TTD BREAKING NEWS: The Trade Desk, Inc. 30% Stock Drop Triggers Securities Fraud Investigation; Investors are Urged to Contact BFA Law if they Suffered Losses

13 Fevereiro 2025 - 4:50PM

Business Wire

Leading securities law firm Bleichmar Fonti & Auld

LLP announces an investigation into The Trade Desk, Inc.

(NASDAQ: TTD) for potential violations of the federal securities

laws.

If you invested in Trade Desk, you are encouraged to obtain

additional information by visiting

https://www.bfalaw.com/cases-investigations/the-trade-desk-inc.

Why is Trade Desk being Investigated?

Trade Desk is an advertising technology company that offers ad

buyers the ability to create and manage data-driven digital

advertising campaigns across ad formats and channels. During the

relevant period, Trade Desk stated that it was seeing “massive

benefits” surrounding the launch of its next-generation platform,

Kokai, and that although it was “already seeing the results of

Kokai performance today,” it was “just getting started.”

In truth, when these statements were made, the rollout of Trade

Desk’s Kokai platform apparently faltered, contributing to Trade

Desk’s first revenue miss in 33 quarters.

The Stock Declines as the Truth is Revealed

On February 12, 2025, after market hours, Trade Desk reported

its fourth quarter 2024 financial results. The company reported

disappointing revenue of $741 million, well below its guidance of

“at least” $756 million in revenue. During the same-day earnings

call, the company admitted that “Kokai rolled out slower than we

anticipated” as the company was still “trying to understand what

the customer needs.” On this news, the price of Trade Desk stock

fell over 30% during the course of trading on February 13, 2025,

from a closing price of $122.23 per share on February 12, 2025.

Click here for more information:

https://www.bfalaw.com/cases-investigations/the-trade-desk-inc.

What Can You Do?

If you invested in Trade Desk you may have legal options and are

encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no

cost to you. Shareholders are not responsible for any court costs

or expenses of litigation. The firm will seek court approval for

any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/the-trade-desk-inc

Or contact: Ross Shikowitz ross@bfalaw.com 212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law

firm representing plaintiffs in securities class actions and

shareholder litigation. It was named among the Top 5 plaintiff law

firms by ISS SCAS in 2023 and its attorneys have been named Titans

of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson

Reuters. Among its recent notable successes, BFA recovered over

$900 million in value from Tesla, Inc.’s Board of Directors, as

well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit

https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/the-trade-desk-inc

Attorney advertising. Past results do not guarantee future

outcomes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213945727/en/

Ross Shikowitz ross@bfalaw.com 212-789-3619

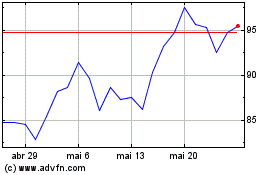

The Trade Desk (NASDAQ:TTD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

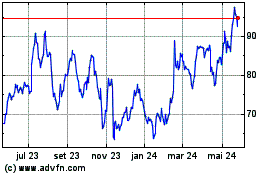

The Trade Desk (NASDAQ:TTD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025