Arista Networks, Inc. (NYSE: ANET), an industry leader in

data-driven, client-to-cloud networking for large AI, data center,

campus and routing environments, today announced financial results

for its fourth quarter and the full year ended December 31,

2024.

"2024 was a remarkable year of momentum resulting in a record $7

billion in revenue," stated Jayshree Ullal, Chairperson and CEO for

Arista Networks. "I am so proud of the team's execution in

delivering the ultimate combination of superior growth and

profitability. We continued to innovate for our customers with

best-of-breed platforms enabling AI for networking and networking

for AI."

Full Year Financial Highlights

- Revenue of $7.003 billion, an increase of 19.5% compared to

fiscal year 2023.

- GAAP gross margin of 64.1%, compared to GAAP gross margin of

61.9% in fiscal year 2023.

- Non-GAAP gross margin of 64.6%, compared to non-GAAP gross

margin of 62.6% in fiscal year 2023.

- GAAP net income of $2.852 billion, or $2.23 per diluted share,

compared to GAAP net income of $2.087 billion, or $1.65 per diluted

share, in fiscal year 2023.

- Non-GAAP net income of $2.910 billion or $2.27 per diluted

share, compared to non-GAAP net income of $2.199 billion or $1.73

per diluted share, in fiscal year 2023.

Fourth Quarter Financial Highlights

- Revenue of $1.930 billion, an increase of 6.6% compared to the

third quarter of 2024, and an increase of 25.3% from the fourth

quarter of 2023.

- GAAP gross margin of 63.8%, compared to GAAP gross margin of

64.2% in the third quarter of 2024 and 64.9% in the fourth quarter

of 2023.

- Non-GAAP gross margin of 64.2%, compared to non-GAAP gross

margin of 64.6% in the third quarter of 2024 and 65.4% in the

fourth quarter of 2023.

- GAAP net income of $801.0 million, or $0.62 per diluted share,

compared to GAAP net income of $613.6 million, or $0.48 per diluted

share, in the fourth quarter of 2023.

- Non-GAAP net income of $830.1 million, or $0.65 per diluted

share, compared to non-GAAP net income of $664.3 million, or $0.52

per diluted share, in the fourth quarter of 2023.

Commenting on the company's financial results, Chantelle

Breithaupt, Arista’s CFO said, "We delivered exceptional financial

performance in Q4, exceeding our guidance on all key metrics. These

results generated over 95% year-over-year growth in operating cash

flow for the quarter, allowing us to continue to invest in

strategic initiatives such as the AI and Campus markets. Our strong

balance sheet and robust cash position allow us to navigate

economic uncertainties while continuing to invest in our long-term

growth.”

Fourth Quarter Company Highlights

- Meta and Arista Build AI at Scale – Arista shared

that Meta has deployed the Arista 7700R4 Distributed Etherlink™

Switch (DES) for its latest Ethernet-based AI cluster.

- Arista Unveiled Modern Stacking for Campus Networks –

Arista introduced the Switch Aggregation Group (SWAG™) capability

in Arista EOS® that uses industry-standard Ethernet to group and

manage individual switches via a single IP address. In addition,

Arista CloudVision® Leaf Spine Stack (LSS™) Management allows

operators to collectively manage a logical stack of switches within

a single networking closet or across the entire campus.

- Arizona State University (ASU) Announced the Partnership

with Arista for its Refugee Program - In October 2024, a group

of eight students that joined ASU as part of the Afghan Refugee

Program completed the Technical Upskilling Program, co-created by

ASU Enterprise Technology and Arista.

- Arista Networks Completed a Four-for-One Stock Split -

Arista announced a four-for-one forward stock split that was

affected through the filing of an amendment to the Company’s

Amended and Restated Certificate of Incorporation on December 3,

2024, upon which date each Arista shareholder received an

additional three shares of Arista common stock. Trading began on a

split-adjusted basis on December 4, 2024.

Full Year Company Highlights

- Arista Unveils Etherlink AI Networking Platforms –

Arista announced the Etherlink AI platforms, which support AI

cluster sizes ranging from thousands to hundreds of thousands of

XPUs with highly efficient one- and two-tier network topologies,

offering superior application performance compared to multi-tier

networks.

- Arista Delivers Holistic AI Solutions in Collaboration with

NVIDIA – Arista, in collaboration with NVIDIA, showcased its

Arista EOS AI Agent, designed to align compute and network domains

as a single-managed AI entity and thus help lower job completion

times.

- Arista Launched Wi-Fi 7 Access Points - The Arista C-460

is designed to help enterprises address the challenges of rapidly

increasing bandwidth requirements, including AR/VR (augmented

reality/virtual reality) applications, streaming multimedia, IoT

proliferation, video applications and high-density

deployments.

- Arista Launches Next Generation Multi-Domain Segmentation

for Zero Trust Networking – Arista announced updates to its

Arista MSSⓇ (Multi-Domain Segmentation Service) offerings, designed

to restrict lateral movement in campus and data center networks

without the need for endpoint agents.

- Arista Introduces Universal Network Observability –

Arista launched CloudVision Universal Network Observability™ (CV

UNO™) to automate network, systems, and application/workload

visibility and provide AI-driven proactive analysis and

prescriptive recommendations.

- Alabama Fiber Network Selects Arista Networks for Statewide

Middle-Mile Initiative - Arista announced that the

Alabama Fiber Network (AFN) selected Arista as its routing and

switching equipment provider to help deliver affordable,

high-capacity, and reliable internet access in underserved rural

areas.

- Arista Celebrated the 20th Anniversary of the Company and

the 10th Anniversary of its IPO – In that time, Arista has

achieved milestones such as over 10,000 customers and 100 million

ports installed globally and attained the #1 market share in data

center switching.

Financial Outlook

For the first quarter of 2025, we expect:

- Revenue between $1.93 billion to $1.97 billion;

- Non-GAAP gross margin of approximately 63%; and

- Non-GAAP operating margin of approximately 44%.

Guidance for non-GAAP financial measures excludes certain items,

including stock-based compensation expense, intangible asset

amortization, and potential non-recurring charges or benefits. A

reconciliation of non-GAAP guidance measures to corresponding GAAP

measures is not available on a forward-looking basis without

unreasonable effort because these exclusions can be uncertain or

difficult to predict, including stock-based compensation expense

which is impacted by the timing of employee stock transactions, the

company’s future hiring and retention needs and the future fair

market value of the company’s common stock. The actual amount of

these exclusions will have a significant impact on the company’s

GAAP gross margin and GAAP operating margin.

Prepared Materials and Conference Call Information

Arista's executives will discuss the fourth quarter and year end

2024 financial results on a conference call at 1:30 p.m. Pacific

time today. To listen to the call via telephone, dial (888)

330-2502 in the United States or +1 (240) 789-2713 from

international locations. The Conference ID is 5655862.

The financial results conference call will also be available via

live webcast on Arista's investor relations website at

https://investors.arista.com/. Shortly after the conclusion of the

conference call, a replay of the audio webcast will be available on

Arista’s investor relations website.

Forward-Looking Statements

This press release contains “forward-looking statements”

regarding our future performance, including quotations from

management, statements in the section entitled “Financial Outlook,”

such as estimates regarding revenue, non-GAAP gross margin and

non-GAAP operating margin for the first quarter of 2025, statements

regarding the benefits of Arista's products, and statements

regarding Arista's ability to navigate economic uncertainties while

continuing to invest in our long-term growth. Forward-looking

statements are subject to known and unknown risks, uncertainties,

assumptions and other factors that could cause actual results,

performance or achievements to differ materially from those

anticipated in or implied by the forward-looking statements

including risks associated with: large purchases by a limited

number of customers who represent a substantial portion of our

revenue; adverse economic and geopolitical conditions and

conflicts, continuing uncertain economic conditions or reduced

information technology and network infrastructure spending; the

impact of sole or limited sources of supply, supply shortages and

extended lead times or supply changes; volatility in our revenue

growth rate; variations in our results of operations; the rapid

evolution of the networking market; failure to successfully carry

out new products and service offerings and expand into adjacent

markets; variability in our gross margins; intense competition and

industry consolidation; expansion of our international sales and

operations; investments in or acquisitions of other businesses;

seasonality and industry cyclicality; fluctuations in currency

exchange rates; failure to raise additional capital on favorable

terms; our inability to attract new large customers or sell

additional products and services to our existing customers;

inability to grow sales of switches which generate most of our

product revenue; large customers requiring more favorable terms;

inability to increase market awareness or acceptance of our new

products and services; decreases in the sales prices of our

products and services; long and unpredictable sales cycles;

inability to offer high quality support and services; declines in

maintenance renewals by customers; product quality problems;

failure to anticipate technological shifts; the complexity of

managing the supply of our products and product components; our

dependence on third-party manufacturers to build our products;

assertions by third parties of intellectual property rights

infringement; failure or inability to protect or assert our

intellectual property rights; defects, errors or vulnerabilities in

our products, the failure of our products to detect security

breaches or incidents, the misuse of our products or the risks or

product liability; breaches of our cybersecurity systems, or other

security or privacy breaches or incidents; enhanced U.S. tax,

tariff, import/export restrictions, Chinese regulations or other

trade barriers; failure to comply with government law and

regulations; issues in the development and use of artificial

intelligence, combined with an uncertain regulatory environment;

and other future events. Additional risks and uncertainties that

could affect us can be found in our most recent filings with the

Securities and Exchange Commission including, but not limited to,

our annual report on Form 10-K and quarterly reports on Form 10-Q.

You can locate these reports through our website at

https://investors.arista.com/ and on the SEC’s website at

https://www.sec.gov/. All forward-looking statements in this press

release are based on information available to the company as of the

date hereof and we disclaim any obligation to publicly update or

revise any forward-looking statement to reflect events that occur

or circumstances that exist after the date on which they were

made.

Non-GAAP Financial Measures

This press release and accompanying table contain certain

non-GAAP financial measures including non-GAAP gross profit,

non-GAAP gross margin, non-GAAP income from operations, non-GAAP

operating margin, non-GAAP net income and non-GAAP diluted net

income per share. These non-GAAP financial measures exclude

stock-based compensation expense, intangible asset amortization,

expenses related to legal settlement, gains/losses on strategic

investments, and the income tax effect of these non-GAAP

exclusions. In addition, non-GAAP financial measures exclude net

tax benefits associated with stock-based awards, which include

excess tax benefits, and other discrete indirect effects of such

awards. The company uses these non-GAAP financial measures

internally in analyzing its financial results and believes that

these non-GAAP financial measures are useful to investors as an

additional tool to evaluate ongoing operating results and trends.

In addition, these measures are the primary indicators management

uses as a basis for its planning and forecasting for future

periods.

Non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for the comparable GAAP financial

measures. Non-GAAP financial measures are subject to limitations,

and should be read only in conjunction with the company's

consolidated financial statements prepared in accordance with GAAP.

Non-GAAP financial measures do not have any standardized meaning

and are therefore unlikely to be comparable to similarly titled

measures presented by other companies. A description of these

non-GAAP financial measures and a reconciliation of the company’s

non-GAAP financial measures to their most directly comparable GAAP

measures have been provided in the financial statement tables

included in this press release, and investors are encouraged to

review the reconciliation.

About Arista Networks

Arista Networks is an industry leader in data-driven,

client-to-cloud networking for large AI, data center, campus and

routing environments. Its award-winning platforms deliver

availability, agility, automation, analytics, and security through

an advanced network operating stack. For more information, visit

www.arista.com.

ARISTA, CloudVision and Etherlink are among the registered and

unregistered trademarks of Arista Networks, Inc. in jurisdictions

around the world. Other company names or product names may be

trademarks of their respective owners.

ARISTA NETWORKS, INC.

Condensed Consolidated

Statements of Income

(Unaudited, in thousands,

except per share amounts)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Revenue:

Product

$

1,608,098

$

1,310,314

$

5,884,021

$

5,029,493

Service

322,338

230,123

1,119,125

830,675

Total revenue

1,930,436

1,540,437

7,003,146

5,860,168

Cost of revenue:

Product

643,648

495,826

2,299,063

2,061,167

Service

55,794

45,385

212,780

168,720

Total cost of revenue

699,442

541,211

2,511,843

2,229,887

Total gross profit

1,230,994

999,226

4,491,303

3,630,281

Operating expenses:

Research and development

285,016

211,481

996,717

854,918

Sales and marketing

110,949

105,538

427,264

399,034

General and administrative

35,377

42,293

122,706

119,080

Total operating expenses

431,342

359,312

1,546,687

1,373,032

Income from operations

799,652

639,914

2,944,616

2,257,249

Other income, net

89,275

54,477

320,418

164,777

Income before income taxes

888,927

694,391

3,265,034

2,422,026

Provision for income taxes

87,931

80,755

412,980

334,705

Net income

$

800,996

$

613,636

$

2,852,054

$

2,087,321

Earnings per share (1):

Basic

$

0.64

$

0.49

$

2.27

$

1.69

Diluted

$

0.62

$

0.48

$

2.23

$

1.65

Weighted-average common shares

outstanding(1):

Basic

1,260,309

1,246,446

1,256,303

1,237,417

Diluted

1,283,370

1,275,380

1,281,077

1,268,538

______________________

(1)

Prior period results have been adjusted to

reflect the four-for-one stock split effected in December 2024.

ARISTA NETWORKS, INC.

Reconciliation of Selected

GAAP to Non-GAAP Financial Measures

(Unaudited, in thousands,

except percentages and per share amounts)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP gross profit

$

1,230,994

$

999,226

$

4,491,303

$

3,630,281

GAAP gross margin

63.8

%

64.9

%

64.1

%

61.9

%

Stock-based compensation expense

4,255

3,273

15,786

12,789

Intangible asset amortization

4,195

4,195

16,780

23,457

Non-GAAP gross profit

$

1,239,444

$

1,006,694

$

4,523,869

$

3,666,527

Non-GAAP gross margin

64.2

%

65.4

%

64.6

%

62.6

%

GAAP income from operations

$

799,652

$

639,914

$

2,944,616

$

2,257,249

GAAP operating margin

41.4

%

41.5

%

42.0

%

38.5

%

Stock-based compensation expense

100,734

81,358

355,364

296,756

Intangible asset amortization

6,690

6,690

26,760

33,437

Legal settlement (1)

—

16,000

—

16,000

Non-GAAP income from operations

$

907,076

$

743,962

$

3,326,740

$

2,603,442

Non-GAAP operating margin

47.0

%

48.3

%

47.5

%

44.4

%

GAAP net income

$

800,996

$

613,636

$

2,852,054

$

2,087,321

Stock-based compensation expense

100,734

81,358

355,364

296,756

Intangible asset amortization

6,690

6,690

26,760

33,437

Gain on strategic investments

—

—

(12,400

)

(18,699

)

Tax benefit on stock-based awards

(61,583

)

(40,561

)

(254,662

)

(174,122

)

Income tax effect on non-GAAP

exclusions

(16,730

)

(12,795

)

(57,594

)

(41,283

)

Legal settlement (1)

—

16,000

—

16,000

Non-GAAP net income

$

830,107

$

664,328

$

2,909,522

$

2,199,410

GAAP diluted net income per share (2)

$

0.62

$

0.48

$

2.23

$

1.65

Non-GAAP adjustments to net income(2)

0.03

0.04

0.04

0.08

Non-GAAP diluted net income per

share(2)

$

0.65

$

0.52

$

2.27

$

1.73

Weighted-average shares used in computing

diluted net income per share(2)

1,283,370

1,275,380

1,281,077

1,268,538

Summary of Stock-Based Compensation

Expense:

Cost of revenue

$

4,255

$

3,273

$

15,786

$

12,789

Research and development

58,910

46,506

211,807

172,177

Sales and marketing

22,132

19,613

78,762

71,074

General and administrative

15,437

11,966

49,009

40,716

Total

$

100,734

$

81,358

$

355,364

$

296,756

___________________

(1)

In the quarter ended December 31, 2023, we

agreed to pay $16 million to settle an intellectual property

dispute and we recorded this amount to general and administrative

expenses.

(2)

Prior period results have been adjusted to

reflect the four-for-one stock split effected in December 2024.

ARISTA NETWORKS, INC.

Condensed Consolidated Balance

Sheets

(Unaudited, in

thousands)

December 31, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

2,762,357

$

1,938,606

Marketable securities

5,541,116

3,069,362

Accounts receivable, net

1,140,478

1,034,398

Inventories

1,834,572

1,945,180

Prepaid expenses and other current

assets

632,292

412,518

Total current assets

11,910,815

8,400,064

Property and equipment, net

98,845

101,580

Goodwill and acquisition-related

intangible assets, net

330,540

357,299

Deferred tax assets

1,440,418

945,792

Other assets

263,303

151,900

TOTAL ASSETS

$

14,043,921

$

9,956,635

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

381,083

$

435,059

Accrued liabilities

435,277

407,302

Deferred revenue

1,727,280

915,204

Other current liabilities

188,582

161,870

Total current liabilities

2,732,222

1,919,435

Deferred revenue, non-current

1,064,135

591,000

Other long-term liabilities

252,757

227,141

TOTAL LIABILITIES

4,049,114

2,737,576

STOCKHOLDERS’ EQUITY:

Common stock (1)

126

125

Additional paid-in capital (1)

2,465,409

2,108,237

Retained earnings

7,542,460

5,114,025

Accumulated other comprehensive income

(loss)

(13,188

)

(3,328

)

TOTAL STOCKHOLDERS’ EQUITY

9,994,807

7,219,059

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

14,043,921

$

9,956,635

______________________

(1)

Prior period results have been adjusted to

reflect the four-for-one stock split effected in December 2024.

ARISTA NETWORKS, INC.

Condensed Consolidated

Statements of Cash Flows

(Unaudited, in

thousands)

Twelve Months Ended December

31,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

2,852,054

$

2,087,321

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

62,038

70,630

Stock-based compensation

355,364

296,756

Deferred income taxes

(492,874

)

(370,796

)

Amortization (accretion) of investment

premiums (discount)

(60,468

)

(33,518

)

Other

6,939

(463

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(106,080

)

(105,927

)

Inventories

110,608

(655,474

)

Other assets

(234,242

)

(66,401

)

Accounts payable

(51,635

)

198,612

Other liabilities

47,823

128,148

Deferred revenue

1,285,211

464,958

Income taxes, net

(66,503

)

20,168

Net cash provided by operating

activities

3,708,235

2,034,014

CASH FLOWS FROM INVESTING

ACTIVITIES:

Proceeds from maturities of marketable

securities

2,058,588

1,887,939

Proceeds from sale of marketable

securities

48,845

67,284

Purchases of marketable securities

(4,526,127

)

(2,606,878

)

Purchases of property, equipment and

intangible assets

(32,032

)

(34,434

)

Other Investing activities

(6,628

)

(1,365

)

Net cash used in investing activities

(2,457,354

)

(687,454

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from issuance of common stock

under equity plans

60,181

62,093

Tax withholding paid on behalf of

employees for net share settlement

(58,372

)

(33,563

)

Repurchase of common stock

(423,619

)

(112,279

)

Net cash used in financing activities

(421,810

)

(83,749

)

Effect of exchange rate changes

(4,767

)

675

NET INCREASE IN CASH, CASH EQUIVALENTS AND

RESTRICTED CASH

824,304

1,263,486

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

—Beginning of period

1,939,464

675,978

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

—End of period

$

2,763,768

$

1,939,464

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218933295/en/

Investor Contacts:

Arista Networks, Inc.

Investor Advocacy Rudolph Araujo Rod Hall +1 (408)

547-8080 ir@arista.com

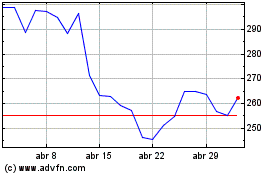

Arista Networks (NYSE:ANET)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Arista Networks (NYSE:ANET)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025