British American Tobacco Backs 2022 Guidance -- Update

09 Junho 2022 - 4:23AM

Dow Jones News

By Jaime Llinares Taboada

British American Tobacco PLC on Thursday reiterated 2022

guidance for revenue and earnings growth.

The FTSE 100 tobacco group maintained full-year

constant-currency guidance of revenue growth at 2%-4%, and

mid-single-digit adjusted diluted earnings-per-share growth, with

operating cash conversion of more than 90%.

Applying current foreign-exchange rates, BAT said that this

would translate into an adjusted EPS tailwind of 2% for the first

half and 5% for the full year.

Chief Executive Jack Bowles said the company is highly cash

generative and is on track to return two billion pounds ($2.51

billion) to shareholders through its 2022 share-buyback

program.

As for its new-category division, BAT said that it expects to

report strong revenue and volume growth with reduced losses and

continued investment this year, and that it is on track to deliver

on its 2025 new-category revenue and profit targets.

However, first-half group results will reflect a strong

prior-year comparator in the U.S. and the sale of its business in

Iran last year, it said.

BAT is working toward the transfer of its Russian business, and

said the conflict in Ukraine is exacerbating inflationary pressures

on supply chains, affecting consumer consumption and resulting in

increased finance costs.

"While we are not immune to these pressures, we are confident in

delivering on our current financial targets, irrespective of the

timing of the transfer of our Russian business," Mr. Bowles

said.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

June 09, 2022 03:08 ET (07:08 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

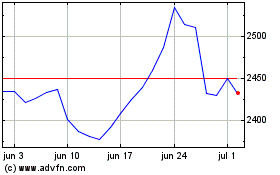

British American Tobacco (LSE:BATS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

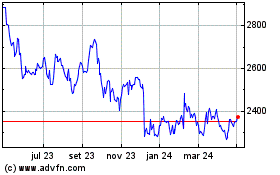

British American Tobacco (LSE:BATS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024