Methodology for the WSJ's Study of Broadband Bills

24 Dezembro 2019 - 12:29PM

Dow Jones News

The Wall Street Journal examined information from more than

3,300 bills for its study of broadband pricing across the U.S. We

excluded more than 600 bills that didn't specify an internet price

and used 2,694 bills for our analysis.

We used 377 bills that were directly submitted to the WSJ by

individuals and 183 bills provided by BillFixers. Data from 2,134

bills was provided by Billshark. BillFixers and Billshark redacted

names and personally identifying information. Both firms help

consumers negotiate better rates with cable and telecommunications

providers.

We examined bills from 54 different broadband providers. Most of

the bills came from Charter Communications Inc. (1,024), Comcast

Corp. (705), AT&T Inc. (232) and Verizon Communications Inc.

(197), four of the biggest broadband providers in the U.S. ( Read

our analysis here.)

To compare internet prices, we used the internet cost as listed

on consumer bills plus any internet-related fees, including modem

rentals, speed surcharges and data-usage fees. We excluded taxes

and one-time fees, such as installation fees or late fees. For

bundle bills, we excluded noninternet services and fees.

There were bills from all 50 states and 2,155 different ZIP

Codes. The Journal used demographic data from the Census Bureau's

American Community Survey to split bills depending on the ZIP Code

and their demographic composition. The analysis looked at median

household income and population density. Multiple bills fit into

one or more demographic groups and were taken into account as part

of each group analysis.

Rural ZIP Codes were defined as those with a population of less

than 100 per square mile. Urban ZIP Codes were defined as those

with a population of 10,000 per square mile or more. High-income

ZIP Codes were defined as those with a median household income of

$90,000 or more. Low-income ZIP Codes were defined as those with a

median household income of $30,000 or less. There were at least 150

bills from each of these categories.

Address-level competition data was provided by Billshark and

obtained through Allconnect, an online marketplace for home

services. Competitive areas were defined as those in which

subscribers could get the same service from more than one cable or

fiber broadband provider. DSL service wasn't considered a

competitive option for high-speed broadband.

--Inti Pacheco and Shalini Ramachandran

(END) Dow Jones Newswires

December 24, 2019 10:14 ET (15:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

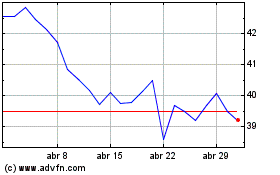

Verizon Communications (NYSE:VZ)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

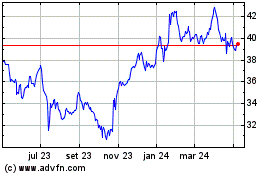

Verizon Communications (NYSE:VZ)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024