ETH mega pump coming? Ether on exchanges falls to near-decade low

21 Março 2025 - 3:07AM

Cointelegraph

Ether’s supply on crypto exchanges has dropped to its lowest

level since November 2015, leading some analysts to predict a major

price rally despite recent bearish sentiment.

“Ethereum's holders have now brought the available supply on

exchanges down to 8.97M, the lowest amount in nearly 10 years

(November, 2015),” crypto analytics platform Santiment

said in a March 20 X

post.

Ether’s supply on crypto exchanges has reached its lowest

point since November 2015. Source: Santiment

Santiment said ETH had been rapidly leaving crypto exchanges,

with balances now 16.4% lower than at the end of January. This

suggests that investors are moving their ETH into

cold storage wallets for long-term holding, potentially holding

more conviction that Ether’s (ETH) price will rise in the

future.

A significant decline in ETH supply across crypto exchanges can

signal a potential price surge soon, commonly known as a “supply

shock.” However, a surge will only happen if demand remains strong

or increases to outpace the reduced supply.

It was recently seen in Bitcoin (BTC). On Jan. 13, Bitcoin

reserves on all crypto exchanges dropped to 2.35 million

BTC, hitting a nearly seven-year low that was last seen in June

2018. Just a week later, Bitcoin surged to a new high of $109,000

amid the inauguration of US President Donald Trump.

Some crypto traders and analysts anticipate a similar scenario

for Ether.

Crypto trader Crypto General told their

230,800 X followers that it is “Just a question of time before the

big supply shock.”

Crypto commentator Ted said in a March 19 X

post that with ETH supply on crypto exchanges decreasing by the

day, “buyers will soon compete, leading to bidding wars.”

Related:

‘Successful’ ETH ETF less perfect without staking —

BlackRock

Meanwhile, crypto trader Naber said in an X post

on the same day that the largest ETH accumulation is taking place,

and it may lead to Ether reaching the $8,000 to $10,000 price

range. Even at the lower end of $8,000, Ether would be up 64% from

its all-time high of $4,878, reached in November 2021.

While the supply decline is giving crypto traders hope for ETH,

other signals have recently cast a bearish shadow over the

asset.

Its performance against Bitcoin has been at its lowest in five

years. Daan Crypto Trades said in a March 19 X

post that it is “unlikely to see this anywhere near its highs

anytime soon.”

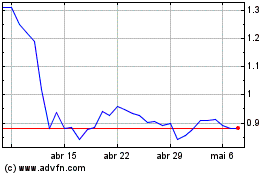

Ether is down 26% over the past 30 days. Source:

CoinMarketCap

Ether is currently trading at $1,971, down 26% over the past

month according to CoinMarketCap

data. Meanwhile, spot Ether ETFs have had 12 straight days of

outflows totaling $370.6 million, according to Farside

data.

“This has been one brutal downtrend,” Daan Crypto Trades

added.

Scott Melker, aka “The Wolf of All Streets,” said, “Either

Ethereum bounces here and this is a generational bottom, or it’s

over.”

Magazine: Memecoins are ded — But Solana ‘100x better’

despite revenue plunge

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading ETH mega pump coming? Ether on

exchanges falls to near-decade low

The post

ETH mega pump coming? Ether on exchanges falls to

near-decade low appeared first on

CoinTelegraph.

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025