MSCI Cuts Russia's Sustainability Rating to Lowest Level

09 Março 2022 - 10:52AM

Dow Jones News

By Maitane Sardon

Index and rating provider MSCI Inc. said it had cut Russia's

sustainability rating to the lowest level, based on the increasing

environmental, social and governance risks faced by the country

after its attack on Ukraine.

MSCI's ESG research arm, which measures countries' and

companies' performance on financially relevant sustainability

issues, said Russia's rating now stands at triple C.

The downgrade, which is effective immediately, came days after

MSCI said it was cutting the country from triple B to B. MSCI's

ratings range from triple A, the highest, to triple C, the

lowest.

The further downgrade was prompted by higher "economic

environment" and "financial governance" risks due to Russia's

financial isolation amid the growing web of Western restrictions,

the company said. Some of the factors behind the decision included

the freeze of its central bank's assets, sanctions placed on

oligarchs by several countries, and its banks' barring from the

Swift payments system.

Several money managers have recently said they are no longer

adding Russian government bonds and shares to their funds in light

of the events. BlackRock Inc., the world's largest asset manager,

said last week that it had stopped trading Russian securities

across its actively managed and index funds. In a statement on its

website on Monday, Vanguard said it had suspended purchases of

Russian securities from its actively managed funds and was working

to exit positions across its index funds.

MSCI's move follows its prior decision to remove Russia from its

MSCI Emerging Markets index.

Write to Maitane Sardon at maitane.sardon@wsj.com

(END) Dow Jones Newswires

March 09, 2022 08:37 ET (13:37 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

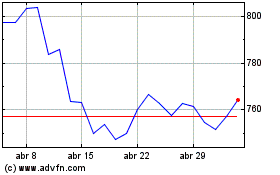

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024