Ventas, Inc. (NYSE: VTR) (“Ventas” or the “Company”) today

reported results for the full year and fourth quarter ended

December 31, 2024.

CEO Remarks

“Ventas delivered strong financial performance and growth in the

fourth quarter and full year 2024 as we executed on our strategy to

capture the unprecedented multiyear growth opportunity in senior

housing. Our team delivered the third consecutive year of

double-digit growth in our senior housing operating portfolio

(SHOP) and completed over two billion dollars of accretive

investments focused on senior housing that enhance our growth

profile,” said Debra A. Cafaro, Ventas Chairman and CEO.

“We expect compelling demand for senior housing to continue

because of the secular trend of a large and growing aging

population, and supply to remain muted. As a leading participant in

the longevity economy, Ventas intends to use its advantaged

platform to drive enterprise growth.

“We are introducing guidance for 2025 that builds on our

momentum and increasing our quarterly dividend to common

stockholders as a result of our strong results and positive

outlook. We are excited about the opportunities ahead to deliver

value for all our stakeholders,” Cafaro concluded.

2024 Full Year

Highlights

- Net Income Attributable to Common Stockholders (“Attributable

Net Income”) per share of $0.19

- Normalized Funds From Operations* (“Normalized FFO”) per share

of $3.19, an increase of approximately 7% compared to the prior

year

- Total Company Net Operating Income* (“NOI”) year-over-year

growth of 7.5% and Total Company Same-Store Cash NOI*

year-over-year growth of 7.7%

- On a Same-Store Cash NOI* basis, the senior housing operating

portfolio (“SHOP”) grew nearly 16% year-over-year, with average

occupancy growth of 300 basis points and NOI margin growth of 180

basis points

- The Company closed over $2 billion of investments,

substantially all of which are focused on senior housing with

attractive financial return expectations, consistent with its

stated financial criteria and Right Market, Right Asset, Right

Operator™ strategy

- During 2024, the Company issued 37.3 million shares of common

stock for gross proceeds of approximately $2.2 billion, of which

approximately $0.2 billion remained unsettled under outstanding

forward sales agreements as of December 31, 2024

- As of December 31, 2024, the Company had $3.8 billion in

liquidity

*Some of the financial measures throughout this press release

are non-GAAP measures. Refer to the Non-GAAP Financial Measures

Reconciliation tables at the end of this press release for

additional information and a reconciliation to the most directly

comparable GAAP measure.

Fourth Quarter and Full Year 2024

Company Results

For the Fourth Quarter 2024 and Full Year 2024, reported per

share results were:

Quarter Ended December

31,

2024

2023

$ Change

% Change

Attributable Net Income (Loss)

$0.13

($0.23)

$0.36

n/m

Nareit FFO*

$0.85

$0.79

$0.06

8%

Normalized FFO*

$0.81

$0.76

$0.05

7%

Year Ended December

31,

2024

2023

$ Change

% Change

Attributable Net Income (Loss)

$0.19

($0.10)

$0.29

n/m

Nareit FFO*

$3.14

$3.26

($0.12)

(4%)

Normalized FFO*

$3.19

$2.99

$0.20

7%

______________________________

n/m - Not meaningful

SHOP Growth

Average occupancy and revenue growth in the SHOP same-store

portfolio exceeded expectations in 2024, contributing to same-store

cash NOI growth of 15.8% in full year 2024 vs. 2023. SHOP

same-store average occupancy grew 300 basis points year-over-year,

supporting revenue growth of 8.2%.

In the fourth quarter, the SHOP same-store portfolio

outperformed historical seasonal trends and grew average occupancy

by 310 basis points year-over-year. Ventas OI™ active asset

management initiatives, collaborative relationships with high

performing operators and the favorable backdrop of demand growth in

the 80+ population combined with limited new senior housing

deliveries contributed to this outperformance.

External Growth Focused on Senior

Housing

Ventas closed over $2 billion of investments focused primarily

on senior housing in 2024. These senior housing investments are

expected to generate attractive NOI yields, are priced below

replacement cost and offer significant multiyear NOI growth

potential, consistent with the Company’s stated investment

criteria. Ventas also has an active pipeline of attractive senior

housing investments consistent with the Company’s investment

criteria and intends to continue to expand its SHOP footprint and

increase its enterprise growth.

Balance Sheet

Ventas’s Net Debt-to-Further Adjusted EBITDA* improved to 6.0x

as of the end of the fourth quarter 2024 driven by SHOP segment

growth and equity-funded senior housing investments, representing

an improvement of 0.9x from year-end 2023. With this improvement,

the Company has now entered its long term targeted range of

5.0x-6.0x.

Ventas Declares Quarterly Dividend of

$0.48 Per Common Share, Representing 7% Increase

The Company’s Board of Directors has declared a quarterly

dividend of $0.48 per share, representing a 7% increase, on the

strength of the Company’s results and its positive outlook. The

dividend will be payable in cash on April 17, 2025 to stockholders

of record on March 31, 2025.

Investments Group

Addition

The Company is expanding its resources to capitalize on its

compelling external growth opportunities:

- Alex Russo, Managing Director in the Real Estate & Lodging

Investment Banking Group at Lazard, will join Ventas as Senior

Managing Director, Investments in the first quarter of 2025. Mr.

Russo has spent 18-years in real estate at Lazard, advising and

executing on a variety of acquisitions, dispositions, partnerships,

investments, financings and other strategic business initiatives.

He leads Lazard’s coverage of the healthcare real estate sector,

and has also focused on real estate investment managers, helping

clients grow and transform their businesses. Mr. Russo will report

to Ventas Executive Vice President, Senior Housing and Chief

Investment Officer, J. Justin Hutchens.

- Tim Sanders, Senior Vice President, Business Development will

continue to lead Ventas’s Investment Officer Group. This group

successfully completed the Company’s 2024 investment activity of

over $2 billion. Mr. Sanders will continue to report to J. Justin

Hutchens.

Full Year 2025 Guidance

The Company’s 2025 guidance contains forward-looking statements

and is based on a number of assumptions; actual results may differ

materially. Ventas expects to report 2025 per share Attributable

Net Income to common stockholders, Nareit FFO and Normalized FFO

within the following ranges:

As of 2/12/2025

Attributable Net Income Per Share

Range

$0.42 - $0.53

Attributable Net Income Per Share

Midpoint

$0.48

Nareit FFO Per Share Range*

$3.27 - $3.38

Nareit FFO Per Share Midpoint*

$3.33

Normalized FFO Per Share Range*

$3.35 - $3.46

Normalized FFO Per Share Midpoint*

$3.41

Full Year 2025 Guidance

Commentary

In 2025, the Company expects to achieve significant NOI growth

in the SHOP segment and to benefit from accretive senior housing

investment activity.

The Company’s full year guidance for 2025 Attributable Net

Income per share of $0.48 at the midpoint of the range compares to

2024 Attributable Net Income of $0.19.

The Company’s full year guidance for 2025 Normalized FFO per

share of $3.41 at the midpoint of the range compares to 2024

Normalized FFO per share of $3.19. The year-over-year projected

increase of approximately 7% per share or $0.22 at the midpoint of

the 2025 guidance range is composed primarily of: (1) the benefit

of (a) NOI growth in the Company’s SHOP segment and (b) accretive

senior housing investment activity in 2024 and expected in 2025,

partially offset by (2) the impact of higher net interest expense,

foreign exchange and the dilutive impact of a higher share price.

The Company has included approximately $1 billion of 2025

investments focused on senior housing in its 2025 guidance.

Investor Presentation

An Earnings Presentation is posted to the Events &

Presentations section of Ventas’s website at

ir.ventasreit.com/events-and-presentations. Additional information

regarding the Company can be found in its Supplemental posted at

ir.ventasreit.com. The information contained on, or that may be

accessed through, the Company’s website, including the information

contained in the aforementioned Earnings Presentation and

Supplemental, is not incorporated by reference into, and is not

part of, this document.

Full Year 2024 Results Conference

Call

Ventas will hold a conference call to discuss this earnings

release on Thursday, February 13, 2025 at 10:00 a.m. Eastern Time

(9:00 a.m. Central Time).

The dial-in number for the conference call is (888) 330-3576 (or

+1 (646) 960-0672 for international callers), and the participant

passcode is 7655497. A live webcast can be accessed from the

Investor Relations section of www.ventasreit.com.

A telephonic replay will be available at (800) 770-2030 (or +1

(609) 800-9909 for international callers), passcode 7655497, after

the earnings call and will remain available for 30 days. The

webcast replay will be posted in the Investor Relations section of

www.ventasreit.com.

About Ventas

Ventas, Inc. (NYSE: VTR) is a leading S&P 500 real estate

investment trust enabling exceptional environments that benefit a

large and growing aging population. With approximately 1,400

properties in North America and the United Kingdom, Ventas occupies

an essential role in the longevity economy. The Company’s growth is

fueled by its over 800 senior housing communities, which provide

valuable services to residents and enable them to thrive in

supported environments. The Ventas portfolio also includes

outpatient medical buildings, research centers and healthcare

facilities. The Company aims to deliver outsized performance by

leveraging its unmatched operational expertise, data-driven

insights from its Ventas OI™ platform, extensive relationships and

strong financial position. Ventas’s seasoned team of talented

professionals shares a commitment to excellence, integrity and a

common purpose of helping people live longer, healthier, happier

lives.

Non-GAAP Financial

Measures

This press release of Ventas, Inc. (the “Company,” “we,” “us,”

“our” and similar terms) includes certain financial performance

measures not defined by generally accepted accounting principles in

the United States (“GAAP”), such as Nareit FFO, Normalized FFO, Net

Operating Income (“NOI”), Same-Store Cash NOI, Same-Store Cash NOI

Growth and Net Debt to Further Adjusted EBITDA. Reconciliations of

these non-GAAP financial measures to the most directly comparable

GAAP measures are included in the appendix to this press release.

Our definitions and calculations of these non-GAAP measures may not

be the same as similar measures reported by other REITs.

These non-GAAP financial measures should not be considered as

alternatives for, or superior to, financial measures calculated in

accordance with GAAP.

Cautionary Statements

Certain of the information contained herein, including

intra-quarter operating information, has been provided by our

operators and we have not verified this information through an

independent investigation or otherwise. We have no reason to

believe that this information is inaccurate in any material

respect, but we cannot assure you of its accuracy.

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements include, among others,

statements of expectations, beliefs, future plans and strategies,

anticipated results from operations and developments and other

matters that are not historical facts. Forward-looking statements

include, among other things, statements regarding our and our

officers’ intent, belief or expectation as identified by the use of

phrases or words such as “assume,” “may,” “will,” “project,”

“expect,” “believe,” “intend,” “anticipate,” “seek,” “target,”

“forecast,” “plan,” “line-of-sight,” “outlook,” “potential,”

“opportunity,” “estimate,” “could,” “would,” “should” and other

comparable and derivative terms or the negatives thereof.

Forward-looking statements are based on management’s beliefs as

well as on a number of assumptions concerning future events. You

should not put undue reliance on these forward-looking statements,

which are not a guarantee of performance and are subject to a

number of uncertainties and other factors that could cause actual

events or results to differ materially from those expressed or

implied by the forward-looking statements. We do not undertake a

duty to update these forward-looking statements, which speak only

as of the date on which they are made. We urge you to carefully

review the disclosures we make concerning risks and uncertainties

that may affect our business and future financial performance,

including those made below and in our filings with the Securities

and Exchange Commission, such as in the sections titled “Cautionary

Statements — Summary Risk Factors” and “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2024.

Certain factors that could affect our future results and our

ability to achieve our stated goals include, but are not limited

to: (a) our exposure and the exposure of our managers, tenants and

borrowers to complex and evolving governmental policy, laws and

regulations, including relating to healthcare, data privacy,

cybersecurity and environmental matters, the impact of such

policies, laws and regulations on our and our managers’, tenants’

and borrowers’ business and the challenges and expense associated

with complying with such policies, laws and regulations; (b) the

potential for significant general and commercial claims, legal

actions, investigations, regulatory proceedings and enforcement

actions that could subject us or our managers, tenants or borrowers

to increased operating costs, uninsured liabilities, including

fines and other penalties, reputational harm or significant

operational limitations, including the loss or suspension of or

moratoriums on accreditations, licenses or certificates of need,

suspension of or nonpayment for new admissions, denial of

reimbursement, suspension, decertification or exclusion from

federal, state or foreign healthcare programs or the closure of

facilities or communities; (c) our reliance on third-party managers

and tenants to operate or exert substantial control over properties

they manage for, or rent from, us, which limits our control and

influence over such properties, their operations and their

performance; (d) the impact of market, macroeconomic, general

economic conditions and fiscal policy on us, our managers, tenants

and borrowers and in areas in which our properties are

geographically concentrated, including changes in or elevated

inflation, interest rates and exchange rates, labor market

dynamics, tightening of lending standards and reduced availability

of credit or capital, events that affect consumer confidence, our

occupancy rates and resident fee revenues, and the actual and

perceived state of the real estate markets and public and private

capital markets; (e) our reliance and the reliance of our managers,

tenants and borrowers on the financial, credit and capital markets

and the risk that those markets may be disrupted or become

constrained; (f) our ability, and the ability of our managers,

tenants and borrowers, to navigate the trends impacting our or

their businesses and the industries in which we or they operate,

including their ability to respond to the impact of the U.S.

political environment on government funding and reimbursement

programs, and the financial condition or business prospect of our

managers, tenants and borrowers; (g) our ability to achieve the

anticipated benefits and synergies from, and effectively integrate,

our completed or anticipated acquisitions and investments; (h) the

risk of bankruptcy, inability to obtain benefits from governmental

programs, insolvency or financial deterioration of our managers,

tenants borrowers and other obligors which may, among other things,

have an adverse impact on the ability of such parties to make

payments or meet their other obligations to us, which could have an

adverse impact on our results of operations and financial

condition; (i) the risk that the borrowers under our loans or other

investments default or that, to the extent we are able to foreclose

or otherwise acquire the collateral securing our loans or other

investments, we will be required to incur additional expense or

indebtedness in connection therewith, that the assets will

underperform expectations or that we may not be able to

subsequently dispose of all or part of such assets on favorable

terms; (j) our current and future amount of outstanding

indebtedness, and our ability to access capital and to incur

additional debt which is subject to our compliance with covenants

in instruments governing our and our subsidiaries’ existing

indebtedness; (k) risks related to the recognition of reserves,

allowances, credit losses or impairment charges which are

inherently uncertain and may increase or decrease in the future and

may not represent or reflect the ultimate value of, or loss that we

ultimately realize with respect to, the relevant assets, which

could have an adverse impact on our results of operations and

financial condition; (l) the risk that our management agreements or

leases are not renewed or are renewed on less favorable terms, that

our managers or tenants default under those agreements or that we

are unable to replace managers or tenants on a timely basis or on

favorable terms, if at all; (m) our ability to identify and

consummate future investments in, or dispositions of, healthcare

assets and effectively manage our portfolio opportunities and our

investments in co-investment vehicles, joint ventures and minority

interests, including our ability to dispose of such assets on

favorable terms as a result of rights of first offer or rights of

first refusal in favor of third parties; (n) risks related to

development, redevelopment and construction projects, including

costs associated with inflation, rising or elevated interest rates,

labor conditions and supply chain pressures, and risks related to

increased construction and development in markets in which our

properties are located, including adverse effect on our future

occupancy rates; (o) our ability to attract and retain talented

employees; (p) the limitations and significant requirements imposed

upon our business as a result of our status as a REIT and the

adverse consequences (including the possible loss of our status as

a REIT) that would result if we are not able to comply with such

requirements; (q) the ownership limits contained in our certificate

of incorporation with respect to our capital stock in order to

preserve our qualification as a REIT, which may delay, defer or

prevent a change of control of our company; (r) increases in our

borrowing costs as a result of becoming more leveraged, including

in connection with acquisitions or other investment activity and

rising or elevated interest rates; (s) our exposure to various

operational risks, liabilities and claims from our operating

assets; (t) our dependency on a limited number of managers and

tenants for a significant portion of our revenues and operating

income; (u) our exposure to particular risks due to our specific

asset classes and operating markets, such as adverse changes

affecting our specific asset classes and the healthcare real estate

sector, the competitiveness or financial viability of hospitals on

or near the campuses where our outpatient medical buildings are

located, our relationships with universities, the level of expense

and uncertainty of our research tenants, and the limitation of our

uses of some properties we own that are subject to ground lease,

air rights or other restrictive agreements; (v) our ability to

maintain a positive reputation for quality and service with our key

stakeholders; (w) the availability, adequacy and pricing of

insurance coverage provided by our policies and policies maintained

by our managers, tenants, borrowers or other counterparties; (x)

the risk of exposure to unknown liabilities from our investments in

properties or businesses; (y) the occurrence of cybersecurity

threats and incidents that could disrupt our or our managers’,

tenants’ or borrower’s operations, result in the loss of

confidential or personal information or damage our business

relationships and reputation; (z) the failure to maintain effective

internal controls, which could harm our business, results of

operations and financial condition; (aa) the impact of merger,

acquisition and investment activity in the healthcare industry or

otherwise affecting our managers, tenants or borrowers; (bb)

disruptions to the management and operations of our business and

the uncertainties caused by activist investors; (cc) the risk of

catastrophic or extreme weather and other natural events and the

physical effects of climate change; (dd) the risk of potential

dilution resulting from future sales or issuances of our equity

securities; and (ee) the other factors set forth in our periodic

filings with the Securities and Exchange Commission.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share amounts; dollars in USD; unaudited)

As of December 31,

2024

2023

Assets

Real estate investments:

Land and improvements

$

2,775,790

$

2,596,274

Buildings and improvements

28,717,990

27,201,381

Construction in progress

336,231

368,143

Acquired lease intangibles

1,558,751

1,448,146

Operating lease assets

308,019

312,142

33,696,781

31,926,086

Accumulated depreciation and

amortization

(11,096,236

)

(10,177,136

)

Net real estate property

22,600,545

21,748,950

Secured loans receivable and investments,

net

144,872

27,986

Investments in unconsolidated real estate

entities

626,122

598,206

Net real estate investments

23,371,539

22,375,142

Cash and cash equivalents

897,850

508,794

Escrow deposits and restricted cash

59,383

54,668

Goodwill

1,044,915

1,045,176

Assets held for sale

18,625

56,489

Deferred income tax assets, net

1,931

1,754

Other assets

792,663

683,410

Total assets

$

26,186,906

$

24,725,433

Liabilities and equity

Liabilities:

Senior notes payable and other debt

$

13,522,551

$

13,490,896

Accrued interest payable

143,345

117,403

Operating lease liabilities

218,003

194,734

Accounts payable and other liabilities

1,152,306

1,041,616

Liabilities related to assets held for

sale

2,726

9,243

Deferred income tax liabilities

8,150

24,500

Total liabilities

15,047,081

14,878,392

Redeemable OP unitholder and

noncontrolling interests

310,229

302,636

Commitments and contingencies

Equity:

Ventas stockholders’ equity:

Preferred stock, $1.00 par value; 10,000

shares authorized, unissued

—

—

Common stock, $0.25 par value; 600,000

shares authorized, 437,085 and 402,380 shares outstanding at

December 31, 2024 and 2023, respectively

109,119

100,648

Capital in excess of par value

17,607,482

15,650,734

Accumulated other comprehensive loss

(33,526

)

(35,757

)

Retained earnings (deficit)

(6,886,653

)

(6,213,803

)

Treasury stock, 4 and 279 shares issued at

December 31, 2024 and 2023, respectively

(25,155

)

(13,764

)

Total Ventas stockholders’ equity

10,771,267

9,488,058

Noncontrolling interests

58,329

56,347

Total equity

10,829,596

9,544,405

Total liabilities and equity

$

26,186,906

$

24,725,433

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per

share amounts; dollars in USD; unaudited)

For the Three Months Ended

December 31,

For the Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenues

Rental income:

Triple-net leased properties

$

157,403

$

155,302

$

622,054

$

619,208

Outpatient medical and research

portfolio

216,199

222,056

874,886

867,193

373,602

377,358

1,496,940

1,486,401

Resident fees and services

896,360

775,195

3,372,796

2,959,219

Third-party capital management

revenues

4,339

4,353

17,359

17,841

Income from loans and investments

4,451

1,601

9,057

22,952

Interest and other income

8,305

5,885

28,114

11,414

Total revenues

1,287,057

1,164,392

4,924,266

4,497,827

Expenses

Interest

153,206

154,853

602,835

574,112

Depreciation and amortization

308,772

435,276

1,253,143

1,392,461

Property-level operating expenses:

Senior housing

661,683

589,765

2,506,413

2,247,812

Outpatient medical and research

portfolio

73,617

74,777

298,320

292,776

Triple-net leased properties

4,206

3,377

15,829

14,557

739,506

667,919

2,820,562

2,555,145

Third-party capital management

expenses

1,551

1,487

6,507

6,101

General, administrative and professional

fees

41,434

36,382

162,990

148,876

Loss (gain) on extinguishment of debt,

net

15

85

687

(6,104

)

Transaction, transition and restructuring

costs

4,226

3,635

20,369

15,215

Reversal of allowance on loans receivable

and investments, net

—

(75

)

(166

)

(20,270

)

Gain on foreclosure of real estate

—

—

—

(29,127

)

Shareholder relations matters

—

—

15,751

—

Other expense (income)

38,855

(22,236

)

49,584

(23,001

)

Total expenses

1,287,565

1,277,326

4,932,262

4,613,408

Loss before unconsolidated entities, real

estate dispositions, income taxes and noncontrolling interests

(508

)

(112,934

)

(7,996

)

(115,581

)

Income (loss) from unconsolidated

entities

6,969

(6,886

)

1,563

13,626

Gain on real estate dispositions

6,727

39,802

57,009

62,119

Income tax benefit (expense)

45,539

(4,698

)

37,775

9,539

Net income (loss)

58,727

(84,716

)

88,351

(30,297

)

Net income attributable to noncontrolling

interests

1,892

6,103

7,198

10,676

Net income (loss) attributable to common

stockholders

$

56,835

$

(90,819

)

$

81,153

$

(40,973

)

Earnings per common share

Basic:

Net income (loss)

$

0.14

$

(0.21

)

$

0.21

$

(0.08

)

Net income (loss) attributable to common

stockholders

0.13

(0.23

)

0.20

(0.10

)

Diluted: (1)

Net income (loss)

$

0.14

$

(0.21

)

$

0.21

$

(0.08

)

Net income (loss) attributable to common

stockholders

0.13

(0.23

)

0.19

(0.10

)

Weighted average shares used in

computing earnings per common share

Basic

421,496

402,995

411,770

401,809

Diluted

427,612

406,977

416,366

405,670

______________________________

(1)

Potential common shares are not included

in the computation of diluted earnings per share (“EPS”) when a net

loss exists as the effect would be an antidilutive per share

amount.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Funds From Operations

Attributable to Common Stockholders (FFO)

(In thousands, except per

share amounts; dollars in USD; totals may not sum due to rounding;

unaudited)

Q4 YoY

2024

2023

Change

Q4

Q4

’24-’23

2024

2023

Net income (loss) attributable to

common stockholders

$

56,835

$

(90,819

)

n/m

$

81,153

$

(40,973

)

Net income (loss) attributable to

common stockholders per share

$

0.13

$

(0.23

)

n/m

$

0.19

$

(0.10

)

Adjustments:

Depreciation and amortization on real

estate assets

308,054

434,673

1,250,453

1,390,025

Depreciation on real estate assets related

to noncontrolling interests

(3,576

)

(3,892

)

(15,113

)

(16,657

)

Depreciation on real estate assets related

to unconsolidated entities

12,463

13,044

49,170

44,953

Gain on real estate dispositions

(6,727

)

(39,802

)

(57,009

)

(62,119

)

Gain on real estate dispositions related

to noncontrolling interests

—

6,688

9

6,685

Gain on real estate dispositions related

to unconsolidated entities

(3,182

)

—

(3,216

)

(180

)

Subtotal: Nareit FFO adjustments

307,032

410,711

1,224,294

1,362,707

Subtotal: Nareit FFO adjustments per

share

$

0.72

$

1.01

$

2.94

$

3.36

Nareit FFO attributable to common

stockholders

$

363,867

$

319,892

14

%

$

1,305,447

$

1,321,734

Nareit FFO attributable to common

stockholders per share

$

0.85

$

0.79

8

%

$

3.14

$

3.26

Adjustments:

Loss (gain) on derivatives, net

18,405

(24,392

)

11,942

(32,076

)

Non-cash impact of income tax (benefit)

expense

(46,022

)

3,961

(43,486

)

(15,269

)

Loss (gain) on extinguishment of debt,

net

15

85

687

(6,104

)

Transaction, transition and restructuring

costs

4,226

3,635

20,369

15,215

Amortization of other intangibles

112

97

400

385

Non-cash impact of changes to executive

equity compensation plan

(2,416

)

(2,465

)

180

161

Significant disruptive events, net

2,603

(1,900

)

8,230

(5,339

)

Reversal of allowance on loans receivable

and investments, net

—

(75

)

(166

)

(20,270

)

Normalizing items related to

noncontrolling interests and unconsolidated entities, net

(1,001

)

1,018

(2,012

)

(25,683

)

Other normalizing items, net (1)

7,445

8,257

25,856

(20,870

)

Subtotal: Normalized FFO adjustments

(16,633

)

(11,779

)

22,000

(109,850

)

Subtotal: Normalized FFO adjustments per

share

(0.04

)

(0.03

)

0.05

(0.27

)

Normalized FFO attributable to common

stockholders

$

347,234

$

308,113

13

%

$

1,327,447

$

1,211,884

Normalized FFO attributable to common

stockholders per share

$

0.81

$

0.76

7

%

$

3.19

$

2.99

Weighted average diluted shares

427,612

406,977

416,366

405,670

______________________________

n/m - Not meaningful

(1) For the year ended December 31, 2024,

primarily related to shareholder relations matters and certain

legal matters. For the year ended December 31, 2023, primarily

related to gain on foreclosure of real estate, payment obligation

arising in connection with sale of real estate, and certain legal

matters.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. However, since real estate values historically have

risen or fallen with market conditions, many industry investors

deem presentations of operating results for real estate companies

that use historical cost accounting to be insufficient by

themselves. For that reason, the Company considers Funds From

Operations attributable to common stockholders (“FFO”) and

Normalized FFO attributable to common stockholders (“Normalized

FFO”) to be appropriate supplemental measures of operating

performance of an equity REIT. The Company believes that the

presentation of FFO, combined with the presentation of required

GAAP financial measures, has improved the understanding of

operating results of REITs among the investing public and has

helped make comparisons of REIT operating results more meaningful.

Management generally considers FFO to be a useful measure for

understanding and comparing our operating results because, by

excluding gains and losses related to sales of previously

depreciated operating real estate assets, impairment losses on

depreciable real estate and real estate asset depreciation and

amortization (which can differ across owners of similar assets in

similar condition based on historical cost accounting and useful

life estimates), FFO can help investors compare the operating

performance of a company’s real estate across reporting periods and

to the operating performance of other companies. The Company

believes that Normalized FFO is useful because it allows investors,

analysts and Company management to compare the Company’s operating

performance to the operating performance of other real estate

companies across periods on a consistent basis without having to

account for differences caused by non-recurring items and other

non-operational events such as transactions and litigation. In some

cases, the Company provides information about identified non-cash

components of FFO and Normalized FFO because it allows investors,

analysts and our management to assess the impact of those items on

our financial results.

Nareit Funds From Operations Attributable to Common

Stockholders (“Nareit FFO”)

The Company uses the National Association of Real Estate

Investment Trusts (“Nareit”) definition of FFO. Nareit defines FFO

as net income attributable to common stockholders (computed in

accordance with GAAP) excluding gains (or losses) from sales of

real estate property, including gain (or loss) on re-measurement of

equity method investments and impairment write-downs of depreciable

real estate, plus real estate depreciation and amortization, and

after adjustments for unconsolidated entities and noncontrolling

interests. Adjustments for unconsolidated entities and

noncontrolling interests will be calculated to reflect FFO on the

same basis.

Normalized FFO Attributable to Common Stockholders

(“Normalized FFO”)

The Company defines Normalized FFO as Nareit FFO excluding the

following income and expense items, without duplication: (a) gains

and losses on derivatives, net and changes in the fair value of

financial instruments; (b) the non-cash impact of income tax

benefits or expenses; (c) gains and losses on extinguishment of

debt, net including the write-off of unamortized deferred financing

fees or additional costs, expenses, discounts, make-whole payments,

penalties or premiums incurred as a result of early retirement or

payment of our debt; (d) transaction, transition and restructuring

costs; (e) amortization of other intangibles; (f) the non-cash

impact of changes to our executive equity compensation plan; (g)

net expenses or recoveries related to significant disruptive

events; (h) the impact of expenses related to asset impairment and

valuation allowances; (i) non-cash charges related to leases; (j)

the financial impact of contingent consideration; (k) gains and

losses on non-real estate dispositions and other normalizing items

related to noncontrolling interests and unconsolidated entities;

and (l) other items set forth in the Normalized FFO reconciliation

included herein.

Nareit FFO and Normalized FFO presented herein may not be

comparable to those presented by other real estate companies due to

the fact that not all real estate companies use the same

definitions. Nareit FFO and Normalized FFO should not be considered

as alternatives to net income attributable to common stockholders

(determined in accordance with GAAP) as indicators of the Company’s

financial performance or as alternatives to cash flow from

operating activities (determined in accordance with GAAP) as

measures of the Company’s liquidity, nor are they necessarily

indicative of sufficient cash flow to fund all of the Company’s

needs. The Company believes that in order to facilitate a clear

understanding of the consolidated historical operating results of

the Company, Nareit FFO and Normalized FFO should be examined in

conjunction with net income attributable to common stockholders as

presented elsewhere herein.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Full Year 2025

Guidance1

Net Income and FFO

Attributable to Common Stockholders2

(In millions, except per share

amounts; dollars in USD; totals may not sum due to rounding;

unaudited)

FY 2025

FY 2025 - Per Share

Low

High

Low

High

Net income attributable to common

stockholders

$192

$244

$0.42

$0.53

Depreciation and amortization

adjustments

1,299

1,299

$2.85

$2.85

Nareit FFO attributable to common

stockholders

$1,491

$1,543

$3.27

$3.38

Other adjustments3

37

37

$0.08

$0.08

Normalized FFO attributable to common

stockholders

$1,528

$1,580

$3.35

$3.46

% Year-over-year growth

5%

8%

Weighted average diluted shares (in

millions)

456

456

1 The Company’s guidance

constitutes forward-looking statements within the meaning of the

federal securities laws and is based on a number of assumptions

that are subject to change and many of which are outside the

control of the Company. Actual results may differ materially from

the Company’s expectations depending on factors discussed herein

and in the Company’s filings with the Securities and Exchange

Commission.

2 Totals may not add due to minor

corporate-level adjustments.

3 Other adjustments include the

categories of adjustments presented in our “Non-GAAP Financial

Measures Reconciliation – Funds From Operations Attributable to

Common Stockholders (FFO)”.

Select

Guidance Assumptions:

1.

Expect to close approximately $1

billion of senior housing investments, weighted in the first half

of 2025

2.

Expect to dispose of assets for

approximately $200 million in net proceeds

3.

FAD capital expenditures of

approximately $285 million at midpoint

4.

General and administrative

expenses of approximately $172 million at midpoint

5.

Net interest expense (i.e.,

interest expense net of interest and other income) expected to

increase ~$32M year-over-year due to refinancing maturing debt at

higher rates and lower cash balances

- Interest expense of ~$618 million at midpoint

- Interest and other income of ~$11 million at midpoint

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Fourth Quarter 2024 Same-Store

Cash NOI by Segment

(In thousands, unless

otherwise noted; dollars in USD; totals may not sum due to

rounding; unaudited)

For the Three Months Ended

December 31, 2024

SHOP

OM&R

NNN

Non-Segment

Total

Net income attributable to common

stockholders

$

56,835

Adjustments:

Interest and other income

(8,305

)

Interest expense

153,206

Depreciation and amortization

308,772

General, administrative and professional

fees

41,434

Loss on extinguishment of debt, net

15

Transaction, transition and restructuring

costs

4,226

Other expense

38,855

Income from unconsolidated entities

(6,969

)

Gain on real estate dispositions

(6,727

)

Income tax benefit

(45,539

)

Net income attributable to noncontrolling

interests

1,892

NOI

$

234,677

$

143,332

$

153,197

$

6,489

$

537,695

Adjustments:

Straight-lining of rental income

—

(1,014

)

2,389

—

1,375

Non-cash rental income

—

(1,818

)

(11,129

)

—

(12,947

)

NOI not included in cash NOI1

808

(403

)

(103

)

—

302

Non-segment NOI

—

—

—

(6,489

)

(6,489

)

Cash NOI

$

235,485

$

140,097

$

144,354

$

—

$

519,936

Adjustments:

Cash NOI not included in Same-Store

(28,394

)

(5,197

)

(10,205

)

—

(43,796

)

Same-Store Cash NOI

$

207,091

$

134,900

$

134,149

$

—

$

476,140

Percentage increase

16.9

%

2.1

%

3.4

%

8.4

%

1

Includes consolidated properties. Excludes

sold assets, assets owned by unconsolidated real estate entities,

assets held for sale, loan repayments, development properties not

yet operational, land parcels and third-party management revenues

from all periods. Assets that have undergone business model

transitions are reflected within the new business segment as of the

transition date.

For the Three Months Ended

December 31, 2023

SHOP

OM&R

NNN

Non-Segment

Total

Net loss attributable to common

stockholders

$

(90,819

)

Adjustments:

Interest and other income

(5,885

)

Interest expense

154,853

Depreciation and amortization

435,276

General, administrative and professional

fees

36,382

Loss on extinguishment of debt, net

85

Transaction, transition and restructuring

costs

3,635

Reversal of allowance on loans receivable

and investments, net

(75

)

Other income

(22,236

)

Loss from unconsolidated entities

6,886

Gain on real estate dispositions

(39,802

)

Income tax expense

4,698

Net income attributable to noncontrolling

interests

6,103

NOI

$

185,430

$

147,945

$

151,925

$

3,801

$

489,101

Adjustments:

Straight-lining of rental income

—

(2,989

)

(182

)

—

(3,171

)

Non-cash rental income

—

(2,144

)

(12,916

)

—

(15,060

)

NOI not included in cash NOI1

2,526

(3,947

)

(2,971

)

—

(4,392

)

Non-segment NOI

—

—

—

(3,801

)

(3,801

)

NOI impact from change in FX

(1,372

)

—

206

—

(1,166

)

Cash NOI

$

186,584

$

138,865

$

136,062

$

—

$

461,511

Adjustments:

Cash NOI not included in Same-Store

(9,398

)

(6,730

)

(6,350

)

—

(22,478

)

NOI impact from change in FX not in

Same-Store

40

—

—

—

40

Same-Store Cash NOI

$

177,226

$

132,135

$

129,712

$

—

$

439,073

1

Includes consolidated properties. Excludes

sold assets, assets owned by unconsolidated real estate entities,

assets held for sale, loan repayments, development properties not

yet operational, land parcels and third-party management revenues

from all periods. Assets that have undergone business model

transitions are reflected within the new business segment as of the

transition date.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Full Year 2024 Same-Store Cash

NOI by Segment

(In thousands, unless

otherwise noted; dollars in USD; totals may not sum due to

rounding; unaudited)

For the Year Ended December

31, 2024

SHOP

OM&R

NNN

Non-Segment

Total

Net income attributable to common

stockholders

$

81,153

Adjustments:

Interest and other income

(28,114

)

Interest expense

602,835

Depreciation and amortization

1,253,143

General, administrative and professional

fees

162,990

Loss on extinguishment of debt, net

687

Transaction, transition and restructuring

costs

20,369

Reversal of allowance on loans receivable

and investments, net

(166

)

Shareholder relations matters

15,751

Other expense

49,584

Income from unconsolidated entities

(1,563

)

Gain on real estate dispositions

(57,009

)

Income tax benefit

(37,775

)

Net income attributable to noncontrolling

interests

7,198

NOI

$

866,383

$

579,271

$

606,225

$

17,204

$

2,069,083

Adjustments:

Straight-lining of rental income

—

(10,181

)

5,087

—

(5,094

)

Non-cash rental income

—

(8,112

)

(46,015

)

—

(54,127

)

Cash modification fees

—

3,000

—

—

3,000

NOI not included in cash NOI1

4,182

(2,075

)

(4,548

)

—

(2,441

)

Non-segment NOI

—

—

—

(17,204

)

(17,204

)

Cash NOI

$

870,565

$

561,903

$

560,749

$

—

$

1,993,217

Adjustments:

Cash NOI not included in Same-Store

(119,359

)

(65,854

)

(41,632

)

—

(226,845

)

Same-Store Cash NOI

$

751,206

$

496,049

$

519,117

$

—

$

1,766,372

Percentage increase

15.8

%

3.0

%

1.8

%

7.7

%

1

Includes consolidated properties. Excludes

sold assets, assets owned by unconsolidated real estate entities,

assets held for sale, loan repayments, development properties not

yet operational, land parcels and third-party management revenues

from all periods. Assets that have undergone business model

transitions are reflected within the new business segment as of the

transition date.

For the Year Ended December

31, 2023

SHOP

OM&R

NNN

Non-Segment

Total

Net loss attributable to common

stockholders

$

(40,973

)

Adjustments:

Interest and other income

(11,414

)

Interest expense

574,112

Depreciation and amortization

1,392,461

General, administrative and professional

fees

148,876

Gain on extinguishment of debt, net

(6,104

)

Transaction, transition and restructuring

costs

15,215

Reversal of allowance on loans receivable

and investments, net

(20,270

)

Gain on foreclosure of real estate

(29,127

)

Other income

(23,001

)

Income from unconsolidated entities

(13,626

)

Gain on real estate dispositions

(62,119

)

Income tax benefit

(9,539

)

Net income attributable to noncontrolling

interests

10,676

NOI

$

711,407

$

576,932

$

604,651

$

32,177

$

1,925,167

Adjustments:

Straight-lining of rental income

—

(9,642

)

2,046

—

(7,596

)

Non-cash rental income

—

(9,379

)

(50,221

)

—

(59,600

)

NOI not included in cash NOI1

9,296

(22,767

)

(22,420

)

—

(35,891

)

Non-segment NOI

—

—

—

(32,177

)

(32,177

)

NOI impact from change in FX

(2,898

)

—

729

—

(2,169

)

Cash NOI

$

717,805

$

535,144

$

534,785

$

—

$

1,787,734

Adjustments:

Cash NOI not included in Same-Store

(69,124

)

(53,409

)

(24,752

)

—

(147,285

)

NOI impact from change in FX not in

Same-Store

51

—

—

—

51

Same-Store Cash NOI

$

648,732

$

481,735

$

510,033

$

—

$

1,640,500

1

Includes consolidated properties. Excludes

sold assets, assets owned by unconsolidated real estate entities,

assets held for sale, loan repayments, development properties not

yet operational, land parcels and third-party management revenues

from all periods. Assets that have undergone business model

transitions are reflected within the new business segment as of the

transition date.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Adjusted EBITDA and Net

Debt

(Dollars in thousands USD;

totals may not sum due to rounding; unaudited)

For the Year Ended

For the Three Months

Ended

December 31, 2024

December 31, 2024

September 30, 2024

December 31, 2023

Net income (loss) attributable to

common stockholders

$

81,153

$

56,835

$

19,243

$

(90,819

)

Adjustments:

Interest expense

602,835

153,206

150,437

154,853

Loss on extinguishment of debt, net

687

15

—

85

Taxes (including tax amounts in general,

administrative and professional fees)

(33,251

)

(44,153

)

3,324

5,743

Depreciation and amortization

1,253,143

308,772

304,268

435,276

Non-cash stock-based compensation

expense

30,992

4,648

4,268

5,690

Transaction, transition and restructuring

costs

20,369

4,226

8,580

3,635

Net income attributable to noncontrolling

interests, adjusted for partners’ share of consolidated entity

EBITDA

(26,536

)

(6,902

)

(7,268

)

(3,491

)

Income from unconsolidated entities,

adjusted for Ventas’ share of EBITDA from unconsolidated

entities

108,330

24,368

21,178

30,539

Gain on real estate dispositions

(57,009

)

(6,727

)

(271

)

(39,802

)

Unrealized foreign currency (gain)

loss

(3,288

)

362

(3,687

)

(320

)

Loss (gain) on derivatives, net

14,742

21,173

1,489

(24,375

)

Significant disruptive events, net

8,229

2,603

2,104

(1,901

)

Reversal of allowance on loan investments

and impairment of unconsolidated entities, net of noncontrolling

interest

(167

)

—

(56

)

(73

)

Other normalizing items, net 1

25,856

7,446

—

2,750

Adjusted EBITDA

$

2,026,085

$

525,872

$

503,609

$

477,790

Adjustment for current period activity

122,705

15,885

4,888

1,035

Further Adjusted EBITDA

$

2,148,790

$

541,757

$

508,497

$

478,825

Further Adjusted EBITDA

annualized

$

2,148,790

$

2,167,028

$

2,033,988

$

1,915,300

Total debt

$

13,522,551

$

13,522,551

$

13,668,871

$

13,490,896

Cash and cash equivalents

(897,850

)

(897,850

)

(1,104,733

)

(508,794

)

Restricted cash pertaining to debt

(32,588

)

(32,588

)

(32,892

)

(29,019

)

Partners’ share of consolidated debt

(310,881

)

(310,881

)

(311,685

)

(297,480

)

Ventas’ share of unconsolidated debt

676,839

676,839

650,166

575,329

Net debt

$

12,958,071

$

12,958,071

$

12,869,727

$

13,230,932

Net debt / Further Adjusted

EBITDA

6.0 x

6.0 x

6.3 x

6.9 x

1

For the year ended December 31, 2024,

primarily related to shareholder relations matters and certain

legal matters.

The Company believes that Net debt and Adjusted Pro Forma EBITDA

are useful to investors, analysts and Company management because

they allow the comparison of the Company’s credit strength between

periods and to other real estate companies without the effect of

items that by their nature are not comparable from period to

period.

Adjusted EBITDA

The Company defines Adjusted EBITDA as consolidated earnings

before interest, taxes, depreciation and amortization (including

non-cash stock-based compensation expense, asset impairment and

valuation allowances), excluding (a) gains or losses on

extinguishment of debt; (b) transaction, transition and

restructuring costs; (c) noncontrolling interests’ share of

adjusted EBITDA; (d) net gains or losses on real estate activity;

(e) gains or losses on re-measurement of equity interest upon

acquisition; (f) unrealized foreign currency gains or losses; (g)

gains or losses on derivatives, net and changes in the fair value

of financial instruments; (h) net expenses or recoveries related to

significant disruptive events; and (i) non-cash charges related to

leases, and including (x) Ventas’ share of adjusted EBITDA from

unconsolidated entities and (y) the impact of other items set forth

in the Adjusted EBITDA reconciliation included herein.

Adjusted Pro Forma EBITDA

Adjusted Pro Forma EBITDA considers the pro forma effect on

Adjusted EBITDA of transactions and events that were completed

during the period, as if the transaction or event had been

consummated at the beginning of the relevant period and considers

any other incremental items set forth in the Adjusted Pro Forma

EBITDA reconciliation included herein.

The Company considers NOI and Cash NOI as important supplemental

measures because they allow investors, analysts and the Company’s

management to assess its unlevered property-level operating results

and to compare its operating results with those of other real

estate companies and between periods on a consistent basis.

NOI

The Company defines NOI as total revenues, less interest and

other income, property-level operating expenses and third-party

capital management expenses.

Cash NOI

The Company defines Cash NOI as NOI for its reportable business

segments (i.e., SHOP, OM&R and NNN), determined on a Constant

Currency basis, excluding the impact of, without duplication (i)

non-cash items such as straight-line rent and the amortization of

lease intangibles, (ii) sold assets, assets held for sale,

development properties not yet operational and land parcels and

(iii) other items set forth in the Cash NOI reconciliation included

herein. In certain cases, results may be adjusted to reflect the

receipt of cash payments, fees, and other consideration that is not

fully recognized as NOI in the period.

Same-Store

The Company defines same-store as properties owned, consolidated

and operational for the full period in both comparison periods and

that are not otherwise excluded; provided, however, that the

Company may include selected properties that otherwise meet the

same-store criteria if they are included in substantially all of,

but not a full, period for one or both of the comparison periods,

and in the Company’s judgment such inclusion provides a more

meaningful presentation of its segment performance.

Newly acquired development properties and recently developed or

redeveloped properties in the Company’s SHOP reportable business

segment will be included in same-store once they are stabilized for

the full period in both periods presented. These properties are

considered stabilized upon the earlier of (a) the achievement of

80% sustained occupancy or (b) 24 months from the date of

acquisition or substantial completion of work. Recently developed

or redeveloped properties in the Company’s OM&R and NNN

reportable business segments will be included in same-store once

substantial completion of work has occurred for the full period in

both periods presented. Our SHOP and NNN that have undergone

operator or business model transitions will be included in

same-store once operating under consistent operating structures for

the full period in both periods presented.

Properties are excluded from same-store if they are: (i) sold,

classified as held for sale or properties whose operations were

classified as discontinued operations in accordance with GAAP; (ii)

impacted by significant disruptive events such as flood or fire;

(iii) for SHOP, those properties that are currently undergoing a

significant disruptive redevelopment; (iv) for OM&R and NNN

reportable business segments, those properties for which management

has an intention to institute, or has instituted, a redevelopment

plan because the properties may require major property-level

expenditures to maximize value, increase NOI, or maintain a

market-competitive position and/or achieve property stabilization,

most commonly as the result of an expected or actual material

change in occupancy or NOI; or (v) for SHOP and NNN reportable

business segments, those properties that are scheduled to undergo

operator or business model transitions, or have transitioned

operators or business models after the start of the prior

comparison period.

Constant Currency

To eliminate the impact of exchange rate movements, all

portfolio performance-based disclosures assume constant exchange

rates across comparable periods, using the following methodology:

the current period’s results are shown in actual reported USD,

while prior comparison period’s results are adjusted and converted

to USD based on the average monthly exchange rate for the current

period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212205304/en/

BJ Grant (877) 4-VENTAS

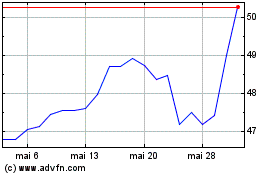

Ventas (NYSE:VTR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Ventas (NYSE:VTR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025