ConocoPhillips (NYSE: COP) today announced it has entered into

an agreement to sell its interests in the Ursa and Europa Fields

and Ursa Oil Pipeline Company LLC to Shell Offshore Inc. and Shell

Pipeline Company LP, subsidiaries of Shell plc, for $735 million

subject to customary closing adjustments. The transaction also

includes an overriding royalty interest in the Ursa Field. Proceeds

from this transaction will be used for general corporate

purposes.

“Combined with previously announced dispositions, this

transaction reflects our ongoing commitment to further strengthen

our portfolio by divesting noncore assets and shows significant

progress toward our $2 billion disposition target,” said Andy

O’Brien, senior vice president, Strategy, Commercial,

Sustainability & Technology.

Full-year 2024 production associated with the company’s 15.96%

interest in the Ursa Field and 1% interest in the Europa Field was

approximately 8 thousand barrels of oil equivalent per day (MBOED).

The transaction is subject to customary closing conditions and is

expected to be completed by the end of second quarter of 2025. The

effective date of the transaction is Jan. 1, 2025.

--- # # # ---

About ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and

production companies based on both production and reserves, with a

globally diversified asset portfolio. Headquartered in Houston,

Texas, ConocoPhillips had operations and activities in 14

countries, $123 billion of total assets, and approximately 11,800

employees at Dec. 31, 2024. Production averaged 1,987 MBOED for the

twelve months ended Dec. 31, 2024, and proved reserves were 7.8

BBOE as of Dec. 31, 2024. For more information, go to

www.conocophillips.com.

CAUTIONARY STATEMENT FOR THE PURPOSES

OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995.

This news release contains forward-looking statements as defined

under the federal securities laws. Forward-looking statements

relate to future events, including, without limitation, statements

regarding our future financial position, business strategy,

budgets, projected revenues, costs and plans, objectives of

management for future operations, the anticipated benefits of our

acquisition of Marathon Oil Corporation (Marathon Oil), the

anticipated impact of our acquisition of Marathon Oil on the

combined company’s business and future financial and operating

results and the expected amount and timing of synergies from our

acquisition of Marathon Oil and other aspects of our operations or

operating results. Words and phrases such as “ambition,”

“anticipate,” “believe,” “budget,” “continue,” “could,” “effort,”

“estimate,” “expect,” “forecast,” “goal,” “guidance,” “intend,”

“may,” “objective,” “outlook,” “plan,” “potential,” “predict,”

“projection,” “seek,” “should,” “target,” “will,” “would,” and

other similar words can be used to identify forward-looking

statements. However, the absence of these words does not mean that

the statements are not forward-looking. Where, in any

forward-looking statement, the company expresses an expectation or

belief as to future results, such expectation or belief is

expressed in good faith and believed to be reasonable at the time

such forward-looking statement is made. However, these statements

are not guarantees of future performance and involve certain risks,

uncertainties and other factors beyond our control. Therefore,

actual outcomes and results may differ materially from what is

expressed or forecast in the forward-looking statements. Factors

that could cause actual results or events to differ materially from

what is presented include, but are not limited to, the following:

effects of volatile commodity prices, including prolonged periods

of low commodity prices, which may adversely impact our operating

results and our ability to execute on our strategy and could result

in recognition of impairment charges on our long-lived assets,

leaseholds and nonconsolidated equity investments; global and

regional changes in the demand, supply, prices, differentials or

other market conditions affecting oil and gas, including changes as

a result of any ongoing military conflict and the global response

to such conflict, security threats on facilities and

infrastructure, global health crises, the imposition or lifting of

crude oil production quotas or other actions that might be imposed

by OPEC and other producing countries or the resulting company or

third-party actions in response to such changes; the potential for

insufficient liquidity or other factors, such as those described

herein, that could impact our ability to repurchase shares and

declare and pay dividends, whether fixed or variable; potential

failures or delays in achieving expected reserve or production

levels from existing and future oil and gas developments, including

due to operating hazards, drilling risks and the inherent

uncertainties in predicting reserves and reservoir performance;

reductions in our reserve replacement rates, whether as a result of

significant declines in commodity prices or otherwise; unsuccessful

exploratory drilling activities or the inability to obtain access

to exploratory acreage; failure to progress or complete announced

and future development plans related to constructing, modifying or

operating E&P and LNG facilities, or unexpected changes in

costs, inflationary pressures or technical equipment related to

such plans; significant operational or investment changes imposed

by legislative and regulatory initiatives and international

agreements addressing environmental concerns, including initiatives

addressing the impact of global climate change, such as limiting or

reducing GHG emissions, regulations concerning hydraulic

fracturing, methane emissions, flaring or water disposal and

prohibitions on commodity exports; broader societal attention to

and efforts to address climate change may cause substantial

investment in and increased adoption of competing or alternative

energy sources; risks, uncertainties and high costs that may

prevent us from successfully executing on our Climate Risk

Strategy; lack or inadequacy of, or disruptions in, reliable

transportation for our crude oil, bitumen, natural gas, LNG and

NGLs; inability to timely obtain or maintain permits, including

those necessary for construction, drilling and/or development, or

inability to make capital expenditures required to maintain

compliance with any necessary permits or applicable laws or

regulations; potential disruption or interruption of our operations

and any resulting consequences due to accidents, extraordinary

weather events, supply chain disruptions, civil unrest, political

events, war, terrorism, cybersecurity threats or information

technology failures, constraints or disruptions; liability for

remedial actions, including removal and reclamation obligations,

under existing or future environmental regulations and litigation;

liability resulting from pending or future litigation or our

failure to comply with applicable laws and regulations; general

domestic and international economic, political and diplomatic

developments, including deterioration of international trade

relationships, the imposition of trade restrictions or tariffs

relating to commodities and material or products (such as aluminum

and steel) used in the operation of our business, expropriation of

assets, changes in governmental policies relating to commodity

pricing, including the imposition of price caps, sanctions or other

adverse regulations or taxation policies; competition and

consolidation in the oil and gas E&P industry, including

competition for sources of supply, services, personnel and

equipment; any limitations on our access to capital or increase in

our cost of capital or insurance, including as a result of

illiquidity, changes or uncertainty in domestic or international

financial markets, foreign currency exchange rate fluctuations or

investment sentiment; challenges or delays to our execution of, or

successful implementation of the acquisition of Marathon Oil or any

future asset dispositions or acquisitions we elect to pursue;

potential disruption of our operations, including the diversion of

management time and attention; our inability to realize anticipated

cost savings or capital expenditure reductions; difficulties

integrating acquired businesses and technologies; or other

unanticipated changes; our inability to deploy the net proceeds

from any asset dispositions that are pending or that we elect to

undertake in the future in the manner and timeframe we anticipate,

if at all; the operation, financing and management of risks of our

joint ventures; the ability of our customers and other contractual

counterparties to satisfy their obligations to us, including our

ability to collect payments when due from the government of

Venezuela or PDVSA; uncertainty as to the long-term value of our

common stock; and other economic, business, competitive and/or

regulatory factors affecting our business generally as set forth in

our filings with the Securities and Exchange Commission. Unless

legally required, ConocoPhillips expressly disclaims any obligation

to update any forward-looking statements, whether as a result of

new information, future events or otherwise.

Use of Non-GAAP Financial Information – This release may

include non-GAAP financial measures, which help facilitate

comparison of company operating performance across periods and with

peer companies. Any historical non-GAAP measures included herein

will be accompanied by a reconciliation to the nearest

corresponding GAAP measure either within the release or on our

website at www.conocophillips.com/nongaap.

Cautionary Note to U.S. Investors – The SEC permits oil

and gas companies, in their filings with the SEC, to disclose only

proved, probable and possible reserves. We may use the term

“resource” in this release that the SEC’s guidelines prohibit us

from including in filings with the SEC. U.S. investors are urged to

consider closely the oil and gas disclosures in our Form 10-K and

other reports and filings with the SEC. Copies are available from

the SEC and from the ConocoPhillips website.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250221421056/en/

Dennis Nuss (media) 281-293-1149

dennis.nuss@conocophillips.com

Investor Relations 281-293-5000

investor.relations@conocophillips.com

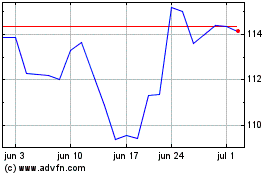

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

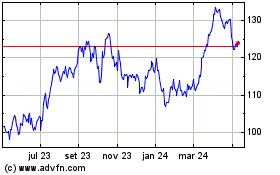

ConocoPhillips (NYSE:COP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025