2024 Net Revenue reached a record high of $1.41

billion

2024 Net Income up 34% to a strong $133

million

2024 Adjusted EBITDA increased 8% to a record

$358 million

Expects 2025 Net Revenue in the range of $1.470

billion to $1.485 billion and Adjusted EBITDA1 in the range of $345

million to $360 million

Yelp Inc. (NYSE: YELP), the company that connects people with

great local businesses, today posted its financial results for the

fourth quarter and full year ended Dec. 31, 2024 in the Q4 and Full

Year 2024 Shareholder Letter available on its Investor Relations

website at yelp-ir.com.

“Yelp's 2024 results reflect the strong execution on our

services roadmap,” said Jeremy Stoppelman, Yelp’s co-founder and

chief executive officer. “In the fourth quarter, we delivered our

15th consecutive quarter of double-digit year-over-year growth in

services revenue, contributing to Yelp's record net revenue and

strong profitability in the full year. Our product-led strategy

continued to drive the growth of our business. We introduced more

than 80 new features and updates as we leveraged AI to drive more

connections between consumers and service pros. Looking ahead, we

remain confident in the opportunities across services categories to

drive long-term profitable growth.”

“Services drove our business performance, with advertising

revenue from these categories up 11% year over year to a record

$879 million, offsetting a challenging environment for restaurant,

retail and other categories,” said David Schwarzbach, Yelp’s chief

financial officer. “We achieved strong overall profitability, while

decreasing our share count resulting in a 40% year-over-year

increase in diluted earnings per share. Our focus remains on

investing in our strategic initiatives to deliver shareholder value

over the long term.”

2024 Key Business Highlights

Yelp’s focus on its services roadmap drove 2024 results:

- Net revenue increased by 6% year over year to a record $1.41

billion, $13 million above the midpoint of the updated range Yelp

provided in November 2024 and $18 million below the midpoint of the

initial range we provided in February 2024.

- Net income increased by 34% year over year to $133 million,

representing a 9% net income margin.

- Adjusted EBITDA grew by 8% year over year to $358 million, $15

million above the midpoint of the updated range the company

provided in November 2024 and $33 million above the midpoint of the

initial range provided in February 2024, representing a 25%

adjusted EBITDA margin.

- In Services, advertising revenue increased 11% year over year

to a record $879 million.

- Advertising revenue from Restaurants, Retail & Other

(RR&O) businesses decreased by 3% year over year to $470

million.

- With a decrease in RR&O paying advertising locations

offsetting growth in Services paying advertising locations, total

paying advertising locations for the year decreased by 5%, while

average revenue per location reached an annual record.

- Ad clicks for the year increased by 6%, while average

cost-per-click was flat, in each case driven by improvements to our

advertising technology and, to a lesser extent, our acquisition of

Services projects through paid search.

- On the consumer side of our business, Yelp continued to grow

our trusted review content through contributions from our large

user base. Yelp users contributed 21 million new reviews in 2024,

resulting in 308 million cumulative reviews, up 7% from the prior

year.

Outlook

The company expects 2025 Net Revenue will be in the range of

$1.470 billion to $1.485 billion as Yelp continues working to

deliver the leading product experience in Services for consumers

and service pros. The company also expects 2025 Adjusted EBITDA1

will be in the range of $345 million to $360 million.

Quarterly Conference Call

Yelp will host a live webcast today at 2 p.m. Pacific Time to

discuss the fourth quarter and full year 2024 financial results and

outlook for the first quarter and full year 2025. The webcast of

the Q&A can be accessed on the Yelp Investor Relations website

at yelp-ir.com. A replay of the webcast will be available at the

same website.

About Yelp

Yelp Inc. (yelp.com) is a community-driven platform that

connects people with great local businesses. Millions of people

rely on Yelp for useful and trusted local business information,

reviews and photos to help inform their spending decisions. As a

one-stop local platform, Yelp helps consumers easily discover,

connect and transact with businesses across a broad range of

categories by making it easy to request a quote for a service, book

a table at a restaurant, and more. Yelp was founded in San

Francisco in 2004.

Yelp intends to make future announcements of material financial

and other information through its Investor Relations website. Yelp

will also, from time to time, disclose this information through

press releases, filings with the Securities and Exchange

Commission, conference calls, or webcasts, as required by

applicable law.

Forward Looking Statements

This press release contains forward-looking statements relating

to, among other things, Yelp’s future performance, including its

expected financial results for 2025, and its ability to drive

shareholder value over the long term, that are based on its current

expectations, forecasts and assumptions that involve risks and

uncertainties.

Yelp’s actual results could differ materially from those

predicted or implied and reported results should not be considered

as an indication of future performance. Factors that could cause or

contribute to such differences include, but are not limited to:

- macroeconomic uncertainty — including related to inflation,

interest rates, tariffs, labor and supply chain issues, as well as

severe weather events and the prevalence of seasonal respiratory

illnesses — and its effect on consumer behavior, user activity and

advertiser spending;

- Yelp’s ability to maintain and expand its base of advertisers,

particularly if advertiser turnover substantially worsens and/or

consumer demand significantly degrades;

- Yelp’s ability to drive continued growth through its strategic

initiatives;

- Yelp’s ability to continue to operate effectively with a

primarily remote work force and attract and retain key talent;

- Yelp’s limited operating history in an evolving industry;

and

- Yelp’s ability to generate and maintain sufficient high-quality

content from its users.

Factors that could cause or contribute to such differences also

include, but are not limited to, those factors that could affect

Yelp’s business, operating results and stock price included under

the captions “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in

Yelp’s most recent Annual Report on Form 10-K or Quarterly Report

on Form 10-Q at yelp-ir.com or the SEC’s website at sec.gov.

_______________________________

1 Yelp has not reconciled its Adjusted EBITDA outlook to GAAP

Net income (loss) because it does not provide an outlook for GAAP

Net income (loss) due to the uncertainty and potential variability

of Other income, net and Provision for (benefit from) income taxes,

which are reconciling items between Adjusted EBITDA and GAAP Net

income (loss). Because Yelp cannot reasonably predict such items, a

reconciliation of the non-GAAP financial measure outlook to the

corresponding GAAP measure is not available without unreasonable

effort. We caution, however, that such items could have a

significant impact on the calculation of GAAP Net income (loss).

For more information regarding the non-GAAP financial measures

discussed in this release, please see “Non-GAAP Financial Measures”

below.

YELP INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

December 31,

2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

217,325

$

313,911

Short-term marketable securities

100,581

127,485

Accounts receivable, net

155,325

146,147

Prepaid expenses and other current

assets

43,648

36,673

Total current assets

516,879

624,216

Property, equipment and software, net

75,669

68,684

Operating lease right-of-use assets

24,112

48,573

Goodwill

130,980

103,886

Intangibles, net

58,787

7,638

Other non-current assets

177,140

161,726

Total assets

$

983,567

$

1,014,723

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

131,322

$

132,809

Operating lease liabilities — current

20,679

39,234

Deferred revenue

2,973

3,821

Total current liabilities

154,974

175,864

Operating lease liabilities —

long-term

22,470

48,065

Other long-term liabilities

62,154

41,260

Total liabilities

239,598

265,189

Stockholders’ equity:

Common stock

—

—

Additional paid-in capital

1,903,598

1,786,667

Treasury stock

(3,909

)

(282

)

Accumulated other comprehensive loss

(15,431

)

(12,202

)

Accumulated deficit

(1,140,289

)

(1,024,649

)

Total stockholders’ equity

743,969

749,534

Total liabilities and stockholders’

equity

$

983,567

$

1,014,723

YELP INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Net revenue

$

361,952

$

342,376

$

1,412,064

$

1,337,062

Costs and expenses:

Cost of revenue(1)

33,270

29,616

123,684

114,229

Sales and marketing(1)

143,263

132,297

585,978

556,605

Product development(1)

74,937

78,323

325,992

332,570

General and administrative(1)

45,487

66,822

184,958

212,431

Depreciation and amortization

11,566

10,303

40,407

42,184

Total costs and expenses

308,523

317,361

1,261,019

1,258,019

Income from operations

53,429

25,015

151,045

79,043

Other income, net

6,638

8,775

31,915

26,039

Income before income taxes

60,067

33,790

182,960

105,082

Provision for income taxes

17,847

6,384

50,110

5,909

Net income attributable to common

stockholders

$

42,220

$

27,406

$

132,850

$

99,173

Net income per share attributable to

common stockholders

Basic

$

0.64

$

0.40

$

1.97

$

1.43

Diluted

$

0.62

$

0.37

$

1.88

$

1.35

Weighted-average shares used to compute

net income per share attributable to common stockholders

Basic

66,083

68,790

67,415

69,221

Diluted

67,989

73,159

70,611

73,596

(1) Includes stock-based compensation

expense as follows:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Cost of revenue

$

1,110

$

1,248

$

5,209

$

5,274

Sales and marketing

7,531

8,266

33,436

35,187

Product development

18,436

22,627

85,510

97,515

General and administrative

7,720

8,006

34,038

35,475

Total stock-based compensation

$

34,797

$

40,147

$

158,193

$

173,451

YELP INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Year Ended December

31,

2024

2023

Operating Activities

Net income

$

132,850

$

99,173

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

40,407

42,184

Provision for doubtful accounts

45,614

40,702

Stock-based compensation

158,193

173,451

Amortization of right-of-use assets

15,094

28,084

Deferred income taxes

(24,920

)

(22,150

)

Amortization of deferred contract cost

24,854

24,035

Asset impairment

5,914

23,563

Other adjustments, net

(2,412

)

(410

)

Changes in operating assets and

liabilities:

Accounts receivable

(51,033

)

(54,947

)

Prepaid expenses and other assets

(24,314

)

(5,123

)

Operating lease liabilities

(39,230

)

(39,734

)

Accounts payable, accrued liabilities and

other liabilities

4,798

(2,548

)

Net cash provided by operating

activities

285,815

306,280

Investing Activities

Purchases of marketable securities —

available-for-sale

(94,304

)

(148,448

)

Sales and maturities of marketable

securities — available-for-sale

123,094

117,916

Purchases of other investments

(2,500

)

—

Maturities of other investments

—

2,500

Acquisition, net of cash received

(66,199

)

—

Purchases of property, equipment and

software

(37,347

)

(26,847

)

Other investing activities

(10

)

195

Net cash used in investing activities

(77,266

)

(54,684

)

Financing Activities

Proceeds from issuance of common stock for

employee stock-based plans

20,790

39,510

Taxes paid related to the net share

settlement of equity awards

(73,411

)

(85,180

)

Repurchases of common stock, including

excise tax

(251,181

)

(199,999

)

Payment of issuance costs for credit

facility

—

(1,109

)

Net cash used in financing activities

(303,802

)

(246,778

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(1,067

)

2,046

Change in cash, cash equivalents and

restricted cash

(96,320

)

6,864

Cash, cash equivalents and restricted cash

— Beginning of period

314,002

307,138

Cash, cash equivalents and restricted cash

— End of period

$

217,682

$

314,002

Non-GAAP Financial Measures

This press release and statements made during the above

referenced webcast may include information relating to Adjusted

EBITDA, Adjusted EBITDA margin and Free cash flow, each of which

the Securities and Exchange Commission has defined as a “non-GAAP

financial measure.”

We define Adjusted EBITDA as net income (loss), adjusted to

exclude: provision for (benefit from) income taxes; other income,

net; depreciation and amortization; stock-based compensation

expense; and, in certain periods, certain other income and expense

items, such as material litigation settlements, impairment charges,

acquisition and integration costs and fees related to shareholder

activism that we deem not to be indicative of our ongoing operating

performance. We define Adjusted EBITDA margin as Adjusted EBITDA

divided by net revenue. We define Free cash flow as net cash

provided by (used in) operating activities, less cash used for

purchases of property, equipment and software.

Adjusted EBITDA and Free cash flow, which are not prepared under

any comprehensive set of accounting rules or principles, have

limitations as analytical tools and you should not consider them in

isolation or as substitutes for analysis of Yelp’s financial

results as reported in accordance with generally accepted

accounting principles in the United States (“GAAP”). In particular,

Adjusted EBITDA and Free cash flow should not be viewed as

substitutes for, or superior to, net income (loss) or net cash

provided by (used in) operating activities prepared in accordance

with GAAP as measures of profitability or liquidity. Some of these

limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and Adjusted EBITDA does not reflect all cash

capital expenditure requirements for such replacements or for new

capital expenditure requirements;

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, Yelp’s working capital needs;

- Adjusted EBITDA does not reflect the impact of the recording or

release of valuation allowances or tax payments that may represent

a reduction in cash available to Yelp;

- Adjusted EBITDA does not consider the potentially dilutive

impact of equity-based compensation;

- Adjusted EBITDA does not take into account any income or costs

that management determines are not indicative of ongoing operating

performance, such as material litigation settlements, impairment

charges, acquisition and integration costs and fees related to

shareholder activism;

- Free cash flow does not represent the total residual cash flow

available for discretionary purposes because it does not reflect

our contractual commitments or obligations; and

- other companies, including those in Yelp’s industry, may

calculate Adjusted EBITDA and Free cash flow differently, which

reduces their usefulness as comparative measures.

Because of these limitations, you should consider Adjusted

EBITDA, Adjusted EBITDA margin and Free cash flow alongside other

financial performance measures, including net income (loss), net

cash provided by (used in) operating activities and Yelp’s other

GAAP results.

The following is a reconciliation of net income to Adjusted

EBITDA, as well as the calculation of net income margin and

Adjusted EBITDA margin, for each of the periods indicated (in

thousands, except percentages; unaudited):

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of Net Income to

Adjusted EBITDA:

Net income

$

42,220

$

27,406

$

132,850

$

99,173

Provision for income taxes

17,847

6,384

50,110

5,909

Other income, net(1)

(6,638

)

(8,775

)

(31,915

)

(26,039

)

Depreciation and amortization

11,566

10,303

40,407

42,184

Stock-based compensation

34,797

40,147

158,193

173,451

Litigation settlement(2)(3)

—

—

—

11,000

Asset impairment(2)

—

20,008

5,914

23,563

Acquisition and integration costs(2)

1,266

—

1,266

—

Fees related to shareholder

activism(2)

—

581

1,168

1,252

Adjusted EBITDA

$

101,058

$

96,054

$

357,993

$

330,493

Net revenue

$

361,952

$

342,376

$

1,412,064

$

1,337,062

Net income margin

12

%

8

%

9

%

7

%

Adjusted EBITDA margin

28

%

28

%

25

%

25

%

(1)

Includes the release of a $3.1 million

reserve related to a one-time payroll tax credit in the year ended

December 31, 2024.

(2)

Recorded within general and administrative

expenses on our Condensed Consolidated Statements of

Operations.

(3)

Represents the loss contingency recorded

in connection with the settlement of a putative class action

lawsuit asserting claims under the California Invasion of Privacy

Act. For additional information, see our most recently filed

Quarterly Report on Form 10-Q.

The following is a reconciliation of net cash provided by

operating activities to Free cash flow for each of the periods

indicated (in thousands; unaudited):

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of Net Cash Provided by

Operating Activities to Free Cash Flow:

Net cash provided by operating

activities

$

70,973

$

79,170

$

285,815

$

306,280

Purchases of property, equipment and

software

(11,010

)

(5,997

)

(37,347

)

(26,847

)

Free cash flow

$

59,963

$

73,173

$

248,468

$

279,433

Net cash used in investing activities

$

(42,826

)

$

(8,219

)

$

(77,266

)

$

(54,684

)

Net cash used in financing activities

$

(70,795

)

$

(63,546

)

$

(303,802

)

$

(246,778

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213220518/en/

Investor Relations Contact: Kate Krieger ir@yelp.com

Press Contact: Amber Albrecht press@yelp.com

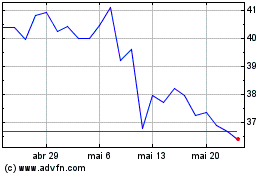

Yelp (NYSE:YELP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Yelp (NYSE:YELP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025