Record Net Sales of $43.3 million for Fiscal

Year 2024, growth of 27% year-over-year. Gross Margin at 40.9%.

Cash increased $0.8 million.

Laird Superfood, Inc. (NYSE American: LSF) (“Laird Superfood,”

the “Company,” “we,” and “our”), today reported financial results

for the fourth quarter and fiscal year ended December 31, 2024.

Jason Vieth, Chief Executive Officer, commented, “I am thrilled

to share that 2024 was, by far, the best performance for Laird

Superfood as a public company. In the last twelve months, we

achieved significant growth across our product lines and all sales

channels, our highest gross margins ever, and positive cash flow

for the first time in company history. These results are especially

impressive when considering the turnaround that we executed over

the past two years and are the direct result of the passion and

dedication of our team of founders and employees. We are clearly

on-trend with the broad consumer desire to eat better, more

wholesome, and functional foods, and we are poised for continued

expansion across products, channels, and geographies.”

Fourth Quarter 2024 Highlights

- Net Sales of $11.6 million compared to $9.2 million in the

corresponding prior year period, representing 26% growth.

- E-commerce sales increased by 12% year-over-year and

contributed 58% of total Net Sales, with significant improvements

in media efficiency in this channel. The growth was driven by

strong sales on Amazon.com, building on the momentum over the

previous three quarters.

- Wholesale sales increased by 52% year-over-year and contributed

42% of total Net Sales, driven by growth in grocery due to

distribution expansion and velocity improvement at shelf, led by

club sales outlets.

- Gross Margin was 38.6% compared to 40.4% in the corresponding

prior year period. This margin contraction was driven primarily by

increased gross to net sales promotional spend related to prior

periods, including higher slotting expenses due to distribution

expansion.

- Net Loss was $0.4 million, or $0.04 per diluted share, compared

to Net Income of $0.1 million, or $0.02 per diluted share, in the

corresponding prior year period. The Net Loss in the fourth quarter

of 2024, compared to the Net Income in the prior year period, was

driven mostly by higher operating expenses, namely stock-based

compensation reflective of our stock performance and other

personnel costs, partially offset by increased net sales.

- Adjusted EBITDA, which is a non-GAAP financial measure, was

$0.2 million, or $0.01 per diluted share, compared to $0.3 million,

or $0.03 per diluted share, in the corresponding prior year period.

The decrease was driven primarily by increased personnel costs. For

more details on non-GAAP financial measures, refer to the

information in the non-GAAP financial measures section of this

press release.

Fiscal Year 2024 Highlights

- Net Sales of $43.3 million compared to $34.2 million in the

corresponding prior year period, representing 27% growth.

- E-commerce sales increased by 32% year-over-year and

contributed 59% of total Net Sales, with significant improvements

in media efficiency in this channel. Sales on Amazon.com and the

DTC platform contributed to e-commerce channel growth, driven by

growth in subscription revenue and repeat customer purchases, as

well as higher order values.

- Wholesale sales increased by 19% year-over-year and contributed

41% of total Net Sales, driven by velocity improvement in retail

and club outlets and distribution expansion in grocery, as well as

more efficient promotional spend.

- Gross Margin was 40.9% compared to 30.1% in the corresponding

prior year period. This margin expansion of 1,071 basis points was

driven by the full benefit realization of the transition to a

variable cost third-party co-manufacturing business model,

favorable product costs, settlement recoveries, as well as planned

reductions in promotional trade spend.

- Net Loss was $1.8 million, or $0.18 per diluted share, compared

to Net Loss of $10.2 million, or $1.09 per diluted share, in the

corresponding prior year period. The improvement was driven by Net

Sales growth, Gross Margin expansion, and lower marketing and

general and administrative ("G&A") costs.

- Adjusted EBITDA was ($0.7) million, or ($0.07) per diluted

share, compared to ($9.0) million, or ($0.96) per diluted share, in

the corresponding prior year period. This improvement was driven by

Net Sales growth, Gross Margin expansion, and lower marketing and

G&A costs. For more details on non-GAAP financial measures,

refer to the information in the non-GAAP financial measures section

of this press release.

Revenue Disaggregation

Three Months Ended December

31,

2024

2023

$

% of Total

$

% of Total

Coffee creamers

$

6,521,777

56

%

$

4,831,008

52

%

Coffee, tea, and hot chocolate

products

3,196,314

28

%

1,924,368

21

%

Hydration and beverage enhancing

supplements

2,318,791

20

%

1,533,728

17

%

Harvest snacks and other food items

1,550,974

13

%

2,084,375

23

%

Other

73,179

1

%

148,422

2

%

Gross sales

13,661,035

118

%

10,521,901

115

%

Shipping income

132,900

1

%

121,870

1

%

Discounts and promotional activity

(2,187,736

)

(18

)%

(1,436,383

)

(16

)%

Sales, net

$

11,606,199

101

%

$

9,207,388

100

%

Year Ended December

31,

2024

2023

$

% of Total

$

% of Total

Coffee creamers

$

23,088,363

53

%

$

20,425,029

60

%

Coffee, tea, and hot chocolate

products

11,184,525

26

%

7,968,956

23

%

Hydration and beverage enhancing

products

9,207,964

21

%

5,320,039

16

%

Harvest snacks and other food items

6,215,989

14

%

6,883,980

20

%

Other

172,788

0

%

435,388

1

%

Gross sales

49,869,629

114

%

41,033,392

120

%

Shipping income

506,732

1

%

899,921

3

%

Discounts and promotional activity

(7,081,224

)

(15

)%

(7,709,115

)

(23

)%

Sales, net

$

43,295,137

100

%

$

34,224,198

100

%

Balance Sheet and Cash Flow

Highlights

We had $8.5 million of cash, cash equivalents, and restricted

cash as of December 31, 2024, and no outstanding debt.

Cash provided by operating activities was $0.9 million for the

fiscal year 2024, compared to cash used in operating activities of

$10.8 million in the same period in 2023. The improvement in net

operating cash flows relative to the corresponding prior year

period was driven by significant improvements in operating

performance driven by sales growth, gross margin expansion, and

reductions in marketing costs.

2025 Outlook

In 2025, management's strategy is to drive growth well in excess

of the consumer goods and food industry averages:

- Management re-affirms Net Sales growth in the 20% to 25% range

on a full-year basis, driven by continued expansion across

Wholesale accounts and further penetration of consumers on

e-commerce platforms. Gross Margin is expected to hold in the upper

30s, despite commodities cost pressures.

- Adjusted EBITDA is targeted to be break even on a full-year

basis.

- We expect $1 to $2 million of negative operating cash flow in

order to invest into inventory to support top line growth and to

minimize out-of-stocks.

Laird Superfood has not provided a reconciliation between its

forecasted Adjusted EBITDA and net income, its most directly

comparable GAAP measure, because applicable information for future

periods, on which this reconciliation would be based, is not

available without unreasonable effort due to the unavailability of

reliable estimates for stock-based compensation, due to volatility

in our stock price, and state and local income taxes, among other

items. These items may vary greatly between periods and could

significantly impact future financial results.

Conference Call and Webcast Details

We will host a conference call and webcast at 5:00 p.m. ET today

to discuss our financial results. Participants may access the live

webcast on the Laird Superfood Investor Relations website at

https://investors.lairdsuperfood.com under “Events”. The webcast

will be archived on the Company's website and will be available for

replay for at least two weeks.

About Laird Superfood

Laird Superfood, Inc. creates award-winning, plant-based

superfood products that are clean, delicious, and functional. Our

products are designed to enhance a consumer's daily ritual and keep

them fueled naturally throughout the day. Laird Superfood was

co-founded in 2015 by the world's most prolific big-wave surfer,

Laird Hamilton. Laird Superfood's offerings are environmentally

conscientious, responsibly tested and made with real ingredients.

Shop all products online at www.lairdsuperfood.com and join the

Laird Superfood community on social media for the latest news and

daily doses of inspiration.

Forward-Looking Statements

This press release and the conference call referencing this

press release contain “forward-looking” statements, as that term is

defined under the federal securities laws, including but not

limited to statements regarding Laird Superfood’s anticipated

expansion across its platforms, channels, products, and

geographies, cash runway, future financial performance, and growth.

Such forward-looking statements may be identified by words such as

"anticipates," "believes," "continues," "could," "estimates,"

"expects," "intends," "may," "outlook," "plans," "potential,"

predicts," "projects," "seeks," "should," "will," "would", or the

antonyms of these terms or other comparable terminology. These

forward-looking statements are based on Laird Superfood’s current

assumptions, expectations and beliefs and are subject to

substantial risks, uncertainties, assumptions and changes in

circumstances that may cause Laird Superfood’s actual results,

performance or achievements to differ materially from those

expressed or implied in any forward-looking statement. We expressly

disclaim any obligation to update or alter any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

The risks and uncertainties referred to above include, but are

not limited to: (1) volatility regarding our revenue, expenses,

including shipping expenses, and other operating results; (2) our

ability to acquire new direct and wholesale customers and

successfully retain existing customers; (3) our ability to attract

and retain our suppliers, distributors and co-manufacturers, and

effectively manage their costs and performance; (4) effects of real

or perceived quality or health issues with our products or other

issues that adversely affect our brand and reputation; (5) our

ability to innovate on a timely and cost-effective basis, predict

changes in consumer preferences and develop successful new

products, or updates to existing products, and develop innovative

marketing strategies; (6) adverse developments regarding prices and

availability of raw materials and other inputs, a substantial

amount of which come from a limited number of suppliers outside the

United States, including in areas which may be adversely affected

by climate change; (7) effects of changes in the tastes and

preferences of our consumers and consumer preferences for natural

and organic food products; (8) the financial condition of, and our

relationships with, our suppliers, co-manufacturers, distributors,

retailers and food service customers, as well as the health of the

food service industry generally; (9) the ability of ourselves, our

suppliers and co-manufacturers to comply with food safety,

environmental or other laws or regulations and the potential impact

of policy changes regarding imports, exports, and tariffs; (10) our

plans for future investments in our business, our anticipated

capital expenditures and our estimates regarding our capital

requirements, including our ability to continue as a going concern;

(11) the costs and success of our marketing efforts, and our

ability to promote our brand; (12) our reliance on our executive

team and other key personnel and our ability to identify, recruit

and retain skilled and general working personnel; (13) our ability

to effectively manage our growth; (14) our ability to compete

effectively with existing competitors and new market entrants; (15)

the impact of adverse economic conditions, consumer confidence and

spending levels; (16) the growth rates of the markets in which we

compete, and (17) the other risks described in our Annual Report on

Form 10-K for the year ended December 31, 2024 and other filings we

make with the Securities and Exchange Commission.

LAIRD SUPERFOOD, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

Year Ended

December 31,

2024

2023

Sales, net

$

43,295,137

$

34,224,198

Cost of goods sold

(25,607,556

)

(23,910,921

)

Gross profit

17,687,581

10,313,277

General and administrative

Salaries, wages, and benefits

4,367,976

4,203,613

Other general and administrative

4,931,033

5,589,747

Total general and administrative

expenses

9,299,009

9,793,360

Sales and marketing

Marketing and advertising

6,484,611

7,600,859

Selling

3,825,992

3,332,872

Related party marketing agreements

251,061

285,172

Total sales and marketing expenses

10,561,664

11,218,903

Total operating expenses

19,860,673

21,012,263

Operating loss

(2,173,092

)

(10,698,986

)

Other income

413,255

551,064

Loss before income taxes

(1,759,837

)

(10,147,922

)

Income tax expense

(60,324

)

(15,195

)

Net loss

$

(1,820,161

)

$

(10,163,117

)

Net loss per share:

Basic and diluted

$

(0.18

)

$

(1.09

)

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock,

basic and diluted

9,946,733

9,297,226

LAIRD SUPERFOOD, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited)

Year Ended December

31,

2024

2023

Cash flows from operating

activities

Net loss

$

(1,820,161

)

$

(10,163,117

)

Adjustments to reconcile net loss to net

cash from operating activities:

Depreciation and amortization

270,271

306,176

Stock-based compensation

1,637,788

1,092,146

Provision for inventory obsolescence

599,902

1,273,171

Allowance for credit losses

(21,094

)

165,980

Noncash lease costs

142,321

152,339

Other operating activities, net

11,370

38,098

Changes in operating assets and

liabilities:

Accounts receivable

(719,445

)

306,117

Inventory

(253,019

)

(1,899,165

)

Prepaid expenses and other current

assets

(267,463

)

1,244,511

Operating lease liability

(128,426

)

(126,434

)

Accounts payable

513,066

570,094

Accrued expenses

900,392

(3,725,797

)

Net cash from operating activities

865,502

(10,765,881

)

Cash flows from investing

activities

Purchase of property and equipment

(24,776

)

(144,023

)

Proceeds on sale of property and

equipment

—

34,330

Proceeds from sale of assets

held-for-sale

—

800,000

Net cash from investing activities

(24,776

)

690,307

Cash flows from financing

activities

Common stock issuances, net of taxes

(70,926

)

(27,422

)

Common stock issuance costs

(57,475

)

—

Stock options exercised, net of option

costs

95,021

—

Net cash from financing activities

(33,380

)

(27,422

)

Net change in cash and cash

equivalents

807,346

(10,102,996

)

Cash, cash equivalents, and restricted

cash, beginning of period

7,706,806

17,809,802

Cash, cash equivalents, and restricted

cash, end of period

$

8,514,152

$

7,706,806

Supplemental disclosures of cash flow

information

Cash paid for interest

$

16,027

$

13,994

Cash paid for income taxes

$

63,852

$

17,625

Right-of-use assets obtained in exchange

for operating lease liabilities

$

—

$

344,382

Prepaid expenses paid for with a

short-term financing arrangement included in accrued expenses

$

165,543

$

—

LAIRD SUPERFOOD, INC.

CONSOLIDATED BALANCE

SHEETS

(unaudited)

As of

December 31, 2024

December 31, 2023

Assets

Current assets

Cash, cash equivalents, and restricted

cash

$

8,514,152

$

7,706,806

Accounts receivable, net

1,762,911

1,022,372

Inventory

5,975,676

6,322,559

Prepaid expenses and other current

assets

1,713,889

1,285,564

Total current assets

17,966,628

16,337,301

Noncurrent assets

Property and equipment, net

58,447

122,595

Intangible assets, net

896,123

1,085,231

Related party license agreements

132,100

132,100

Right-of-use assets

205,703

354,732

Total noncurrent assets

1,292,373

1,694,658

Total assets

$

19,259,001

$

18,031,959

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

2,137,760

$

1,647,673

Accrued expenses

3,642,998

2,586,343

Related party liabilities

34,947

2,688

Lease liabilities, current portion

105,966

138,800

Total current liabilities

5,921,671

4,375,504

Lease liabilities

140,464

243,836

Total liabilities

6,062,135

4,619,340

Stockholders’ equity

Common stock, $0.001 par value,

100,000,000 shares authorized at December 31, 2024 and December 31,

2023; 10,668,705 and 10,292,374 issued and outstanding at December

31, 2024, respectively; and 9,749,326 and 9,383,622 issued and

outstanding at December 31, 2023, respectively.

10,292

9,384

Additional paid-in capital

121,304,884

119,701,384

Accumulated deficit

(108,118,310

)

(106,298,149

)

Total stockholders’ equity

13,196,866

13,412,619

Total liabilities and stockholders’

equity

$

19,259,001

$

18,031,959

LAIRD SUPERFOOD, INC.

NON-GAAP FINANCIAL

MEASURES

(unaudited)

In this press release, we report Adjusted

EBITDA and Adjusted EBITDA per diluted share, which are financial

measures not required by, or presented in accordance with,

accounting principles generally accepted in the United States of

America (“GAAP”). The Company’s management uses non-GAAP financial

measures, both internally and externally, to assess and communicate

the financial performance of the Company. The Company defines

Adjusted EBITDA as net income (loss), adjusted to exclude: (1)

interest expense and other (income) expense, net, (2) income tax

(benefit) expense, (3) depreciation and amortization expenses, (4)

stock-based compensation, (5) expenses related to a product quality

issue, (6) costs incurred as part of the strategic downsizing of

the Company’s operations, (7) rebranding costs, and (8) estimated

class action lawsuit settlement costs. The Company believes

Adjusted EBITDA is useful to investors because it facilitates

comparisons of its core business operations, excluding non-cash

costs and non-recurring events, across periods on a consistent

basis.

Management uses Adjusted EBITDA internally

in analyzing the Company’s financial results to assess operational

performance and to determine the Company’s future capital

requirements. The presentation of this financial information is not

intended to be considered in isolation or as a substitute for the

financial information prepared in accordance with GAAP. The Company

believes that both management and investors benefit from referring

to Adjusted EBITDA in assessing its performance and when planning,

forecasting and analyzing future periods. The Company believes

Adjusted EBITDA is useful to investors and others to understand and

evaluate the Company’s operating results and it allows for a more

meaningful comparison between the Company’s performance and that of

competitors. Our use of Adjusted EBITDA has limitations as an

analytical tool, and you should not consider this performance

measure in isolation from or as a substitute for analysis of our

results as reported under GAAP. Some of these limitations are that

Adjusted EBITDA does not reflect, among other things: cash capital

expenditures for assets underlying depreciation and amortization

expense that may need to be replaced or for new capital

expenditures; interest expense; income tax expense from continuing

operations; our working capital requirements; the potentially

dilutive impact of stock-based compensation; and the provision for

income taxes. Other companies, including companies in our industry,

may calculate Adjusted EBITDA differently, which reduces its

usefulness as a comparative measure.

Because of these limitations, you should

consider Adjusted EBITDA along with other financial performance

measures, including Net Sales, net loss, cash and cash equivalents,

restricted cash, net cash used in operating activities and our

financial results presented in accordance with GAAP.

The following table presents a

reconciliation of net income (loss), the most directly comparable

financial measure stated in accordance with GAAP, to adjusted

EBITDA, for each of the periods presented:

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Net (loss) income

$

(398,443

)

$

142,923

$

(1,820,161

)

$

(10,163,117

)

Adjusted for:

Depreciation and amortization

65,852

71,151

270,271

306,176

Stock-based compensation

564,090

273,499

1,637,788

1,092,146

Income tax expense

12,422

2,023

60,324

15,195

Interest expense and other (income)

expense, net

(91,298

)

(98,776

)

(413,255

)

(551,064

)

Product quality issue (a)

—

(69,842

)

(434,329

)

282,000

Strategic organizational shifts (b)

—

42,030

—

(13,318

)

Company-wide rebranding costs (c)

—

—

—

163,806

Estimated class action lawsuit settlement

costs (d)

—

(95,000

)

—

(95,000

)

Adjusted EBITDA

$

152,623

$

268,008

$

(699,362

)

$

(8,963,176

)

Net (loss) income per share,

diluted:

$

(0.04

)

$

0.02

$

(0.18

)

$

(1.09

)

Adjusted EBITDA per share,

diluted:

$

0.01

$

0.03

$

(0.07

)

$

(0.96

)

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock,

basic

10,288,653

9,337,789

9,946,733

9,297,226

Dilutive securities

1,705,180

200,679

—

—

Weighted-average shares of common stock

outstanding used in computing adjusted EBITDA per share of common

stock, diluted

11,993,833

9,538,468

9,946,733

9,297,226

(a) In January 2023, we identified a

product quality issue with raw material from one vendor and we

voluntarily withdrew any affected finished goods. We previously

incurred costs associated with product testing, discounts for

replacement orders, and inventory obsolescence costs. We reached

settlement with a supplier in the third quarter of 2023 and

recorded recoveries in 2024.

(b) Costs incurred and recovered during

2023 as part of the strategic downsizing of our operations,

including severances, forfeitures of stock-based compensation, and

other personnel costs, IT integration costs, and freight costs to

move inventory to third-party facilities.

(c) Costs incurred as part of the

company-wide rebranding efforts that launched in Q1 2023.

(d) Estimated legal settlement costs

related to a class action lawsuit which was included in general and

administrative expenses in Q4 2022 and was reversed in Q4 2023 upon

dismissal of the suit.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226333389/en/

Investor Relations Contact Trevor Rousseau

investors@lairdsuperfood.com

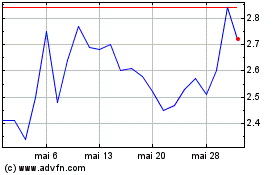

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025