By Asa Fitch

Qualcomm Inc. on Tuesday said Chief Executive Steve Mollenkopf

would step down in June after leading the mobile-phone chip giant

through an unusually tumultuous period that has seen the company

capitalize on booming smartphone sales as it battled one of its

most important customers, Apple Inc.

The company named Cristiano Amon as Mr. Mollenkopf's successor,

handing over the reins as Qualcomm aims to exploit rising demand

for superfast 5G phones and leave behind a period of legal

struggles. Mr. Mollenkopf is to remain an adviser for a period

after Mr. Amon succeeds him, the company said.

As Qualcomm's president, Mr. Amon, 50 years old, has been the

public face of the company's efforts to become a central supplier

in the shift to 5G, winning business with Apple, building on its

share of the Chinese handset market and moving into new areas such

as chips for autonomous cars. He is set to take over on June 30,

the company said.

Mr. Mollenkopf, 52, was promoted from president to CEO in 2014

and led the company through several years of unprecedented

challenges. They included a long-running legal struggle with Apple

over Qualcomm's patent-licensing practices, an antitrust case

brought by the Federal Trade Commission, repelling an activist

investor, averting a hostile takeover and having a $44 billion

acquisition scrapped amid U.S.-China political tensions.

Mr. Mollenkopf was in the running to succeed Steve Ballmer as

Microsoft Corp.'s CEO in 2013 when Qualcomm gave him the top job --

a surprise move at the time. Microsoft eventually chose Satya

Nadella, who has steered the company to record sales and made it

one of the most valuable companies in the world.

Mark McLaughlin, Qualcomm's chairman, said Mr. Mollenkopf faced

"more in his seven years as CEO than most leaders face in their

entire careers," citing his guiding of the company through its

challenges.

Mr. Amon has spent most of his career at Qualcomm, spread over

two stints interrupted by a period during which he helped rescue a

venture-capital-owned telecom company in his native Brazil. After

rejoining Qualcomm in 2004, he rose up the ranks within the

company's chip-making operation, and became president -- and, to

many observers, the presumptive heir to the CEO -- in 2018.

In an industry rife with dry-talking engineers, Mr. Amon is

known for being gregarious and high-energy -- traits on display

when he unveiled Qualcomm's latest cellphone chip last month.

Qualcomm normally holds the annual product showcase in Hawaii, but

had to move it online during the pandemic.

"I'm sorry we couldn't bring you to Hawaii, so we're bringing a

bit of Hawaii to you," Mr. Amon said, standing on a virtual beach,

palm trees and the ocean in the background.

The CEO switch comes against the backdrop of a rapid deployment

of new 5G networks world-wide that has boosted Qualcomm's fortunes.

The company is a leading supplier of communications chips for

mobile phones, including Apple's latest offerings -- though the

iPhone maker has signaled it was starting to do some of that work

in-house.

Mr. Amon said he plans to maintain a focus on 5G, artificial

intelligence, internet-of-things devices and other novel

applications for chips. While the CEO transition was "a story of

continuity," he told reporters, "the company is always reinventing

itself because we really invest in disruptive technologies."

Mr. Amon added that he expects to keep his president title as he

becomes CEO later this year.

Qualcomm in November said sales in its most recent quarter

jumped sharply to $8.3 billion, beating Wall Street forecasts and

boosting a stock that climbed 73% last year.

While the global pandemic initially dented demand for

smartphones, handset sales have rebounded in recent months, leading

Qualcomm to issue an optimistic forecast for 5G phone shipments

this year, putting them at 450 million to 550 million.

The U.S. chip industry is undergoing sweeping changes amid

pandemic-fueled strong demand for laptops, videogames and data

centers that has sent shares in some companies surging. Nvidia

Corp., whose shares more than doubled last year, has overtaken

Intel Corp. as America's most valued chip company.

A wave of consolidation has swept through the chip industry over

the past year, driven in large part by stock prices that have risen

during the pandemic. Chip-company stocks have become hot

commodities as they benefited from a surge in digital transactions

and demand for computing power in the new work-from-home

economy.

Nvidia agreed to pay $40 billion for Arm Holdings, the British

mobile-phone chip design giant backed by SoftBank Group Corp., in a

stock and cash deal that would be the industry's biggest ever if it

goes through. Advanced Micro Devices Inc. has said it plans to buy

rival chip maker Xilinx Inc. in an all-stock deal valued at $35

billion. Those proposed tie-ups landed after Analog Devices Inc. in

July agreed to pay more than $20 billion for Maxim Integrated

Products Inc.

Though Qualcomm's stock also has risen sharply, it so far hasn't

joined the latest deal-making frenzy. Four years ago its bid for

rival chip maker NXP Semiconductors NV for $44 billion fizzled when

Chinese authorities didn't give their approval to the transaction.

Qualcomm became a takeover target in 2017 when rival Broadcom Inc.

launched a hostile takeover bid that the Trump administration

blocked.

Qualcomm has been making acquisitions to boost its organic

growth strategy, Mr. Amon said, but he suggested the company wasn't

hunting for a splashy play. "We don't need transformative M&A,"

he said. "We're always going to be open to those things, but the

good thing is we're at such an intersection point where our

technology is going to other industries that the demand is there,

and we're going to look at how we can go faster or add new

capabilities to the company."

Qualcomm's business model, which mixes chip sales with

patent-licensing deals, has made it another kind of target in

recent years. The FTC and Apple sued the company in 2017, alleging

it leveraged its status as a key supplier of mobile-phone chips to

extract unfair fees for its licensing division. Qualcomm settled

its differences with Apple in 2019, and last year won the FTC case

in a federal appeals court.

Mr. Amon has long been associated with the chip division, which

has become increasingly central to Qualcomm's business future with

the 5G rollout. Qualcomm chips powered 39% of 5G phones sold

world-wide in last year's third quarter, according to Counterpoint

Technology Market Research.

Mr. Amon's appointment came perhaps earlier than anticipated,

though the change itself wasn't a surprise, said Stacy Rasgon, an

analyst at Bernstein Research. Qualcomm, he said, isn't expected to

alter its course under Mr. Amon. "I think we move ahead as

planned," Mr. Rasgon said.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

January 05, 2021 12:25 ET (17:25 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

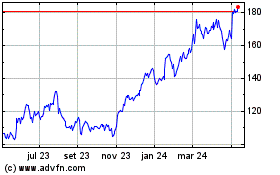

QUALCOMM (NASDAQ:QCOM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

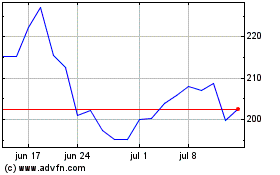

QUALCOMM (NASDAQ:QCOM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025