- Delivered Fourth Quarter Net Sales above guidance

- Fourth Quarter Net Loss of $3.0 million compared to prior

year’s Net Loss of $4.1 million

- Exceeded Fourth Quarter Adjusted EBITDA(1) guidance

- Financial condition strong with year-end cash of $48.5

million and liquidity of $158.0 million

- Initiates Fiscal 2025 Guidance

Torrid Holdings Inc. (“Torrid” or the “Company”) (NYSE: CURV), a

direct-to-consumer apparel, intimates, and accessories brand in

North America for women sizes 10 to 30, today announced its

financial results for the quarter ended February 1, 2025.

Lisa Harper, Chief Executive Officer, stated, “We successfully

closed fiscal 2024 with positive results, fueled by product

innovation in our core assortment and strong customer response to

the launch of our high-growth, higher margin sub-brands. Thoughtful

growth of our well received sub-brands set the stage for elevated,

new and younger customer engagement, incremental lifestyle

purchases, as well as creating a halo effect across the business.

Combining our successful sub-brand assortment initiatives with our

commitment to modernizing and evolving our core Torrid offerings

gives me great confidence in the long-term health and growth

prospects of our business.”

Harper continued, “As we enter 2025, our strategic priorities

are clear: enhancing our product assortment, driving customer

growth, and executing our store optimization plan. Our ongoing

store optimization strategy includes balancing our fleet, enhancing

store economics, refreshing store environments, and aligning our

sales channels more closely with customer demand—allowing us to

further accelerate customer growth.”

“Our fiscal first quarter was off to a choppy start; however,

trends have been steadily improving as the quarter has progressed.

Our disciplined inventory management, targeted marketing

investments, and our diversified supply chain, coupled with our

strong financial condition provides us the confidence and

flexibility to navigate the current dynamic macro environment,

while strategically investing in areas of our business which we

believe will fuel long-term profitable growth,” concluded

Harper.

Financial Highlights for the Fourth Quarter of Fiscal

2024

- Net sales decreased 6.1% to $275.6 million compared to $293.5

million for the fourth quarter of last year. Comparable sales(2)

decreased 0.8% in the fourth quarter. As a reminder, last year

included an additional $21.7 million in sales for the 53rd

week.

- Gross profit margin was 33.6% compared to 34.5% in the fourth

quarter of last year. The 90-bps decline was primarily driven by

lower sales.

- Net loss of $3.0 million, or ($0.03) per share, compared to a

net loss of $4.1 million, or ($0.04) per share, in the fourth

quarter of last year.

- Adjusted EBITDA(1) was $16.7 million, or 6.1% of net

sales, compared to $16.4 million, or 5.6% of net sales, in the

fourth quarter of last year. Last year included $2.3 million for

the 53rd week.

- In the fourth quarter, we opened 1 Torrid store and closed 22

Torrid stores. The total store count at quarter end was 634

stores.

Financial Highlights for the Full Year of Fiscal 2024

- Net sales decreased 4.2% to $1,103.7 million compared to

$1,151.9 million last year. Comparable sales(2) decreased 4.5%

compared to last year.

- Gross profit margin was 37.5% compared to 35.2% last year.

- Net income of $16.3 million, or $0.16 per share, compared to

net income of $11.6 million, or $0.11 per share last year.

- Adjusted EBITDA(1) was $109.1 million, or 9.9% of net sales,

compared to $106.2 million, or 9.2% of net sales, last year.

- Opened 14 Torrid stores and closed 35 Torrid stores. The total

store count at year end was 634 stores.

Full Year Fiscal 2024 Financial and Operating Metrics

Fiscal Year Ended

(in thousands, except number

of stores and percentages)

February 1, 2025

February 3, 2024

Year over Year Change

Net sales

$

1,103,737

$

1,151,945

(4)%

Comparable sales(A)

(5

)%

(12

)%

Number of stores (as of end of period)

634

655

Net income

$

16,318

$

11,619

40%

Adjusted EBITDA(B)

$

109,120

$

106,219

3%

(A) The computation of fiscal 2024

comparable sales compares sales in fiscal 2024 to sales in the

52-week period ended February 3, 2024. The computation of fiscal

2023 comparable sales compares sales in fiscal 2023 to sales in the

53-week period ended February 4, 2023.

(B) Please refer to "Non-GAAP

Reconciliation" below for a reconciliation of Net (loss) income to

Adjusted EBITDA.

Balance Sheet and Cash

Flow

Cash and cash equivalents at the end of fiscal 2024

totaled $48.5 million. Total liquidity at the end of the

year, including available borrowing capacity under our revolving

credit agreement, was $158.0 million.

Cash flow from operations for the twelve-month period

ended February 1, 2025 was $77.4 million, compared to $42.8

million for the twelve-month period ended February 3, 2024.

Outlook

For the first quarter of fiscal 2025 the Company

expects:

- Net sales between $264 million and $274 million.

- Adjusted EBITDA(1) between $24 million and $28 million.

For the full year fiscal 2025 the Company expects:

- Net sales between $1.080 billion and $1.100 billion.

- Adjusted EBITDA(1) between $100 million and $110 million.

- Capital expenditures between $15 million and $20 million

reflecting infrastructure and technology investments as well as

between 4 and 8 new stores for the year.

The above outlook is based on several assumptions, including,

but not limited to, the macroeconomic challenges in the industry in

fiscal 2025 as well as higher labor costs. The above outlook does

not take into consideration the volatility of tariff changes or its

impact on inflation or consumer demand. See “Forward-Looking

Statements” for additional information.

Conference Call Details

A conference call to discuss the Company’s fourth quarter and

fiscal 2024 results is scheduled for March 20, 2025, at 4:30 p.m.

ET. Those who wish to participate in the call may do so by dialing

(877) 407-9208 or (201) 493-6784 for international callers. The

conference call will also be webcast live at

https://investors.torrid.com. For those unable to participate, a

replay of the conference call will be available approximately three

hours after the conclusion of the call until March 27, 2025.

Notes

(1)

Adjusted EBITDA is a non-GAAP financial

measure. See “Non-GAAP Financial Measures” and “Non-GAAP

Reconciliation” for additional information on non-GAAP financial

measures and the accompanying table for a reconciliation to the

most comparable GAAP measure. The Company does not provide

reconciliations of the forward-looking non-GAAP measures of

Adjusted EBITDA to the most directly comparable forward-looking

GAAP measure because the timing and amount of excluded items are

unreasonably difficult to fully and accurately estimate. For the

same reasons, the Company is unable to address the probable

significance of the unavailable information, which could be

material to future results.

(2)

Comparable sales for any given period are

defined as the sales of Torrid’s e-Commerce operations and stores

that it has included in its comparable sales base during that

period. The Company includes a store in its comparable sales base

after it has been open for 15 full fiscal months. If a store is

closed during a fiscal year, it is only included in the computation

of comparable sales for the full fiscal months in which it was

open. Partial fiscal months are excluded from the computation of

comparable sales. Fiscal 2024 comparable sales compares sales in

fiscal 2024 to sales in the 52-week period ended February 3, 2024.

Fiscal 2023 comparable sales compares sales in fiscal 2023 to sales

in the 53-week period ended February 4, 2023. Comparable sales

allow the Company to evaluate how its unified commerce business is

performing exclusive of the effects of new store openings. The

Company applies current year foreign currency exchange rates to

both current year and prior year comparable sales to remove the

impact of foreign currency fluctuation and achieve a consistent

basis for comparison.

About Torrid

TORRID is a direct-to-consumer brand in North America dedicated

to offering a diverse assortment of stylish apparel, intimates, and

accessories skillfully designed for the curvy woman. Specializing

in sizes 10 to 30, our primary focus is on providing fashionable,

comfortable, and affordable options that meet the unique needs of

our customers. Our extensive collection features high quality

merchandise, including tops, bottoms, denim, dresses, intimates,

activewear, footwear, and accessories. Our products are exclusive

to us, and each product is meticulously crafted to cater to the

needs of the curvy woman, empowering her to love the way she looks

and feels. Our collections are artfully curated to suit all aspects

of our customers’ lives, including casual weekends, work, dressy

and special occasions. Understanding the importance of

affordability, we aim to keep our prices reasonable without

compromising on quality. This allows us to build a meaningful

connection with our customers, distinguishing us from other brands

that often overlook plus- and mid-size consumers. Our brand

experience and product offerings establish us as a differentiated

and reliable choice for plus- and mid-size customers, which we

believe sets us apart in the market. We strive to be everything our

customer needs in her closet, consistently delivering products that

make her feel confident and stylish.

Non-GAAP Financial Measures

In addition to results determined in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”), management utilizes certain non-GAAP performance

measures, such as Adjusted EBITDA, for purposes of evaluating

ongoing operations and for internal planning and forecasting

purposes. We believe that these non-GAAP operating measures, when

reviewed collectively with our GAAP financial information, provide

useful supplemental information to investors in assessing our

operating performance.

Adjusted EBITDA is a supplemental measure of our operating

performance that is neither required by, nor presented in

accordance with, GAAP and our calculations thereof may not be

comparable to similarly titled measures reported by other

companies. Adjusted EBITDA represents GAAP net income (loss) plus

interest expense less interest income, net of other expense

(income), plus provision for (benefit from) income taxes,

depreciation and amortization (“EBITDA”), and share-based

compensation, non-cash deductions and charges, and other

expenses.

We believe Adjusted EBITDA facilitates operating performance

comparisons from period to period by isolating the effects of

certain items that vary from period to period without any

correlation to ongoing operating performance. We also use Adjusted

EBITDA as one of the primary methods for planning and forecasting

the overall expected performance of our business and for evaluating

on a quarterly and annual basis, actual results against such

expectations.

Further, we recognize Adjusted EBITDA as a commonly used measure

in determining business value and, as such, use it internally to

report and analyze our results and as a benchmark to determine

certain non-equity incentive payments made to executives.

Adjusted EBITDA has limitations as an analytical tool. This

measure is not a measurement of our financial performance under

GAAP and should not be considered in isolation or as an alternative

to or substitute for net income (loss), income (loss) from

operations, earnings (loss) per share or any other performance

measures determined in accordance with GAAP or as an alternative to

cash flows from operating activities as a measure of our liquidity.

Our presentation of Adjusted EBITDA should not be construed as an

inference that our future results will be unaffected by unusual or

non-recurring items.

Forward-Looking Statements

Certain statements made in this earnings release are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”) and

Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and are subject to the safe harbor created thereby

under the Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical or current fact

included in this earnings release are forward-looking statements.

Forward-looking statements reflect our current expectations and

projections relating to our financial condition, results of

operations, plans, objectives, future performance and business. You

can identify forward-looking statements by the fact that they do

not relate strictly to historical or current facts. These

statements may include words such as “anticipate,” “estimate,”

“expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,”

“should,” “can have,” “likely” and other words and terms of similar

meaning (including their negative counterparts or other various or

comparable terminology).

For example, all statements we make relating to our expected

first quarter of fiscal 2025, our full year fiscal 2025 performance

and our plans and objectives for future operations, growth or

initiatives are forward-looking statements. All forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those that we expected,

including:

- changes in consumer spending and general economic

conditions;

- the negative impact on interest expense as a result of high

interest rates;

- inflationary pressures with respect to labor and raw materials

and global supply chain constraints that could increase our

expenses;

- the adverse impact of rulemaking changes implemented by the

Consumer Financial Protection Bureau on our income streams,

profitability and results of operations;

- our ability to identify and respond to new and changing product

trends, customer preferences and other related factors;

- our dependence on a strong brand image;

- increased competition from other brands and retailers;

- our reliance on third parties to drive traffic to our

website;

- the success of the shopping centers in which our stores are

located;

- our ability to adapt to consumer shopping preferences and

develop and maintain a relevant and reliable omni-channel

experience for our customers;

- our dependence upon independent third parties for the

manufacture of all of our merchandise;

- availability constraints and price volatility in the raw

materials used to manufacture our products;

- interruptions of the flow of our merchandise from international

manufacturers causing disruptions in our supply chain;

- our sourcing a significant amount of our products from

China;

- shortages of inventory, delayed shipments to our e-Commerce

customers and harm to our reputation due to difficulties or

shut-down of our distribution facility;

- our reliance upon independent third-party transportation

providers for substantially all of our product shipments;

- our growth strategy;

- our failure to attract and retain employees that reflect our

brand image, embody our culture and possess the appropriate skill

set;

- damage to our reputation arising from our use of social media,

email and text messages;

- our reliance on third parties for the provision of certain

services, including real estate management;

- our dependence upon key members of our executive management

team;

- our reliance on information systems;

- system security risk issues that could disrupt our internal

operations or information technology services;

- unauthorized disclosure of sensitive or confidential

information, whether through a breach of our computer system,

third-party computer systems we rely on, or otherwise;

- our failure to comply with federal and state laws and

regulations and industry standards relating to privacy, data

protection, advertising and consumer protection;

- payment-related risks that could increase our operating costs

or subject us to potential liability;

- claims made against us resulting in litigation;

- changes in laws and regulations applicable to our

business;

- regulatory actions or recalls arising from issues with product

safety;

- our inability to protect our trademarks or other intellectual

property rights;

- our substantial indebtedness and lease obligations;

- restrictions imposed by our indebtedness on our current and

future operations;

- changes in tax laws or regulations or in our operations that

may impact our effective tax rate;

- the possibility that we may recognize impairments of

definite-lived assets;

- our failure to maintain adequate internal control over

financial reporting; and

- the threat of war, terrorism or other catastrophes, including

natural disasters, that could negatively impact our business.

The outcome of the events described in any of our

forward-looking statements are also subject to risks, uncertainties

and other factors described in the sections entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” in our Annual Report on Form 10-K filed

with the Securities and Exchange Commission (“SEC”) on April 2,

2024 and in our other filings with the SEC and public

communications. You should evaluate all forward-looking statements

made in this communication in the context of these risks and

uncertainties.

We derive many of our forward-looking statements from our

operating budgets and forecasts, which are based upon many detailed

assumptions. While we believe that our assumptions are reasonable,

we caution that it is very difficult to predict the effect of known

factors, and it is impossible for us to anticipate all factors that

could affect our actual results. We caution you that the important

factors referenced above may not include all of the factors that

are important to you. In addition, we cannot assure you that we

will realize the results or developments we expect or anticipate

or, even if substantially realized, that they will result in the

outcomes or affect us or our operations in the way we expect. The

forward-looking statements included in this earnings release are

made only as of the date hereof. We undertake no obligation to

publicly update or revise any forward-looking statement as a result

of new information, future events or otherwise except to the extent

required by law. Our forward-looking statements do not reflect the

potential impact of any future acquisitions, mergers, dispositions,

joint ventures or investments.

Investors and others should note that we may announce material

information to our investors using our investor relations website

(https://investors.torrid.com), SEC filings, press releases, public

conference calls and webcasts. We use these channels, as well as

social media, to communicate with our investors and the public

about our company, our business and other issues. It is possible

that the information that we post on social media could be deemed

to be material information. We therefore encourage investors to

visit these websites from time to time. The information contained

on such websites and social media posts is not incorporated by

reference into this filing. Further, our references to website URLs

in this filing are intended to be inactive textual references

only.

TORRID HOLDINGS INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

AND COMPREHENSIVE (LOSS)

INCOME

(UNAUDITED)

(In thousands, except per

share data)

Three Months Ended

Twelve Months Ended

February 1, 2025

February 3, 2024

February 1, 2025

February 3, 2024

Net sales

$

275,562

$

293,539

$

1,103,737

$

1,151,945

Cost of goods sold

182,927

192,382

690,266

745,967

Gross profit

92,635

101,157

413,471

405,978

Selling, general and administrative

expenses

73,829

80,631

302,032

293,331

Marketing expenses

15,356

16,511

54,231

55,499

Income from operations

3,450

4,015

57,208

57,148

Interest expense

8,330

10,372

35,633

39,203

Interest income, net of other expense

(income)

348

(328

)

(28

)

(90

)

(Loss) income before (benefit from)

provision for income taxes

(5,228

)

(6,029

)

21,603

18,035

(Benefit from) provision for income

taxes

(2,240

)

(1,959

)

5,285

6,416

Net (loss) income

$

(2,988

)

$

(4,070

)

$

16,318

$

11,619

Net (loss) earnings per share:

Basic

$

(0.03

)

$

(0.04

)

$

0.16

$

0.11

Diluted

$

(0.03

)

$

(0.04

)

$

0.15

$

0.11

Weighted average number of

shares:

Basic

104,137

104,137

104,564

103,990

Diluted

104,137

104,137

105,684

104,400

Other comprehensive (loss) income:

Foreign currency translation

adjustment

(311

)

162

(585

)

(52

)

Total other comprehensive (loss)

income

(311

)

162

(585

)

(52

)

Comprehensive (loss) income

$

(3,299

)

$

(3,908

)

$

15,733

$

11,567

TORRID HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(In thousands, except share

and per share data)

February 1, 2025

February 3, 2024

Assets

Current assets:

Cash and cash equivalents

$

48,523

$

11,735

Restricted cash

399

399

Inventory

148,493

142,199

Prepaid expenses and other current

assets

24,507

22,229

Prepaid income taxes

4,244

2,561

Total current assets

226,166

179,123

Property and equipment, net

77,669

103,516

Operating lease right-of-use assets

140,651

162,444

Deposits and other noncurrent assets

18,935

14,783

Deferred tax assets

16,620

8,681

Intangible asset

8,400

8,400

Total assets

$

488,441

$

476,947

Liabilities and stockholders'

deficit

Current liabilities:

Accounts payable

$

72,378

$

46,183

Accrued and other current liabilities

125,743

107,750

Operating lease liabilities

40,505

42,760

Borrowings under credit facility

—

7,270

Current portion of term loan

16,144

16,144

Due to related parties

8,362

9,329

Income taxes payable

—

2,671

Total current liabilities

263,132

232,107

Noncurrent operating lease liabilities

134,481

155,825

Term loan

272,409

288,553

Deferred compensation

3,913

5,474

Other noncurrent liabilities

5,595

6,705

Total liabilities

679,530

688,664

Stockholders' deficit:

Preferred shares: $0.01 par value;

5,000,000 shares authorized; zero shares issued and outstanding at

February 1, 2025 and February 3, 2024

—

—

Common shares: $0.01 par value;

1,000,000,000 shares authorized; 104,859,266 shares issued and

outstanding at February 1, 2025; 104,204,554 shares issued and

outstanding at February 3, 2024

1,049

1,043

Additional paid-in capital

140,029

135,140

Accumulated deficit

(331,269

)

(347,587

)

Accumulated other comprehensive loss

(898

)

(313

)

Total stockholders' deficit

(191,089

)

(211,717

)

Total liabilities and stockholders'

deficit

$

488,441

$

476,947

TORRID HOLDINGS INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

(In thousands)

Fiscal Year Ended

February 1, 2025

February 3, 2024

January 28, 2023

OPERATING ACTIVITIES

Net income

$

16,318

$

11,619

$

50,209

Adjustments to reconcile net income to net

cash provided by operating activities:

Write down of inventory

1,779

4,577

2,297

Operating right-of-use assets

amortization

40,574

41,366

41,839

Depreciation and other amortization

37,239

38,002

37,592

Share-based compensation

7,634

8,042

9,980

Deferred taxes

(7,939

)

(5,670

)

1,863

Other

(1,092

)

(2,436

)

(1,209

)

Changes in operating assets and

liabilities:

Inventory

(7,615

)

33,182

(12,028

)

Prepaid expenses and other current

assets

(2,278

)

(2,179

)

(5,364

)

Prepaid income taxes

(1,683

)

(480

)

4,264

Deposits and other noncurrent assets

(4,314

)

(6,296

)

(1,712

)

Accounts payable

26,999

(30,293

)

(1,241

)

Accrued and other current liabilities

18,148

(1,721

)

(29,659

)

Operating lease liabilities

(40,352

)

(43,532

)

(42,912

)

Other noncurrent liabilities

(829

)

(1,897

)

3,900

Deferred compensation

(1,561

)

1,228

(2,627

)

Due to related parties

(967

)

(3,412

)

(1,881

)

Income taxes payable

(2,671

)

2,671

—

Net cash provided by operating

activities

77,390

42,771

53,311

INVESTING ACTIVITIES

Purchases of property and equipment

(14,392

)

(26,002

)

(23,369

)

Net cash used in investing activities

(14,392

)

(26,002

)

(23,369

)

FINANCING ACTIVITIES

Proceeds from revolving credit

facility

62,780

592,775

832,635

Payments on revolving credit facility

(70,050

)

(593,885

)

(824,255

)

Principal payments on the Amended Term

Loan Credit Agreement

(17,500

)

(17,500

)

(21,875

)

Proceeds from issuances under share-based

compensation plans

1,044

399

746

Withholding tax payments related to

vesting of restricted stock units and awards and exercise of non

qualified stock options

(774

)

(306

)

(668

)

Repurchases and retirement of common

stock

—

—

(31,700

)

Net cash used in financing activities

(24,500

)

(18,517

)

(45,117

)

Effect of foreign currency exchange rate

changes on cash, cash equivalents and restricted cash

(1,710

)

(53

)

(177

)

Increase (decrease) in cash, cash

equivalents and restricted cash

36,788

(1,801

)

(15,352

)

Cash, cash equivalents and restricted cash

at beginning of period

12,134

13,935

29,287

Cash, cash equivalents and restricted cash

at end of period

$

48,922

$

12,134

$

13,935

SUPPLEMENTAL INFORMATION

Cash paid during the period for interest

related to the revolving credit facility and term loan

$

35,077

$

34,195

$

29,564

Cash paid during the period for income

taxes

$

17,765

$

11,154

$

15,601

SUPPLEMENTAL DISCLOSURE OF NONCASH

INVESTING AND FINANCING ACTIVITIES

Property and equipment purchases included

in accounts payable and accrued liabilities

$

1,367

$

4,524

$

3,959

Non-GAAP

Reconciliation

The following table

provides a reconciliation of Net (loss) income to Adjusted EBITDA

for the periods presented (dollars in thousands):

Three Months Ended

Twelve Months Ended

February 1, 2025

February 3, 2024

February 1, 2025

February 3, 2024

Net (loss) income

$

(2,988

)

$

(4,070

)

$

16,318

$

11,619

Interest expense

8,330

10,372

35,633

39,203

Interest income, net of other expense

(income)

348

(328

)

(28

)

(90

)

(Benefit from) provision for income

taxes

(2,240

)

(1,959

)

5,285

6,416

Depreciation and amortization(A)

9,017

9,381

35,721

36,484

Share-based compensation(B)

3,103

2,061

7,634

8,042

Non-cash deductions and charges(C)

168

462

347

816

Other expenses(D)

979

509

8,210

3,729

Adjusted EBITDA

$

16,717

$

16,428

$

109,120

$

106,219

____________________(A) Depreciation and amortization

excludes amortization of debt issuance costs and original issue

discount that are reflected in interest expense.(B) Share-based

compensation for the quarter and year ended February 1, 2025

includes $1.8 million and $3.0 million, respectively, for awards

that will be settled in cash as they are accounted for as

share-based compensation in accordance with ASC 718,

Compensation—Stock Compensation, similar to awards settled in

shares.(C) Noncash deductions and charges includes losses on

property and equipment disposals and the net impact of noncash rent

expense.(D) Other expenses include severance costs for certain key

management positions, certain transaction and litigation fees

(including certain settlement costs), and the reimbursement of

certain management expenses, primarily for travel, incurred by

Sycamore on our behalf, which are not considered to be part of our

core business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250320570232/en/

Investors Lyn Walther IR@torrid.com Media Joele

Frank, Wilkinson Brimmer Katcher Michael Freitag / Arielle

Rothstein / Lyle Weston Media@torrid.com

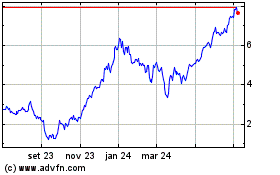

Torrid (NYSE:CURV)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

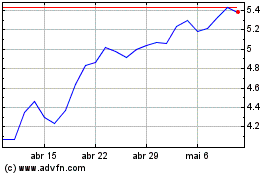

Torrid (NYSE:CURV)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025