Economic Concerns Lower U.S. Workforce Health and Productivity, Raising Need for Employee-Employer Trust: New MetLife Study

17 Março 2025 - 9:00AM

Business Wire

As economic stress takes its toll, MetLife's

23rd annual Employee Benefit Trends Study finds employees are

placing greater trust in employers to provide stability and

support

MetLife’s 2025 U.S. Employee Benefit Trends Study reveals

notable drops in holistic health (-5%), productivity (-5%) and

engagement (-7%) across the workforce and finds the majority of

employees cite financial concerns, including rising medical costs

(77%) and economic uncertainty (68%), as their primary source of

stress.

Click here to download MetLife’s 2025 Employee

Benefit Trends Study (EBTS)

Amid social and economic turmoil, employees are turning to their

employers for stability and support, while trust outside of the

workplace is declining. According to MetLife’s EBTS, 81% of

employees hold their employer accountable for building trust at

work, while employees overall are 1.5x more likely to trust their

employer than other institutions.

With a greater responsibility to build trust also comes a

significant opportunity to improve workplace outcomes, as MetLife’s

study finds trust, when combined with employee care, has a profound

impact. Employees who trust and feel cared for by their employer

are more likely to feel holistically healthy (3.8x), engaged (2.4x)

and productive (1.9x) than those with either or neither.

MetLife’s research shows employers can build trust by fostering

a supportive culture and promoting positive benefits experiences,

which includes providing employees with opportunities to give

feedback and the right tools to choose and use their benefits

effectively.

“Our research continues to validate that employers who

demonstrate care for their employees see improved workplace health

and outcomes,” said Todd Katz, head of Group Benefits at MetLife.

“What we’ve newly uncovered this year, given macro challenges, is

an opportunity to fortify care by fostering trust. Employers that

focus on prioritizing benefit experiences and culture can

effectively build high-trust, high-performing workplaces.”

Fostering Trust and Amplifying Care: Key Drivers

Workplaces that promote recognition of achievements, transparent

leadership and empathy are more likely to foster trust between

employees and employers, MetLife’s report finds. Combining the

right mix of benefits with a positive utilization experience is

also highly correlated to increased trust and improved

outcomes.

Employees who use and have positive experiences with their

benefits are:

- 2.4x more likely to feel holistically healthy

- 2.1x more likely to trust that their employer will protect them

in economic downturns

- 1.8x more likely to trust their employer’s leadership

“Benefits provide employees with stability and protection in

uncertain times, which helps them feel cared for and amplifies

trust,” adds Katz. “But as misunderstanding and underutilization of

benefits persists, MetLife is helping employers deliver experiences

that empower employees with greater confidence in their ability to

choose, use and unlock the full potential of their benefits.”

Employers can enhance benefits experiences by optimizing

communication strategies, providing personalized guidance, and

consistently engaging employees to support year-round

utilization.

Tools like MetLife’s Upwise, a digital solution that aids

employees in choosing benefits wisely with personalized

recommendations and using them seamlessly with timely reminders and

guidance, help employees get the most value out of their benefits

and employers the best return on investment. To date, adoption of

MetLife’s Upwise has been positive, particularly in benefits

decision support—in 2024, 64% of employees who had the opportunity

to use Upwise during enrollment did so and 84% of those completed

the steps to get a benefits recommendation.1

Visit www.metlife.com/ebts2025 to view MetLife’s 2025 Employee

Benefit Trends Study or visit www.upwise.com to learn more about

how MetLife is enhancing benefits experiences.

Unless otherwise stated, all data referenced in this release is

from MetLife’s 2025 Employee Benefit Trends Study.

Research Methodology MetLife's 23rd

annual U.S. Employee Benefit Trends Study builds on over 20 years

of data from employees and employers, incorporating multiple phases

of qualitative and quantitative research. The quantitative portion

surveyed 5,579 full-time employees in September and December 2024

and 2,567 HR decision-makers in September 2024. The qualitative

portion interviewed 33 senior-level stakeholders and 16 employees

in June and December 2024, respectively. Respondents were aged 21

and over and were nationally representative of the full-time U.S.

workforce in terms of demographics and firmographics. The surveys,

interviews and analysis were conducted by STRAT7, a global

strategy, insights and analytics consultancy, in partnership with

MetLife.

About MetLife MetLife, Inc. (NYSE:

MET), through its subsidiaries and affiliates (“MetLife”), is one

of the world’s leading financial services companies, providing

insurance, annuities, employee benefits and asset management to

help individual and institutional customers build a more confident

future. Founded in 1868, MetLife has operations in more than 40

markets globally and holds leading positions in the United States,

Asia, Latin America, Europe and the Middle East. For more

information, visit www.metlife.com.

____________________

1Based on enrollment data provided by participating MetLife

customers between 10/1/2024 and 11/27/2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250317900699/en/

Media Contact Mary Cassone, U.S.

Business Communications Mary.Cassone@metlife.com

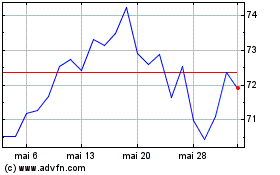

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

MetLife (NYSE:MET)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025