By Andrew Tangel and Doug Cameron

Boeing Co. ousted Chief Executive Dennis Muilenburg as the

company struggles with an extended crisis caused by two fatal

crashes of its 737 MAX jetliner and friction with regulators over

returning the grounded planes to service.

The aerospace giant said David Calhoun, a longtime Boeing

director with deep ties to the aviation and private-equity

industries, will become CEO next month. He was named Boeing's

chairman in October in a boardroom shake-up.

Mr. Calhoun, 62 years old, is stepping down as a senior

executive at private-equity giant Blackstone Group Inc. An

experienced corporate fixer, he is also a former top executive at

airplane engine-maker General Electric Co.

Mr. Calhoun and Boeing finance chief Greg Smith, who will serve

as interim CEO, face the same challenges as Mr. Muilenburg: winning

back the confidence of government officials, suppliers, airlines

and the traveling public. Mr. Calhoun spent much of Monday phoning

some of those constituents, including lawmakers, a Boeing spokesman

said.

In a call with one U.S. airline CEO, Mr. Calhoun struck a tone

of partnership and signaled Boeing would be taking a different

tack, said a person familiar with the call. Airlines have lost

money as they have been forced to adjust schedules that were

dependent on a MAX fleet that should have numbered about 800 jets

by now, only for all to be grounded.

Regulators had criticized Mr. Muilenburg's efforts to reassure

customers and the financial community that government approval of a

fix for the MAX was coming soon -- optimism that repeatedly proved

misplaced. The new leadership team made it clear in public

statements Monday that they won't get ahead of regulators in

predicting the return to service of the 737 MAX after its grounding

in March following twin crashes that claimed 346 lives.

Boeing's board decided to oust Mr. Muilenburg during a

conference call late Sunday following discussions over the weekend,

according to a Boeing official and a person close to the board.

Their decision culminated a series of setbacks for the plane maker

that led to its recent decision to halt production of the 737 MAX

-- its best-selling plane -- starting next year, according to the

person close to the board.

Directors were also dissatisfied at times with delays by

management in providing them updates, this person said. "There were

some surprises along the way," this person added, without providing

specifics.

The malfunction of Boeing's Starliner space capsule during its

maiden flight on Friday, which left it unable to dock with the

international space station, added to setbacks at the Chicago-based

company. Mr. Muilenburg tweeted his congratulations to the

Starliner team before the problem was disclosed on Friday.

The company has lost around $50 billion in market value since

the MAX crisis began, with the stock off 24% from its level prior

to the second crash in March. Boeing shares rose about 2.5% in

Monday trading, recently at $337.26.

The MAX's return to service won't happen until regulators

approve fixes to a flight-control system implicated in the two

crashes. And board members have been particularly concerned about

increasing friction with the Federal Aviation Administration, which

ultimately holds the key, the person familiar with the board said,

calling the tension a "very significant and negative

development."

With the leadership change, Boeing's board wanted to signal it

would improve communication, particularly with regulators and

customers, the person said.

An engineer by training, Mr. Muilenburg appeared to often rely

heavily on data and legal advice rather than diplomacy in

formulating his response to the escalating crisis, and his approach

sometimes exacerbated friction with customers and regulators. His

relationship with FAA leaders deteriorated to the point that about

two weeks ago agency chief Steve Dickson publicly called out the

company's failures to provide complete and timely data supporting

proposed MAX software fixes.

After Boeing's announcement Monday, the FAA reiterated that it

has set no timetable for when the MAX would be allowed to resume

carrying passengers. It also said that it expects Boeing to focus

on "the quality and timeliness of data submittals for FAA review,

as well as being transparent with its relationship with the

FAA."

Mr. Calhoun, who is set to become CEO on Jan. 13, has been a

Boeing director since 2009. He spent 26 years at GE, including

running its aircraft engine business.

At Blackstone, he has confronted other major corporate crises.

He is credited with turning around the fortunes of Nielsen Holdings

PLC after being put in charge of the market research and

measurement company. He later became chairman of Caterpillar Inc.'s

board weeks after federal agents raided the heavy machinery maker's

Illinois headquarters. Both he and Mr. Muilenburg are on

Caterpillar's board.

Directors and executives who have worked with Mr. Calhoun say

his experience will help Boeing overcome its problems. Inside

boardrooms, his personality looms large, and he became increasingly

assertive inside Boeing's boardroom as problems mounted this year,

his colleagues have said.

Mr. Smith, who has spent most of his career at Boeing except for

a stint running investor relations at Raytheon Co, is well

respected by the investment community. As Boeing's finance chief,

he expanded his role in recent years to reduce risk on the

company's balance sheet and focus on a raft of efficiency measures,

He also has led efforts to realign production and negotiate

customer compensation following the MAX grounding.

On Monday, Mr. Smith pledged to help "chart a new direction for

Boeing," in a note to staff viewed by The Wall Street Journal.

He isn't joining the company's board, more than half of whose

members were directors when the decision was made in 2011 to

proceed with the 737 MAX rather than counter rival Airbus SE with

an all-new airplane. The board's makeup has prompted criticism from

some investors and analysts that Boeing needs to reset its internal

culture.

Larry Kellner, a veteran airline executive who has been on the

Boeing board since 2011, will take over from Mr. Calhoun as

chairman.

Mr. Muilenburg's defense of Boeing's development of the MAX

after the second crash in March made him a target of criticism,

though he subsequently apologized to victims' families on multiple

occasions and acknowledged Boeing made mistakes.

Michael Stumo, who lost a daughter in the Ethiopian crash,

called Mr. Muilenburg's departure "a good first step," but also

said several board members should resign.

Mr. Muilenburg became CEO in July 2015. Before the MAX

grounding, Boeing shares had more than tripled on his watch as the

company boosted jetliner production and returned a bigger portion

of profits to shareholders through stock buybacks and higher

dividends.

Mr. Muilenburg is eligible to a $39 million payout, including

$6.6 million in cash as well as bonuses and stock awards, based on

share price of $322.50, according to regulatory filings.

Boeing's new leadership will have its hands full. The company is

suspending production of the MAX in 2020 amid uncertainty over the

aircraft's future, which will pressure Boeing's finances, suppliers

and the U.S. economy.

The crisis has disadvantaged Boeing in its competition with

Airbus to supply carriers in a fast-growing air travel market. The

two plane makers have a backlog of more than 13,000 jet orders,

representing seven years of production. Boeing had planned to build

more than 900 aircraft this year, including almost 600 MAX

jets.

The company, which has about 5,000 MAX orders in hand, estimates

the MAX crisis will cost it $10 billion in added costs and customer

compensation, a figure analysts expect to at least double.

The FAA isn't expected to approve the MAX software fixes, as

well as related changes to pilot training, before February,

according to people familiar with the matter.

Dennis Tajer, a spokesman for the union that represents pilots

at American Airlines Group Inc., said pilots are seeking "actions

that are desperately needed in rebuilding trust in Boeing."

The FAA's own pilots may pose hurdles to the return of the MAX.

Some of them contend tests so far suggest airline crews need

simulator drills to prepare for certain emergencies involving the

flight-control system, according to people familiar with the

details. A final decision will likely take weeks, and involve

various other pilots inside and outside the agency.

--Andy Pasztor and Alison Sider contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Doug Cameron

at doug.cameron@wsj.com

(END) Dow Jones Newswires

December 23, 2019 15:38 ET (20:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

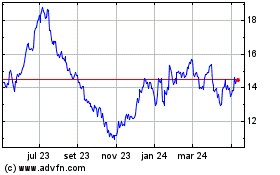

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

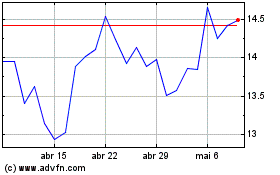

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024