InvestCloud to enable multiple service

providers across the InvestCloud PMA Network to seamlessly access

the full suite of capabilities to manage alternative investments on

InvestCloud APL, a market-leading managed account platform with

more than $3 trillion of assets on the platform

Apollo to provide private markets model

portfolios enabling a financial advisor’s preferred portfolio

construction – including fixed income, equity and real asset

private market replacement solutions, risk-based portfolios and

outcome-based solutions – across the InvestCloud platform

InvestCloud, a global leader in wealth technology, today

announced a founding partnership with Apollo (NYSE: APO) to

activate the Private Markets Account Network (PMA Network), which

was launched with the first-of-its-kind Private Markets Account

(PMA) in December 2024. Only available from InvestCloud, the PMA

combines public and private assets within a single, unified

platform to enable a seamless wealth management experience for

financial advisors and their clients.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250220281183/en/

This collaboration enables InvestCloud’s wealth management

clients to incorporate Apollo’s private market model portfolios,

and multi-manager models, into their managed account programs

through its industry-leading APL platform. By offering efficient

access to private markets alongside traditional public market

securities, the partnership empowers thousands of advisors to

diversify portfolios with confidence and achieve better investment

outcomes for millions of clients.

The PMA Network is a connected ecosystem of asset managers,

wealth managers, intermediaries, distributors and model creators

that will include access to Apollo’s private market model

portfolios within the PMA, a centralized point for holding, valuing

and rebalancing alternative investments for those who are eligible.

The PMA Network will use the InvestCloud platform to connect wealth

managers to an array of alternative asset managers, making private

markets products available for inclusion in portfolios. Apollo is

the founding alternative asset manager in the PMA Network, leading

the market on combining private and public market investments in a

single portfolio.

“The PMA Network is a unique InvestCloud innovation designed to

crack the code on how wealth managers, financial advisors and

investors access private markets to deliver a unique and seamless

public-private investment experience,” said Jeff Yabuki, Chairman

and CEO of InvestCloud. “By combining Apollo’s deep private market

expertise with our leading technology, we are dramatically

accelerating the integration of private markets into the wealth

management landscape.”

Yabuki added, “We are thrilled to have Apollo as the founding

alternative asset manager to join the PMA Network, which connects

private markets asset managers, wealth managers and other

suppliers. The Network is further democratizing access to private

markets, helping our clients to achieve better outcomes for their

customers. The PMA is a truly innovative solution, and the close

partnership with Apollo creates an unrivalled capability, offering

and platform.”

“The convergence of private and public markets is shaping the

future of wealth management. Apollo is investing heavily to provide

the global wealth market access to private markets investments and

seamless infrastructure for advisors to integrate these solutions

into their broader client portfolios. Today’s announcement is the

culmination of months of deep collaboration with InvestCloud, a

partnership we believe marks a pivotal step for the wealth

management industry to broadly manage true total-market portfolios.

Leveraging InvestCloud’s world-class platform, and client base of

leading wealth management firms, Apollo and other general partners

within the PMA Network can gain unparalleled access to distribution

channels, creating new possibilities for the entire ecosystem,”

said Stephanie Drescher, Partner and Chief Client & Product

Solutions Officer at Apollo Global Management.

Apollo’s portfolio strategies include a wide range of private

market investments. Designed to simplify and align with advisors’

preferred portfolio construction approach, Apollo’s model solutions

can support full fixed income, equity and real asset replacement

solutions to create complementary risk-based total market

portfolios, as well as outcome-based private market solutions.

Originally unveiled in December 2024, InvestCloud’s Private

Markets Account is poised to evolve further in 2025 with enhanced

capabilities to help clients stay ahead of the market. The PMA is

enabled by APL from InvestCloud, which is the largest managed

accounts platform in the country with more than $3 trillion of

assets across nearly 10 million accounts utilizing nearly 4 million

models on its market-leading technology. APL will bring the

innovation of the PMA to the network, with enhanced efficiency and

effectiveness.

About InvestCloud InvestCloud, a global leader in wealth

technology, aspires to enable a smarter financial future. Driving

the digital transformation of the wealth management industry, the

company serves a broad array of clients globally, including Wealth

and Asset Managers, Wirehouses, Banks, RIAs, and Insurers. In terms

of scale, the company’s clients represent more than 40 percent of

the $132 trillion of total assets globally. As a leader in

delivering personalization and scale across advisory programs,

including unified managed accounts (UMA) and separately managed

accounts (SMA), the company is committed to the success of its

clients. By equipping and enabling advisors and their clients with

connected technology, enhanced intelligence, and inspired

experiences, InvestCloud delivers leading digital wealth management

and financial planning solutions, complemented by a dynamic data

warehouse, which scale across the complete wealth continuum. In

2024, InvestCloud introduced the first-of-its-kind Private Markets

Account™ and Private Markets Account Network to enable integrated

management of public and private markets assets from a single,

unified managed account. InvestCloud was also named a CNBC World’s

Top Fintech Company, a proof point of the company’s commitment to

innovation and client success. Headquartered in the United States,

InvestCloud serves clients around the world. Learn more at:

https://investcloud.com/pma/

About Apollo Apollo is a high-growth, global alternative

asset manager. In our asset management business, we seek to provide

our clients excess return at every point along the risk-reward

spectrum from investment grade credit to private equity. For more

than three decades, our investing expertise across our fully

integrated platform has served the financial return needs of our

clients and provided businesses with innovative capital solutions

for growth. Through Athene, our retirement services business, we

specialize in helping clients achieve financial security by

providing a suite of retirement savings products and acting as a

solutions provider to institutions. Our patient, creative, and

knowledgeable approach to investing aligns our clients, businesses

we invest in, our employees, and the communities we impact, to

expand opportunity and achieve positive outcomes. As of December

31, 2024, Apollo had approximately USD $751 billion of assets under

management. To learn more, please visit www.apollo.com.

Apollo Forward-Looking Statements

This press release contains forward-looking statements that are

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to,

discussions related to Apollo’s expectations regarding the

performance of its business and other non-historical statements.

These forward-looking statements are based on management’s beliefs,

as well as assumptions made by, and information currently available

to, management. When used in this press release, the words

“believe,” “anticipate,” “estimate,” “expect,” “intend” and similar

expressions are intended to identify forward-looking statements.

Although management believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to have been correct.

These statements are subject to certain risks, uncertainties and

assumptions. Apollo believes these factors include but are not

limited to those described under the section entitled “Risk

Factors” in Apollo’s most recent annual report on Form 10-K filed

with the Securities and Exchange Commission (the “SEC”), as such

factors may be updated from time to time in Apollo’s periodic

filings with the SEC, which are accessible on the SEC’s website at

www.sec.gov. These factors should not be construed as exhaustive

and should be read in conjunction with the other cautionary

statements that are included in this press release and in Apollo’s

other filings with the SEC. Apollo undertakes no obligation to

publicly update any forward-looking statements, whether as a result

of new information, future developments or otherwise, except as

required by applicable law. This press release does not constitute

an offer of any Apollo fund.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220281183/en/

For InvestCloud Media Inquiries InvestCloud

Communications Email: Britt.Zarling@MotivePartners.com For Apollo

Media Inquiries: Tim Quinn Email: tquinn@apollo.com

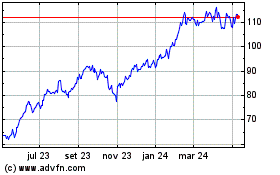

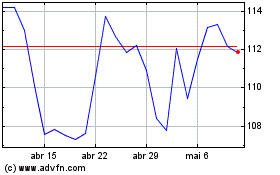

Apollo Global Management (NYSE:APO)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Apollo Global Management (NYSE:APO)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025