British American Tobacco Launches Buyback Program of Up to GBP2 Billion, 2021 Pretax Profit Up

11 Fevereiro 2022 - 4:57AM

Dow Jones News

By Anthony O. Goriainoff

British American Tobacco PLC said Friday that it was launching a

share-buyback program of up to 2 billion pounds ($2.71 billion),

and that 2021 pretax profit rose after booking lower costs.

The FTSE 100 cigarette maker--which houses the Kent, Dunhill and

Lucky Strike brands--said its buyback program will start on Monday

and will end no later than Dec. 31. It added that the number of

ordinary shares permitted to be purchased is 229.4 million.

Pretax profit for last year was GBP9.16 billion, compared with

GBP8.67 billion in 2020, the company said.

Adjusted profit from operations was GBP10.23 billion, compared

with GBP11.37 billion the year before, BAT said.

Revenue for the full year fell to GBP25.68 billion from GBP25.78

billion in the year prior. Revenue consensus for the year was

GBP25.63 billion, taken from FactSet and based on 15 analysts'

forecasts.

BAT said it expects constant-currency revenue growth of 3% to 5%

this year. It said it expects high-single-digit adjusted

earnings-per-share growth in 2022, and that growth will be weighted

toward the second half.

The company added that it expects global tobacco industry volume

to be down around 2.5% in 2022.

The board declared an interim dividend of 217.8 pence, compared

with 215.6 pence a share the year before.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

February 11, 2022 02:42 ET (07:42 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

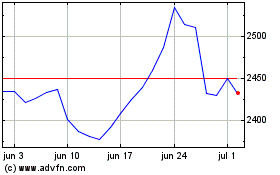

British American Tobacco (LSE:BATS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

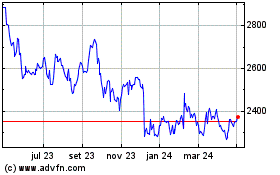

British American Tobacco (LSE:BATS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024