- Q4 revenue was $415.4 million, above the high end of

guidance

- Q4 GAAP EPS from continuing operations was $1.29; Q4

Non-GAAP EPS was $1.30, above the mid-point of guidance

- 2024 revenue was $1.48 billion

- 2024 GAAP EPS from continuing operations was $1.49; 2024

Non-GAAP EPS was $3.71

- 2024 cash flow from continuing operations was $132.9

million

Advanced Energy Industries, Inc. (Nasdaq: AEIS), a global leader

in highly engineered, precision power conversion, measurement, and

control solutions, today announced financial results for the fourth

quarter and year ended December 31, 2024.

“Fourth quarter results exceeded our guidance, with total

revenue resuming year-over-year growth on better-than-expected

demand in our semiconductor and data center computing markets,”

said Steve Kelley, president and CEO of Advanced Energy. “Customers

are embracing our best-in-class products, which we believe will

drive meaningful share gains as markets recover.”

Quarter Results

Revenue was $415.4 million in the fourth quarter of 2024,

compared with $374.2 million in the third quarter of 2024 and

$405.3 million in the fourth quarter of 2023.

GAAP net income from continuing operations was $49.1 million or

$1.29 per diluted share in the quarter, compared with GAAP net loss

of $14.1 million or a loss of $0.38 per diluted share in the prior

quarter, and GAAP net income of $37.9 million or $1.01 per diluted

share a year ago.

GAAP net income in the fourth quarter included a one-time, net

tax benefit of $15.0 million as a result of an intercompany

transfer of assets as part of the company streamlining its legal

entity structure. GAAP net loss in the third quarter reflected a

$28.5 million restructuring charge as part of our previously

announced manufacturing consolidation. GAAP net income in the

fourth quarter of 2023 included a restructuring and impairment

charge of $18.1 million as part of the factory and cost

optimization plan and a tax benefit of $25.6 million as a result of

the release of a deferred tax asset valuation allowance.

Non-GAAP net income was $49.4 million or $1.30 per diluted share

in the fourth quarter of 2024. This compares with $37.0 million or

$0.98 per diluted share in the third quarter of 2024, and $46.7

million or $1.24 per diluted share in the fourth quarter of

2023.

Advanced Energy generated $82.7 million in cash flow from

continuing operations during the quarter and paid $3.8 million in

quarterly dividends.

Full Year 2024 Results

2024 revenue was $1.48 billion, a 10% decrease from $1.66

billion in 2023.

GAAP net income from continuing operations was $56.3 million or

$1.49 per diluted share in 2024, compared with $130.7 million or

$3.46 per diluted share in 2023.

GAAP net income for the year included a one-time, net tax

benefit of $15.0 million as a result of an intercompany transfer of

assets as part of the company streamlining its legal entity

structure and a $29.6 million restructuring charge as part of our

previously announced manufacturing consolidation. GAAP net income

in 2023 included a restructuring and impairment charge of $27.0

million as part of the factory and cost optimization plan and a tax

benefit of $25.6 million as a result of the release of a deferred

tax asset valuation allowance.

The Company generated $132.9 million in cash flow from operating

activities from continuing operations, repurchased $1.8 million of

common stock at an average price of $93.58, and paid $15.4 million

in dividends. The Company used $355.0 million of cash on hand to

prepay the term loan. At year-end, outstanding debt was $564.7

million, representing the 2028 convertible notes, net of

unamortized issuance costs. Cash and equivalents at year-end were

$722.1 million.

Non-GAAP net income was $140.3 million or $3.71 per diluted

share in 2024. This compares with $184.0 million or $4.88 per

diluted share in 2023.

A reconciliation of GAAP and non-GAAP measures is provided in

the tables below.

First Quarter 2025 Guidance

Based on the Company’s current view, beliefs, and assumptions,

guidance is within the following ranges:

Q1 2025

Revenue

$392 million +/- $20 million

GAAP EPS from continuing operations

$0.48 +/- $0.25

Non-GAAP EPS

$1.03 +/- $0.25

Conference Call

Management will host a conference call today, February 12, 2025,

at 2:30 p.m. Eastern Time to discuss the fourth quarter financial

results. To participate in the live earnings conference call,

please dial 877-407-0890 approximately ten minutes prior to the

start of the meeting and an operator will connect you.

International participants can dial +1-201-389-0918. A webcast will

also be available on our investor web page at ir.advancedenergy.com

in the Events & Presentations section. The archived webcast

will be available approximately two hours following the end of the

live event.

About Advanced Energy

Advanced Energy Industries, Inc. (Nasdaq: AEIS) is a global

leader in the design and manufacture of highly engineered,

precision power conversion, measurement and control solutions for

mission-critical applications and processes. Advanced Energy’s

power solutions enable customer innovation in complex applications

for a wide range of industries including semiconductor equipment,

industrial production, medical and life sciences, data center

computing, networking, and telecommunications. With engineering

know-how and responsive service and support for customers around

the globe, the Company builds collaborative partnerships to meet

technology advances, propels growth of its customers, and innovates

the future of power. Advanced Energy has devoted four decades to

perfecting power. It is headquartered in Denver, Colorado, USA. For

more information, visit www.advancedenergy.com.

Advanced Energy | Precision. Power. Performance. Trust.

Non-GAAP Measures

This release includes measures, such as non-GAAP net income and

non-GAAP earnings per share (“EPS”) that are not prepared in

accordance with accounting principles generally accepted in the

United States of America (“U.S. GAAP”). Management uses non-GAAP

net income and non-GAAP EPS to evaluate business performance

without the impacts of certain non-cash charges and other charges

which are not part of our usual operations. We use these non-GAAP

measures to assess performance against business objectives and make

business decisions, including developing budgets and forecasting

future periods. In addition, management’s incentive plans include

these non-GAAP measures as criteria for achievements. These

non-GAAP measures are not prepared in accordance with U.S. GAAP and

may differ from non-GAAP methods of accounting and reporting used

by other companies. However, we believe these non-GAAP measures

provide additional information that enables readers to evaluate our

business from the perspective of management. The presentation of

this additional information should not be considered a substitute

for results prepared in accordance with U.S. GAAP.

The non-GAAP results presented below exclude the impact of

non-cash related charges, such as stock-based compensation,

amortization of intangible assets, and long-term unrealized foreign

exchange gains and losses. In addition, we exclude discontinued

operations and other non-recurring items such as

acquisition-related costs, facility expansion and related costs,

and restructuring expenses, as they are not indicative of future

performance. The tax effect of our non-GAAP adjustments represents

the anticipated annual tax rate applied to each non-GAAP adjustment

after consideration of their respective book and tax

treatments.

Forward-Looking Statements

This press release and statements we make on the above announced

conference call contain, in addition to historical information,

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Statements in this

press release or the conference call that are not historical

information are forward-looking statements. For example, statements

relating to our beliefs, expectations, and plans are

forward-looking statements, as are statements that certain actions,

conditions, or circumstances will continue. The inclusion of words

such as "anticipate," "expect," "estimate," "can," "may," "might,"

"continue," "enables," "plan," "intend," "should," "could,"

"would," "likely," "potential," or "believe," and similar

expressions and the negative versions thereof indicate

forward-looking statements; however, not all forward-looking

statements may contain such words or expressions. These

forward-looking statements are based upon information available as

of the date of this press release and management’s current

estimates, forecasts, and assumptions. Although we believe that our

expectations reflected in or suggested by these forward-looking

statements are reasonable, we may not achieve the results,

performance, plans, or objectives expressed or implied by such

forward-looking statements. Forward-looking statements involve

risks and uncertainties, which are difficult to predict and many of

which are beyond our control.

Risks and uncertainties to which our forward-looking statements

are subject include, but are not limited to: volatility and

business fluctuations in the industries in which we operate; our

ability to achieve design wins with new and existing customers; our

ability to accurately forecast and meet customer demand; risks

related to global economic conditions, such as the impact of

escalating global conflicts on macroeconomic conditions, economic

uncertainty, market volatility, rising interest rates, inflation,

or recession; customer price sensitivity; concentration of our

customer base; risks associated with breach of our information

security measures; difficulties with the implementation of our

enterprise resource planning and other enterprise-wide information

technology system applications; our loss of or inability to attract

and retain key personnel; risks associated with our manufacturing

footprint optimization and movement of manufacturing locations for

certain products; disruptions to our manufacturing operations or

those of our customers or suppliers; our ability to successfully

identify, close, integrate and realize anticipated benefits from

our acquisitions; quality issues or unanticipated costs in

fulfilling our warranty obligations (including our discontinued

solar inverter product line); risks inherent in our international

operations, including the effect of trade and export controls,

political and geographical risks, the impact of tariffs on our

supply or products, and fluctuations in currency exchange rates;

our ability to enforce, protect, and maintain our proprietary

technology and intellectual property rights; regulatory risk

related to our supply chain; legal matters, claims, investigations,

and proceedings; changes to tax laws and regulations or our tax

rates; changes in federal, state, local and foreign regulations,

including with respect to privacy and data protection, and

environmental regulation; the effect of our debt obligations and

restrictive covenants on our ability to operate our business; risks

related to our unfunded pension obligations; our estimates of the

fair value of intangible assets; the potential impact of dilution

related to our convertible debt, hedge, and warrant transactions;

and certain risks relating to ownership of our common stock.

Actual results could differ materially and adversely from those

expressed in any forward-looking statements, and readers are

cautioned not to place undue reliance on forward-looking

statements. Factors that could contribute to these differences or

prove our forward-looking statements, by hindsight, to be overly

optimistic or unachievable include, but are not limited to, the

risks and uncertainties listed above and described in Advanced

Energy’s Form 10-K, Forms 10-Q and other reports and statements

filed with the Securities and Exchange Commission (the “SEC”).

These reports and statements are available on the SEC’s website at

www.sec.gov. Copies may also be obtained from Advanced Energy’s

investor relations page at ir.advancedenergy.com or by contacting

Advanced Energy’s investor relations at 970-407-6555.

Forward-looking statements are made and based on information

available to us on the date of this press release. Aspirational

goals and targets discussed on the conference call or in the

presentation materials should not be interpreted in any respect as

guidance. We assume no obligation to update the information in this

press release or provide the reasons why our actual results may

differ.

ADVANCED ENERGY INDUSTRIES,

INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

(in thousands, except per share

data)

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

2024

2023

2024

2024

2023

Revenue, net

$

415,403

$

405,271

$

374,217

$

1,482,042

$

1,655,810

Cost of revenue

260,698

262,405

240,149

952,699

1,063,412

Gross profit

154,705

142,866

134,068

529,343

592,398

Gross margin %

37.2

%

35.3

%

35.8

%

35.7

%

35.8

%

Operating expenses:

Research and development

56,102

49,025

53,561

211,834

202,439

Selling, general, and administrative

58,164

54,932

56,237

224,538

221,034

Amortization of intangible assets

5,527

7,068

6,772

26,046

28,254

Restructuring, asset impairments, and

other charges

902

18,071

28,546

30,318

26,977

Total operating expenses

120,695

129,096

145,116

492,736

478,704

Operating income (loss)

34,010

13,770

(11,048

)

36,607

113,694

Interest income

7,078

12,810

11,018

42,860

27,092

Interest expense

(4,644

)

(7,198

)

(6,378

)

(25,105

)

(16,566

)

Other income (expense), net

4,137

(3,184

)

(8,139

)

(1,985

)

(1,759

)

Income from continuing operations, before

income tax

40,581

16,198

(14,547

)

52,377

122,461

Income tax benefit

(8,481

)

(21,693

)

(400

)

(3,929

)

(8,288

)

Income (loss) from continuing

operations

49,062

37,891

(14,147

)

56,306

130,749

Loss from discontinued operations, net of

income tax

(188

)

(389

)

(758

)

(2,092

)

(2,465

)

Net income (loss)

$

48,874

$

37,502

$

(14,905

)

$

54,214

$

128,284

Basic weighted-average common shares

outstanding

37,536

37,297

37,532

37,476

37,480

Diluted weighted-average common shares

outstanding

38,000

37,585

37,532

37,839

37,750

Earnings (loss) per share attributable

to Advanced Energy Industries, Inc:

Continuing operations:

Basic earnings (loss) per share

$

1.31

$

1.02

$

(0.38

)

$

1.50

$

3.49

Diluted earnings (loss) per share

$

1.29

$

1.01

$

(0.38

)

$

1.49

$

3.46

Discontinued operations:

Basic loss per share

$

(0.01

)

$

(0.01

)

$

(0.02

)

$

(0.06

)

$

(0.07

)

Diluted loss per share

$

—

$

(0.01

)

$

(0.02

)

$

(0.06

)

$

(0.07

)

Net income (loss):

Basic earnings (loss) per share

$

1.30

$

1.01

$

(0.40

)

$

1.45

$

3.42

Diluted earnings (loss) per

share

$

1.29

$

1.00

$

(0.40

)

$

1.43

$

3.40

ADVANCED ENERGY INDUSTRIES,

INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands)

December 31,

December 31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

722,086

$

1,044,556

Accounts receivables, net

265,315

282,430

Inventories

360,411

336,137

Other current assets

41,511

48,771

Total current assets

1,389,323

1,711,894

Property and equipment, net

185,604

167,665

Operating lease right-of-use assets

96,305

95,432

Other assets

155,269

136,448

Goodwill and intangible assets, net

435,393

445,318

Total assets

$

2,261,894

$

2,556,757

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$

143,502

$

141,850

Other accrued expenses

152,894

156,254

Current portion of long-term debt

—

20,000

Current portion of operating lease

liabilities

17,826

17,744

Total current liabilities

314,222

335,848

Long-term debt

564,695

895,679

Other long-term liabilities

176,267

181,048

Long-term liabilities

740,962

1,076,727

Total liabilities

1,055,184

1,412,575

Deferred compensation

3,539

—

Total stockholders' equity

1,203,171

1,144,182

Total liabilities and stockholders’

equity

$

2,261,894

$

2,556,757

ADVANCED ENERGY INDUSTRIES,

INC.

CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS (UNAUDITED)

(in thousands)

Year Ended December

31,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

54,214

$

128,284

Less: loss from discontinued operations,

net of income tax

(2,092

)

(2,465

)

Income from continuing operations, net of

income tax

56,306

130,749

Adjustments to reconcile net income to net

cash from operating activities:

Depreciation and amortization

68,455

66,533

Stock-based compensation

45,940

31,001

Amortization and write off of debt

issuance costs and debt discount

3,771

1,330

Deferred income tax benefit

(20,505

)

(33,940

)

Other

1,165

439

Changes in operating assets and

liabilities, net of assets acquired

(22,208

)

16,813

Net cash from operating activities from

continuing operations

132,924

212,925

Net cash from operating activities from

discontinued operations

(2,177

)

(3,988

)

Net cash from operating activities

130,747

208,937

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of long-term investments

(2,991

)

(3,746

)

Purchases of property and equipment

(56,788

)

(61,005

)

Acquisitions, net of cash acquired

(13,762

)

-

Net cash from investing activities

(73,541

)

(64,751

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from long-term borrowings

-

575,000

Payment of fees for long-term

borrowings

(105

)

(13,880

)

Payments on long-term borrowings

(355,000

)

(20,000

)

Dividend payments

(15,369

)

(15,222

)

Payment for purchase of note hedges

-

(115,000

)

Proceeds from sale of warrants

-

74,865

Purchase and retirement of common

stock

(1,770

)

(40,000

)

Net payments related to stock-based

awards

(4,849

)

(79

)

Net cash from financing activities

(377,093

)

445,684

EFFECT OF CURRENCY TRANSLATION ON

CASH

(2,583

)

(4,132

)

NET CHANGE IN CASH AND CASH

EQUIVALENTS

(322,470

)

585,738

CASH AND CASH EQUIVALENTS, beginning of

period

1,044,556

458,818

CASH AND CASH EQUIVALENTS, end of

period

$

722,086

$

1,044,556

ADVANCED ENERGY INDUSTRIES,

INC.

SUPPLEMENTAL INFORMATION

(UNAUDITED)

(in thousands)

Net Revenue by Market

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

2024

2023

2024

2024

2023

Semiconductor Equipment

$

226,838

$

191,375

$

197,497

$

792,559

$

743,794

Industrial and Medical

76,818

108,600

76,837

316,177

474,449

Data Center Computing

88,673

62,853

80,653

284,192

249,874

Telecom and Networking

23,074

42,443

19,230

89,114

187,693

Total

$

415,403

$

405,271

$

374,217

$

1,482,042

$

1,655,810

Net Revenue by Geographic

Region

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

2024

2023

2024

2024

2023

North America

$

187,382

$

187,240

$

175,691

$

669,946

$

724,481

Asia

194,744

169,700

163,212

661,854

713,571

Europe

32,302

47,501

34,892

147,560

212,368

Other

975

830

422

2,682

5,390

Total

$

415,403

$

405,271

$

374,217

$

1,482,042

$

1,655,810

ADVANCED ENERGY INDUSTRIES,

INC.

SELECTED OTHER DATA (UNAUDITED)

(in thousands)

Reconciliation of Non-GAAP measure -

Operating expenses and operating income, excluding certain

items

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

2024

2023

2024

2024

2023

Gross profit from continuing operations,

as reported

$

154,705

$

142,866

$

134,068

$

529,343

$

592,398

Adjustments to gross profit:

Stock-based compensation

1,063

472

1,046

3,994

2,059

Facility expansion, relocation costs and

other

2,084

1,146

868

4,421

2,334

Acquisition-related costs

—

44

—

(13

)

238

Non-GAAP gross profit

157,852

144,528

135,982

537,745

597,029

Non-GAAP gross margin

38.0

%

35.7

%

36.3

%

36.3

%

36.1

%

Operating expenses from continuing

operations, as reported

120,695

129,096

145,116

492,736

478,704

Adjustments:

Amortization of intangible assets

(5,527

)

(7,068

)

(6,772

)

(26,046

)

(28,254

)

Stock-based compensation

(10,574

)

(7,716

)

(10,868

)

(41,946

)

(28,942

)

Acquisition-related costs

(1,184

)

(1,372

)

(1,581

)

(5,965

)

(4,026

)

Facility expansion, relocation costs and

other

(734

)

—

(488

)

(1,222

)

(189

)

Restructuring, asset impairments, and

other charges

(902

)

(18,071

)

(28,546

)

(30,318

)

(26,977

)

Non-GAAP operating expenses

101,774

94,869

96,861

387,239

390,316

Non-GAAP operating income

$

56,078

$

49,659

$

39,121

$

150,506

$

206,713

Non-GAAP operating margin

13.5

%

12.3

%

10.5

%

10.2

%

12.5

%

ADVANCED ENERGY INDUSTRIES,

INC.

SELECTED OTHER DATA (UNAUDITED)

(in thousands, except per share

data)

Reconciliation of Non-GAAP measure -

Income excluding certain items

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

2024

2023

2024

2024

2023

Income (loss) from continuing operations,

less non-controlling interest, net of income tax

$

49,062

$

37,891

$

(14,147

)

$

56,306

$

130,749

Adjustments:

Amortization of intangible assets

5,527

7,068

6,772

26,046

28,254

Acquisition-related costs

1,184

1,416

1,581

5,952

4,264

Facility expansion, relocation costs, and

other

2,818

1,146

1,356

5,643

2,523

Restructuring, asset impairments, and

other charges

902

18,071

28,546

30,318

26,977

Unrealized foreign currency loss

(gain)

(4,203

)

2,728

3,993

(3,512

)

(89

)

Other costs included in other income

(expense), net

(853

)

—

3,665

2,812

(1,516

)

Tax effect of non-GAAP adjustments,

including certain discrete tax benefits

(14,271

)

(28,030

)

(4,172

)

(19,563

)

(31,303

)

Non-GAAP income, net of income tax,

excluding stock-based compensation

40,166

40,290

27,594

104,002

159,859

Stock-based compensation, net of tax

9,193

6,387

9,412

36,292

24,181

Non-GAAP income, net of income tax

$

49,359

$

46,677

$

37,006

$

140,294

$

184,040

Reconciliation of Non-GAAP measure -

Weighted-average common shares adjusted for stock awards

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

2024

2023

2024

2024

2023

Diluted weighted-average common shares

outstanding

38,000

37,585

37,532

37,839

37,750

Dilutive effect of stock awards

—

—

360

—

—

Non-GAAP diluted weighted-average common

shares outstanding

38,000

37,585

37,892

37,839

37,750

Reconciliation of non-GAAP measure -

per share earnings excluding certain items

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

2024

2023

2024

2024

2023

Diluted earnings (loss) per share from

continuing operations, as reported

$

1.29

$

1.01

$

(0.38

)

$

1.49

$

3.46

Add back:

Per share impact of non-GAAP adjustments,

net of tax

0.01

0.23

1.36

2.22

1.42

Non-GAAP earnings per share

$

1.30

$

1.24

$

0.98

$

3.71

$

4.88

Reconciliation of Q1 2025

Guidance

Low End

High End

Revenue

$372 million

$412 million

Reconciliation of non-GAAP earnings per

share

GAAP earnings per share

$

0.23

$

0.73

Stock-based compensation

0.35

0.35

Amortization of intangible assets

0.15

0.15

Restructuring, asset impairments, and

other charges

0.17

0.17

Tax effects of excluded items

(0.12

)

(0.12

)

Non-GAAP earnings per share

$

0.78

$

1.28

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212434708/en/

For more information, contact:

Andrew Huang Advanced Energy Industries, Inc. 970-407-6555

ir@aei.com

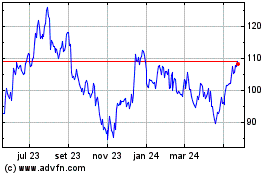

Advanced Energy Industries (NASDAQ:AEIS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

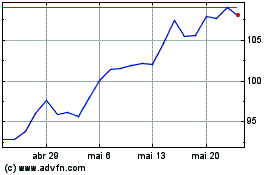

Advanced Energy Industries (NASDAQ:AEIS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025