Kinder Morgan Closes on $640 Million Acquisition of a Natural Gas Gathering and Processing System From Outrigger Energy II

18 Fevereiro 2025 - 6:05PM

Business Wire

Acquired assets complementary to existing

Hiland gas assets in the Bakken

Kinder Morgan, Inc. (NYSE: KMI) today announced that its

subsidiary, Hiland Partners Holdings LLC, closed on its previously

announced $640 million acquisition of a natural gas gathering and

processing system in North Dakota from Outrigger Energy II LLC. The

acquisition includes a 270 million cubic feet per day (MMcf/d)

processing facility and a 104-mile, large-diameter, high-pressure

rich gas gathering header pipeline with 350 MMcf/d of capacity

connecting supplies from the Williston Basin area to high-demand

markets. The gathering and processing system is backed by long-term

contracts with commitments from major customers in the basin.

“We are pleased to have completed this strategic acquisition and

to start integrating these assets with our existing Hiland gas

footprint,” said KMI Natural Gas Midstream President Tom Dender.

“This acquisition expands our transportation and processing

services, allowing us to meet the growing needs of our

customers.”

KMI expects the acquisition to be immediately accretive to its

shareholders, with a 2025 Adjusted EBITDA multiple of approximately

8 times on a full-year basis. Adjusted EBITDA does not include

approximately $20 million of expected cash payments in 2025 that

receive deferred revenue recognition. With this transaction, KMI

expects to reduce future capital expenditures needed to accommodate

the growth of its existing Bakken customers.

About Kinder Morgan,

Inc.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy

infrastructure companies in North America. Access to reliable,

affordable energy is a critical component for improving lives

around the world. We are committed to providing energy

transportation and storage services in a safe, efficient and

environmentally responsible manner for the benefit of the people,

communities and businesses we serve. We own an interest in or

operate approximately 79,000 miles of pipelines, 139 terminals, 702

Bcf of working natural gas storage capacity and have renewable

natural gas generation capacity of approximately 6.1 Bcf per year

with an additional 0.8 Bcf in development. Our pipelines transport

natural gas, refined petroleum products, crude oil, condensate,

CO2, renewable fuels and other products, and our terminals store

and handle various commodities including gasoline, diesel fuel, jet

fuel, chemicals, metals, petroleum coke, and ethanol and other

renewable fuels and feedstocks. Learn more about our work advancing

energy solutions on the lower carbon initiatives page at

www.kindermorgan.com.

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities Exchange Act of 1934.

Generally, the words “expects,” “believes,” anticipates,” “plans,”

“will,” “shall,” “estimates,” and similar expressions identify

forward-looking statements, which are generally not historical in

nature. Forward-looking statements in this news release include

express or implied statements concerning the transaction, including

the extent and timing of anticipated benefits to KMI’s business and

stockholders. Forward-looking statements are subject to risks and

uncertainties and are based on the beliefs and assumptions of

management, based on information currently available to them.

Although KMI believes that these forward-looking statements are

based on reasonable assumptions, it can give no assurance as to

when or if any such forward-looking statements will materialize nor

their ultimate impact on our operations or financial condition.

Important factors that could cause actual results to differ

materially from those expressed in or implied by these

forward-looking statements, the timing and extent of changes in the

supply of and demand for the products we transport and handle, and

the other risks and uncertainties described in KMI’s reports filed

with the Securities and Exchange Commission (SEC), including its

Annual Report on Form 10-K for the year-ended December 31, 2024

(under the headings “Risk Factors” and “Information Regarding

Forward-Looking Statements” and elsewhere) and its subsequent

reports, which are available through the SEC’s EDGAR system at

www.sec.gov and on our website at ir.kindermorgan.com.

Forward-looking statements speak only as of the date they were

made, and except to the extent required by law, KMI undertakes no

obligation to update any forward-looking statement because of new

information, future events or other factors. Because of these risks

and uncertainties, readers should not place undue reliance on these

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218509537/en/

KINDER MORGAN CONTACTS Media Relations

newsroom@kindermorgan.com Investor Relations (800) 348-7320

km_ir@kindermorgan.com www.kindermorgan.com

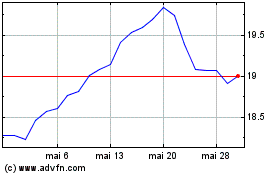

Kinder Morgan (NYSE:KMI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Kinder Morgan (NYSE:KMI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025