By Sharon Terlep and Matt Grossman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 2, 2020).

Americans' dramatically altered spending habits amid the

coronavirus pandemic upended financial results for some of the

biggest consumer-products companies.

Clorox Co. and Colgate-Palmolive Co. on Friday reported soaring

sales for the most recent period as people amassed cleaning

products, soaps and vitamins. Meantime, beauty giant Estée Lauder

Cos. reported an 11% sales decline and swung to a $6 million

quarterly loss as global shutdowns cut off consumers' access to

high-end beauty products from Clinique skin cream to M.A.C.

makeup.

The results were reversals of fortune for Clorox and Estée

Lauder in particular. Before the pandemic, Clorox had been

struggling with tepid sales gains relative to rivals, and Estée

Lauder was far outperforming its competitors.

Even companies experiencing sales increases amid the pandemic

stressed uncertainty ahead.

"The unpredictability that we've seen across the world is unlike

anything we've seen before, it's very difficult to get a line of

sight on how things are going to unfold," Colgate Chief Executive

Noel Wallace said in a call with analysts. "The biggest unknown for

us is the degree of the recession all over the world."

Clorox, which posted its highest quarterly sales gain in 20

years, took the unusual step of increasing its forecast for the

year, predicting both higher sales and profits. The company's

brands include in-demand items from Clorox disinfectant wipes to

Rainbow Light vitamins. Most of its sales are in the U.S., which

largely insulated Clorox from the shutdown in China earlier this

year and from currency volatility affecting rivals.

The company now expects to report year-over-year sales growth of

4% to 6%. In early February, the last time it offered such

guidance, Clorox had said the year-to-year change in sales would be

between 1% growth and a single-digit percentage decline.

Clorox said sales of its cleaning products, which includes wipes

and bleaches, grew 32% year over year between January and March.

Overall, the company's revenue increased 15% to $1.78 billion in

the period, the third quarter of its fiscal year.

Colgate-Palmolive also reported a surge in demand. North

American sales of personal- and home-care products, which include

Colgate toothpaste and Softsoap hand soap, grew 8.9% in the period

compared with the same time last year, the company said Friday.

Overall, Colgate's first-quarter revenue grew 5.5% to $4.1

billion.

Estée Lauder, in turn, reported its weakest quarter since the

recession, with sales down 11% to $3 billion for the latest

quarter.

"Brick-and-mortar was completely closed and the consumer was

shocked," in March, Estée Lauder CEO Fabrizio Freda said in a call

with analysts.

Sales in Estée Lauder's Americas segment tumbled 23% as stores

in North America and elsewhere remained closed because of the

pandemic and lockdowns reduced demand for makeup and

fragrances.

The New York-based cosmetics company said while many retail

locations have been opening in Asian markets including China, where

sales have begun to rebound, closures elsewhere continue to weigh

on its overall results. Sales at airports and other duty-free

shops, which are profit centers for the company, also continue to

be hit hard by curtailed air travel globally.

Mr. Freda said the company expected a swath of retailers would

never reopen, accelerating the beauty industry's shift online.

Ultimately, he said, Estée Lauder was well-positioned to compete in

such a shakeout, but the "transition is coming to be complex and

difficult," he said.

Also reporting results on Friday was Newell Brands Inc., the

maker of Crock Pots, Sharpie pens and other household products. The

company said sales plunged 25% in April and significant disruptions

are likely in the second quarter. Sales fell 7.6% to $1.89 billion

in the March ended quarter and Newell posted a $1.28 billion net

loss after recording a $1.5 billion impairment charge.

Newell said about 20 of its 135 manufacturing plants were

temporarily closed in March or April because of the coronavirus

pandemic, including a home fragrance factory in South Deerfield,

Mass. The company has furloughed about 5,000 workers and

temporarily closed its Yankee Candle retail stores in North

America.

Newell withdrew its financial forecasts for the full year and

second quarter. The Atlanta company said it was hopeful its

business would improve in the second half of the year, but the

pandemic's disruptions to consumer demand and its supply chain make

it too difficult to set targets.

Newell CEO Ravi Saligram told analysts he was "heartened" by

early signs that business was picking up and the company had

resumed more regular production. He said he expected sales would

improve throughout the year and anticipated workers would return to

offices this summer and students will be in school by fall.

Colgate also withdrew its guidance for the 2020 calendar year,

citing uncertainty around the virus and the economy. Mr. Wallace,

the CEO, said further coronavirus-related shutdowns, potential

production interruptions, currency volatility and the worsening

economy could threaten growth.

Write to Sharon Terlep at sharon.terlep@wsj.com and Matt

Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

May 02, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

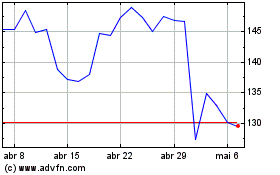

Estee Lauder Companies (NYSE:EL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Estee Lauder Companies (NYSE:EL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025