Initiates strategic review process to explore

alternatives and files a complaint against Google LLC and Alphabet

Inc.

Chegg, Inc. (NYSE:CHGG), the leading student-first connected

learning platform, today reported financial results for the quarter

and year ended December 31, 2024.

"We made two important and connected decisions to maximize the

future of our business and shareholder value. We are launching a

strategic review process and filed a complaint against Google,

which has unjustly retained traffic that has historically come to

Chegg, impacting our acquisitions, revenue and employees,” said

Nathan Schultz, CEO of Chegg. “As we look to stabilize Chegg’s

business in 2025, we have a strong and trusted brand, millions of

global subscribers, a large market opportunity, and amazing

employees. Our superior product for education is verticalized,

personalized, and built on a deep understanding of modern students,

and we believe this year will be a turning point for Chegg.”

Fourth Quarter 2024

Highlights

- Total Net Revenues of $143.5 million, a decrease of 24%

year-over-year

- Subscription Services Revenues of $128.5 million, a

decrease of 23% year-over-year

- Gross Margin of 68%

- Non-GAAP Gross Margin of 72%

- Net Loss was $6.1 million

- Non-GAAP Net Income was $19.0 million

- Adjusted EBITDA was $36.6 million

- 3.6 million Subscription Services subscribers, a

decrease of 21% year-over-year

Full Year 2024

Highlights

- Total Net Revenues of $617.6 million, a decrease of 14%

year-over-year

- Subscription Services Revenues of $549.2 million, a

decrease of 14% year-over-year

- Gross Margin of 71%

- Non-GAAP Gross Margin of 73%

- Net Loss was $837.1 million

- Non-GAAP Net Income was $85.0 million

- Adjusted EBITDA was $149.7 million

- 6.6 million Subscription Services subscribers, a

decrease of 14% year-over-year

Total net revenues include revenues from Subscription Services

and Skills and Other. Subscription Services includes revenues from

our Chegg Study Pack, Chegg Study, Chegg Writing, Chegg Math, and

Busuu offerings. Skills and Other includes revenues from Chegg

Skills, Advertising, and any other revenues not included in

Subscription Services.

For more information about non-GAAP net income, non-GAAP gross

margin and adjusted EBITDA, and a reconciliation of non-GAAP net

income to net (loss) income, gross margin to non-GAAP gross margin

and adjusted EBITDA to net (loss) income, see the sections of this

press release titled, “Use of Non-GAAP Measures,” “Reconciliation

of Net (Loss) Income to EBITDA and Adjusted EBITDA,” and

“Reconciliation of GAAP to Non-GAAP Financial Measures.”

Business Outlook

First Quarter 2025

- Total Net Revenues in the range of $114 million to $116

million

- Subscription Services Revenues in the range of $104

million to $106 million

- Gross Margin between 66% and 67%

- Adjusted EBITDA in the range of $13 million to $14

million

For more information about the use of forward-looking non-GAAP

measures, a reconciliation of forward-looking net loss to EBITDA

and adjusted EBITDA for the first quarter 2025, see the below

sections of the press release titled “Use of Non-GAAP Measures,”

and “Reconciliation of Forward-Looking Net Loss to EBITDA and

Adjusted EBITDA.”

An updated investor presentation and an investor data sheet can

be found on Chegg’s Investor Relations website

https://investor.chegg.com.

Prepared Remarks - Nathan Schultz, CEO

& President Chegg, Inc.

Thank you, Tracey. Hello everyone and thank you for joining

Chegg’s fourth-quarter earnings call.

Before I cover our 2024 accomplishments and 2025 focus, I want

to make sure the two announcements we are making are clear. First,

we announced that we are undertaking a strategic review process and

exploring a range of alternatives to maximize shareholder value,

including being acquired, undertaking a go-private transaction, or

remaining as a public standalone company. Second, we announced the

filing of a complaint against Google LLC and Alphabet Inc. These

two actions are connected, as we would not need to review strategic

alternatives if Google hadn’t launched AI Overviews, or AIO,

retaining traffic that historically had come to Chegg, materially

impacting our acquisitions, revenue, and employees. Chegg has a

superior product for education, as evident by our brand awareness,

engagement, and retention. Unfortunately, traffic is being blocked

from ever coming to Chegg because of Google’s AIO and their use of

Chegg’s content to keep visitors on their own platform. We retained

Goldman Sachs as the financial advisor in connection with our

strategic review and Susman Godfrey with respect to our complaint

against Google.

As the education industry at large continues to transform, Chegg

has strengthened its commitment to serving students, with a clear

focus on those seeking to build knowledge and achieve success along

their academic journey. Through focused investment over the past

year, and the integration of cutting-edge technologies, we have

advanced the Chegg product offering to deliver a comprehensive,

personalized and verticalized learning experience for higher

education. The Chegg of today provides precisely what learners need

and ensures that Chegg maintains its strong reputation for quality

and trust.

- On technology in 2024, we integrated AI and machine

learning into our product stack. We blended third-party AI models

with our proprietary student-focused data and high-quality content,

delivering more value to the learner. We are AI model-agnostic,

seamlessly incorporating new frontier models like Llama, Anthropic,

Mistral, GPT and new models as they become available. We use

techniques like A/B testing, multi-shot prompting and

Retrieval-Augmented Generation to improve how our AI learns,

retrieves information in real time, and delivers consistent

results. With this work complete, we are now building verticalized

applications for education at a fraction of the time and cost,

while also increasing our level of personalization. As we have

mentioned before, our implementation of machine learning, and

multiple AI models, has significantly reduced the cost of creating

content by more than 70%, while keeping our quality at the high

standards students expect. We stand by the quality of our content

so much that in Q3 we implemented a Satisfaction Guarantee.

- On brand and marketing, last fall, we launched an

innovative brand marketing campaign and activation program that

reinvigorated top-of-funnel traffic, creating strong consideration,

bringing in new users, and ultimately driving conversion. As a

result of our full funnel program, we have seen year-over-year

improvements in click-through and conversion rates, leading us to

double down on this commitment in 2025. With regards to TikTok

specifically, we were able to capture a 16% increase in awareness

among underclassmen.

- On the product, we significantly advanced and

differentiated Chegg’s AI-powered Question and Answer experience.

At the front end, we have simplified the question submission

process and allowed for more natural inputs and interactions.

Learners now instantly receive step-by-step explanations and

reinforcement, adaptive and personalized based on their individual

strengths or weaknesses. Finally, at the conclusion, Chegg

proactively offers students a variety of unique recommendations –

called “next best actions” – to reinforce and further their

learning. These product upgrades resulted in 66% more questions

being asked in 2024 versus 2023, adding nearly 26 million

additional solutions to our archive and contributing to the 15

basis points increase in subscriber retention over the course of

the year.

- Finally, I want to touch on Busuu, our language learning

service, which has done a tremendous job transitioning to a

freemium business model and integrating AI as a key product feature

with the introduction of Speaking Practice. This strategic refocus

increased the first 30-day conversion rate to paying customers by

31% and led to 9% year-over-year revenue growth for 2024 – a trend

we expect to continue in 2025. The enterprise part of this business

is performing very well, with revenue up 46% in 2024, as we added

an impressive set of enterprise customers including Total Energy

and Carrefour. The enterprise business will continue to expand with

additional organizations, reseller relationships, and our

successful partnership with Guild, specifically within their

English language learning category.

While we made significant headway on our technology, product,

and marketing programs, 2024 came with a series of challenges,

including the rapid evolution of the content landscape,

particularly the rise of Google AIO, which as I previously

mentioned, has had a profound impact on Chegg’s traffic, revenue,

and workforce. As already mentioned, we are filing a complaint

against Google LLC and Alphabet Inc. in the U.S. District Court for

the District of Columbia, making three main arguments.

- First is reciprocal dealing, meaning that Google forces

companies like Chegg to supply our proprietary content in order to

be included in Google’s search function.

- Second is monopoly maintenance, or that Google unfairly

exercises its monopoly power within search and other

anti-competitive conduct to muscle out companies like Chegg.

- And third is unjust enrichment, meaning Google is reaping the

financial benefits of Chegg’s content without having to spend a

dime.

As we allege in our complaint, Google AIO has transformed Google

from a “search engine” into an “answer engine,” displaying

AI-generated content sourced from third-party sites like Chegg.

Google’s expansion of AIO forces traffic to remain on Google,

eliminating the need to go to third-party content source sites. The

impact on Chegg’s business is clear. Our non-subscriber traffic

plummeted to negative 49% in January 2025, down significantly from

the modest 8% decline we reported in Q2 2024.

We believe this isn’t just about Chegg—it’s about students

losing access to quality, step-by-step learning in favor of

low-quality, unverified AI summaries. It’s about the digital

publishing industry. It’s about the future of internet search.

In summary, our complaint challenges Google’s unfair

competition, which is unjust, harmful, and unsustainable. While

these proceedings are just starting, we believe bringing this

lawsuit is both necessary and well-founded.

While the challenges we outlined will persist, we are focused on

the clear goal of stabilizing the business through the course of

2025. We are driven by a core belief that the relevancy and need

for comprehensive student success platforms – offering an adaptive,

personalized experience to support learning – will only increase

over the coming years. Administrators and faculty are acknowledging

the need to change their teaching models and assessments to better

reflect the AI-normalized environment we are now in. The dramatic

disruption that came with the launch of generative AI platforms has

started to stabilize as schools now understand the significant risk

and impact of students GPT’ing their way through their educational

journey. This view is widely supported by some recent studies:

- First, a study from The American Association of Colleges and

Universities and Elon University explored the impact of generative

AI on academic integrity, with 92% of faculty worried about AI

undermining deep learning by overreliance on AI tools and 95% of

these leaders say the teaching models at their schools will be

affected significantly or to some degree by generative AI.

- Second, the latest edition of Chegg’s Global Student Survey

measured the insights of nearly 12,000 undergraduate students in 15

countries. 53% of undergraduate students who have used generative

AI voiced concerns about “receiving incorrect or inaccurate

information”.

- Third, we conducted proprietary research on student personas

and learned that at least 82% of US college students want more than

what GPT offers. These students need to develop knowledge, not just

get grab-and-go answers.

So, as 2025 gets underway, here’s where we are leaning in:

In 2025, on brand and marketing, we are continuing to

raise brand awareness and improve conversion rates. In January, we

debuted our “Get a Grip” brand campaign featuring our new amazing

mascot, Ace the Octopus. A physical representation of Chegg allows

us to connect with our audience in a fun way, clearly conveying how

we are on and by students’ sides throughout the semester. In

addition, we are continuing our expansion into new media channels,

including streaming platforms like Hulu and YouTube, and social

channels like Discord and Twitch. We also launched Live Office

Hours on social media channels to provide students with instant,

live, course-specific instruction. We aim to provide an

interactive, community-based learning opportunity while introducing

our brand and value to new users. Our goal is to have more than 1.5

million students attend our live programming this year.

Diversification is key to funnel resiliency, and taking a

full-funnel approach is necessary to make sure we are bringing in

the right traffic and regrowing our customer acquisitions.

In 2025, on product, we are building experiences worthy

of virality, acquisition growth, and retention, and making those

experiences as universally available as possible.

- First is Solution Scout, a new product we launched earlier this

month. As I mentioned earlier, students lack trust in generative

AI, and they’ve told us that they’re spending too much time

triangulating, comparing, and verifying solutions across multiple

platforms. This results in an incredible amount of wasted time that

could be spent learning! Solution Scout allows students to see

side-by-side answers from multiple LLMs alongside Chegg’s solution,

but what’s most important is that Chegg, through our proprietary

technology, can compare and contrast the solutions, providing

students a massive time save and value, and our early indications

are very positive.

- We are also excited to launch an updated feature set for

practice and exam preparation, personalized for each student. 71%

of students report that they do not have adequate practice

resources when preparing for exams, and Chegg can help coach each

student to confidence. Monthly, our platform collects more than

three billion data interaction points, which enables us to

customize and personalize this experience. Along with our

personalization, students can change the difficulty and format of

questions – whether they want to learn via flashcards, multiple

choice, or word problems. Students need to gain competency in their

studies, and practice tailored specifically to their individual

strengths and weaknesses is how they will do it.

This is the Chegg that exists right now. Our goal with our

platform is simple. We want students to thrive. We want students to

have that "wow” moment with Chegg. “Wow Chegg is not just a grab

and go answer...wow Chegg is not just generative AI.” That “wow”

moment is when a student realizes Chegg understands me and my

specific needs and is a platform I can use every day to succeed in

my educational journey. This “wow” moment is what will unlock our

ability to stabilize our business.

Finally, on the expansion of our business model in 2025,

I would like to touch on our enterprise strategy, which enables us

to diversify and generate recurring revenue streams. We are

continuing to expand our business-to-institution pilot program,

which began in late 2024. With five pilot programs active, we hope

to work with approximately 35 additional institutions by the end of

the year. There is a tremendous opportunity to support a broader

range of students in achieving their academic goals and increase

persistence and graduation rates, which is a major issue in higher

education today. We have seen early receptivity and positive

feedback on how these pilots are already helping students and hope

to move a number of them into full campus-wide implementations by

the end of the year.

Before I hand it over to David, I want to summarize what’s most

important from today’s call. We announced that we are undertaking a

process to review strategic alternatives, and we filed a complaint

against Google. In addition to this, here are the keys to our 2025

strategy to stabilize our business:

- Key #1: Build brand awareness, drive more qualified traffic,

and increase conversion rates.

- Key #2: Expand our product set to offer unique solutions for

students that increase the frequency of use and create clear and

differentiated value for Chegg.

- Key #3: Diversify our revenue streams with

business-to-institution programs and other enterprise

offerings.

We continue to have a strong and trusted brand, a customer base

of millions of global subscribers, a large market opportunity, and

amazing employees to get the job done, and we believe 2025 will

mark a turning point for Chegg.

With that, I’ll turn it over to David.

Prepared Remarks - David Longo, CFO

Chegg, Inc.

Thank you, Nathan and good afternoon.

Today, I will be presenting our financial performance for the

fourth quarter of 2024, along with the company’s outlook for the

first quarter of 2025.

We delivered a solid fourth quarter, surpassing our Q4 guidance

for both revenue and adjusted EBITDA. While navigating industry

challenges, we remained laser-focused on executing our strategic

plan, enhancing our product-market fit, and continuing to prudently

manage our expenses. We remain on track to achieve 2025 non-GAAP

savings of $100-120 million from our previously announced

restructuring activities. Additionally, we strengthened our balance

sheet by repurchasing $117 million of our 2026 convertible notes at

a significant discount.

In the fourth quarter, total revenue was $143.5 million, a

decrease of 24% year-over-year. This includes Subscription Services

revenue of $128.5 million, down 23% year-over-year. We had 3.6

million subscribers during the quarter, representing a decline of

21%. Subscription Services ARPU decreased by 3% year-over-year,

primarily driven by a temporary dip in our monthly retention rate

in November and December, which has since returned to historical

norms. Skills and Other revenue was $14.9 million, down 31%

year-over-year, due to the market shift away from traditional

bootcamps to lower cost, short-form programs, and a decline in

advertising revenue from reduced traffic and sessions across our

platform. We delivered adjusted EBITDA of $37 million, representing

a margin of 25%.

As mentioned earlier, in the fourth quarter we opportunistically

repurchased $116.6 million in aggregate principal amount of our

2026 convertible notes at a $20 million discount to par.

Free cash flow for the fourth quarter was $4.8 million, despite

incurring approximately $25 million in cash outlays related to

employee severance from our two restructurings in which we laid off

more than 700 employees, as well as the Pearson legal settlement.

As anticipated, we expect another $11 million in cash restructuring

payments, with a significant portion to be incurred in Q1. Capital

expenditures for the quarter were $13 million, down 52%

year-over-year, of which $8.7 million were content costs.

Leveraging the power of AI, CapEx content costs have decreased 56%

year-over-year, while the number of questions asked increased

2%.

Looking at the balance sheet, we concluded the quarter with cash

and investments of $528 million and a net cash balance of $42

million.

Looking ahead, as Nathan detailed earlier, we have an exciting

and ambitious agenda for product and marketing in 2025. However, as

we work towards realizing the benefits of these initiatives,

industry challenges are causing a notable decline in traffic and

subscriber acquisitions. These factors are putting pressure on our

business and impacting our financial outlook.

For Q1 guidance, we expect:

- Total revenue between $114 and $116 million, with Subscription

Services revenue between $104 and $106 million;

- Gross margin to be in the range of 66 to 67 percent;

- And adjusted EBITDA between $13 and $14 million.

In closing, despite the ongoing industry challenges that are

putting pressure on our financial performance, we made significant

progress in 2024 by building technology, integrating AI and

enhancing products, all while prudently managing expenses. We enter

2025 with a solid foundation and are focused on stabilizing

business trends.

With that, I will turn the call over to the operator for your

questions. We respectfully advise that we will not be taking

questions related to the company's strategic review process.

Conference Call and Webcast

Information

To access the call, please dial 1-877-407-4018, or outside the

U.S. +1-201-689-8471, five minutes prior to 1:30 p.m. Pacific Time

(or 4:30 p.m. Eastern Time). A live webcast of the call will also

be available at https://investor.chegg.com under the Events &

Presentations menu. An audio replay will be available beginning at

4:30 p.m. Pacific Time (or 7:30 p.m. Eastern Time) on February 24,

2025, until 8:59 p.m. Pacific Time (or 11:59 p.m. Eastern Time) on

March 3, 2025, by calling 1-844-512-2921, or outside the U.S.

+1-412-317-6671, with Conference ID 13751122. An audio archive of

the call will also be available at https://investor.chegg.com.

Use of Investor Relations Website for

Regulation FD Purposes

Chegg also uses its media center website,

https://www.chegg.com/press, as a means of disclosing material

non-public information and for complying with its disclosure

obligations under Regulation FD. Accordingly, investors should

monitor https://www.chegg.com/press, in addition to following press

releases, Securities and Exchange Commission filings and public

conference calls and webcasts.

About Chegg

Chegg provides individualized learning support to students as

they pursue their educational journeys. Available on demand 24/7

and powered by over a decade of learning insights, the Chegg

platform offers students artificial intelligence (“AI”)-powered

academic support thoughtfully designed for education coupled with

access to a vast network of subject matter experts who help ensure

quality and accuracy. No matter the goal, level, or style, Chegg

helps millions of students around the world learn with confidence

by helping them build essential academic, life, and job skills to

achieve success. Chegg is a publicly held company based in Santa

Clara, California and trades on the NYSE under the symbol CHGG. For

more information, visit www.chegg.com.

Use of Non-GAAP Measures

To supplement Chegg’s financial results presented in accordance

with generally accepted accounting principles in the United States

(GAAP), this press release and the accompanying tables and the

related earnings conference call contain non-GAAP financial

measures, including adjusted EBITDA, non-GAAP cost of revenues,

non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating

expenses, non-GAAP income from operations, non-GAAP net income,

non-GAAP weighted average shares, non-GAAP net income per share,

and free cash flow. For reconciliations of these non-GAAP financial

measures to the most directly comparable GAAP financial measures,

please see the section of the accompanying tables titled,

“Reconciliation of Net (Loss) Income to EBITDA and Adjusted

EBITDA,” “Reconciliation of GAAP to Non-GAAP Financial Measures,”

“Reconciliation of Net Cash Provided by Operating Activities to

Free Cash Flow,” and “Reconciliation of Forward-Looking Net Loss to

EBITDA and Adjusted EBITDA.”

The presentation of these non-GAAP financial measures is not

intended to be considered in isolation from, as a substitute for,

or superior to, the financial information prepared and presented in

accordance with GAAP, and may be different from non-GAAP financial

measures used by other companies. Chegg defines (1) adjusted EBITDA

as earnings before interest, taxes, depreciation and amortization

or EBITDA, adjusted for share-based compensation expense, other

income, net, acquisition-related compensation costs, impairment

expense, restructuring charges, content and related assets charge,

impairment of lease related assets, loss contingency, and

transitional logistic charges; (2) non-GAAP cost of revenues as

cost of revenues excluding amortization of intangible assets,

share-based compensation expense, acquisition-related compensation

costs, restructuring charges, content and related assets charge,

and transitional logistic charges; (3) non-GAAP gross profit as

gross profit excluding amortization of intangible assets,

share-based compensation expense, acquisition-related compensation

costs, restructuring charges, content and related assets charge,

and transitional logistic charges; (4) non-GAAP gross margin is

defined as non-GAAP gross profit divided by net revenues, (5)

non-GAAP operating expenses as operating expenses excluding

share-based compensation expense, amortization of intangible

assets, acquisition-related compensation costs, restructuring

charges, impairment expense, impairment of lease related assets,

and loss contingency; (6) non-GAAP income from operations as (loss)

income from operations excluding share-based compensation expense,

amortization of intangible assets, acquisition-related compensation

costs, restructuring charges, impairment expense, content and

related assets charge, impairment of lease related assets, loss

contingency, and transitional logistic charges; (7) non-GAAP net

income as net (loss) income excluding share-based compensation

expense, amortization of intangible assets, acquisition-related

compensation costs, amortization of debt issuance costs, the income

tax effect of non-GAAP adjustments, restructuring charges,

impairment expense, content and related assets charge, impairment

of lease related assets, gain on sale of strategic equity

investment, gain on early extinguishment of debt, loss contingency

and transitional logistic charges; (8) non-GAAP weighted average

shares outstanding as weighted average shares outstanding adjusted

for the effect of shares for stock plan activity and shares related

to our convertible senior notes, to the extent such shares are not

already included in our weighted average shares outstanding; (9)

non-GAAP net income per share is defined as non-GAAP net income

divided by non-GAAP weighted average shares outstanding; and (10)

free cash flow as net cash provided by operating activities

adjusted for purchases of property and equipment. To the extent

additional significant non-recurring items arise in the future,

Chegg may consider whether to exclude such items in calculating the

non-GAAP financial measures it uses.

Chegg believes that these non-GAAP financial measures, when

taken together with the corresponding GAAP financial measures,

provide meaningful supplemental information regarding Chegg’s

performance by excluding items that may not be indicative of

Chegg’s core business, operating results or future outlook. Chegg

management uses these non-GAAP financial measures in assessing

Chegg’s operating results, as well as when planning, forecasting

and analyzing future periods and believes that such measures

enhance investors’ overall understanding of our current financial

performance. These non-GAAP financial measures also facilitate

comparisons of Chegg’s performance to prior periods.

As presented in the “Reconciliation of Net (Loss) Income to

EBITDA and Adjusted EBITDA,” “Reconciliation of GAAP to Non-GAAP

Financial Measures,” “Reconciliation of Forward-Looking Net Loss to

EBITDA and Adjusted EBITDA,” and “Reconciliation of Net Cash

Provided by Operating Activities to Free Cash Flow,” tables below,

each of the non-GAAP financial measures excludes or includes one or

more of the following items:

Share-based compensation expense.

Share-based compensation expense is a non-cash expense that

varies in amount from period to period and is dependent on market

forces that are often beyond Chegg's control. As a result,

management excludes this item from Chegg's internal operating

forecasts and models. Management believes that non-GAAP measures

adjusted for share-based compensation expense provide investors

with a basis to measure Chegg's core performance against the

performance of other companies without the variability created by

share-based compensation as a result of the variety of equity

awards used by other companies and the varying methodologies and

assumptions used.

Amortization of intangible assets.

Chegg amortizes intangible assets, including those that

contribute to generating revenues, that it acquires in conjunction

with acquisitions, which results in non‑cash expenses that may not

otherwise have been incurred. Chegg believes excluding the expense

associated with intangible assets from non-GAAP measures allows for

a more accurate assessment of its ongoing operations and provides

investors with a better comparison of period-over-period operating

results. No corresponding adjustments have been made related to

revenues generated from acquired intangible assets.

Acquisition-related compensation costs.

Acquisition-related compensation costs include compensation

expense resulting from the employment retention of certain key

employees established in accordance with the terms of the

acquisitions. In most cases, these acquisition-related compensation

costs are not factored into management's evaluation of potential

acquisitions or Chegg's performance after completion of

acquisitions, because they are not related to Chegg's core

operating performance. In addition, the frequency and amount of

such charges can vary significantly based on the size and timing of

acquisitions and the maturities of the businesses being acquired.

Excluding acquisition-related compensation costs from non-GAAP

measures provides investors with a basis to compare Chegg’s results

against those of other companies without the variability caused by

purchase accounting.

Amortization of debt issuance costs.

The difference between the effective interest expense and the

contractual interest expense are excluded from management's

assessment of our operating performance because management believes

that these non-cash expenses are not indicative of ongoing

operating performance. Chegg believes that the exclusion of the

non-cash interest expense provides investors with a better

comparison of period-over-period operating results.

Income tax effect of non-GAAP adjustments.

We utilize a non-GAAP effective tax rate for evaluating our

operating results, which is based on our current mid-term

projections. This non-GAAP tax rate could change for various

reasons including, but not limited to, significant changes

resulting from tax legislation, changes to our corporate structure

and other significant events. Chegg believes that the inclusion of

the income tax effect of non-GAAP adjustments provides investors

with a better comparison of period-over-period operating

results.

Restructuring charges.

Restructuring charges represent expenses incurred in conjunction

with a reduction in workforce. Chegg believes that it is

appropriate to exclude them from non-GAAP financial measures

because they are nonrecurring and the result of an event that is

not considered a core-operating activity. Chegg believes that it is

appropriate to exclude the restructuring charges from non-GAAP

financial measures because it provides investors with a better

comparison of period-over-period operating results.

Impairment expense.

Impairment expense represents the impairment of goodwill,

intangible assets, and property and equipment. Chegg believes that

it is appropriate to exclude them from non-GAAP financial measures

because they are the result of discrete events that are not

considered core-operating activities and are not indicative of our

ongoing operating performance. Chegg believes that it is

appropriate to exclude the impairment expense from non-GAAP

financial measures because it provides investors with a better

comparison of period-over-period operating results.

In order to conform with current period presentation, $3.6

million of impairment of intangible assets has been reclassified

from content and related assets charge to impairment expense during

the year ended December 31, 2023.

Impairment of lease related assets.

The impairment of lease related assets represents impairment

charge recorded on the ROU asset and leasehold improvements

associated with the closure of our offices. The impairment of lease

related assets is the result of an event that is not considered a

core-operating activity and we believe its exclusion provides

investors with a better comparison of period-over-period operating

results.

Content and related assets charge.

The content and related assets charge represents a write off of

certain content and related assets. The content and related assets

charge is excluded from non-GAAP financial measures because it is

the result of a discrete event that is not considered

core-operating activities. Chegg believes that it is appropriate to

exclude the content and related assets charge from non-GAAP

financial measures because it enables the comparison of

period-over-period operating results.

Gain on sale of strategic equity investment.

The gain on sale of strategic equity investment represents a

one-time event to record the sale of our equity investment in Sound

Ventures. We believe that it is appropriate to exclude the gain

from non-GAAP financial measure because it is the result of an

event that is not considered a core-operating activity and we

believe its exclusion provides investors with a better comparison

of period-over-period operating results.

Gain on early extinguishment of debt.

The difference between the carrying amount of early extinguished

debt and the reacquisition price is excluded from management's

assessment of our operating performance because management believes

that these non-cash gains are not indicative of ongoing operating

performance. Chegg believes that the exclusion of the gain on early

extinguishment of debt provides investors with a better comparison

of period-over-period operating results.

Loss contingency.

We record a contingent liability for a loss contingency related

to legal matters when a loss is both probable and reasonably

estimable. The loss contingency is excluded from non-GAAP financial

measures because they are the result of discrete events that are

not considered core-operating activities. Chegg believes that it is

appropriate to exclude the loss contingency from non-GAAP financial

measures because it enables the comparison of period-over-period

operating results.

Transitional logistics charges.

The transitional logistics charges represent incremental

expenses incurred as we transition our print textbooks to a third

party. Chegg believes that it is appropriate to exclude them from

non-GAAP financial measures because it is the result of an event

that is not considered a core-operating activity and we believe its

exclusion provides investors with a better comparison of

period-over-period operating results.

Effect of shares for stock plan activity.

The effect of shares for stock plan activity represents the

dilutive impact of outstanding stock options, RSUs, and PSUs

calculated under the treasury stock method.

Effect of shares related to convertible senior notes.

The effect of shares related to convertible senior notes

represents the dilutive impact of our convertible senior notes, to

the extent such shares are not already included in our weighted

average shares outstanding as they were antidilutive on a GAAP

basis.

Free cash flow.

Free cash flow represents net cash provided by operating

activities adjusted for purchases of property and equipment. Chegg

considers free cash flow to be a liquidity measure that provides

useful information to management and investors about the amount of

cash generated by the business after the purchases of property and

equipment, which can then be used to, among other things, invest in

Chegg's business and make strategic acquisitions. A limitation of

the utility of free cash flow as a measure of financial performance

is that it does not represent the total increase or decrease in

Chegg's cash balance for the period.

Forward-Looking

Statements

This press release contains forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, which include, without limitation,

that there continues to be a large market of students looking for

the high-quality, proven, and differentiated learning expertise and

experience that Chegg provides, that we will continue to

enthusiastically serve this audience, our strategy and intent to

extend our brand, individualize our product and our ability to

weather current and future business challenges, our strategy to

drive more qualified traffic, and increase conversion rates, our

strategy to expand our product set to offer unique solutions for

students that increase the frequency of use and create clear and

differentiated value for us, our strategy to diversify our revenue

streams with business-to-institution programs and other enterprise

offerings, our commencement of a process to explore strategic

alternatives and the outcome of such process, the expected timing,

volume and nature of our existing securities repurchase program,

the disintermediation of content sites like Chegg, the impact of

generative AI for academic support on the education ecosystem at

large, including universities and education technology companies

broadly, the speed, scale and potential impact of Google's AIO

rollout, our litigation commenced against Google and its outcome,

student adoption of generative AI products, our intent to develop a

verticalized and individualized experience for education and

supporting students throughout their entire learning journey for

education at a fraction of the time and cost, starting with

academic support and eventually functional support, our expectation

that our expansion into new media channels, including streaming

platforms such as Hulu and YouTube, and social channels like

Discord and Twitch, will reach students where they are, will engage

them with our product, create new pathways for product-driven

growth, and reduce our reliance on SEO, that our new vendor-based

commerce platform will reduce our costs, provide flexibility and

allow us to move faster as we continue to evolve our pricing and

packaging programs, our commitment to building and generating

momentum with our brand, traffic, and product capabilities, that we

will bring both audience expansion and acquisition efficiency based

on what we learned from prior brand marketing campaigns, that our

product will continue to deliver individualized learning solutions,

that our brand and product experiences are resilient, our ability

to strengthen our student experience and increase efficiency across

the business and to manage our expenses prudently as the

competitive landscape evolves, all statements about Chegg’s outlook

under “Business Outlook”, including our Q1 2025 guidance, including

total revenue, Subscription Services revenue, gross margin, and

adjusted EBITDA, the time it will take to adjust to Chegg's new

opportunity and see the benefits in our business results and our

ability to stabilize the business, as well as those included in the

investor presentation referenced above and those included in the

“Prepared Remarks” sections above. The words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “project,” “endeavor,”

“will,” “should,” “future,” “transition,” “outlook” and similar

expressions, as they relate to Chegg, are intended to identify

forward-looking statements. These statements are not guarantees of

future performance, and are based on management’s expectations as

of the date of this press release and assumptions that are

inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results, performance or achievements

to differ materially from any future results, performance or

achievements. Important factors that could cause actual results to

differ materially from those expressed or implied by these

forward-looking statements include the following: the effects of AI

technology on Chegg’s business and the economy generally; Chegg’s

ability to stabilize the business by attracting new learners to,

and retaining existing learners on, our learning platform in light

of declining revenue and user traffic; Chegg's ability to innovate

and offer new products and services in response to competitive

technology and market developments, including generative AI;

Chegg’s ability to diversify its revenue streams with

business-to-institution programs and other enterprise offerings;

the outcome and effects of Chegg’s exploration of strategic

alternatives, which may not be successful and may disrupt our

ongoing business, result in increased expenses and present other

risks; the uncertainty surrounding the evolving educational

landscape; enrollment and student behavior, including the impact of

generative AI; Chegg’s ability to expand internationally; the

efficacy of Chegg's expanded efforts to drive user traffic,

including search engine optimization, social media campaigns, and

other marketing efforts; the efficacy of Chegg’s efforts to build

and maintain strong brands and reputation; the success of Chegg’s

new product offerings, including 360 degrees of individualized

academic and functional support; competition in all aspects of

Chegg’s business, including with respect to AI and Chegg's

expectation that such competition will increase; the outcome of

Chegg’s litigation against Google; Chegg’s ability to maintain its

services and systems without interruption, including as a result of

technical issues, cybersecurity threats, or cyber-attacks;

third-party payment processing risks; adoption of government

regulation of education unfavorable to Chegg; the rate of adoption

of Chegg’s offerings; mobile app stores and mobile operating

systems making Chegg’s apps and mobile website available to

students and to grow Chegg’s user base and increase their

engagement; colleges and governments restricting online access or

access to Chegg’s services; Chegg’s ability to strategically take

advantage of new opportunities; competitive developments, including

pricing pressures and other services targeting students; Chegg’s

ability to build and expand its services offerings; Chegg’s ability

to integrate acquired businesses and assets; the impact of

seasonality and student behavior on the business; the outcome of

any current litigation and investigations; misuse of Chegg’s

platform and content; Chegg’s ability to effectively control

operating costs; the impact and effectiveness of Chegg’s internal

restructuring activities; regulatory changes, in particular

concerning privacy, marketing, and education; changes in the

education market, including as a result of AI technology; and

general economic, political and industry conditions, including

inflation, recession and war. All information provided in this

release and in the conference call is as of the date hereof, and

Chegg undertakes no duty to update this information except as

required by law. These and other important risk factors are

described more fully in documents filed with the Securities and

Exchange Commission, including Chegg's Annual Report on Form 10-K

for the year ended December 31, 2024 to be filed with the

Securities and Exchange Commission following the date hereof, and

could cause actual results to differ materially from

expectations.

CHEGG, INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except for

number of shares and par value)

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

161,475

$

135,757

Short-term investments

154,249

194,257

Accounts receivable, net of allowance of

$190 and $376 at December 31, 2024 and December 31, 2023,

respectively

23,641

31,404

Prepaid expenses

17,100

20,980

Other current assets

81,094

32,437

Total current assets

437,559

414,835

Long-term investments

212,650

249,547

Property and equipment, net

170,648

183,073

Goodwill, net

—

631,995

Intangible assets, net

10,347

52,430

Right of use assets

22,256

25,130

Deferred tax assets, net

964

141,843

Other assets

14,527

28,382

Total assets

$

868,951

$

1,727,235

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

15,159

$

28,184

Deferred revenue

39,217

55,336

Accrued liabilities

115,360

77,863

Current portion of convertible senior

notes, net

358,605

357,079

Total current liabilities

528,341

518,462

Long-term liabilities

Convertible senior notes, net

127,344

242,758

Long-term operating lease liabilities

18,509

18,063

Other long-term liabilities

1,776

3,334

Total long-term liabilities

147,629

264,155

Total liabilities

675,970

782,617

Commitments and contingencies (Note

10)

Stockholders’ equity:

Preferred stock, $0.001 par value –

10,000,000 shares authorized, no shares issued and outstanding at

December 31, 2024 and December 31, 2023

—

—

Common stock, $0.001 par value –

400,000,000 shares authorized; 104,880,048 and 102,823,700 shares

issued and outstanding at December 31, 2024 and December 31, 2023,

respectively

105

103

Additional paid-in capital

1,114,550

1,031,627

Accumulated other comprehensive loss

(32,233

)

(34,739

)

Accumulated deficit

(889,441

)

(52,373

)

Total stockholders’ equity

192,981

944,618

Total liabilities and stockholders’

equity

$

868,951

$

1,727,235

CHEGG, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share amounts)

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Net revenues

$

143,484

$

187,987

$

617,574

$

716,295

Cost of revenues(1)

45,599

45,804

180,927

225,941

Gross profit

97,885

142,183

436,647

490,354

Operating expenses:

Research and development(1)

41,008

45,724

170,431

191,705

Sales and marketing(1)

27,901

29,746

108,329

126,591

General and administrative(1)

56,296

53,426

217,756

236,183

Impairment expense

—

—

677,239

3,600

Total operating expenses

125,205

128,896

1,173,755

558,079

(Loss) income from operations

(27,320

)

13,287

(737,108

)

(67,725

)

Interest expense and other income,

net:

Interest expense

(631

)

(658

)

(2,590

)

(3,773

)

Other income, net

25,847

5,139

51,332

121,810

Total interest expense and other income,

net

25,216

4,481

48,742

118,037

(Loss) income before provision for income

taxes

(2,104

)

17,768

(688,366

)

50,312

Provision for income taxes

(4,021

)

(8,103

)

(148,702

)

(32,132

)

Net (loss) income

$

(6,125

)

$

9,665

$

(837,068

)

$

18,180

Net (loss) income per share

Basic

$

(0.06

)

$

0.09

$

(8.10

)

$

0.16

Diluted

$

(0.06

)

$

0.09

$

(8.10

)

$

(0.34

)

Weighted average shares used to compute

net (loss) income per share

Basic

104,513

109,093

103,300

116,504

Diluted

104,513

118,902

103,300

128,569

(1) Includes share-based compensation

expense and restructuring charges as follows:

Share-based compensation expense:

Cost of revenues

$

336

$

571

$

1,786

$

2,256

Research and development

4,220

10,194

28,044

44,103

Sales and marketing

1,500

2,408

7,466

9,524

General and administrative

9,291

18,733

47,318

77,619

Total share-based compensation expense

$

15,347

$

31,906

$

84,614

$

133,502

Restructuring charges:

Cost of revenues

$

559

$

—

$

762

$

12

Research and development

8,478

—

11,387

1,692

Sales and marketing

1,724

—

2,630

1,228

General and administrative

5,002

—

9,824

2,772

Total restructuring charges

$

15,763

$

—

$

24,603

$

5,704

CHEGG, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

Years Ended December

31,

2024

2023

2022

Cash flows from operating activities

Net (loss) income

$

(837,068

)

$

18,180

$

266,638

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Share-based compensation expense

84,614

133,502

133,456

Depreciation and amortization expense

78,344

129,718

89,997

Deferred tax assets

143,319

26,575

(168,679

)

(Gain)/loss on early extinguishments of

debt

(19,515

)

(85,926

)

(93,519

)

Loss contingency accrual

—

7,000

—

Impairment expense

677,239

3,600

—

Loss from write-offs of property and

equipment

5,795

4,137

3,549

Amortization of debt issuance costs

2,147

3,156

5,166

Operating lease expense, net of

accretion

5,864

6,079

6,327

Realized loss on sale of investments

27

2,106

9,675

Gain on textbook library, net

—

—

(4,976

)

Print textbook depreciation expense

—

—

1,610

Gain on foreign currency remeasurement of

purchase consideration

—

—

(4,628

)

Impairment on lease related assets

5,557

—

5,225

Other non-cash items

656

(1,228

)

378

Change in assets and liabilities, net of

effect of acquisition of business:

Accounts receivable

7,771

(7,799

)

(3,752

)

Prepaid expenses and other current

assets

(41,732

)

3,476

17,191

Other assets

1,130

10,829

14,563

Accounts payable

(12,376

)

13,057

(4,144

)

Deferred revenue

(15,885

)

(1,585

)

7,538

Accrued liabilities

47,103

(7,342

)

(20,111

)

Other liabilities

(7,785

)

(11,337

)

(5,768

)

Net cash provided by operating

activities

125,205

246,198

255,736

Cash flows from investing activities

Purchases of property and equipment

(74,953

)

(83,052

)

(103,092

)

Purchases of textbooks

—

—

(3,815

)

Proceeds from disposition of textbooks

—

9,787

6,003

Purchases of investments

(170,950

)

(637,939

)

(730,509

)

Proceeds from sale of investments

70,077

394,533

458,489

Maturities of investments

171,671

597,197

884,940

Proceeds from sale of strategic equity

investments

15,500

—

—

Acquisition of business, net of cash

acquired

—

—

(401,125

)

Purchases of strategic equity

investments

—

(11,853

)

(6,000

)

Net cash provided by investing

activities

11,345

268,673

104,891

Cash flows from financing activities

Proceeds from common stock issued under

stock plans, net

2,636

4,165

6,477

Payment of taxes related to the net share

settlement of equity awards

(9,239

)

(16,440

)

(26,549

)

Repayment of convertible senior notes

(96,520

)

(505,986

)

(401,203

)

Proceeds from exercise of convertible

senior notes capped call

—

297

—

Payment of withholding tax

(3,450

)

—

—

Repurchase of common stock

(2,569

)

(334,806

)

(323,528

)

Net cash used in financing activities

(109,142

)

(852,770

)

(744,803

)

Effect of exchange rate changes

(1,025

)

21

4,137

Net increase (decrease) in cash, cash

equivalents and restricted ca

26,383

(337,878

)

(380,039

)

Cash, cash equivalents and restricted

cash, beginning of period

137,976

475,854

855,893

Cash, cash equivalents and restricted

cash, end of period

$

164,359

$

137,976

$

475,854

Years Ended December

31,

2024

2023

2022

Supplemental cash flow data:

Cash paid during the period for:

Interest

$

449

$

741

$

875

Income taxes, net of refunds

$

8,085

$

11,074

$

6,841

Cash paid for amounts included in the

measurement of lease liabilities:

Operating cash flows from operating

leases

$

7,243

$

9,042

$

8,863

Right of use assets obtained in exchange

for lease obligations:

Operating leases

$

10,108

$

12,407

$

10,232

Non-cash investing and financing

activities:

Accrued purchases of long-lived assets

$

5,850

$

9,650

$

4,927

December 31,

2024

2023

2022

Reconciliation of cash, cash equivalents

and restricted cash:

Cash and cash equivalents

$

161,475

$

135,757

$

473,677

Restricted cash included in other current

assets

956

—

63

Restricted cash included in other

assets

1,928

2,219

2,114

Total cash, cash equivalents and

restricted cash

$

164,359

$

137,976

$

475,854

CHEGG, INC.

RECONCILIATION OF NET (LOSS)

INCOME TO EBITDA AND ADJUSTED EBITDA

(in thousands)

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Net (loss) income

$

(6,125

)

$

9,665

$

(837,068

)

$

18,180

Interest expense

631

658

2,590

3,773

Provision for income taxes

4,021

8,103

148,702

32,132

Depreciation and amortization expense

19,378

20,773

78,344

129,718

EBITDA

17,905

39,199

(607,432

)

183,803

Share-based compensation expense

15,347

31,906

84,614

133,502

Other income, net

(25,847

)

(5,139

)

(51,332

)

(121,810

)

Acquisition-related compensation costs

192

204

752

6,290

Restructuring charges

15,763

—

24,603

5,704

Impairment expense

—

—

677,239

3,600

Impairment of lease related assets

3,368

—

5,557

—

Content and related assets charge

2,937

—

3,666

4,047

Loss contingency

6,900

—

12,000

7,000

Transitional logistics charges

—

—

—

253

Adjusted EBITDA

$

36,565

$

66,170

$

149,667

$

222,389

CHEGG, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except

percentages and per share amounts)

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Cost of revenues

$

45,599

$

45,804

$

180,927

$

225,941

Content and related assets charge

(2,937

)

—

(3,666

)

(38,242

)

Amortization of intangible assets

(1,077

)

(3,111

)

(8,713

)

(12,970

)

Share-based compensation expense

(336

)

(571

)

(1,786

)

(2,256

)

Acquisition-related compensation costs

(5

)

(4

)

(21

)

(21

)

Restructuring charges

(559

)

—

(762

)

(12

)

Transitional logistics charges

—

—

—

(253

)

Non-GAAP cost of revenues

$

40,685

$

42,118

$

165,979

$

172,187

Gross profit

$

97,885

$

142,183

$

436,647

$

490,354

Content and related assets charge

2,937

—

3,666

38,242

Amortization of intangible assets

1,077

3,111

8,713

12,970

Share-based compensation expense

336

571

1,786

2,256

Acquisition-related compensation costs

5

4

21

21

Restructuring charges

559

—

762

12

Transitional logistics charges

—

—

—

253

Non-GAAP gross profit

$

102,799

$

145,869

$

451,595

$

544,108

Gross margin %

68

%

76

%

71

%

68

%

Non-GAAP gross margin %

72

%

78

%

73

%

76

%

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Operating expenses

$

125,205

$

128,896

$

1,173,755

$

558,079

Share-based compensation expense

(15,011

)

(31,335

)

(82,828

)

(131,246

)

Amortization of intangible assets

—

(2,594

)

(1,291

)

(11,417

)

Acquisition-related compensation costs

(187

)

(200

)

(731

)

(6,269

)

Impairment expense

—

—

(677,239

)

(3,600

)

Restructuring charges

(15,204

)

—

(23,841

)

(5,692

)

Loss contingency

(6,900

)

—

(12,000

)

(7,000

)

Impairment of lease related assets

(3,368

)

—

(5,557

)

—

Non-GAAP operating expenses

$

84,535

$

94,767

$

370,268

$

392,855

(Loss) income from operations

$

(27,320

)

$

13,287

$

(737,108

)

$

(67,725

)

Share-based compensation expense

15,347

31,906

84,614

133,502

Amortization of intangible assets

1,077

5,705

10,004

24,387

Acquisition-related compensation costs

192

204

752

6,290

Impairment expense

—

—

677,239

3,600

Content and related assets charge

2,937

—

3,666

38,242

Transitional logistics charges

—

—

—

253

Restructuring charges

15,763

—

24,603

5,704

Loss contingency

6,900

—

12,000

7,000

Impairment of lease related assets

3,368

—

5,557

—

Non-GAAP income from operations

$

18,264

$

51,102

$

81,327

$

151,253

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Net (loss) income

$

(6,125

)

$

9,665

$

(837,068

)

$

18,180

Share-based compensation expense

15,347

31,906

84,614

133,502

Amortization of intangible assets

1,077

5,705

10,004

24,387

Acquisition-related compensation costs

192

204

752

6,290

Amortization of debt issuance costs

519

546

2,147

3,156

Income tax effect of non-GAAP

adjustments

(1,442

)

(5,368

)

124,740

(12,633

)

Gain on early extinguishment of debt

(19,515

)

—

(19,515

)

(85,926

)

Impairment expense

—

—

677,239

3,600

Content and related assets charge

2,937

—

3,666

38,242

Restructuring charges

15,763

—

24,603

5,704

Loss contingency

6,900

—

12,000

7,000

Transitional logistics charges

—

—

—

253

Gain on sale of strategic equity

investment

—

—

(3,783

)

—

Impairment of lease related assets

3,368

—

5,557

—

Non-GAAP net income

$

19,021

$

42,658

$

84,956

$

141,755

Weighted average shares used to compute

net (loss) income per share, diluted

104,513

118,902

103,300

128,569

Effect of shares for stock plan

activity

297

—

1,019

514

Effect of shares related to convertible

senior notes

9,234

—

9,234

—

Non-GAAP weighted average shares used to

compute non-GAAP net income per share, diluted

114,044

118,902

113,553

129,083

Net income (loss) per share, diluted

$

(0.06

)

$

0.09

$

(8.10

)

$

(0.34

)

Adjustments

0.23

0.27

8.85

1.44

Non-GAAP net income per share, diluted

$

0.17

$

0.36

$

0.75

$

1.10

CHEGG, INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(in thousands)

Years Ended December

31,

2024

2023

Net cash provided by operating

activities

$

125,205

$

246,198

Purchases of property and equipment

(74,953

)

(83,052

)

Proceeds from disposition of textbooks

—

9,787

Free cash flow

$

50,252

$

172,933

CHEGG, INC.

SELECTED QUARTERLY FINANCIAL

DATA

(in thousands)

(unaudited)

Three Months Ended

March 31, 2024

June 30, 2024

September 30, 2024

December 31,

2024

Subscription Services

$

154,051

$

146,813

$

119,804

$

128,543

Skills and Other

20,299

16,334

16,789

14,941

Total net revenues

$

174,350

$

163,147

$

136,593

$

143,484

Gross profit

127,853

117,736

93,173

97,885

Loss from operations

(2,491

)

(485,007

)

(222,290

)

(27,320

)

Net loss

(1,420

)

(616,884

)

(212,639

)

(6,125

)

Weighted average shares used to compute

net (loss) income per share:

Basic

102,343

102,604

103,723

104,513

Diluted

102,343

102,604

103,723

104,513

Net (loss) income per share:

Basic

$

(0.01

)

$

(6.01

)

$

(2.05

)

$

(0.06

)

Diluted

$

(0.01

)

$

(6.01

)

$

(2.05

)

$

(0.06

)

Three Months Ended

March 31, 2023

June 30, 2023

September 30, 2023

December 31, 2023

Subscription Services

$

168,440

$

165,855

$

139,912

$

166,313

Skills and Other

19,161

16,998

17,942

21,674

Total net revenues

$

187,601

$

182,853

$

157,854

$

187,987

Gross profit

138,451

135,441

74,279

142,183

(Loss) income from operations

(4,446

)

(18,696

)

(57,870

)

13,287

Net income (loss)

2,186

24,612

(18,283

)

9,665

Weighted average shares used to compute

net (loss) income per share:

Basic

123,710

117,977

115,407

109,093

Diluted

124,304

132,944

115,407

118,902

Net (loss) income per share:

Basic

$

0.02

$

0.21

$

(0.16

)

$

0.09

Diluted

$

0.02

$

(0.11

)

$

(0.16

)

$

0.09

CHEGG, INC.

RECONCILIATION OF

FORWARD-LOOKING NET LOSS TO EBITDA AND ADJUSTED EBITDA

(in thousands)

(unaudited)

Three Months Ending March 31,

2025

Net loss

$

(14,300

)

Interest expense, net

400

Provision for income taxes

600

Depreciation and amortization expense

17,800

EBITDA

4,500

Share-based compensation expense

11,500

Other income, net

(5,500

)

Restructuring charges

3,000

Adjusted EBITDA

$

13,500

* Adjusted EBITDA guidance for the three months ending March 31,

2025 represents the midpoint of the range of $13 million to $14

million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250223441916/en/

Media Contact: Mansi Bandarupalli, press@chegg.com Investor

Contact: Tracey Ford, IR@chegg.com

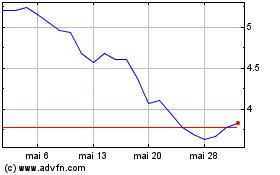

Chegg (NYSE:CHGG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Chegg (NYSE:CHGG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025