Endeavor Group Holdings, Inc. (NYSE: EDR) (“Endeavor” or the

“Company”), a global sports and entertainment company, today

released its financial results for the quarterly period and fiscal

year ended December 31, 2024.

2024 Highlights

- $7.111 billion in full year 2024 revenue

- Growth across the Owned Sports Properties segment driven by

strong performance at UFC, WWE, and Professional Bull Riders

(“PBR”)

- Growth in the Representation segment driven by strong

performance in WME’s talent, music, and sports groups

Full Year 2024 Consolidated Financial Results

- Revenue: $7.111 billion

- Net loss: $1.215 billion

- Adjusted EBITDA: $1.316 billion

Q4 2024 Consolidated Financial Results

- Revenue: $1.568 billion

- Net loss: $237.2 million

- Adjusted EBITDA: $277.1 million

“We closed out 2024 with continued momentum reflecting strong

demand for premium content and live events,” said Ariel Emanuel,

CEO, Endeavor. “Over the next few months, our focus remains on

completing our sale of IMG, On Location, and PBR to TKO; closing

our take-private transaction with Silver Lake; and ensuring

Endeavor is well-positioned for long-term success in

representation.”

Segment Operating Results

- Owned Sports Properties segment revenue was $670.4

million for the quarter, up $27.7 million, or 4%, compared to the

prior-year quarter, and was $2.985 billion for the year, up $1.169

billion, or 64%, compared to the prior year. For the year, the

increase in revenue was primarily attributed to the acquisition of

WWE in September 2023, which contributed $1.0 billion, and

increases at UFC from sponsorships, live event revenue, and site

fees, as well as higher media rights fees from contractual

escalations. The revenue increase was also attributable to PBR from

increases in team-related revenue, brand partnerships, and ticket

sales. The segment’s Adjusted EBITDA was $237.2 million for the

quarter, up $12.5 million, or 6%, compared to the prior-year

quarter, and was $1.275 billion for the year, up $447.5 million, or

54%, compared to the prior year.

- Events, Experiences & Rights segment revenue was

$411.9 million for the quarter, down $2.6 million, or 1%, compared

to the prior-year quarter, and was $2.529 billion for the year, up

$355.4 million, or 16%, compared to the prior year. For the year,

the increase in revenue was primarily driven by the Paris 2024

Olympic and Paralympic Games, Super Bowl LVIII, and the Miami Open

and Madrid Open tennis tournaments, partially offset by the sale of

IMG Academy in June 2023. The segment’s Adjusted EBITDA was $11.0

million for the quarter, down $2.7 million, or 20%, compared to the

prior-year quarter, and was $(29.8) million for the year, down

$257.9 million, compared to the prior year.

- Representation segment revenue was $501.6 million for

the quarter, up $74.2 million, or 17%, compared to the prior-year

quarter, and was $1.688 billion for the year, up $143.2 million, or

9% compared to the prior year. For the year, the increase was

primarily driven by growth at WME across talent, music, and sports,

as well as an increase in our nonscripted business, primarily due

to an acquisition in 2024, partially offset by decreases in our

marketing, licensing, and fashion businesses. The segment’s

Adjusted EBITDA was $108.2 million for the quarter, up $4.7

million, or 5%, compared to the prior-year quarter, and was $405.7

million for the year, up $14.6 million, or 4%, compared to the

prior year.

Sports Data & Technology Segment

In the second quarter of 2024, the Company began to actively

market the businesses comprising the Sports Data & Technology

segment, OpenBet and IMG ARENA. In November 2024, the Company

signed a definitive agreement for the sale of OpenBet and IMG ARENA

to OB Global Holdings LLC in a management buyout backed by Ariel

Emanuel with participation from executives of OpenBet. For

financial reporting purposes, these businesses are considered Held

for Sale and the Sports Data & Technology segment is presented

as discontinued operations in our consolidated financial

statements.

Balance Sheet and Liquidity

At December 31, 2024, cash and cash equivalents totaled $1.201

billion, compared to $1.004 billion at September 30, 2024. Total

debt was $5.678 billion at December 31, 2024, compared to $5.228

billion at September 30, 2024.

For further information regarding the Company's financial

results, as well as certain non-GAAP financial measures, and the

reconciliations thereof, please refer to the following pages of

this release or visit the Company’s Investor Relations site at

investor.endeavorco.com.

Recent Updates

On October 24, 2024, the Company announced a definitive

agreement with TKO Group Holdings, Inc. (NYSE: TKO) to acquire

Endeavor assets including PBR, On Location, and IMG in an

all-equity transaction valued at $3.25 billion. The acquisition of

IMG does not include businesses associated with the IMG brand in

licensing, models, and tennis and golf representation, nor IMG’s

full events portfolio. The transaction is expected to close in the

near term and in any event within the first quarter of 2025.

Also on October 24, 2024, the Company announced it has commenced

a review and potential sale of certain events within its portfolio,

including but not limited to the Miami Open and Madrid Open tennis

tournaments and the art platform Frieze. No definitive timetable

has been set for completion of any potential sales.

Silver Lake Transaction

On April 2, 2024, Endeavor announced that it entered into a

definitive agreement to be acquired by Silver Lake, the global

leader in technology investing, in partnership with the Endeavor

management team and additional anchor investors. Under the terms of

the agreement, Silver Lake will acquire 100% of the outstanding

shares it does not already own, other than rolled interests.

Endeavor stockholders will receive $27.50 per share in cash. The

merger agreement requires the Company to, in each calendar quarter

prior to the closing, declare and pay a dividend in respect of each

issued and outstanding share of the Company’s Class A common stock

at a price equal to $0.06 per share. The transaction is subject to

the satisfaction of customary closing conditions and required

regulatory approvals. No other stockholder approval is required.

The transaction is expected to close by the end of the first

quarter of 2025.

Webcast Details

Following the prior announcement of Endeavor’s definitive

agreement to be acquired by Silver Lake, the Company will not be

hosting an earnings conference call this quarter.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements in this press release that do not relate to matters of

historical fact should be considered forward-looking statements,

including, without limitation, the Company’s business strategy, the

expected take-private of the Company by Silver Lake; the payment to

be made to the Company’s stockholders; the expected timing of the

closing of the take-private transaction; the announced acquisition

of PBR, On Location and IMG by TKO, the potential sale of certain

events within the Company’s IMG portfolio, and the expected sale of

the businesses comprising the Company’s Sports Data &

Technology segment. The words “believe,” “may,” “will,” “estimate,”

“potential,” “continue,” “anticipate,” “intend,” “expect,” “could,”

“would,” “project,” “plan,” “target,” and similar expressions are

intended to identify forward-looking statements, though not all

forward-looking statements use these words or expressions. These

forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees

and involve known and unknown risks, uncertainties and other

important factors that may cause actual results, performance or

achievements to be materially different from what is expressed or

implied by the forward-looking statements, including, but not

limited to: risks related to the Company’s potential transaction

with Silver Lake, the announced acquisition of PBR, On Location and

IMG by TKO, and the potential sale of the businesses comprising the

Company’s Sports Data & Technology segment; changes in public

and consumer tastes and preferences and industry trends; impacts

from changes in discretionary and corporate spending on

entertainment and sports events due to factors beyond our control,

such as adverse economic conditions, on our operations; Endeavor’s

ability to adapt to or manage new content distribution platforms or

changes in consumer behavior resulting from new technologies;

Endeavor’s reliance on its professional reputation and brand name;

Endeavor’s dependence on the relationships of its management,

agents, and other key personnel with clients; Endeavor’s dependence

on key relationships with television and cable networks, satellite

providers, digital streaming partners, corporate sponsors, and

other distribution partners; Endeavor’s ability to effectively

manage the integration of and recognize economic benefits from

businesses acquired, its operations at its current size, and any

future growth; failure to protect the Company’s IT systems and

confidential information against breakdowns, security breaches, and

other cybersecurity risks; risks related to Endeavor’s gaming

business and applicable regulatory requirements; risks related to

Endeavor’s organization and structure; risks related to the

successful integration of the businesses of UFC and WWE; and other

important factors discussed in Part I, Item 1A “Risk Factors” in

Endeavor’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2024, as any such factors may be updated from time to

time in the Company’s other filings with the SEC, accessible on the

SEC’s website at www.sec.gov and Endeavor’s Investor Relations site

at investor.endeavorco.com. Forward-looking statements speak only

as of the date they are made and, except as may be required under

applicable law, Endeavor undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Non-GAAP Financial Measures

We refer to certain financial measures that are not recognized

under United States generally accepted accounting principles

(“GAAP”). Please see “Note Regarding Non-GAAP Financial Measures"

and the reconciliation tables below for additional information and

a reconciliation of the Non-GAAP financial measures to the most

comparable GAAP financial measures.

About Endeavor

Endeavor (NYSE: EDR) is a global sports and entertainment

company, home to many of the world’s most dynamic and engaging

storytellers, brands, live events, and experiences. The Endeavor

network specializes in talent representation through entertainment

agency WME; sports operations and advisory, event management, media

production and distribution, and brand licensing through IMG; live

event experiences and hospitality through On Location; full-service

marketing through global cultural marketing agency 160over90; and

sports data and technology through OpenBet. Endeavor is also the

majority owner of TKO Group Holdings (NYSE: TKO), a premium sports

and entertainment company comprising UFC and WWE.

Website Disclosure

Investors and others should note that we announce material

financial and operational information to our investors using press

releases, SEC filings and public conference calls and webcasts, as

well as our Investor Relations site at investor.endeavorco.com. We

may also use our website as a distribution channel of material

Company information. In addition, you may automatically receive

email alerts and other information about Endeavor when you enroll

your email address by visiting the “Investor Email Alerts” option

under the Resources tab on investor.endeavorco.com.

Consolidated Statements of

Operations

(Unaudited)

(In thousands, except share and

per share data)

Three Months Ended December 31, Year Ended

December 31,

2024

2023

2024

2023

Revenue

$

1,568,274

$

1,469,604

$

7,110,982

$

5,490,777

Operating expenses: Direct operating costs

667,293

593,355

3,297,728

2,211,918

Selling, general and administrative expenses

754,610

705,605

3,351,405

2,590,173

Depreciation and amortization

122,496

138,489

539,052

310,204

Impairment charges

75,707

46,716

75,707

74,912

Total operating expenses

1,620,106

1,484,165

7,263,892

5,187,207

Operating (loss) income from continuing operations

(51,832

)

(14,561

)

(152,910

)

303,570

Other (expense) income: Interest expense, net

(105,261

)

(88,426

)

(407,792

)

(346,237

)

Tax receivable agreement liability adjustment

(10,131

)

48,414

(12,591

)

40,635

Other (expense) income, net

(29,603

)

30,136

2,971

783,680

(Loss) income from continuing operations before income taxes and

equity (losses) earnings of affiliates

(196,827

)

(24,437

)

(570,322

)

781,648

Provision for (benefit from) income taxes

40,996

13,369

(52,133

)

208,890

(Loss) income from continuing operations before equity (losses)

earnings of affiliates

(237,823

)

(37,806

)

(518,189

)

572,758

Equity (losses) earnings of affiliates, net of tax

(3,625

)

1,273

(13,940

)

(21,018

)

(Loss) income from continuing operations, net of tax

(241,448

)

(36,533

)

(532,129

)

551,740

Income (loss) from discontinued operations, net of tax

4,292

7,196

(682,632

)

5,729

Net (loss) income

(237,156

)

(29,337

)

(1,214,761

)

557,469

Less: Net (loss) income attributable to non-controlling interests

(71,269

)

(43,856

)

(432,347

)

200,953

Net (loss) income attributable to Endeavor Group Holdings, Inc.

$

(165,887

)

$

14,519

$

(782,414

)

$

356,516

(Loss) earnings per share of Class A common stock: Basic

from continuing operations

$

(0.57

)

$

0.04

$

(1.17

)

$

1.19

Basic from discontinued operations

0.04

0.01

(1.39

)

—

Basic

(0.53

)

0.05

(2.56

)

1.19

Diluted from continuing operations

$

(0.64

)

$

(0.04

)

$

(1.23

)

$

1.14

Diluted from discontinued operations

—

0.01

(1.42

)

—

Diluted

(0.64

)

(0.03

)

(2.65

)

1.14

Weighted average number of shares used in computing basic

and diluted (loss) earnings per share: Basic

309,886,722

300,710,649

305,400,277

298,915,993

Diluted(1)

452,844,550

458,426,960

452,178,505

464,862,899

(1) The diluted weighted average number of shares of

452,178,505 for the year ended December 31, 2024 includes weighted

average Class A common shares outstanding, plus additional shares

based on an assumed exchange of Endeavor Manager Units and Endeavor

Operating Units into 146,178,228 shares of the Company’s Class A

common stock. Securities that are anti-dilutive for the year ended

December 31, 2024, are additional shares based on an assumed

exchange of remaining unvested Endeavor Operating Units, additional

shares based on an assumed exchange of Endeavor Profits Units into

shares of the Company’s Class A common stock, as well as additional

shares from Stock Options, RSUs, Phantom Units and redeemable

non-controlling interests.

Segment Results

(Unaudited)

(In thousands)

Three Months Ended December 31, Year Ended

December 31,

2024

2023

2024

2023

Revenue: Owned Sports Properties

$

670,412

$

642,755

$

2,985,103

$

1,815,880

Events, Experiences & Rights

411,880

414,471

2,528,759

2,173,399

Representation

501,633

427,433

1,687,597

1,544,441

Eliminations

(15,651

)

(15,055

)

(90,477

)

(42,943

)

Total Revenue

$

1,568,274

$

1,469,604

$

7,110,982

$

5,490,777

Adjusted EBITDA: Owned Sports Properties

$

237,245

$

224,702

$

1,274,518

$

827,024

Events, Experiences & Rights

11,022

13,720

(29,782

)

228,140

Representation

108,182

103,434

405,684

391,114

Corporate

(79,398

)

(75,622

)

(334,452

)

(305,817

)

Consolidated Balance

Sheets

(Unaudited)

(In thousands, except share

data)

December 31, December 31,

2024

2023

ASSETS Current Assets: Cash and cash equivalents

$

1,201,490

$

1,166,526

Restricted cash

348,729

278,456

Accounts receivable (net of allowance for doubtful accounts of

$56,171 and $58,026 respectively)

880,988

810,857

Deferred costs

231,494

606,207

Assets held for sale

880,904

7,500

Other current assets

306,665

424,542

Current assets of discontinued operations

175,535

170,459

Total current assets

4,025,805

3,464,547

Property, buildings and equipment, net

786,257

914,645

Operating lease right-of-use assets

385,420

309,704

Intangible assets, net

4,008,543

4,812,284

Goodwill

9,159,410

9,517,143

Investments

400,984

394,179

Deferred income taxes

660,833

430,339

Other assets

759,140

599,765

Long-term assets of discontinued operations

379,170

1,102,167

Total assets

$

20,565,562

$

21,544,773

LIABILITIES, REDEEMABLE INTERESTS AND SHAREHOLDERS'

EQUITY Current Liabilities: Accounts payable

491,949

462,361

Accrued liabilities

883,407

684,390

Current portion of long-term debt

2,248,029

58,894

Current portion of operating lease liabilities

65,842

73,899

Deferred revenue

534,624

802,344

Deposits received on behalf of clients

285,232

262,436

Current portion of tax receivable agreement liability

130,499

156,155

Liabilities held for sale

100,309

—

Other current liabilities

67,594

97,190

Current liabilities of discontinued operations

189,906

199,276

Total current liabilities

4,997,391

2,796,945

Long-term debt

3,430,102

4,969,417

Long-term operating lease liabilities

359,447

279,042

Long-term tax receivable agreement liability

751,002

834,298

Deferred tax liabilities

371,865

446,861

Other long-term liabilities

474,010

393,322

Long-term liabilities of discontinued operations

94,887

102,377

Total liabilities

10,478,704

9,822,262

Commitments and contingencies Redeemable

non-controlling interests

232,882

215,458

Shareholders' Equity: Class A common stock, $0.00001 par

value; 5,000,000,000 shares authorized; 312,605,680 and 298,698,490

shares issued and outstanding as of December 31, 2024 and 2023,

respectively

3

3

Class B common stock, $0.00001 par value; 5,000,000,000 shares

authorized; none issued and outstanding as of December 31, 2024 and

2023

—

—

Class C common stock, $0.00001 par value; 5,000,000,000 shares

authorized; none issued and outstanding as of December 31, 2024 and

2023

—

—

Class X common stock, $0.00001 par value; 4,967,940,840 and

4,983,448,411 shares authorized; 155,699,136 and 166,569,908 shares

issued and outstanding as of December 31, 2024 and 2023,

respectively

1

1

Class Y common stock, $0.00001 par value; 987,806,109 and

989,681,838 shares authorized; 215,927,779 and 225,960,405 shares

issued and outstanding as of December 31, 2024 and 2023,

respectively

2

2

Additional paid-in capital

5,035,750

4,901,922

Accumulated deficit

(973,094

)

(117,065

)

Accumulated other comprehensive loss

(48,508

)

(157

)

Total Endeavor Group Holdings, Inc. shareholders' equity

4,014,154

4,784,706

Nonredeemable non-controlling interests

5,839,822

6,722,347

Total shareholders' equity

9,853,976

11,507,053

Total liabilities, redeemable interests and shareholders' equity

$

20,565,562

$

21,544,773

Note Regarding Non-GAAP Financial Measures

This press release includes financial measures that are not

calculated in accordance with United States generally accepted

accounting principles (“GAAP”), including Adjusted EBITDA and

Adjusted EBITDA Margin.

Adjusted EBITDA is a non-GAAP financial measure and is defined

as net income (loss), excluding the results of discontinued

operations, income taxes, net interest expense, depreciation and

amortization, equity-based compensation, merger, acquisition and

earn-out costs, certain legal costs and settlements, restructuring,

severance and impairment charges, certain non-cash fair value

adjustments, certain equity earnings (losses), net gains on sales

of businesses, tax receivable agreement liability adjustment, and

certain other items, when applicable. Adjusted EBITDA margin is a

non-GAAP financial measure defined as Adjusted EBITDA divided by

Revenue.

Management believes that Adjusted EBITDA is useful to investors

as it eliminates the significant level of non-cash depreciation and

amortization expense that results from our capital investments and

intangible assets recognized in business combinations, and improves

comparability by eliminating the significant level of interest

expense associated with our debt facilities, as well as income

taxes and the tax receivable agreement, which may not be comparable

with other companies based on our tax and corporate structure.

Adjusted EBITDA and Adjusted EBITDA margin are used as the

primary bases to evaluate our consolidated operating

performance.

Adjusted EBITDA and Adjusted EBITDA margin have limitations as

analytical tools, and you should not consider them in isolation or

as a substitute for analysis of our results as reported under GAAP.

Some of these limitations are:

- they do not reflect every cash expenditure, future requirements

for capital expenditures, or contractual commitments;

- Adjusted EBITDA does not reflect the significant interest

expense or the cash requirements necessary to service interest or

principal payments on our debt;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced or require improvements in the future, and Adjusted EBITDA

and Adjusted EBITDA margin do not reflect any cash requirement for

such replacements or improvements; and

- they are not adjusted for all non-cash income or expense items

that are reflected in our statements of cash flows.

We compensate for these limitations by using Adjusted EBITDA and

Adjusted EBITDA margin along with other comparative tools, together

with GAAP measurements, to assist in the evaluation of operating

performance.

Adjusted EBITDA and Adjusted EBITDA margin should not be

considered substitutes for the reported results prepared in

accordance with GAAP and should not be considered in isolation or

as alternatives to net income (loss) as indicators of our financial

performance, as measures of discretionary cash available to us to

invest in the growth of our business or as measures of cash that

will be available to us to meet our obligations. Although we use

Adjusted EBITDA and Adjusted EBITDA margin as financial measures to

assess the performance of our business, such use is limited because

it does not include certain material costs necessary to operate our

business. Our presentation of Adjusted EBITDA and Adjusted EBITDA

margin should not be construed as indications that our future

results will be unaffected by unusual or nonrecurring items. These

non-GAAP financial measures, as determined and presented by us, may

not be comparable to related or similarly titled measures reported

by other companies. Set forth below are reconciliations of our most

directly comparable financial measures calculated in accordance

with GAAP to these non-GAAP financial measures on a consolidated

basis.

Adjusted EBITDA

(Unaudited)

(In thousands)

Three Months Ended December 31, Year Ended

December 31,

2024

2023

2024

2023

Net (loss) income

$

(237,156

)

$

(29,337

)

$

(1,214,761

)

$

557,469

(Income) loss from discontinued operations, net of tax

(4,292

)

(7,196

)

682,632

(5,729

)

Provision for (benefit from) income taxes

40,996

13,369

(52,133

)

208,890

Interest expense, net

105,261

88,426

407,792

346,237

Depreciation and amortization

122,496

138,489

539,052

310,204

Equity-based compensation expense (1)

52,127

53,044

214,686

254,028

Merger, acquisition and earn-out costs (2)

37,628

(307

)

128,659

105,463

Certain legal costs (3)

843

28,834

27,465

41,067

Legal settlement (4)

—

—

375,000

—

Restructuring, severance and impairment (5)

82,002

54,822

147,778

125,610

Fair value adjustment - equity investments (6)

(4,181

)

(56

)

(4,218

)

(985

)

Equity method losses (income)– Endeavor Content (7)

1,627

(8,584

)

12,411

11,113

Net gain on sale of the Academy business (8)

—

—

—

(736,978

)

Tax receivable agreement liability adjustment (9)

10,131

(48,414

)

12,591

(40,635

)

Other (10)

69,569

(16,856

)

39,014

(35,293

)

Adjusted EBITDA

$

277,051

$

266,234

$

1,315,968

$

1,140,461

Net (loss) income margin

(15.1

%)

(2.0

%)

(17.1

%)

10.2

%

Adjusted EBITDA margin

17.7

%

18.1

%

18.5

%

20.8

%

(1)

Equity-based compensation

represents primarily non-cash compensation expense associated with

our equity-based compensation plans.

The decrease for the three months

ended December 31, 2024 compared to the three months ended December

31, 2023 was primarily due to awards granted at the IPO under the

Endeavor Group Holdings, Inc.'s 2021 Incentive Award Plan becoming

fully vested and partially offset by new awards granted under the

new TKO equity plan and the Endeavor Group Holdings, Inc.'s 2021

Incentive Award Plan. Equity-based compensation was recognized in

all segments and Corporate for the three months ended December 31,

2024.

The decrease for the year ended

December 31, 2024 compared to the year ended December 31, 2023 was

primarily due to awards granted at the IPO under the Endeavor Group

Holdings, Inc.'s 2021 Incentive Award Plan becoming fully vested

partially offset by awards granted under the new TKO equity plan

and the WWE plan assumed in connection with the TKO Transactions.

Equity-based compensation was recognized in all segments and

Corporate for the year ended December 31, 2024.

(2)

Includes (i) certain costs of

professional advisors related to mergers, acquisitions,

dispositions or joint ventures and (ii) fair value adjustments for

contingent consideration liabilities related to acquired businesses

and compensation expense for deferred consideration associated with

selling shareholders that are required to retain our employees.

Such costs for the three months

ended December 31, 2024 primarily related to professional advisor

costs, which were approximately $37 million and includes

approximately $33 million of costs related to our evaluation and

execution of strategic alternatives, and related to our

Representation and Owned Sport Properties segments and Corporate.

Fair value adjustments for contingent consideration liabilities

related to acquired businesses and acquisition earn-out adjustments

were a benefit of approximately $1 million, which primarily related

to our Events, Experiences & Rights and Representation

segments.

Such costs for the three months

ended December 31, 2023 primarily related to professional advisor

costs of approximately $3 million and primarily related to our

Owned Sport Properties segment and Corporate. Fair value

adjustments for contingent consideration liabilities related to

acquired businesses and acquisition earn-out adjustments were a

loss of approximately $3 million, which primarily related to our

Events, Experiences & Rights and Representation segments.

Such costs for the year ended

December 31, 2024 primarily related to professional advisor costs,

which were approximately $124 million and includes approximately

$97 million of costs related to our evaluation and execution of

strategic alternatives, and related to our Representation and Owned

Sports Properties segments and Corporate. Fair value adjustments

for contingent consideration liabilities related to acquired

businesses and acquisition earn-out adjustments were approximately

$5 million, which primarily related to our Representation and

Events, Experiences & Rights segments.

Such costs for the year ended

December 31, 2023 related to professional advisor costs and bonuses

of approximately $101 million, which primarily related to the TKO

Transactions, and primarily related to our Owned Sport Properties

segment and Corporate and other. The bonuses and certain

professional advisor costs were contingent on the closing of the

TKO Transactions. Fair value adjustments for contingent

consideration liabilities related to acquired businesses and

acquisition earn-out adjustments were approximately $5 million,

which primarily related to our Events, Experiences & Rights and

Representation segments.

(3)

Includes costs related to certain

litigation or regulatory matters, which related to our Owned Sports

Properties and Events, Experiences & Rights segments and

Corporate and other. The three months and the year ended December

31, 2023 includes a $20 million antitrust settlement, which related

to our Owned Sports Properties segment.

(4)

Relates to a legal settlement in

our Owned Sports Properties segment.

(5)

Includes certain costs related to

our restructuring activities and non-cash impairment charges.

Such costs for the three months

and year ended December 31, 2024 primarily related to the

impairments of intangible assets and goodwill in our Events,

Experiences & Rights segment of approximately $76 million;

losses on certain assets sold in our Owned Sports Properties

segment of approximately $2 million and $28 million, respectively;

and restructuring expenses across all of our segments and Corporate

of approximately $4 million and $31 million, respectively.

Such costs for the three months

and year ended December 31, 2023 primarily related to the

impairments of intangible assets and goodwill in our Events,

Experiences & Rights segment of approximately $47 million and

$75 million, respectively; and restructuring expenses across all of

our segments and Corporate of approximately $8 million and $40

million, respectively.

(6)

Includes the net change in fair

value for equity investments with and without readily determinable

fair values, based on observable price changes.

(7)

Relates to equity method losses

(income) from the equity interest we retained in the restricted

Endeavor Content business, which we sold in January 2022.

(8)

Relates to the gain recorded for

the sale of the Academy business, net of transactions costs of $5.5

million, which were contingent on the sale closing.

(9)

For the three months and year

ended December 31, 2024 and 2023, the adjustment for the tax

receivable agreement liability related to a change in estimates of

future TRA payments.

(10)

For the three months ended

December 31, 2024, other was comprised primarily of losses of

approximately $26 million for the estimated loss on sale and

impairment of certain assets, which related to our Representation

segment; debt restructuring costs of approximately $16 million,

which related to our Owned Sports Properties segment; losses of

approximately $22 million on foreign currency exchange

transactions, which related to all of our segments and Corporate

and other; a loss of approximately $2 million related to change in

the fair value of forward foreign exchange contracts, which related

to Events Experiences & Rights segment and Corporate.

For the three months ended

December 31, 2023, other costs were comprised primarily of gains of

approximately $18 million on foreign currency exchange

transactions, which related to all of our segments and Corporate;

$3 million of costs related to our evaluation of strategic

alternatives, which related to Corporate; and a gain of

approximately $1 million related to the change in the fair value of

forward foreign exchange contracts, which related to our Events,

Experiences & Rights segment and Corporate.

For the year ended December 31,

2024, other was comprised primarily of losses of approximately $26

million for the estimated loss on sale and impairment of certain

assets, which related to our Representation segment; debt

restructuring costs of approximately $16 million, which related to

our Owned Sports Properties segment; gains of approximately $7

million on the sales of investments, which related to our

Representation and Events, Experiences & Rights segments and

Corporate and other; losses of approximately $6 million on foreign

currency exchange transactions, which related to all of our

segments and Corporate and other; and a gain of approximately $3

million related to non-cash fair value adjustments of embedded

foreign currency derivatives, which related to our Events,

Experiences & Rights segment.

For the year ended December 31,

2023, other was comprised primarily of gains of approximately $18

million on foreign currency exchange transactions, which related to

all of our segments and Corporate and other; gains of approximately

$6 million on the sales of certain businesses, which relates to our

Events, Experiences & Rights segment; a gain of approximately

$5 million related to the change in the fair value of forward

foreign exchange contracts, which related to our Events,

Experiences & Rights segment and Corporate and other; a gain of

approximately $5 million from the resolution of a contingency; a $3

million release of an indemnity reserve recorded in connection with

an acquisition, which related to our Events, Experiences &

Rights segment; and $3 million of costs related to our evaluation

of strategic alternatives, which related to Corporate and

other.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226994050/en/

Investors: investor@endeavorco.com Press:

press@endeavorco.com

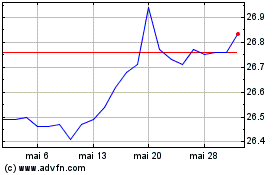

Endeavor (NYSE:EDR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Endeavor (NYSE:EDR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025