Establishes Over $115 Billion Global Real

Assets Platform With Enhanced Capabilities Across New Economy

Sectors and Attractive Geographies

Ares Management Corporation (NYSE: ARES) (“Ares”) announced

today that it has completed its acquisition of the international

business of GLP Capital Partners Limited, excluding its operations

in Greater China, and certain of its affiliates (“GCP

International”). With the addition of GCP International, Ares’

leading global alternative investment platform managed over $525

billion in assets, including more than $115 billion in its global

Real Assets business, as of December 31, 2024.

The transaction adds important geographic exposure in Asia with

a significant presence in Japan through one of the largest

logistics platforms in the country, local logistics platforms in

emerging economies such as Brazil and Vietnam and an expanded

presence in Europe and the U.S. The addition of GCP International

alongside the recently completed acquisition of Walton Street

Mexico cements Ares as a top three global owner and operator of

logistics assets with over 570 million square feet of logistics

properties around the world. Further, the acquisition of GCP

International has enhanced Ares’ capabilities in other

high-conviction sectors, including digital infrastructure and

self-storage. More broadly, Ares has reinforced its position as a

leading global real estate investor, differentiated by its local

investment approach and vertically integrated operating and

development capabilities across sectors and regions.

In addition, Ares now operates a digital infrastructure business

with several large hyperscale projects in process across key global

markets that collectively represent over 1GW of IT capacity,

including approximately 500MW in projects currently underway, as

well as a substantial pipeline of future growth. These projects

have attracted strong investor interest and, in combination with

Ares’ existing climate, real estate and digital infrastructure

capabilities, should enable Ares to achieve significant scale for

this business.

Ares’ strong presence in logistics, digital infrastructure and

traditional real estate sectors positions the platform as a leader

in fast-growing new economy sectors. Ares believes the

opportunities in these sectors will continue to be fueled by rising

demand for new technologies, significant changes in global supply

chains and evolving demographic trends that are transforming how

communities live and work.

Ming Mei, currently CEO of GLP and GCP’s remaining business,

will continue to support Ares’ growth initiatives as a Partner and

Senior Advisor, and Michael Steele, most recently President at GCP

International, has joined Ares as a Partner in its Real Assets

Group. In addition, colleagues across GCP International’s global

team have joined Ares Real Estate, which will continue to be led by

Co-Heads Bill Benjamin and Julie Solomon.

“We are proud to welcome our new team members as we establish a

powerhouse in the critical real asset sectors driving the new

economy,” said Michael Arougheti, Chief Executive Officer of Ares.

“Together, we have the scale, relationships and experience to

benefit from the long-term secular tailwinds that are facilitating

unprecedented growth in logistics, digital infrastructure and clean

energy assets. We look forward to accelerating execution against

our strategic objectives, including growing our global footprint

and expanding across asset classes and institutional and retail

investor offerings, to deliver an enhanced value proposition for

our investors, stockholders and other market participants.”

“Over the last decade, we have aimed to solidify Ares Real

Estate as a leading global investor through our skilled team,

longstanding investor and sponsor relationships and performance

across market cycles,” said Mr. Benjamin and Ms. Solomon. “As we

start on this next chapter, the combination of our collaborative

cultures, strong sector focus and deep local networks gives us

conviction in the power of our platform. We are more excited than

ever to be bringing together two top-tier firms and are confident

that our integrated team’s breadth of experience and disciplined

investment approach will fuel our ability to capitalize on

attractive long-term structural trends in global real estate

markets.”

Advisors

Eastdil Secured, L.L.C., Barclays, Goldman Sachs & Co. LLC

and Wells Fargo Securities, LLC served as financial advisors to

Ares, with Latham & Watkins acting as legal counsel. Citigroup,

Morgan Stanley & Co. LLC, Greenhill, a Mizuho affiliate, UOB

Group and Deutsche Bank served as financial advisors to GCP

International and Kirkland & Ellis LLP served as legal

counsel.

About Ares Management Corporation

Ares Management Corporation (NYSE: ARES) is a leading global

alternative investment manager offering clients complementary

primary and secondary investment solutions across the credit, real

estate, private equity and infrastructure asset classes. We seek to

provide flexible capital to support businesses and create value for

our stakeholders and within our communities. By collaborating

across our investment groups, we aim to generate consistent and

attractive investment returns throughout market cycles. As of

December 31, 2024, including the acquisition of GCP International

which closed on March 1, 2025, Ares Management Corporation's global

platform had over $525 billion of assets under management, with

operations across North America, South America, Europe, Asia

Pacific and the Middle East. For more information, please visit

www.aresmgmt.com.

Forward-Looking Statements

Statements included herein contain forward-looking statements

within the meaning of the federal securities laws. You can identify

these forward-looking statements by the use of forward-looking

words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates,”

“foresees” or negative versions of those words, other comparable

words or other statements that do not relate to historical or

factual matters. The forward-looking statements are based on Ares’

beliefs, assumptions and expectations of Ares’ future performance,

taking into account all information currently available to Ares.

Such forward-looking statements are subject to various risks and

uncertainties, including Ares’ ability to effectively integrate

each of GCP International and Walton Street Mexico into Ares’

operations and to achieve the expected benefits therefrom, and

assumptions including those relating to the acquisitions of GCP

International and Walton Street Mexico, Ares’ operations, financial

results, financial condition, business prospects, growth strategy

and liquidity. Some of these factors are described in the Annual

Report on Form 10-K for the year ended December 31, 2024, including

under the headings “Item 1A. Risk Factors” and “Item 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations.” These factors should not be construed as

exhaustive and should be read in conjunction with the risk factors

and other cautionary statements that are included in this report

and in Ares’ other periodic filings. If one or more of these or

other risks or uncertainties materialize, or if Ares’ underlying

assumptions prove to be incorrect, Ares’ actual results may vary

materially from those indicated in these forward-looking

statements. New risks and uncertainties arise over time, and it is

not possible for Ares to predict those events or how they may

affect Ares. Therefore, you should not place undue reliance on

these forward-looking statements. Any forward-looking statement

speaks only as of the date on which it is made. Ares does not

undertake any obligation to update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303508549/en/

Media: Priscila Roney, +1-212-808-1185

media@aresmgmt.com

Investors: Greg Mason, Carl Drake irares@aresmgmt.com

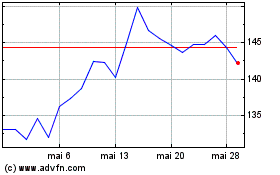

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025