan participant accounts, 2.0

million banking accounts, and $10.10 trillion in client assets.

Through its operating subsidiaries, the Company provides a full

range of wealth management, securities brokerage, banking, asset

management, custody, and financial advisory services to individual

investors and independent investment advisors. Its broker-dealer

subsidiary, Charles Schwab & Co., Inc. (member SIPC,

https://www.sipc.org), and its affiliates offer a complete range of

investment services and products including an extensive selection

of mutual funds; financial planning and investment advice;

retirement plan and equity compensation plan services; referrals to

independent, fee-based investment advisors; and custodial,

operational and trading support for independent, fee-based

investment advisors through Schwab Advisor Services. Its primary

banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an

Equal Housing Lender), provides banking and lending services and

products.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250209475232/en/

MEDIA: Mayura Hooper Charles Schwab Phone: 415-667-1525

public.relations@schwab.com

INVESTORS/ANALYSTS: Jeff Edwards Charles Schwab Phone:

817-854-6177 investor.relations@schwab.com

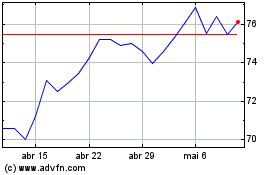

Charles Schwab (NYSE:SCHW)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

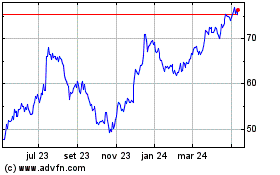

Charles Schwab (NYSE:SCHW)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025